The Board of Directors, as agents of the shareholders, monitors the functions of the bank, whether it is performed efficiently or not, and also solves all the problems. An existing bank’s board of directors is normally elected in an annual general meeting held after a specific time interval.

When there is successful management in the bank, all the interest groups of the bank, i.e., shareholders, depositors, debtors, government, and bank regulatory authority, remain satisfied.

Successful management needs a competent, suitable, and efficient board of directors. The representatives of the elected shareholders to direct the bank are called the board of directors altogether.

All the power and authority to direct the bank are assigned to them. They apply their power and authority collectively.

Bank Board of Directors: Requirements, Composition, Responsibilities, Power, Functions, Liabilities, Committees

What is the Bank’s Board of Directors?

The Board of directors is the supreme authority of the bank. The shareholders approve or determine the key principles and planning in annual, special, and extraordinary meetings. The bank’s directors perform all the activities perfect for a new and small bank.

But for, a large-sized bank cannot involve directly in all matters. In this case, an executive president or managing director becomes responsible for the board of directors.

They apply all the methods and principles of management as assigned to them by the board of directors. He again assigns some duties and responsibilities to the general managers and divisional/departmental heads to ease his responsibility.

Composition of Bank Board of Directors

For new banks, sponsors/ promoters, in particular numbers, become directors. But for existing banks, several categories of directors are seen to be involved.

An efficient board of directors is required to run the banking activities effectively. There are different ways through which directors of an existing are included in the board:

- Appointment by the promoters or sponsors

- Appointment by the shareholders

- Appointment by the existing members of the board of directors (Co-opted directors)

- Appointment by the third party

- Appointment by the government / Central bank

There is no restriction on the number of directors included in the board of directors of a bank. The size varies from country to country and in the same country from time to time.

However, the directors of the bank may be of two types- lull lime and part-time. The part-time directors participate in the pre-determined meeting with a specific agenda.

On the other hand, though the full-time directors are not paid employees or officers, they perform special responsibilities for the bank’s sake.

They get an honorarium, car facility, meeting fee, etc., for discharging their duties to the bank. In some countries, a director can not act as a director beyond a maximum number of organizations.

However, in the case of the appointment of the directors of nationalized banks, the government has a greater choice and role to play.

Sometimes specialized persons from outside the bank may be appointed. The central bank often defines the maximum and minimum number of directors. In the USA, this number is a maximum of 25 and a minimum of 5.

Qualification and Election of Directors

Generally, the bank’s first directors are elected by the sponsors, as their name is stated in the Memorandum and Article of association.

Suppose there is no name of the director in the article of association; the persons who sign the memorandum will be considered the first directors of the firm. They remain as directors up to the first annual general meeting.

Afterward, the bank’s shareholders appoint the directors through a formal election in the annual general meeting. Besides minimum shareholdings, persons eligible to make a contract can become the bank’s directors as this post is to be taken by written agreement.

Any person having a sound mind and the ability to pay debt can be the director by purchasing the qualifying shares.

Qualifying shares are to be taken at the time of election or within a specified time period after the election. Otherwise, the director will be competent to act in the capacity stated.

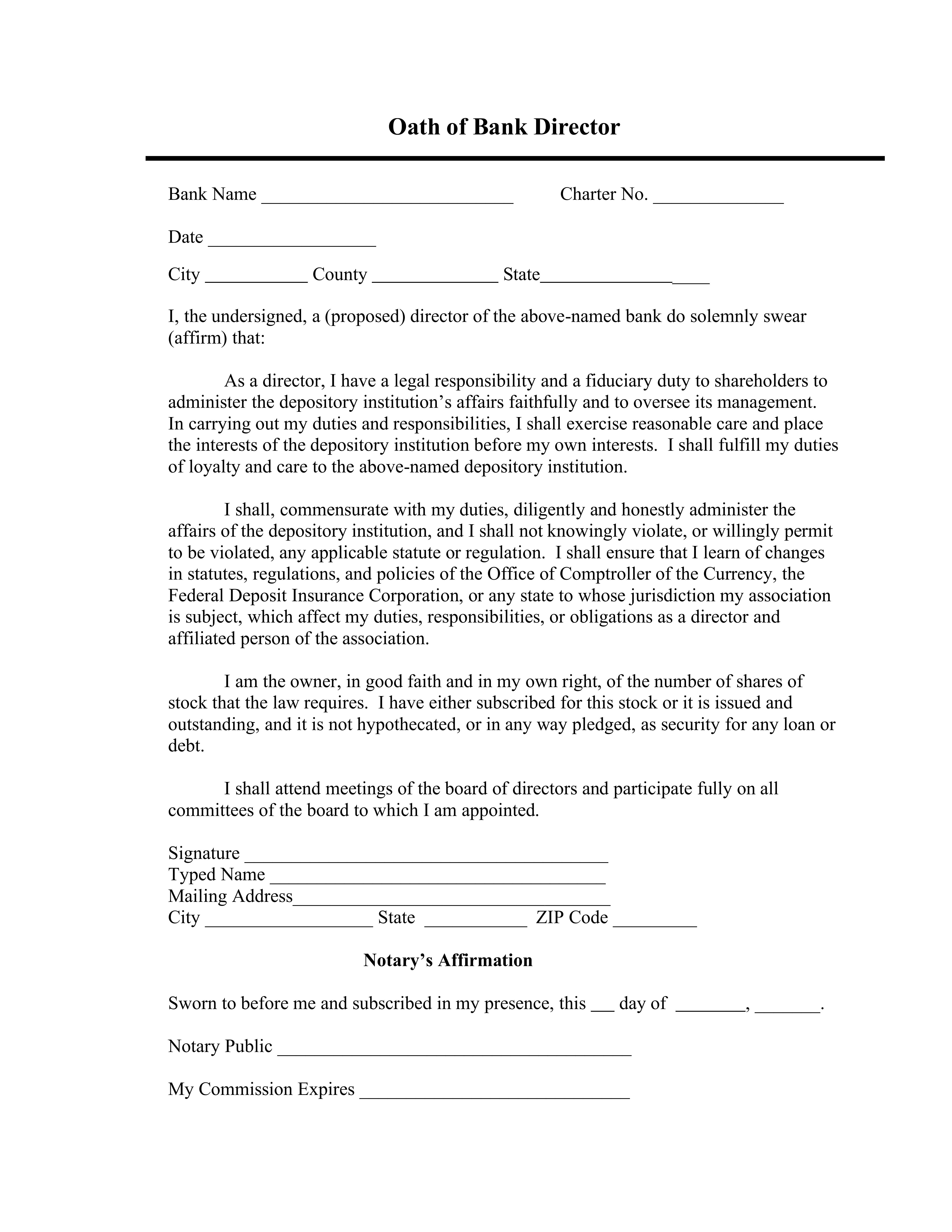

Oath of Bank Directors

The government of any country is liable to ensure a safe and favorable environment for the depositors, as the bank takes deposits from many people.

One of the measures is that the directors of the banks promise to obey their duties with honesty, integrity, and efficiency at the time of taking the oath.

Taking the oath of the directors is not always obligatory. It varies from country to country but is done under the constitution of the Bankers’ Associations.

American Comptroller of Currency publishes the booklet on the duties and responsibilities of the national commercial banks. The oath written in the following words is to be undertaken in the USA at the time of taking responsibilities by the directors:

| “I, the undersigned, director of the [bank] located at [address) being a citizen of the United States, and resident of the state of |insert], so solemnly [affirm] that I will, go for as the duty develops on me, diligently and honestly administer the affairs of said association, that I will not knowingly violate, or willingly permit to be violated any of the status of the United States under which this association has been organized and that I am the owner, in good faith and in my own right of the number of shares of stock of the aggregate par value required by said status, subscribed by me as standing in my name on the books of the said associations; and that the same is not hypothecated or in any way pledged as securities for any loan or debt.” |

Format of the oath of bank directors;

Powers of the Directors

The powers of the directors depend on the size of the bank. If the bank size is small, the directors will scrutinize all the important problems for the smooth operation of the bank. If the bank size is large, the directors will decide when details of the important matters are dealt with elaborately by a committee appointed by the board of directors.

They cannot delegate the authority of supervising the bank; the directors’ responsibility confined by the association article is not transferable. The article of association describes the limit of the directors’ power, so this power is considered legal.

Some special powers of the directors are stated below;

- To call the so far uncalled portion of the share capital from the shareholders.

- To invest funds of the bank properly.

- To adopt the general rules and policies framing regarding bank management.

- To appoint one or more directors in case of the director’s premature death, resignation, or discharge.

- To appoint the CEO of the bank.

- To appoint the chairman of the board.

- To inspect the accounts.

Directors’ Indemnifications

Directors can accept the money spent as expenses for the bank if mentioned in the article of association. Where it is not mentioned in the articles of association, these expenses or other expenses reimbursable can be received subject to approval in the annual meeting of shareholders.

Moreover, directors have the right to receive the expenses from banks incurred during their period as directors for legal purposes by promising to give an advance voucher. But this rule is not applicable when the directors suffer personally for huge negligence or intentional crime when performing their responsibilities as directors.

Personal Attributes of Successful Bank Directors

All banks do business by creating a liaison between depositors & users of funds based on trust. Directors and banks stand on the trust reposed on them that upholds the indispensable goodwill required of the banking businesses worldwide.

Personally renowned directors increase the goodwill of the bank directed by them. On the other hand, it is also not astounding to increase the goodwill of individuals after fetching the directors of a well-known bank.

Because of being a public service institution, the honesty, efficiency, reliability, and overall high moral character of the directors are very precious assets for a bank for directors as individuals.

The personal qualities that directors of an ideal bank should possess are as follows;

- Successful bank directors must have a progressive outlook and advanced thinking. In short, progressive directors would collect the needed information well to meet the need of time and take necessary prior preparation for future actions accordingly.

- A successful director must be a well-known and respectable person in society.

- Successful directors must be aware of the preference or non-preference that is the demand or taste of clients of society and its inner people known as employees.

- Successful directors must be able to expand the scope of bank services by constantly attempting to innovate new bank products/services.

- Bank directors must be conversant with the monetary and fiscal policies of the country and must lie strategically in handling the clients’ reactions in different situations.

- Successful directors must know about national and international, political, economic, and social changes besides the knowledge of the scope of activities of the bank.

Besides these attributes, bank directors must have the following additional qualities if they want to be successful-

- Sense of discipline.

- Tactful.

- Patience and tolerance.

- Optimistic.

- The capacity to adapt to changing conditions or environments.

- Sincerity.

- Dedicated to the duties and responsibilities.

- The capacity to control the adverse situation quickly.

- Mental balance.

- Attitude towards impartial judgment.

- Firm to discharge duties by strictly following the laws and rules of the bank.

- The capacity to give leadership to the staff of the bank.

- The capacity to keep a good relationship with the bank personnel.

6 Responsibilities of the bank directors

The board of directors is responsible for a bank’s ultimate success and failure. Directors are elected and appointed to achieve the right service or claim of the shareholders, depositors, and other stakeholders.

Bank directors sometimes are required to make decisions in advance, keeping bank interest before its implementation: keeping the secrecy of such cases is also a moral obligation of the directors. Besides banking activities, directors sometimes remain busy with other businesses or social work.

With all of these, there is no scope for viewing their appointment as unimportant. Directors should participate actively in the board meetings, notwithstanding their other involvement elsewhere.

Although social status, self-satisfaction, allowance, or honorarium as directors act as matters of satisfaction for the directors, they

Cannot avoid the responsibilities of the loss to the clients and or banks incurred due to their negligence of duty.

Although diminutive in number, some directors were held liable for criminal cases at home or abroad for causing losses to the bank or bank-related stakeholders due to their carelessness and negligence made intentionally or unintentionally.

Generally, directors should look after the rights & perform proper duties to the following persons;

- Depositors.

- Shareholders.

- Central bank.

- Tax authority.

- Government.

- Society.

The responsibilities of directors to the related stakeholders are described below:

1. Depositors

Depositors supply the major portion of bank capital. They can transfer their deposit to another bank if they are displeased. So keeping the interest of depositors and expanding quality services due to them appropriately is the responsibility of the directors.

The ways by which better-quality service can be rendered to the depositors are as follows-

- Ensuring the security of the deposited money.

- Ensure getting money immediately after giving a check for withdrawal.

- Rendering quality and quicker services at the front counter.

- Appointing efficient and service-oriented staff and employees.

2. Shareholders

Directors are the agents of the shareholders. They are elected in the annual general meeting on the promise of upholding the interest of the shareholders. It is expected that directors will keep a close eye on behalf of the shareholders on the following matters:

- Remain careful so that shareholders get a reasonable amount of dividend.

- Develop innovative ideas & products so that the goodwill of the bank is raised.

- Giving leadership on behalf of shareholders within and outside the bank with the related parties and interest groups.

- Implementing such kind of project so that bank staff can sell the products/services profitably.

- Making forward-looking profitable plans to overcome competition.

3. Central bank

The central bank is the guardian and leader of a country’s banks. With the help of the central bank, the government of a country controls the banking system, especially commercial banks, to safeguard the public interest. The expectation of the central bank from the commercial bank directors, among others, include the following:

- Operate banking activities following the regulatory guidelines and, above all, upholding the constitution of the country

- Submit periodical reports to the central bank on specific forms and designs: weekly statement, monthly statement, quarterly statement, and half-yearly statement, and yearly statement as and when due.

- Faithfully and sincerely implementing the advised steps/ measures provided by the inspection team of the central bank after examining the bank’s activities for correcting their mistakes and errors when identified.

- Accept the punitive actions/ warnings awarded for repeated negligence of instructions.

4. Tax authority

Implementation of the fiscal policies by the tax authority should be intimately aided by the bank and its personnel, including directors. It is legally and morally binding on the bank directors to help the government raise public funds by collecting taxes and duties from the banks and the banks’ clients.

Banks have to prepare tax statements on behalf of the clients for submission to the tax authority. To verify the accuracy of those data, the bank can help the tax authority by supplying confidential information.

5. Government

Banks act as an important tool for augmenting the country’s economic activities. To implement the country’s long-term goal or overall plan, directors of the banks can actively help the government by increasing or reducing the loan supply.

Priority sectors or groups or backward areas are to be preferred while extending loan facilities, for example, for expanding exports, income-generating activities, disadvantaged people of the backdated areas, production of food grains, etc., bank directors should help the government actively by keeping the balance of the loan program.

6. Society

A bank is an artificial person created by law and treated as a member of civil society. The responsibility of directors is to participate in social activities on demand by society without hampering their own business activities.

In the USA and other western countries, “Business ethics and social responsibilities” have been developed due to the movement of consumers & civil societies.”In the USA and other western countries, “Business ethics and social responsibilities” have been developed due to the movement of consumers & civil societies.

As a business organization, bank directors must be cautious not to violate the bank’s policy and not involve the bank in irresponsible social activities.

It is not desirable to help the anti-social businessman and the enemy of the country by providing loans to illegal activities against the law and constitution of the country: Smuggling, drugs trafficking, and unsocial activities, etc., must not be patronized by extending credit facilities.

Bank directors would lead the banking activities profitably without ignoring the legal expectation of the stakeholders. Otherwise, they will tie treated as negligent of duties.

Functions of Bank Directors

Directors of banks perform many functions for the bank. Directors of banks are usually engaged in discharging the following functions:

- Determination of the banks’ goals and objectives: The most important function of the board of directors of a bank is to set down the goal of the bank business.

- Formulations of bank policies: Once the goal has been established, the board has to lay down such policies conducive to attaining the goal.

- Selection of the bank management: The selection of capable executives requires careful consideration of the bank directors.

- Determining authority and responsibility of key executives: The appointment of the top corporate executives & framing their job description is an important function of the bank directors.

- Creating required committees: Besides selecting the officers, the board of directors creates a required number of the standing committee and elects the members for the same.

- Supervision of the bank’s relatively bigger loans

- Supervision of banks’ major investment

- Counseling of the key personnel

- Counseling of the prime customers when sought

- Business development

- Reviewing bank operations

- Evaluating the performance of bank executives and officers in the light of their job descriptions and expected standard of the banks

- Recommendations of dividends to be distributed to shareholders

- Signing contracts on behalf of the bank

- Maintaining books of records and accounts

- Issuing shares and distributing the same among the shareholders

Liabilities of the Bank Directors

According to Hazeltine, “It has been established that the directors are liable not only for wrongs but also for negligence.” Criminal liabilities! Criminal liabilities are the violations for which a bank’s directors, officers, agents, or employees may be prosecuted. These include the following:

- False entries, false report

- False certificate of equities

- Theft, embezzlement & misapplication by bank officers or employees

- False representation as to insurance coverage

- Violation of prohibition of loans to directors

- Violation of prohibition of trust funds to directors

- Violation of prohibition of directors receiving fees for procuring loans

- Violation of prohibition of political contribution and expenditure

- Violation of prohibition of participation by a financial institution in lotteries

Common law liabilities for negligence

The loss that has the scope to be avoided but ultimately occurred just for the directors’ negligence of duty is considered the common law liabilities of directors for negligence.

When directors decide indifferently without care, without exercising a reasonable amount of intelligence, and the bank’s clients incur a loss, directors be held liable.

To get rid of punishments, directors must prove in the court that they took all sorts of care and, in good faith, decisions were made, but despite all that, the bank or its clients suffered a loss.

For example, if the borrower cannot pay the loan amount, the director is not liable.

But when it is proved that the loan amount cannot be recovered due to the imprudent activities and improper inspection by the directors, drey will be liable for this non-recovery.

Risk management of directors’ Liabilities

We have already discussed the nature, scope, and type of risks. There are three methods of handling the liability and risks of the directors:

- Avoidance.

- Prevention and control.

- Transfer.

These are described below:

1. Avoidance

On, can manage the risk of liabilities as a director by not being a director. As a director may Cause to bear liabilities, a person can avoid such responsibilities just by deciding not to be a director. The person, who cannot give enough time and effort as a bank director due to their preoccupations, should not be inclined to be a director.

2. Prevention and control

The second alternative to liability risk management is to take a positive attitude & awareness regarding risk-prone activities. That is, a director should be aware of the activities that will create risk and make the director liable. Then the director can prevent the same from occurring by being very cautious and reasonable care and internal control measures while performing such activities.

3. Transfer

Some risks cannot be prevented or are very tough to prevent. To minimize the loss from such risky activities, liability insurance is an alternative. The. directors can insure the liability risks in an insurance company in exchange for a premium.

Retirements of Directors

Directors of a bank and other financial institutions have greater responsibilities than other business organizations. So in a bank, the directors should be competent and efficient from different angles. Moreover, experienced and competent directors can make challenging decisions.

In many western countries, directors are required to retire after a certain age. This ensures the entrance of new, young people as the bank’s directors. According to the tire author, directors should be retired when they attain the age of-65.

Relationship between Board of Directors and Bank Management

Shareholders are the owners of a bank, but they aren’t directly related to the tire bank’s activities. They perform their bank activities indirectly by formulating the board of directors. The Board of directors performs these activities on behalf of the shareholders.

On the other hand, the board of directors doesn’t participate in the day-to-day activities of the banks.

The Board of directors frames the policies and transfers the management to execute them.

Though the board of directors is praised by the shareholders for the efficient and profitable activities of the bank, in the real sense, they do not operate the bank’s activities. They only appoint the personnel in the management body.

On the other hand, the board of directors is held responsible by the bank’s shareholders for the unsatisfactory performance of the bank. Though, inefficient management is mostly responsible for the unsatisfactory performance of the banks.

It is mentionable that the board of directors is responsible for developing the management quality and efficient staff. The board can ensure efficient management activities by appointing experienced and efficient persons to the top management positions.

Besides this, the board can also help the management to make the correct decisions and to achieve the best possible target by ensuring the organizational responsibilities and flow of activities through some committees.

The bank’s top executive is responsible for creating a favorable working environment by ensuring good internal and external communication and developing employee motivation and morale. The top executive is also responsible for appointing the right staff with appropriate qualifications and experience in the right position.

Besides, the top executive must also see whether the training, promotions, and transfers are unbiasedly performed according to the bank’s policy. So, we can say that though management and the board of directors are separate, they are related.

Standing Committee of the Board of Directors

The board of directors usually directly participates in the bank management through the selection and appointment of the key executives of a bank. But this body usually takes part in bank management indirectly through the standing committee.

Directors are usually very busy with their other businesses, so they can not devote much time to the bank now and then.

Since it is difficult for the directors to be involved in regular bank management, they perform mostly through Standing Committee. It would be wiser to decide on a group of heads instead of a single one. It conforms with the long-standing saying: two heads are better than one.

Some committees in the banking business are occasionally formed due to initiate the non-repetitive particular job. But the existence of these bodies usually expires after completing that particular assignment.

The Standing Committees are not like the Occasional Committees that we stated earlier. These bodies basically are initiating the regular businesses of the bank that occur as a normal feature. That’s why these are not abolished but reformed on the expiry of a certain period.

Members of the Committee

There is no hard and fast rule in the banking industry regarding the number of members of the Standing Committees. The board of directors usually decides the number and the members o the particular Standing committee. It is not expected that every committee would contain the same number.

In some cases, some externals are included as experts in the Standing Committee. Often knowledgeable & experienced persons in the line may be invited for fruitful interaction.

9 Types of Standing Committees

- Executive Committee

- Loan Committee

- Investment Committee

- Salary and Employee Relations Committee

- Examining Committee and Audit Committee

- Management Evaluation Committee

- Trust Committee

- Discount Committee

- Business Development Committee

1. Executive Committee

The By-Laws of the Company empowers this executive committee, popularly known as EC. The EC usually takes any decision on behalf of the board of directors.

Before any board of directors meeting, the EC usually submits relevant cases& issues in detail and recommends to the board logically suggestions. The recommendation of the EC should get approved at the next meeting of the board of directors.

It should be mentioned that the EC does not have any power to declare the dividends, change the By-Laws of the Company, or change any bank management rules. But the committee makes important suggestions basing which board can finally take resolutions without loss of much time & energy.

2. Loan Committee

This committee can consider short-listed loan applications up to a certain limit. But, it should be disclosed here that this body must not violate the loan policy of that particular bank. For example, a loan application above five lacs could be sanctioned by the Loan Committee but need the approval of the next board of directors’ meeting.

But any application of above one crore must refer to the board of directors meeting. The Loan Committee does not have any final power to sanction the loan case; they act as a recommending body to the board of directors.

3. Investment Committee

This committee usually considers the investment proposal to the banks. By investment, we mean the use of bank funds through money & capital market instruments. The committee must comply with the Investment Policy of the Bank. This committee decides the maturity of the investment portfolio size of the investment.

What is decided in the Investment Committee, as analyzed by technical persons, is taken to be final. It needs to be forwarded to the board of directors’ meeting for information & reference.

4. Salary and Employee Relations Committee

In the competitive market economy, the competition is very high & acute. It requires finding a balance between recruiting professionally rich personnel on one side and reducing the employee costs per unit of service. This body usually prepares a pay scale for the bank employees to attract the existing employees in this industry.

5. Examining and Audit Committee

This committee is basically liable for the inspection and internal audit of the finical transaction of the bank besides the extent of regulatory compliance. The committee usually examines whether the bank management is following the accounting and auditing standards of the bank.

Even this committee is responsible for the examination of the financial transactions of any particular branch. No doubt, the jobs of this committee minimize non-compliance with accounting and regulatory standards, enhancing the bank’s image and goodwill.

6. Management Evaluation Committee

Either the bank itself or any appointed management consultancy firm can evaluate the management policy of the bank, MIS, Credit Management, or other issues related to the bank management.

7. Trust Committee

This committee usually inspects or checks the financial transactions of different investment portfolios of trusts and assesses the income source from that investment. This body usually forwards those sorts of investments that yield higher with less risk to the board of directors.

8. Discount Committee

One of the busiest committees of commercial banks is the Discount Committee. This body implements the following jobs: determining the interest rate for discounting bills and suggesting an increase or decrease in funds for a particular sector.

9. Business Development Committee

This committee could be of two types in nature. Firstly, one team would innovate newer Financial Products or Services; another would increase or build customer awareness through innovative publicity.

Whatever the committee decides, the management will initiate the decision to enhance the volume of the banking business. The committee’s suggestions must be placed before the Board for final approval.