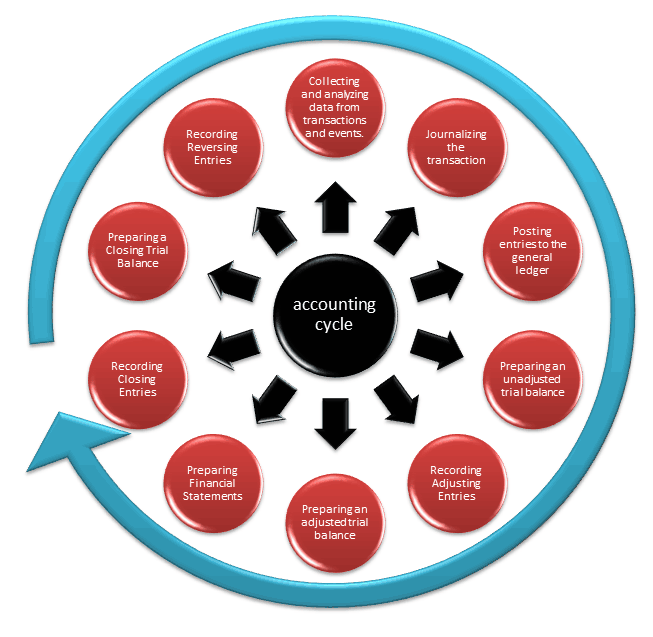

Experts use “Accounting Cycle” and “Accounting Process”; to describe the ten steps of accounting procedure in any organization.

What is Accounting Cycle or Accounting Process?

Accounting cycle is a process of a complete sequence of accounting procedures in appropriate order during each accounting period. The accounting process is a combination of activities that begin when a transaction occurs and end with its inclusion in the financial statements at the end of the accounting period.

The sequence of accounting procedures used to record, classify and summarize accounting information is called the Accounting Cycle.

The term indicates that these procedures must be repeated continuously to enable the business to prepare new up-to-date financial statements at reasonable intervals.

10 Steps of the Accounting Process or Accounting Cycle

Let’s understand the steps and process of the accounting cycle.

Analyzing and Classify Data about an Economic Event

Identifying the transactions from the events is the first step in the accounting process.Events are analyzed to find the impact on the financial position or to be more specific the impacts on the accounting equation.

Documents such as; a receipt, an invoice, a depreciation schedule, and a bank statement, etc. provide evidence that an economic event has actually occurred.

Journalizing the transaction

Transactions having an impact on the financial position of a business are recorded in the general journal. In the general journal, the transactions are recorded as a debit and a credit in monetary terms with the date and short description of the cause of the particular economic event.

Posting from the Journals to the General Ledger

Transactions recorded in the general journal are then posted to the general ledger accounts.

The accounts classify accounting data into certain categories and they are recorded in general journal entries according to that classification.

Depending on the frequency of the transactions posting to ledger accounts may be less frequent.

Preparing the Unadjusted Trial Balance

To determine the equality of debits and credits as recorded in the general ledger, an unadjusted is prepared. It is a way to investigate and find the fault or prove the correctness of the previous steps before proceeding to the next step.

Unadjusted trial balance makes the next steps of the accounting process easy and provides the balances of all the accounts that may require an adjustment in the next step.

The unadjusted balance sheet is for internal use only.

Recording Adjusting Entries

Adjusting entries ensure that the revenue recognition and matching principles are followed. To find the revenues and expenses of an accounting period adjustments are required.

Adjusting entries are required to be is because a transaction may have influence revenues or expenses beyond the current accounting period and to journalize to the events that not yet recorded.

Preparing the Adjusted Trial Balance

An adjusted trial balance contains all the account titles and balances of the general ledger which is created after the adjusting entries for an accounting period have been posted to the accounts.

It is an internal document and is not a financial statement.

It helps to create the income statement and balance sheet and provide enough information for preparing the cash flow statement.

Preparing Financial Statements

Financial statements are prepared from the balances from the adjusted trial balance. The financial statements are made at the very last of the accounting period.

Cash flow statement, income statement, balance sheet and statement of retained earnings; are the financial statements that are prepared at the end of the accounting period.

This is the output of the accounting process, which is used by the interested parties both within and out of the organization.

Recording Closing Entries

At the end of an accounting period, Closing entries are made to transfer data in the temporary accounts to the permanent balance sheet or income statement accounts.

Transferring the balances of the temporary accounts or nominal accounts (e.g. revenue, expense, and drawing accounts) to the owner’s equity or retained earnings account is used because these types of accounts only affect one accounting period.

Preparing a Closing Trial Balance

To make sure that debits equal credits, the final trial balance is prepared. As the temporary ones have been closed, only the permanent accounts appear on the closing trial balance to make sure that debits equal credits.

Recording Reversing Entries

Posting closing entries is an optional step of the accounting cycle. A reversing journal entry is recorded on the first day of the new period to avoid double counting the amount when the transaction occurs in the next period.

Conclusion

The primary objective of the accounting cycle in an organization is to process financial information and prepare financial statements at the end of the accounting period.

An accounting cycle is a continuous and fixed process that needs to be followed accordingly. Maintenance of the continuity accounting cycle is important.