What is the Balance Sheet?

The financial statement prepared for the end day of the accounting period to show the financial position of a business concern is called a balance sheet.

In other words, the balance sheet is a statement of assets and liabilities including the owner’s equity at a particular date of a business concern. Its main task is to exhibit the financial position of a business concern at a particular date.

The statement of “assets” and “liabilities” exhibits the financial position of a business.

The balance sheet is prepared with those ledger balances that are left after transferring revenue ledger balances into the income statement.

The balance sheet is not an account. It is a financial statement that is prepared with ledger balances. Ledger balances are not transferred to the balance sheet.

These ledger balances remain as closing balances which are transferred to the next accounting period as opening ledger balances.

The balance sheet includes assets and liabilities & owner’s equity. The total assets are equal to the total liabilities and owner’s equity.

So Assets = Liabilities + Owner’s Equity. In brief A= L + OE.

The objective of the Balance Sheet

The balance sheet is prepared with the following objects:

- Knowing the financial position of a business.

- Knowing the real value of assets.

- Knowing the amount and nature of liabilities.

- Verification of debt paying capability of a business.

- Knowing the trend of changes in assets and liabilities.

- Knowing the trend of profit or loss of business.

- Knowing the deduction of depreciation from assets.

- Knowing the amount of prepaid and unpaid expenses.

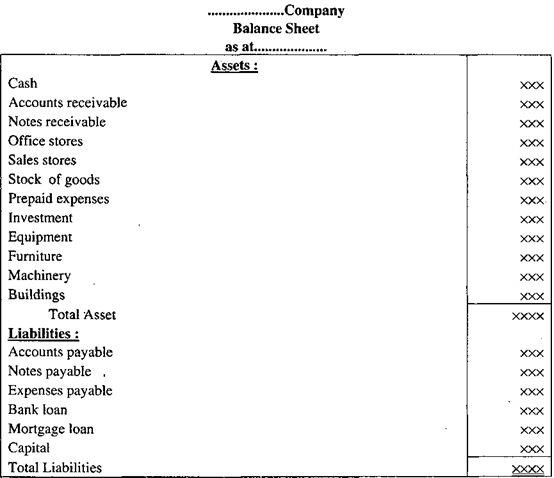

2 Types of Balance Sheet are;

- Unclassified balance sheet.

- Classified Balance Sheet.

Presentation form of the balance sheet is of two types:

1. Unclassified Balance Sheet

In an unclassified balance sheet, all assets are shown without making any classification. Similarly, liabilities are also shown without making any classification.

But in writing, assets liquidity and durability of assets are taken into consideration as far as possible. Similarly, liabilities are written considering their short term and long term nature.

That is, if assets are written giving emphasis on liquidity, the long-term liabilities follow short-term liabilities.

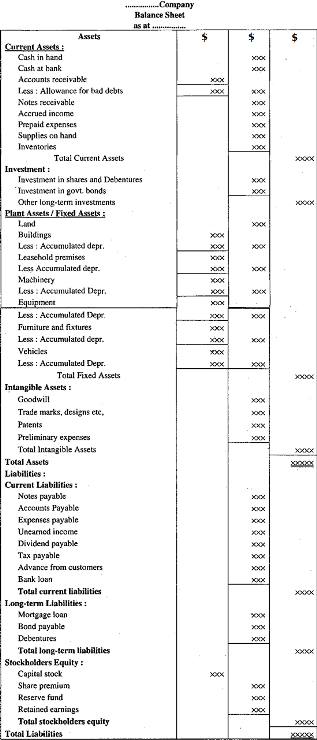

2. Classified Balance Sheet

In statement form balance sheet assets are shown first. Assets are shown classifying them into:

- Current assets,

- Investment,

- Property, plant, and equipment,

- Intangible assets.

In the later part, liabilities are shown classifying them into current liabilities, long-term liabilities, and owner’s equity.

If assets, liabilities and owner’s equity are written accurately it is evident that the total of assets must be equal to the total of liabilities and owner’s equity.

Thereby the equation A= L + OE is proved.

The balance sheet in which assets are shown classifying them into current and fixed-and liabilities as short term and long term and owner’s equity separately is called a classified balance sheet.

In below we discuss the components of the classified balance sheet.

Current Assets

Cash or other assets that are convertible into money and exhausted within a short period, one year or less from the date of the balance sheet are called current assets.

A service-oriented business concern generally has four types of current assets:

- Cash,

- Investment (short term),

- Accounts receivable and notes receivable,

- Prepaid expenses and accrued income but not received.

The current assets are explained below;

Cash

Cash means cash in hand and cash at the bank which is used for current operating purposes; such as deposits into saving account and current account. Cash as a current asset is shown as a first item in the balance sheet.

Cash equivalent

Cash equivalents are those assets that are readily convertible into money. Such as treasury bills, short-term notes maturing within 90 days, deposit certificates, etc.

Investment (Short-term)

Generally, marketable securities’ are called short-term investments. For example, shares and bonds of other companies purchased for a short-term period.

Accounts receivable and notes receivable

Accounts receivable means money is receivable from persons or organizations. Accounts receivable are created when services are rendered or goods are sold on account.

For these debts, no documentary evidence is kept excepting signature on invoice or ticket.

Notes receivable

Accounts receivable are created when services are rendered or goods are sold on account. This account receivable is called the debtor. Debtor prepares a promissory note and signs on it and hands it over to the creditor as documentary evidence of his debts.

A promissory note is a promise to pay a certain sum of money within the stipulated time. This note is generally prepared for a short period. After the expiry of the stipulated time money is received.

Prepaid expense and accrued income

The prepaid expense and accrued income not received within the particular accounting period are termed as current assets. Generally house rent, insurance premium, office supply, etc. are paid in advance.

Interest on investment accrued but not received on the date of maturity is shown as current assets at the end of the accounting period.

Merchandise inventory

In a trading concern, merchandise inventory is also treated as current assets. It means merchandise remains unsold at the end day of an accounting period.

Fixed or long-term assets

The assets which are used in business for a long-term period are called fixed or long-term assets.

For example,

Property, plant, equipment, long-term investment, and intangible assets. A business organization enjoys the utility of fixed assets for more than a year.

Property, plant, and equipment

Land, building, plant, and equipment last for more than a year in business. A business concern purchases these assets for use in the business, not for sale. Property, plant, and equipment are synonymous with plant assets or fixed assets.

In the balance sheet, under fixed assets property is shown first, then plant and the equipment.

Land

The land is a space of a business concern where office building, factory building, and store-building are built and business activities are carried out thereon.

Building

Buildings are the structures of a business concern where its activities are carried out. The building of a business concern is the plant asset.

Plant and machinery

Manufacturing concern uses heavy plant and machinery for production purposes. These are the fixed assets of the business. Business concern enjoys the utility of these plant and machinery for a longer period.

Equipment

Equipment means table, chair, cabinet, computer, copier, calculator, fax machine, telephone, computer, etc. used in offices and stores of the business.

Long-term Investment

Long-term investment generally means stocks and bonds of other companies purchased. These are purchased

- to hold control over other companies,

- for permanent income and

- for maintaining good relations with other companies.

Intangible assets

The assets which are invisible and untouchable are called intangible assets of a business, such as, goodwill, trademark, copyright, preliminary expenses, share discount, brand name, etc.

Current liabilities

Liabilities payable within a short period of quickly changeable are called current liabilities.

The liabilities which are payable within the next year from the date of the balance sheet or within an operating cycle whichever is longer are called current liabilities.

For example,

Accounts payable, notes payable, expense payable, dividend payable, unearned revenue, bank loan, interest payable etc.

Long-term liabilities

The liabilities which are payable after one year from the date of the balance sheet or after an operating cycle whichever is longer are called long-term liabilities.

Such as mortgage loan, debenture, long term notes payable, lease, pension, and gratuity fund, etc.

Owner’s equity

Owner’s equity differs as per the nature of the business

For example, in a sole-proprietorship business, a single capital account is maintained. In a partnership business, separate capital accounts are maintained for individual partners.

In the case of a joint-stock company owner’s equity is divided into share capital and retained earnings. Share capital and retained earning joined together are called shareholder’s equity.

Source

Provided by iedunote: https://www.iedunote.com/