Audit working papers record all audit evidence used to support the audit work done to assure that the relevant auditing standards performed the audit.

Let’s understand the importance, contents, characteristics, examples, ownership, responsibility, protection, and preservation of audit working papers.

Meaning of Audit Working Papers

Audit working papers are the documents that record all audit evidence obtained during financial statements auditing, internal management auditing, information systems auditing, and investigations.

According to SAS 41, working papers are the records the auditor keeps of the procedures, the tests performed, the information obtained, and the pertinent conclusions reached in the engagement.

Working papers should include all the information the auditor considers necessary to conduct the audit adequately and support the audit report. Increasingly, working papers are maintained in computerized files.

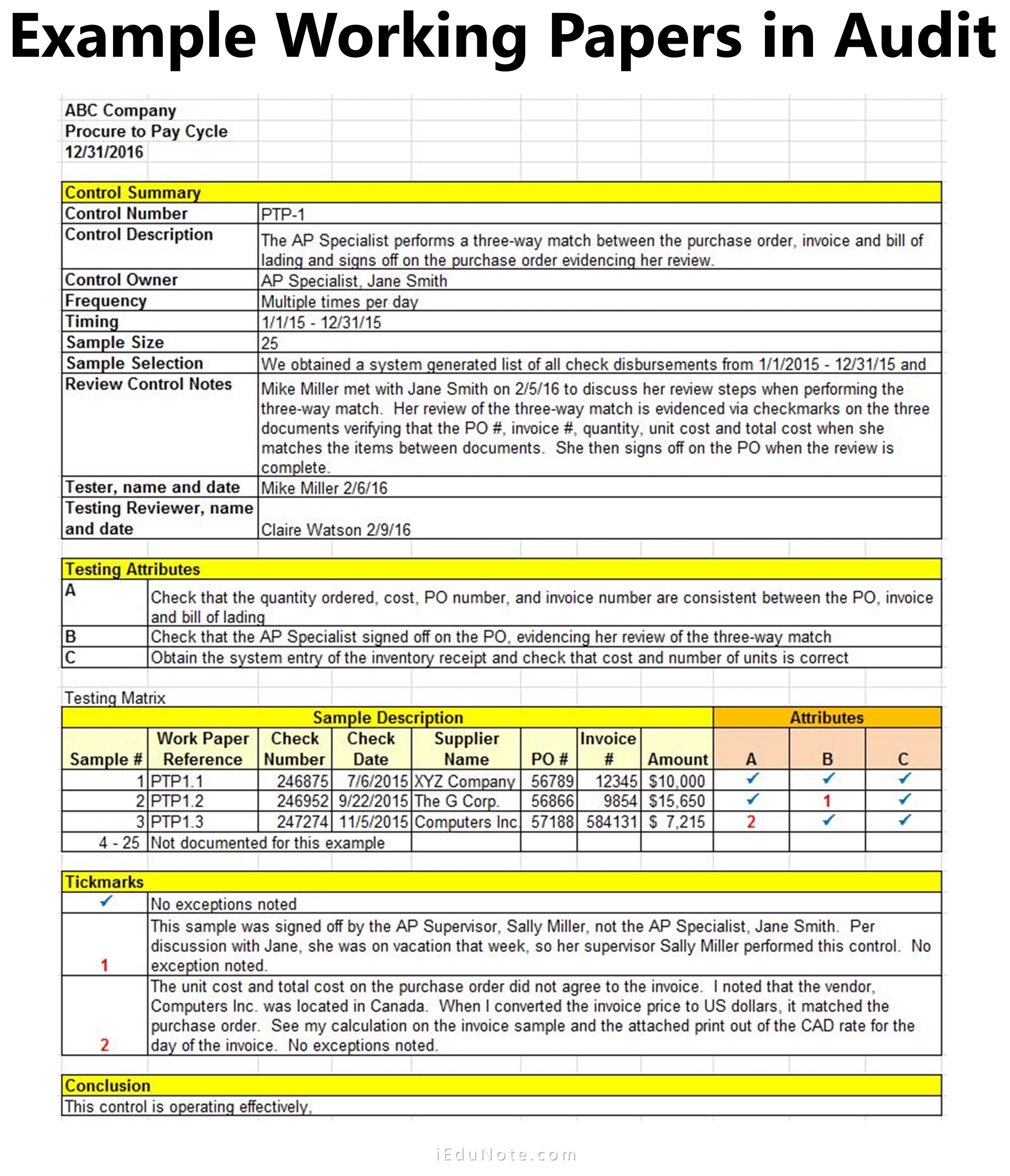

Example of Audit Working Papers

Importance of Working Papers

Working papers are an essential part of every audit for effectively planning the audit, providing a record of the evidence accumulated and the results of the tests, deciding the proper type of audit report, and reviewing the work of assistants.

CPA firms establish their policies and approaches for working paper preparation to ensure these objectives are met.

High-quality CPA firms ensure that working papers are properly prepared and appropriate for the audit’s circumstances. Working papers are important because:

- Working papers assist in the planning and performance of the audit.

- Working papers are necessary for audit quality control purposes.

- Working papers assure that the work delegated by the audit partner has been properly completed.

- Working papers provide evidence that an effective audit has been carried out.

- Working papers increase the economy, efficiency, and effectiveness of the audit.

- Working papers contain sufficiently detailed and up-to-date facts which justify the reasonableness of the auditor’s conclusions.

- Working papers retain a record of matters of continuing significance to future audits.

- The preparation of the working papers is a means to give training to the audit clerks as to how to summarize the work done by them.

- The working papers enable the auditor to point out to the client the weakness of the operation’s internal control system and the accountancy system’s inefficiency. Therefore, he may be in a position to advise his client on how to avoid such pitfalls.

- The working papers enable the auditor to prepare the report to be issued without wasting time.

- He can know that his assistants had followed his instructions.

Contents of Working Papers

Each audit working paper must be headed with the following information:

- The name of the client.

- The period covered by the audit.

- The subject matter.

- The file reference.

- The initials (signature) of the member of staff who prepared the working paper and the date on which it was prepared.

- In the case of audit papers prepared by client staff, the date the working papers were received, and the initials of the audit team member who carried out the audit work.

- The initials of the member of staff who reviewed the working papers and the date on which the review was carried out.

Characteristics of Good Working Papers

Based on the discussion above, a good, working paper should meet the requirements of ISA 230 by displaying the following characteristics:

- Working papers should contain all the essential information to be of maximum utility. Facts that are not important should be omitted.

- It should state a clear audit objective, usually regarding an audit assertion (for example, ‘to ensure the completeness of trade creditors’).

- It should fully state the year/period end (e.g., 31 October 2006) so that the working paper is not confused with documentation belonging to a different year/period.

- It should state the full extent of the test (i.e., how many items were tested and how this number was determined). This will enable the preparer and subsequent reviewers to determine the sufficiency of the audit evidence provided by the working paper.

- Where there is a necessary reference to another working paper, the full reference for that other working paper must be given. A statement that testing details can be found on ‘another working paper’ is insufficient.

- The working paper should clearly and objectively state the test results without bias and based on documented facts.

- The conclusions reached should be consistent with the results of the test and should be able to withstand independent scrutiny.

- The working paper should be referenced to be filed appropriately and found easily when required later.

- It should be signed by the person who prepares it so that queries can be directed to the appropriate person.

- It should be signed and dated by any person who reviews it to meet the quality control requirements of the review.

- The paper used for working papers should be of good quality so that it may not be damaged by frequent handling.

- Paper used should be of convenient and uniform size.

- Sufficient space should be left after each note so that any decision the auditor may take down in that space.

Ownership of Working Papers

The working papers prepared during the engagement, including those prepared by the client for the auditor, are the auditor’s property. The only time anyone else, including the client, has a legal right to examine the papers is when a court subpoenas them as legal evidence.

After the engagement, working papers and computer files are retained on the CPA’s premises for future reference. Many firms follow the practice of microfilming hard copy working papers after several years to reduce storage costs.

Responsibility, Protection, and Preservation of Working Papers

Whosoever has working papers should be responsible for their safe custody. They should, in no case, be shown to a third party except with the client’s permission.

After the audit report has been prepared and delivered to the client, these papers- may be filed and preserved for five to ten years or even more.