Price Analysis is the process of deciding if the asking price for a product or service is fair and reasonable, without examining the specific cost and profit calculations the seller used in arriving at the price. It is a process of comparing the price with known indicators of reasonableness.

In other words, price analysis is the process of examining and evaluating a proposed price without evaluating its separate cost elements and proposed profit. There are many ways to analyze the pricing of a product or service. Some of the ways are as follows:

Price movement due to seasonal and cyclic variations

All agricultural markets and livestock markets are susceptible to seasonal variation. Fresh milk prices fluctuate in the same way as food crop prices which are moving inversely with supply in the dry season. Meat prices move in a slightly different manner with natural shocks.

While food prices are likely to rise during bad years then crop production falls, meat prices will fall during the same years.

Producers attempt to sell livestock because they cannot maintain their livestock due to a lack of feed or water.

Due to the fall in demand reduced consumption. The perishability of livestock during such a year causes a decrease in supplies to be consumed more quickly than normal.

The effects may be felt for years as producers attempt to rebuild their herds. Cyclical price variation Cyclical price variation is not due to natural shocks, but it is based on the reactions of supply to changing market conditions.

Because sustained increases in livestock production, in response to some increase in demand, may take some years to bring about equilibrium conditions.

The Cobweb Model or Cobweb Theory

The cobweb model or cobweb theory is an economic model that explains why prices might be subject to periodic fluctuations in certain types of markets.

It describes cyclical supply and demand in a market where the amount of production must be chosen before prices are observed.

Producers’ expectations about prices are assumed to be based on observations of previous prices.

Nicholas Kaldor analyzed the model in 1934, coining the term ‘cobweb theorem’.

The cobweb model is based on a time lag between supply and demand decisions. Agricultural markets are a context where the Cobweb model might apply since there is a lag between planting and harvesting.

Suppose for unexpectedly bad weather, farmers go to market with an unusually small crop of strawberries. This shortage, equivalent to a leftward shift in the market’s supply curve, produces high prices.

If farmers expect these high price conditions to continue, then in the following year, they will raise their production of strawberries relative to other crops.

Therefore, when they go to market the supply will? high, resulting in low prices. If they then expect low prices to continue, they will decrease their production of strawberries for the next year, resulting in high prices again.

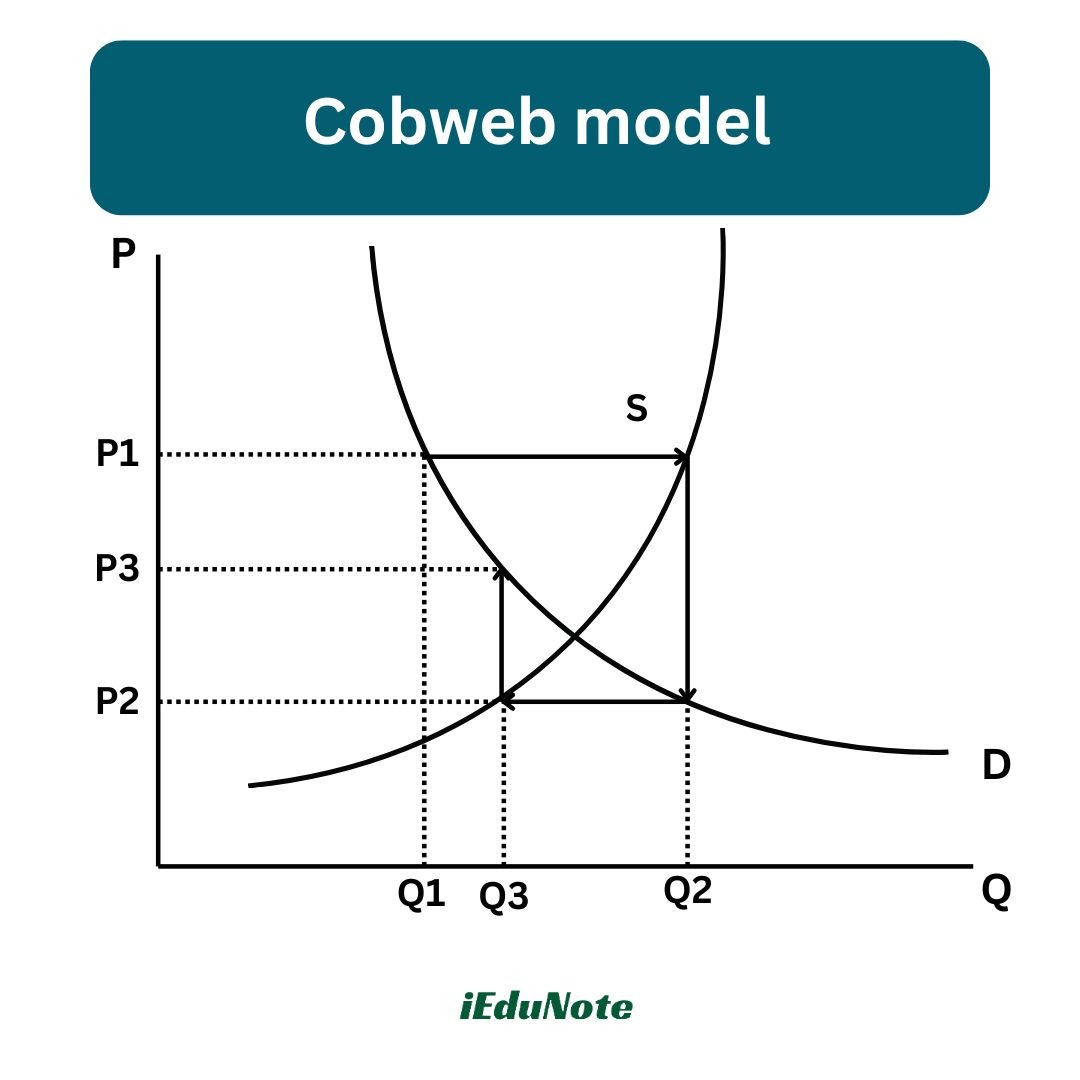

This process is illustrated by the diagram below:

The equilibrium price is at the intersection of the supply and demand curves. A poor harvest in period 1 means supply falls to Qi so that prices rise to Pt.

If producers plan their period 2 productions under the expectation that this high price will continue, then the period 2 supply will be higher, in Q2.

Prices, therefore, fall to P? when they try to sell all their output. As this process repeats itself, oscillating between periods of low supply with high prices and then high supply with low prices, the price and quantity trace out a spiral.

In either of the first two production plans, the combination of the spiral and the supply and demand curves often looks like a Cobweb, hence the name of the theory is the Cobweb model.

Dynamic pricing model

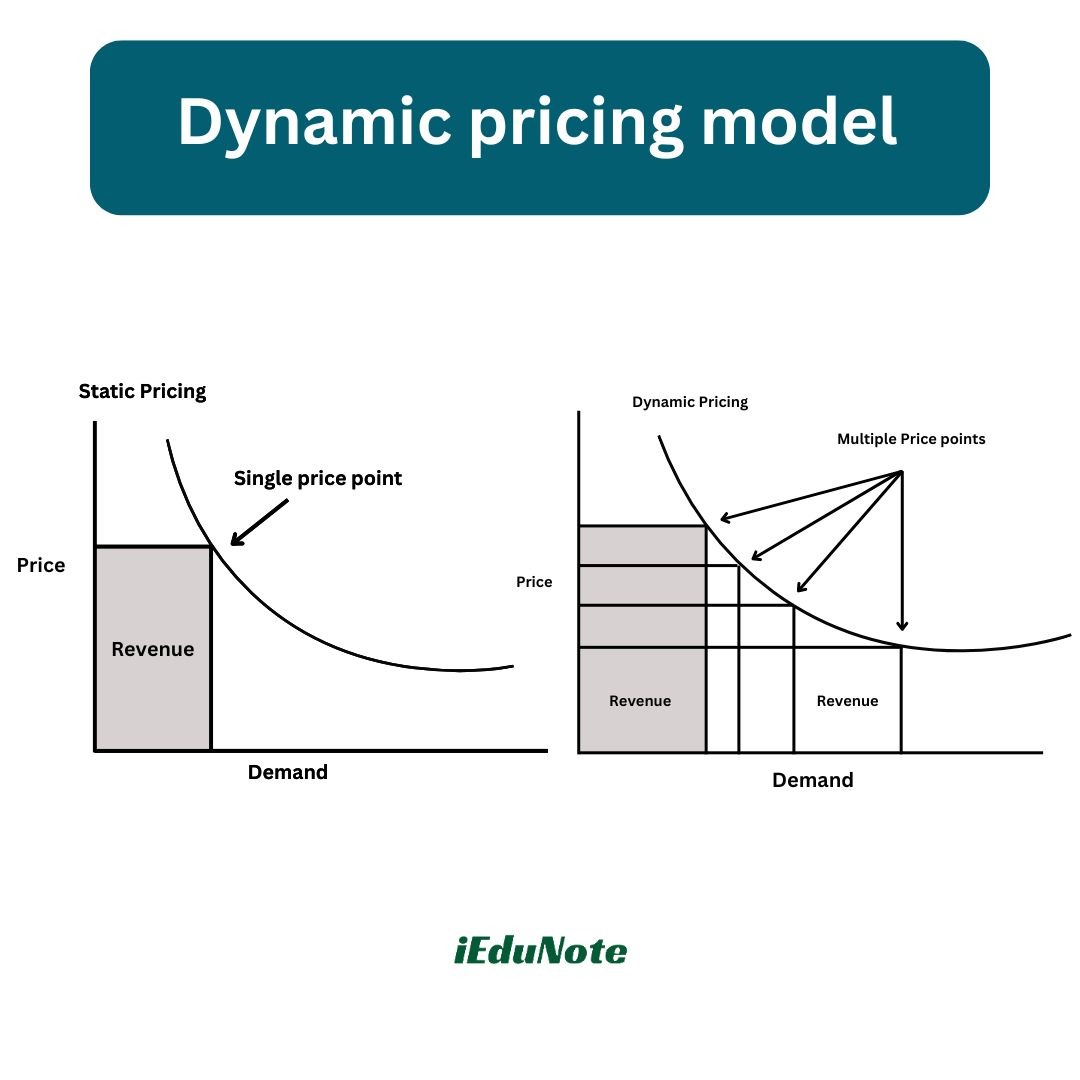

Dynamic pricing, also called real-time pricing, is an approach to setting the cost for a product or service that is highly flexible. The goal of dynamic pricing is to allow a company that sells goods or services to adjust prices in response to market demands.

Therefore, dynamic pricing is a strategy in which product prices continuously adjust, sometimes in a matter of minutes, in response to real-time supply and demand.

In the case of the dynamic pricing model, the business takes into account such things as the customer’s location, the time of day, the day of the week, the level of demand, and competitors’ pricing.

By collecting and analyzing data about a particular customer, a seller can more accurately predict what price the customer is willing to pay and adjust prices accordingly.

Dynamic pricing models update prices frequently based on changing supply or demand characteristics (i.e., different prices based on customer segment, time of use, and product or capacity availability to

increase supply chain profits).

Pricing teams that implement dynamic pricing models or tactical pricing operations do not set firm prices; rather, they adjust prices based on changing circumstances, such as increases in demand at certain times, the type of customer being targeted, or changing marketing conditions.

For example, Novo Air or United Air has a dedicated pricing and revenue management function that has built a sophisticated revenue management system to maximize revenue over individual flights.

Over several years, these companies have been able to price discriminate using dynamic pricing models (often for individual customers).

Such as pricing of the air ticket according to customer segmentation at any time and/or pricing according to the amount of time until departure for any customer segment.

Implementing a pricing strategy is becoming an increasingly popular method of boosting profits. When demand increases, conversely, dynamic pricing enables businesses to profit to increase again as demand increases.

When a supplier serves multiple customer segments with a fixed asset, the supplier can improve revenues by setting different prices for each segment.

However, a high-performing pricing team does not implement dynamic pricing without considering customer value drivers by segment and micro-segment.

Pricing setting can be a challenge. We are moving into an era of customer data and analytics. We are becoming more focused on what our customers want and why they buy from us.

We are developing more customer-driven strategies and processes to help us reconnect with customers.

Factors affecting dynamic pricing

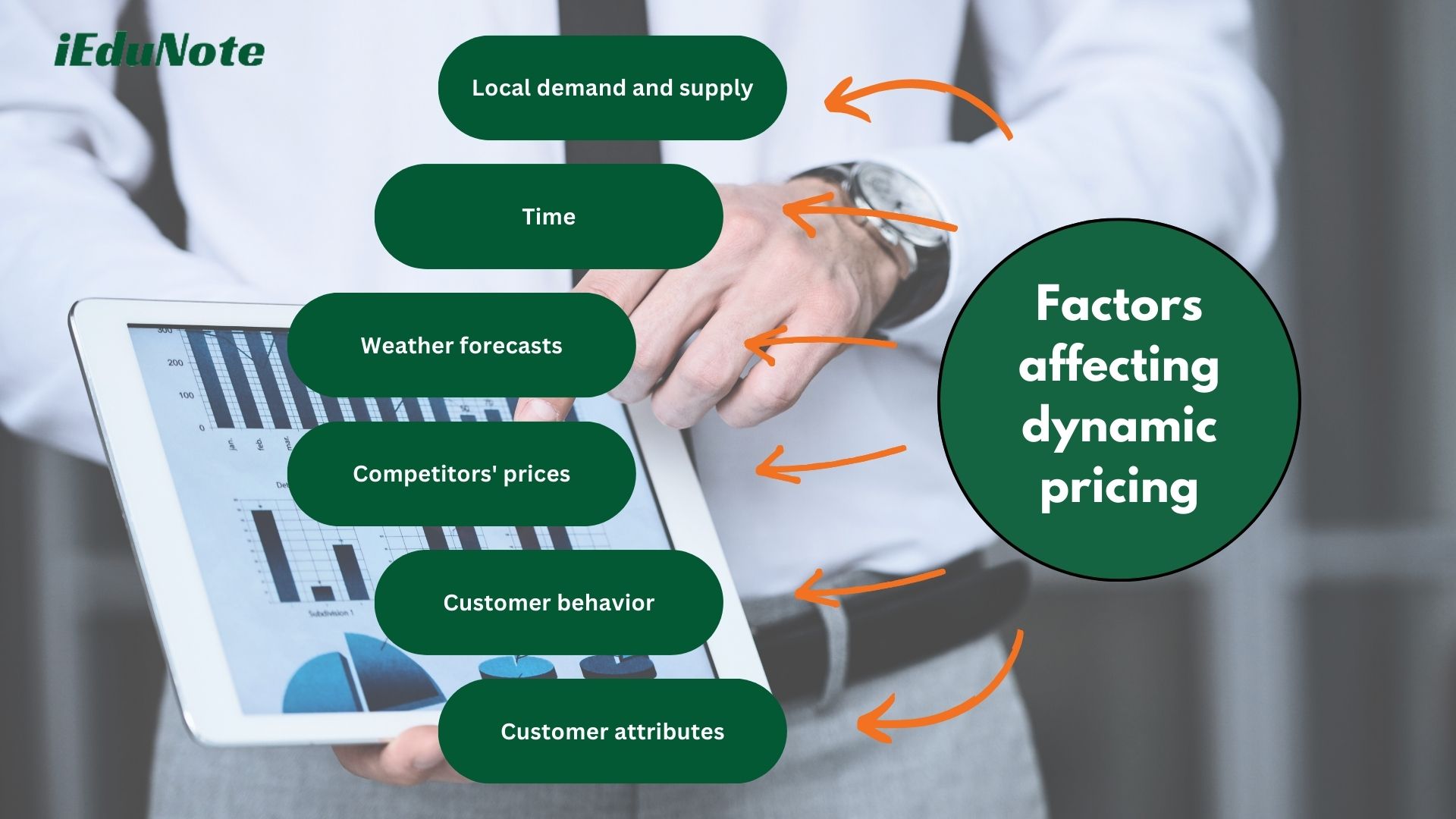

With dynamic pricing, prices are changed based on automated processes. Apart from demand and supply, other factors can be included as well, such as:

Local demand and supply

instead of looking at overall demand within the nation, prices can be adopted on local demand and supply.

Time

this factor is strongly tied to demand. Some restaurants are, for example, cheaper during the week than during the weekend, as demand is less.

Weather forecasts

rain, snow, and sun can all influence the future demand of the product. With rain coming, people care less about the prices of umbrellas.

Competitors’ prices

at what price does the competitor offer the same product? Should we match the price or even go lower?

Customer behavior

if a customer comes back several times, the chance that he will buy the product increases. Increasing the price may even entice the customer to buy the product faster.

Customer attributes

in-store, if a customer looks wealthy, one may want to try to sell at a higher price, for example, iPhone owners on average are wealthier than Android users.

Steps in dynamic pricing

The dynamic pricing process may follow the following process

- Selecting the pricing objective

- Determining Demand

- Estimating costs

- Analyzing Competitors’ Costs, prices, and offers

- Selecting a pricing method

- Selecting the final price

Advantages and disadvantages of dynamic pricing:

Advantages

Dynamic pricing is often referred to as discriminatory pricing because it allows for maximizing profits through:

- Upselling: use low prices to attract customers, and sell additional high-margin products and/or services.

- Specific prices for targeted customer segments: e.g. different prices for households and businesses.

- Specific prices for specific sales channels: e.g. different prices in online and offline retail.

- Specific prices for specific periods: e.g. different prices at the weekend and weekdays.

- Optimal discounting strategies: to make sure that all goods are sold.

Another advantage of dynamic pricing is the ability to adjust prices for service projects or products based on the time and costs involved or fluctuating demand.

Seafood distributors and restaurants, for instance, often vary prices depending on season and inventory supply.

Disadvantages

Dynamic pricing can lead to customer alienation. If customers realize they paid higher prices than others for the same solution, they may demand their money back or spread negative messages in the marketplace.

This approach also may turn off customers. If customers become irritated or angry as a result of dynamic pricing, it can damage a company’s brand loyalty. Another challenge for companies that use dynamic pricing is increased competition.

If a certain company prices a product lower than others, it can force competitors to reduce their prices to compete.

Increased competition can lead to the bidding down of product prices and lower profit margins, which is bad for businesses but good for consumers.