The bank reconciliation Statement shows differences between the balance shown in the bank statement and the balance shown in the depositor’s accounting record.

A bank reconciliation statement is prepared for accounting purposes as it indicates the differences between the bank statement balance and the balance in the depositor’s accounting records.

The statement that the depositor prepares at a particular date to reconcile the balance differences as shown in the bank statement and the balance shown in the depositor’s books of accounts is called the bank reconciliation statement.

Definition of Bank Reconciliation Statement

A bank reconciliation is a schedule explaining any differences between the balance shown in the bank statement and the balance shown in the depositor’s accounting record.

A Bank reconciliation statement or schedule is a schedule the depositor prepares to reconcile or explain the difference between the cash balance on the bank statement and the cash balance on the depositor’s books.

A business concern prepares a bank reconciliation statement to ascertain the correct cash balance and correct cash balance in the ledger, passing necessary journal entries.

Bank Reconciliation Statement Template

![Template of Bank Reconciliation Statement How Bank Reconciliation Statement Prepared [Definition, Types, Template]](https://www.iedunote.com/img/1105/bank-reconciliation-statement.jpg)

Steps in preparing a bank reconciliation statement

The following steps are to be taken in preparing a bank reconciliation statement:

- Deposits mentioned in the bank statement and deposits shown in the depositor’s books of account will be compared. Any deposit not recorded in the bank account would be treated as a deposit in transit and should be added to the balance shown on the bank statement.

- The encashed cheques should be arranged chronologically, and each will be compared with the cash disbursement journal. Cheques issued but not paid by the bank, termed as outstanding cheques, should be listed, and the amount of these cheques should be deducted from the balance shown on the bank statement.

- If not recorded in the depositor’s books, a credit memo issued by the bank should be added to the depositor’s cash balance—for example, a collection note receivable of $2,500 shown in the bank account. Bank sends a credit memo for this to the depositor. In this case, the amount mentioned in the credit memo was $2,500 he added to the cash balance of the depositor’s account.

- If not recorded in the depositor’s book, the debit memo issued by the bank should be deducted from the cash balance shown in the depositor’s account.

- Bank statements and depositors’ accounts are to be adjusted properly for rectification of errors if any.

- It is to be ensured that the adjusted cash balance of the bank statement and the depositor’s ledger account are equal.

- Adjusting journal entries are to be passed for those items added to and deducted from the cash balance of the depositor’s ledger account in the bank reconciliation statement.

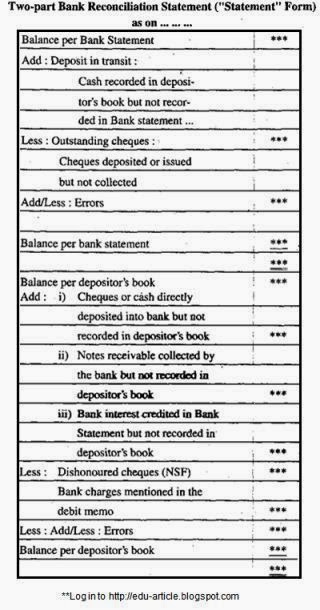

Two-part bank reconciliation statement

Modem accountants prepare a bank reconciliation statement under this two-part bank reconciliation method. This helps achieve the objective of reconciliation on the one hand and knowing the bank balance on the other.

Besides, adjustments to be made in the books of depositors can be known by this type of reconciliation statement. This method of preparing a bank reconciliation statement is termed a two-part bank reconciliation statement.

Under this method, a bank reconciliation statement is prepared, taking balances of bank statements and cash books simultaneously in ‘T’ form or statement form.

The transactions recorded in the depositor’s cash book but not recorded on the bank statement are adjusted with the bank statement balance.

On the other hand, the transactions recorded in the depositor’s bank statement or bank account but not in the depositor’s book of accounts are to be adjusted with the cash balance of the depositor’s account.

It may be mentioned that two adjusted balances will be equal under this process. If both balances do not agree, it is evident that the adjustments were not made correctly.

A specimen of a two-part reconciliation bank statement

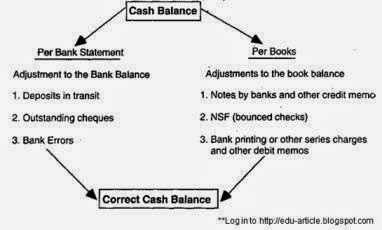

The mechanism of the two-part bank reconciliation statement is in the following diagram;

Depositor’s book amended the method

This amended method is a realistic approach to correctly, easily, and briefly presenting a bank reconciliation statement.

In this method depositor’s account is prepared to ascertain its correct cash balance before preparing a bank reconciliation statement.

The transactions shown in the depositor’s bank statement are only recorded in the depositor’s account to ascertain the corrected cash balance.

For example, bank charges, interest on the deposit, direct deposit into the bank by the debtor, dividend realized by the bank, payment made by the bank, dishonored, discounted bill, etc.

The corrected cash balance ascertained through the preparation of the depositor’s amended cash book will be the same as the cash balance shown on the bank statement. The bank reconciliation statement is prepared with that corrected cash balance.

The transactions shown to the depositor’s account but not recorded on the bank statement are recorded in the bank reconciliation statement.

Single Balance Method

This is not quite a scientific method.

Nevertheless, sometimes, in problems, the cash balance of only one party, i.e., the depositor’s or the bank statement’s cash balance, is mentioned.

In such a case, the bank reconciliation statement is sometimes prepared under a single balance method.