Despite accounting’s huge advantages, there are limitations of accounting that every accountant, businessmen, student must be aware of.

In the modem age in all spheres of the society, the importance and necessity of Accounting are felt deeply.

Accounting has already achieved wide acceptability as a critical applied branch of knowledge. Despite its huge advantages, one should have a clear concept of its limitations.

9 limitations of accounting are;

- Recording only monetary items.

- Time value of money.

- Recommendation of alternative methods.

- Restrain of accounting principles.

- Recording of past events.

- Allocation of the problem.

- Maintaining secrecy.

- The tendency for secret reserves.

- Importance of form over substance.

These limitations are stated below;

1. Recording only monetary items

As per accounting principles, only the events measurable in terms of money are recorded in the books of accounts. But events of great importance, if not measurable in terms of money, are not accounted for.

For that reason, recorded accounting information fails to exhibit the exact financial position of a business concern.

2. Time Value of Money

Under the accounting system, money value is treated constantly.

But the value of money always changes due to inflation. Under existing accounting systems, accounts are maintained considering historical cost ignoring current changed value.

As a result, the accounts maintained fail to exhibit the exact financial position of a business concern.

3. Recommendation of alternative methods

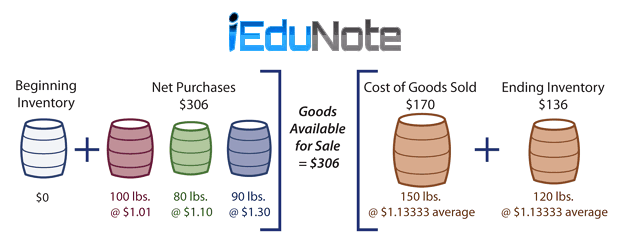

There exists an application of alternative methods in determining depreciation of assets and valuation of stock etc.

Information regarding the activities of the business is expressed in a misleading way if an alternative method is used to achieve a particular object.

4. Restrain of Accounting Principles

Exhibited accounting information cannot always exhibit a true and fair picture of a business concern owing to limitations of the accounting principles used.

For example,

Fixed assets are shown after deducting depreciation. In the case of inflation, the value of fixed assets shown in the accounts does not correspond to the real position.

5. Recording of past events

Accounting past events are accounted for. But naturally, there is no system of recording events that may occur in the future.

6. Allocation of problem

The allocation process is an important problem in the accounting system. The value of fixed assets is exhausted, charging depreciation for the allocated period.

The useful life of fixed assets is fixed up hypothetically, which does not stand accurately in most cases.

7. Maintaining secrecy

Secrecy cannot be ensured for the involvement of many employees in accounting work, although maintaining secrecy is very important.

8. The tendency for secret reserves

Often management creates secret reserves intentionally by increasing or decreasing assets and liabilities for which the total financial picture of an organization is not reflected.

9. Importance of form over substance

At the time of preparing accounts for a particular period, the emphasis is laid on the form, table, etc. instead of giving importance to an exhibition of substantial information.

As per Company Act, preparation of the balance sheet in the prescribed form is mandatory.

Although there are some limitations in the present accounting system, accounting in the present-day world has generally been accepted as a recognized profession.

Efforts are on throughout the world to overcome these limitations. Economic activities of any society without accounting are neither possible nor legal.