The audit is a systematic process of obtaining an objective evaluation of the evidence referring to the statements regarding documents or events with the economic character to appreciate the degree of conformity of these with pre-established criteria and to communicate the results of the interesting parts.

Meaning of Audit

Auditing is a systematic examination of the books and records of a business or other organization to ascertain or verify and report upon the facts regarding its financial operations and the results thereof.

Auditing is concerned with verifying accounting data by determining the accuracy and reliability of accounting statements and reports.

The Report of the Committee on Basic Auditing Concepts of the American Accounting Association (AAA) defines,

Auditing is a systematic process of objectively obtaining and evaluating evidence regarding assertions about economic actions and events to ascertain the degree of correspondence between those assertions and established criteria and communicate the results to interested users.

The audit is one of the most dynamic areas of the accounting sciences.

The word “audit” has Latin origins (audire, means listening). This word has known many definitions and classifications during this time. Generally, it is a synonym to control, check, inspect, and revise.

While accounting has suffered a little change in time, the audit has permanently evolved, answering to the environmental changes and modifying its objectives starting the middle age, passing through the industrial revolution up to the 21st century.

Companies prepare financial statements of their activities, which represent their overall performance. These financial statements are examined and evaluated by independent persons, who assess them according to the industry’s generally accepted standards.

This examination and evaluation is an audit.

Thus, an audit is an examination and verification of a company’s financial and accounting records and supporting documents by an independent professional against established criteria.

Definition of Audit

The term “audit” has been derived from the Latin word “audire,” which means “to hear.” Hence, an auditor is a person who hears or listens.

For centuries, audits were “oral hearings” in which people entrusted with fiscal responsibilities justified their stewardship. An audit is one assurance service provided by competent and qualified professional accountants.

The objective of an audit of financial statements is to enable the auditor to express an opinion of where the financial statements are prepared, in all material respects, by an applicable financial reporting framework.

The audit conclusion takes that auditors state whether the financial statements give a true and fair view. This is an expression of reasonable assurance.

A precise definition of the term ‘auditing’ is difficult to give. Some of the definitions given by different authors are as follows:

According to the audit definition given by the International Federation of Accountants (IFAC), “An audit is the independent examination of financial information of any entity, whether profit-oriented or not and irrespective of its size, or legal form when such an examination is conducted to express an opinion thereon.”

According to R.R. Comber, “Audit is an independent examination of the financial books and records of some person or persons responsible or accountable to the third party with a view of verifying the accountancy of statement prepared by or for the accounting party.”

According to Spicer and Pegler defined an audit as “such as examination of the books, accounts, and voucher of a business, as will enable the auditor to satisfy himself that the balance sheet is properly drawn up, to give a true and fair view of the state of the affairs of the business and whether the profit and loss account gives a true and fair view of profit or loss for the financial period, according to the best of his information and the explanations given to him and -as shown by the books; and if not, in what respect he is not satisfied.”

According to Montgomery, “Auditing is a systematic examination of the books and records of a business or the organization to ascertain or verify and to report upon the facts regarding the financial operation and the result thereof.”

So;

- auditing is the systematic and scientific examination of the books of accounts and records of a business,

- enables the auditor to judge that the balance sheet and the profit and loss account are properly drawn up, so it exhibits a true and fair view of the financial state of affairs of the business and profit or loss for the financial period.

The auditor will have to go through various books and accounts and related evidence to satisfy himself about the accuracy and authenticity of reporting the business’s financial health.

Companies are expected to pass their audits, as the results are very important to the company’s reputation and success.

Audits are very valuable to external company affiliates, such as shareholders and investors, because they provide an extra reassurance of their choice in investments when issues arise.

Definition of an Auditor

An auditor is a professional that accumulates and evaluates evidence to report on the degree to a company’s assertions that they comply with an established set of procedures or standards (criteria).

While it takes a highly trained accountant to work as an auditor, there are different types of auditors with different aims.

An efficient auditor must have certain qualities besides professional qualifications. He needs to carry out the audit efficiently and smoothly.

Origin and Evolution of Auditing

Auditing was primarily a method to maintain governmental accountancy, and record-keeping was its mainstay.

From the time of the ancient Egyptians, Greeks, and Romans, the practice of auditing the accounts of public institutions existed.

It wasn’t until the advent of the Industrial Revolution, from 1750 to 1850, that auditing began evolving into a field of fraud detection- and financial accountability.

In the early 20th century, the reporting practice of auditors, which involved submitting reports of their duties and findings, was standardized as the “Independent Auditor’s Report.”

The increase in demand for auditors leads to the development of the testing process. Auditors developed a way to strategically select key cases representative of the company’s overall performance.

This was an affordable alternative to examining every case in detail, requiring less time than the standard audit.

Learn more about the origin and evolution of auditing from our article.

Essential Features of an Audit

From the definitions, the six essential features of auditing can be described as follows:

- Systematic process,

- Three-party relationship,

- Subject matter,

- Evidence,

- Established criteria,

- Opinion.

An audit must have all this six features.

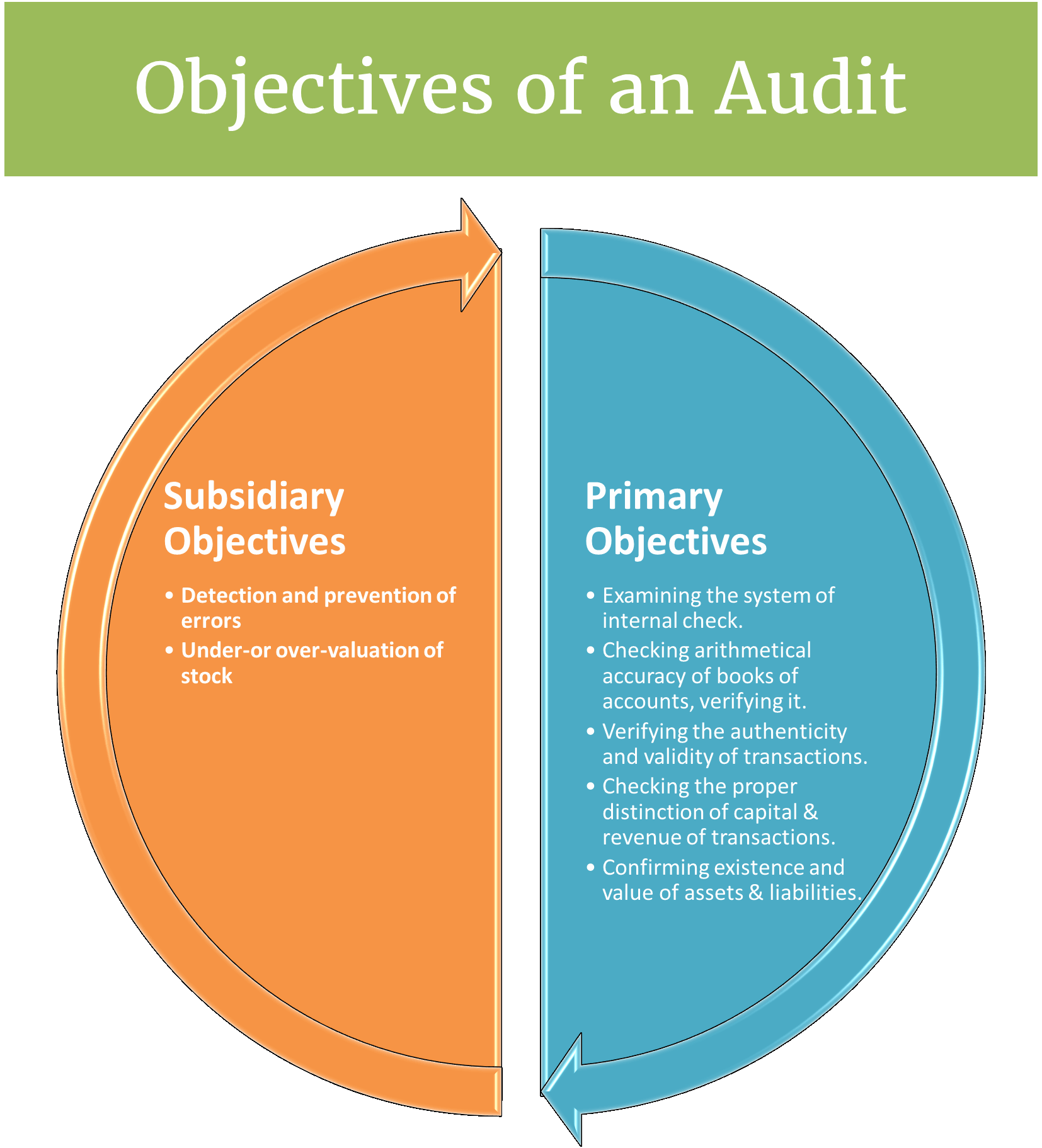

Objectives of an Audit

The objective of an audit is to express an opinion on financial statements. The objectives of the audit can be categorized into;

- primary objectives of the audit,

- subsidiary objectives of the audit.

Primary Objectives of Audit

The main objectives of the audit are known as the primary objectives of the audit.

They are as follows:

- Examining the system of internal checks.

- Checking arithmetical accuracy of books of accounts, verifying posting, casting, balancing, etc.

- Verifying the authenticity and validity of transactions.

- Checking the proper distinction between capital and revenue nature of transactions.

- Confirming the existence and value of assets and liabilities.

Subsidiary Objectives of Audit

These are such objectives that are set up to help in attaining primary objectives.

They are as follows:

- Detection and prevention of errors.

- Detection and prevention of fraud.

- Under-or over-valuation of stock.

Scope of Audit

The scope of an audit is the determination of the range of the activities and the period of records that are to be subjected to an audit examination.

The scope of an audit is;

- Legal Requirements.

- Entity Aspects.

- Reliable Information.

- Proper Communication.

- Evaluation.

- Test.

- Comparison.

- Judgments.

Read More about Scope of Audit.

Economic Benefits of an Audit

Some specific economic benefits accrue from audits. Among the economic benefits of financial statement audits are the following:

Access to Capital Market

Public limited companies must satisfy audit requirements under the Securities and Exchange Commission to register securities and have them traded in the securities markets.

Without audits, companies would be denied access to these capital markets.

Lower Cost of Capital

Because of the reduced information risk associated with audited financial statements, creditors may offer lower interest rates, and investors may be willing to accept a lower rate of return on their investment.

Deterrent to Inefficiency and Fraud

When employees know that an independent audit is to be made, they take care to make fewer errors in performing the accounting function and are less likely to misappropriate company assets.

Control and Operational Improvements

The independent auditor can often make suggestions to improve controls and achieve greater operating efficiencies within the client’s organization.

Limitations/Disadvantages of an Audit

A key issue for accountants is that there are limitations to assurance services, and therefore, there is always a risk that the wrong conclusion will be drawn.

Assurance can never be absolute. Assurance providers will never give a certification of absolute correctness due to the limitations set out below:

- Testing is used – the auditors do not oversee the process of building financial statements from start to finish.

- The accounting systems on which assurance providers may rely also have inherent limitations.

- Most audit evidence is persuasive rather than conclusive.

- Assurance providers would not text every item in the subject matter.

- The client’s staff members may collude in fraud that can then be deliberately hidden from the auditor or misrepresent matters to them for the same purpose.

- Assurance provision can be subjective, and professional judgments have to be made. For example, what aspects of the subject matter are the most important, how much evidence to obtain, etc.

- Assurance providers rely on the responsible party and its staff to provide correct information, which in some cases may be impossible to verify by other means.

- Some items in the subject matter may be estimates and are therefore uncertain. It is impossible to conclude absolutely that judgmental estimates are correct.

- The nature of the assurance report might be limiting, as every judgment and conclusion the assurance provider has drawn cannot be included in it.

- It does not consider the productivity and the skills of the business employees.

- The financial data is never current and does not reveal much about the present financial position of a company.

- Different accountants use different techniques; therefore, comparing audits between companies that have used different accountants would be hard.

- Hiring a firm to carry out an audit can be costly for smaller companies.

- A bad audit can discourage investment.

- It can time consuming to answer the auditor’s questions, and the business may not work to maximum capacity.

Organizations Establishing International Standards for Auditing

There are few Chartered Accountants international organizations responsible for setting auditing standards. They are;

International Federation of Accountants.

International Federation of Accountants (IFAC) is an independent global organization of the accountancy profession for establishing international standards on ethics, auditing and assurance, accounting education, and public sector accounting.

What is the International Federation of Accountants (IFAC)

International Federation of Accountants (IFAC) is the global organization for the accountancy profession.

Founded in 1977, IFAC has 179 members and associates in 130 countries and jurisdictions, representing more than 2.5 million accountants employed in public practice, industry and commerce, government, and academe.

Through its independent standard-setting boards, the organization establishes the globally accepted and implemented standards of ethics, auditing, and accounting education.

It also issues guidance to encourage high-quality performance by professional accountants in business.

To ensure the activities of IFAC and the independent standard-setting bodies supported by IFAC are responsive to the public interest, an international Public Interest Oversight Board (PIOB) was established in February 2005.

Functions of the International Federation of Accountants (IFAC)

As a global body of the accountancy profession; the International Federation of Accountants (IFAC) performs;

- Set Global Standards for Accounting and Auditing Practice.

- Monitor public sector accounting.

- Standardize Accounting education.

- Serve public interest in the account profession.

The mission of the International Federation of Accountants

IFAC’s mission is to serve the public interest by contributing to developing high-quality standards and guidance.

The International Federation of Accountants facilitates adopting and implementing high-quality standards and guidance.

By contributing to developing strong professional accountancy organizations and accounting firms and high-quality practices by professional accountants, promoting the value of professional accountants worldwide, and speaking out on public interest issues.

The International Federation of Accountants’ vision is to recognize the global accountancy profession as a valued leader in developing strong and sustainable organizations, financial markets, and economies.

Structure & Governance of the International Federation of Accountants

IFAC’s structure and governance are designed to promote transparency, facilitate collaboration with members and consultation with stakeholders, and ensure the efficient operations of the organization.

Founded in 1977, IFAC is a Swiss-registered association whose members are professional accountancy organizations.

Council of International Federation of Accountants

The ultimate governance of IFAC rests with the IFAC Council, which comprises one representative from each member.

The Council meets annually and is responsible for deciding constitutional and strategic matters and electing the Board.

Operations of the International Federation of Accountants

Overall direction and administration are provided by the IFAC Secretariat headquartered in New York IFAC are staffed by accounting professionals worldwide.

Institute of Chartered Accountants in England and Wales.

Royal Charter established the Institute of Chartered Accountants in England and Wales (ICAEW) in 1880. It has over 147,000 members.

Over 15,000 of these members live and work outside the U.K. The Institute also has some 9,000 students.

The Institute is a member of the Consultative Committee of Accountancy Bodies (CCAB), formed in 1974 by the major accountancy professional bodies in the U.K. and Ireland.

The fragmented nature of the accountancy profession in the U.K. is partly due to the absence of any legal requirement for an accountant to be a member of one of the many Institutes, as the term accountant does not have legal protection.

However, a person must belong to the ICAEW, ICAS, or CAI to hold themselves out as a chartered accountant in the U.K. (although there are other chartered bodies of qualified British accountants whose members are likewise authorized to conduct restricted work such as auditing).

The ICAEW has two offices in the U.K.; the main one is in Moorgate, London, and the other in Central Milton Keynes, in the newly built Hub: M.K. complex. In 2009 it also opened regional offices in Singapore and Dubai to support its members in Asia, followed by Beijing in 2011.

Early Years of Institute of Chartered Accountants in England and Wales.

Until the mid-nineteenth century, the role of accountants in England and Wales was restricted to that of bookkeepers. Accountants merely maintained records of what other business people had purchased and sold.

However, with the growth of the limited liability company and large-scale manufacturing and logistics in Victorian Britain, a demand was created for more technically proficient accountants to deal with the increasing complexity of accounting transactions dealing with a depreciation of assets, inventory valuation, and the Companies legislation being introduced.

To improve their status and combat criticism of low standards, accountants in the cities of Britain formed professional bodies.

The ICAEW was formed from the five of these associations in England before its establishment by the Royal Charter in May 1880.

- The Incorporated Society of Liverpool Accountants, formed in January 1870;

- The Institute of Accountants in London was formed in November 1870, comprising 37 members under the leadership of William Quilter. In 1871, standards for membership were established, with new members having to show knowledge and aptitude through successfully passing an oral examination. Initially, the London Institute restricted its membership to that city, but as other institutes were established elsewhere (for example, in Manchester and Sheffield), it was decided to remove this restriction, and as such, in 1872, it simply became known as the Institute of Accountants to reflect its new national coverage;

- The Manchester Institute of Accountants, formed in February 1871;

- The Society of Accountants in England (1872);

- The Sheffield Institute of Accountants (1877).

The Institute headquarters, Chartered Accountants’ Hall, in the city of London, was designed in the Italian Renaissance style by John Belcher in 1890. It was built by Colls & Sons. It is regarded as one of the finest Victorian Baroque architecture.

In 1948, the Institute received a Supplemental Charter.

In 1957 the ICAEW merged with the Society of Incorporated Accountants (founded in 1885 as the Society of Incorporated Accountants and Auditors).

Recent Developments of Institute of Chartered Accountants in England and Wales.

In 2005 the ICAEW sought to merge with the Chartered Institute of Management Accountants (CIMA) and the Chartered Institute of Public Finance and Accountancy (CIPFA).

However, this project proved unsuccessful.

The Institute also announced that it was considering dropping the reference to England and Wales in its title to become the Institute of Chartered Accountants.

However, this plan was also withdrawn following objections from the Institute of Chartered Accountants of Scotland.

The Institute introduced a new syllabus in 2007. The mandatory examinations will become more flexible based on a modular structure to make it more appealing to prospective students.

In addition to paper-based assessments, there are now computer-based assessments of objective test questions (multiple choices).

American Institute of Certified Public Accountants.

The American Institute of Certified Public Accountants (AICPA) is the national professional organization of Certified Public Accountants (CPAs) in the United States, founded in 1887.

AICPA has 394,000 members in 128 countries in business and industry, public practice, government, education, student affiliates, and international associates.

It sets ethical standards for the profession and U.S. auditing standards for audits of private companies, non-profit organizations, and federal, state, and local governments.

It also develops and grades the Uniform CPA Examination. The AICPA maintains offices in New York City; Washington, DC; Durham, NC; and Ewing, NJ. The AICPA celebrated the 125th anniversary of its founding in 2012.

The AICPA’s founding established accountancy as a profession distinguished by rigorous educational requirements, high professional standards, a strict code of professional ethics, and a commitment to serving the public interest.

History of American Institute of Certified Public Accountants.

The AICPA and its predecessors have a history dating back to 1887, when the American Association of Public Accountants (AAPA) was formed. In 1916, the American Association of Public Accountants was succeeded by the Institute of Public Accountants, at which time there was a membership of 1,150.

The name was changed to the American Institute of Accountants in 1917 and remained so until 1957, when it changed to its current name of the American Institute of Certified Public Accountants.

The American Society of Certified Public Accountants was formed in 1921 and acted as a federation of state societies. The Society was merged into the Institute in 1936, and, at that time, the Institute agreed to restrict its future members to CPAs.

Mission of American Institute of Certified Public Accountants.

The AICPA’s mission is to provide members with the resources, information, and Jeadersbuft that enable them to provide valuable services.

In the highest professional manner to benefit the public, employers, and clients. In fulfilling its mission, the AICPA works with state CPA organizations and prioritizes areas where public reliance on GPA skills is most significant.

Professional Standards Setting by American Institute of Certified Public Accountants.

The AICPA sets generally accepted professional and technical standards for CPAs in multiple areas. Until the 1970s, the AICPA held a virtual monopoly in this field.

In the 1970s, however, it transferred its responsibility for setting generally accepted accounting principles (GAAP) to the newly formed Financial Accounting Standards Board (FASB).

Following this, it retained its standards-setting function in areas such as financial statement auditing, professional ethics, attest services, CPA firm quality control, CPA tax practice, business valuation, and financial planning practice.

Before the passage of the Sarbanes-Oxley law, AICPA standards in these areas were considered generally accepted by all CPA practitioners.

In the early 2000s, federal public policymakers concluded where independent financial statement audits of public companies regulated by the U.S. Securities and Exchange Commission are concerned.

The AICPA’s standards-setting and related enforcement roles should be transferred to a government-empowered body with more enforcement authority than a non-governmental professional association, such as the AICPA could provide.

As a result, the Sarbanes-Oxley law created the Public Company Accounting Oversight Board (PCAOB), which has jurisdiction over virtually every area of CPA practice about public companies.

However, the AICPA retains its considerable standards setting, ethics enforcement, and firm practice quality monitoring roles for most practicing CPAs, who serve privately held businesses and individuals.

Conclusion

We can say auditing is,

- the examination of a balance sheet and profit and loss account prepared by others,

- together with the books, accounts, and vouchers relating to that in such a manner that the auditor may be able to satisfy himself and honestly report that(audit), in his opinion,

- the such balance sheet is properly drawn up to exhibit a true and correct view of the estate of affairs of the particular concern according to the information and explanations given to him, and as shown by the books.