GAAP are rules of action derived from experience and practice, proving useful and becoming Generally Accepted Accounting Principles.

What is GAAP?

Generally Accepted Accounting Principles may be defined as those rules of action or conduct in accounting practice. When they prove useful, they become accepted principles of accounting. GAPP’s complete form is Generally Accepted Accounting Principles.

According to the American Institute of Certified Public Accountants (AICPA), the principles with substantial authoritative support become a part of the GAAP (Generally Accepted Accounting Principles).

Why is GAAP Necessary?

The main dispute in setting accounting standards is, “Whose rules should we play by, and what should they be?” The answer is not nearly clear.

Financial accounting statement users have coinciding and conflicting needs for information of various types.

To meet these needs and satisfy management’s fiduciary reporting responsibility, companies prepare a single set of general-purpose financial statements.

Users expect these statements to present the company’s financial operations fairly, completely, and clearly. The accounting profession has attempted to develop a set of generally accepted and universally practiced standards.

Otherwise, each economic entity would have to develop its standards.

Further, readers of financial statements would have to familiarize themselves with every company’s peculiar accounting and reporting practices.

It would be impossible to prepare statements that could be compared and thus creating chaos in the business and financial world.

This common set of standards and procedures is generally accepted by accounting principles (GAAP).

The term “generally accepted” indicates either that an authoritative accounting rule-making body has established a principle of reporting in a given area or that over time a given practice has been accepted as appropriate because of its universal application.

Although principles and practices continue to provoke debate and criticism, most financial community members recognize them as the standards that, over time, have proven to be most useful.

History of GAAP – How GAAP Was Formulated?

Generally Accepted Accounting Principles were eventually established in response to the 1929 Stock Market Crash and the Great Depression it caused. Many experts believed that the great depression resulted from some publicly-traded companies’ unregulated and non-standardized financial reporting practices.

So the US federal government worked in collaboration with economic experts, with professional accounting groups, and other government agencies to establish financial reporting standards and practices that are consistent, accurate, and follow a legal framework.

Generally Accepted Accounting Principles began to be established with legislation such as the Securities Act of 1933 and the Securities Exchange Act of 1934.

The GAAP has evolved based on these established concepts, standards, and best practices that are now “generally accepted” by companies, industries, central banks worldwide, financial institutions, and universities.

Groups, Organizations, And Regulatory Body That Shaped Generally Accepted Accounting Principles (GAAP)

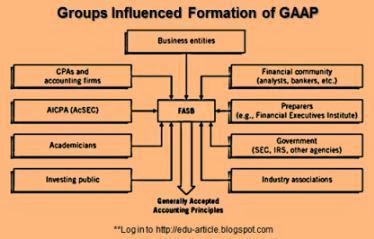

The primary sources of Generally Accepted Accounting Principles (GAAP) come from the organizations; the American Institute of Certified Public Accountants (AICPA), the Financial Accounting Standards Board (FASB), and the Securities and Exchange Commission (SEC).

Accounting is universally necessary, and anybody influenced by it; has influenced the formation process of generally accepted accounting principles in various ways.

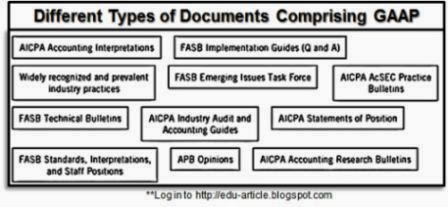

GAAP (Generally Accepted Accounting Principles) is composed of a fusion of over 2,000 documents that have developed over the last 60 years or so. It includes FASB Standards, Interpretations, Staff Positions, APB Opinions, and AICPA Research Bulletins.

One of the major groups involved in the standard-setting process is the American Institute of Certified Public Accountants.

Initially, it was the primary organization that established accounting principles in the United States. Subsequently, it relinquished its power to the FASB.

Since the enactment of GAAP; may affect many interests, much discussion occurs about who should develop GAAP and to whom it should apply. User groups are possibly the most potent force influencing the development of GAAP.

User groups consist of those most interested in or affected by accounting rules. Some accountants have said that politicization in the development and acceptance of generally accepted accounting principles (i.e., rule-making) is taking place.

Some use the term “politicization” in a narrow sense to mean the influence by governmental agencies, predominantly the Securities and Exchange Commission, on the development of generally accepted accounting principles.

Others use it more broadly to mean the compromise that results when the groups responsible for developing generally accepted accounting principles are pressured by interest groups such as; the SEC, the American Accounting Association, businesses through their various organizations, Institute of Management Accountants, financial analysts, bankers, lawyers, and so on.

GAAP Alternative – IFRS (International Financial Reporting Standards)

GAAP is the standards and practices followed in the United States. Most world economies follow the International Financial Reporting Standards (IFRS), regulated by the International Accounting Standards Board (IASB).

Both GAAP and IFRS are working to merge into one system. Both systems have different principles, rules, and guidelines, but they have many similarities.

10 Core GAAP Principles

- Principle of consistency.

- Principle of permanent methods.

- Principle of non-compensation.

- Principle of prudence.

- Principle of regularity.

- Principle of sincerity.

- Principle of good faith.

- Principle of materiality.

- Principle of continuity.

- Principle of periodicity.

3 Main Criteria of GAAP

The general acceptance of the accounting principles or practices depends on how well they meet the following three criteria. 3 main criteria of GAAP are;

- Relevance

- Objectivity

- Feasibility

Relevance

A principle is relevant to the extent that it results in information that is meaningful and useful to the users of the accounting information.

Objectivity

Objectivity connotes impartiality and trustworthiness. A principle is objective to the extent that the accounting information is not influenced by personal bias or judgment of those who provide it.

It also implies verifiability, which means that there is some way of ascertaining the correctness of the information reported.

Feasibility

A principle is feasible to the extent that it can be implemented without much complexity or cost.

These criteria often conflict with each other, e.g., information about the value of a new product to the inventor is indeed relevant. Still, the best estimate of the value of a new product made by the management is highly subjective.

Accounting, therefore, does not attempt to record such values. It sacrifices relevance in the interest of objectivity. In developing new principles, the essential problem is to achieve a trade-off between relevance on the one hand and objectivity and feasibility on the other hand.

Some argue that having various organizations establish accounting principles is wasteful and inefficient.

Rather than mandating accounting rules, each company could voluntarily disclose the type of information that is considered important.

Also, if an investor wants additional information, the investor could contact the company and pay to receive the desired information.

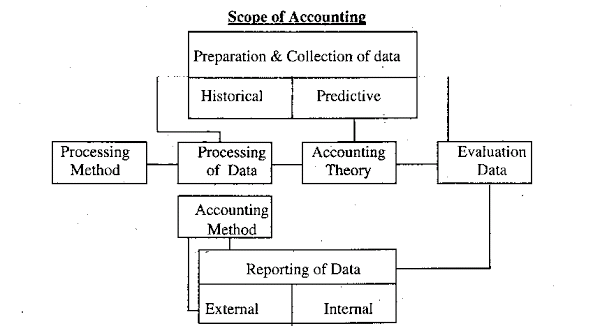

The GAAP consists of several assumptions, principles, and constraints that explain how companies should recognize, measure, and report financial elements and events.

These are globally accepted concepts or rules for recognition, measurement, treatment, and presentation of the financial status of business enterprises.

4 Basic Accounting Concepts or Accounting Assumptions

The basic concepts/assumptions are like the pillars on which the accounting structure is based. The four basic concepts/assumptions of Accounting are as under;

- Business Entity Assumption

- Money Measurement Assumption

- Going Concern Assumption

- Accounting Period Assumption

Business Entity Assumption

According to this assumption, the business is treated as a unit or entity apart from its owners, creditors, managers, and others. For recording the transactions, the business is the entity we are concerned with.

Money Measurement Assumption

The money measurement assumption underlines that in accounting, every worth-recording event, happening, or transaction is recorded in terms of money.

Going Concern Assumption

Also known as ”continuity assumption,” the enterprise is normally viewed as a going concern, i.e., continuing operation for the foreseeable future.

Accounting Period Assumption

The economic activities of a company can be divided into artificial periods.

According to this assumption, the economic life of an enterprise is artificially split into periodic intervals, which are known as accounting periods, at the end of which an income statement and financial position statement are prepared to show the performance and financial position, the use of this assumption further requires the allocation of expenses between capital and revenue.

Please read our article, where we explained the four basic accounting concepts or assumptions in full detail with examples.

5 Basic Accounting Principles or Accounting Conventions in GAAP (Generally Accepted Accounting Principles)

Basic principles of Accounting are essential, and these are the general decision-making rules which govern the development of accounting techniques.

These principles guide how transactions should, be recorded and reported. Based on the four basic assumptions of accounting, the following basic principles of accounting have been developed:

- Revenue Recognition Principle

- Historical Cost Principle

- Matching Principle

- Full Disclosure Principle

- Objectivity Principle

Revenue Recognition Principle

A crucial question for many companies is when to recognize revenue. Revenue recognition generally occurs (1) when realized or realizable and (2) when earned.

This approach has often been referred to as the revenue recognition principle.

Historical Cost Principle

According to this principle, an asset is ordinarily recorded in the accounting records at a price paid to acquire it at the time of its acquisition. The cost becomes the basis for the accounts during the acquisition and subsequent accounting periods.

Matching Principle

According to this principle, the expenses incurred in an accounting period should be matched with the revenues recognized during that period.

Full Disclosure Principle

According to the full disclosure principle, the financial statements should act as a means of conveying and not concealing.

Objectivity Principle

According to this principle, the accounting data should be definite, verifiable, and free from the personal bias of the accountant.

Please read our article where we explained these five accounting principles or conventions.

6 Accounting Constraints According to GAAP

Constraints are the limitations or boundaries that are necessary for providing information with qualitative characteristics. The basic assumptions and principles discussed earlier have to be modified to make the information useful.

These modifying principles are as under:

- Cost-Benefit Relationship

- Materiality

- Consistency

- Conservatism

- Timeliness

- Industry Practice

Cost-Benefit Relationship

The cost of applying an accounting principle should not be more than its benefits. If the cost is more, this principle should be modified.

Materiality

This constraint is an exception to the full disclosure principle. It requires that the items or events that have an insignificant economic effect or are not relevant to the user need not be disclosed.

Consistency

It states that, whatever accounting practices (whether logical or not) are selected for a given category of transactions, they should be followed on a horizontal basis from one accounting period to another to achieve compatibility,

Conservatism

Conservatism means choosing the solution that will be least likely to overstate assets and income when in doubt.

Timeliness

According to these constraints, timely information (though less reliable) should be made available to the decision-makers.

Industry Practice

The peculiar characteristics of an industry may require a departure from the accounting assumptions, principles, and constraints discussed above.

Learn more about these six accounting constraints with examples in our article here.