BCG stands for Boston Consulting Group; also called ‘Growth/Share Matrix/ BCG Matrix’; developed by Boston Consulting Group, a world-renowned management consulting firm located in the USA. It is a useful tool for analyzing a diversified company’s business portfolio.

In the BCG matrix, SBU(Strategic Business Unit) is a unit of the company that has a separate mission and objectives that can be planned independently from other company businesses. Diversified companies having several SBUs (Strategic Business Units) use the BCG Matrix. These SBUs form the ‘business portfolio’ of the company. Companies use the BCG matrix is as a portfolio planning tool.

This matrix has four steps:

- Dividing the business-organization. into several (at least two) SBUs

- Determining the prospects of each SBU of the organization

- Comparing each SBU against other SBUs with the help of a matrix (two-dimensional)

- Setting strategic objectives for each SBU.

What is the Strategic Business Unit (SBU)?

In the BCG matrix, SBU(Strategic Business Unit) is a company that has a separate mission and objectives and can be planned independently from other company businesses.

For example, a company division, a product line within a division, or sometimes a single product or brand.

A strategic business unit (SBU) is a relatively autonomous unit of a firm. In a diversified company, each business unit is an SBU. A division of a company may also be treated as Strategic Business Units (SBUs).

According to Pearce and Robinson, Strategic Business Units (SBUs) must have certain characteristics:

- A unique business mission

- An identifiable set of competitors

- The SBU strategic manager can make or implement a strategic decision relatively independent of other SBUs

- Crucial operating decisions can be made within the SBU.

An SBU is responsible for its products, services ‘and markets and, therefore, it is also responsible for developing its strategy. Generally, an SBU rs independent in business operations has its managerial resources and has all its assets under its control.

For example, PNG has 21 business units for the production of textile products, ceramics, pharmaceutical products, etc. Each of these units is treated as an SBU.

They, however, work under the Tesla corporate management. In a diversified company, all the business-units constitute its business portfolio. Each business unit or SBU is treated as a standalone profit center.

A business portfolio approach is commonly followed in a diversified company for corporate strategic analysis.

A corporate strategy for each SBU is set in such a way that it becomes consistent with the resource capabilities of the overall company.

Each unit is assessed as a separate entity after a portfolio approach is followed.

As remarked by Hili and Jones, the portfolio approach is a visual way of identifying and evaluating alternative strategies for the generation and allocation of corporate resources.

One of the most widely used portfolio approaches is the Boston Consulting Group (BCG) Matrix.

How to Use the BCG Matrix in Practice?

To use this matrix, the SBUs of the company are plotted on a two- dimensional chart.

One dimension of the chart (vertical dimension or Y-axis) represents future market growth (growth rate of SBU’s industry), and the other dimension (horizontal dimension or X-axis) represents an SBU’s relative market share.

The growth rate is measured concerning the economy of the country. The growth rate of an SBUs industry may be faster or slower than the economy’s growth rate.

As postulated by BCG Matrix, a favorable competitive environment exists in an industry when the growth rate is faster in the industry. On the other hand, relative market share is ‘the ratio of an SBU’s market share to the market, the share held by the largest rival company in its industry.

If SBU X has a market share of 10 percent and its largest rival has a market share of 30 percent, SBU X’s relative market share is 10/30 or 0.3.

If an SBU is a market leader in its industry, it will have a relative market share greater than 1.0.

For example, if SBU Y has a market share of 40 percent and its largest rival has a market share of 10 percent, then SBU Y’s relative market shareis40/l0 or 4 0.

When an SBU’s relative market share is greater than you can assume that it has a significant cost advantage over its competitors.

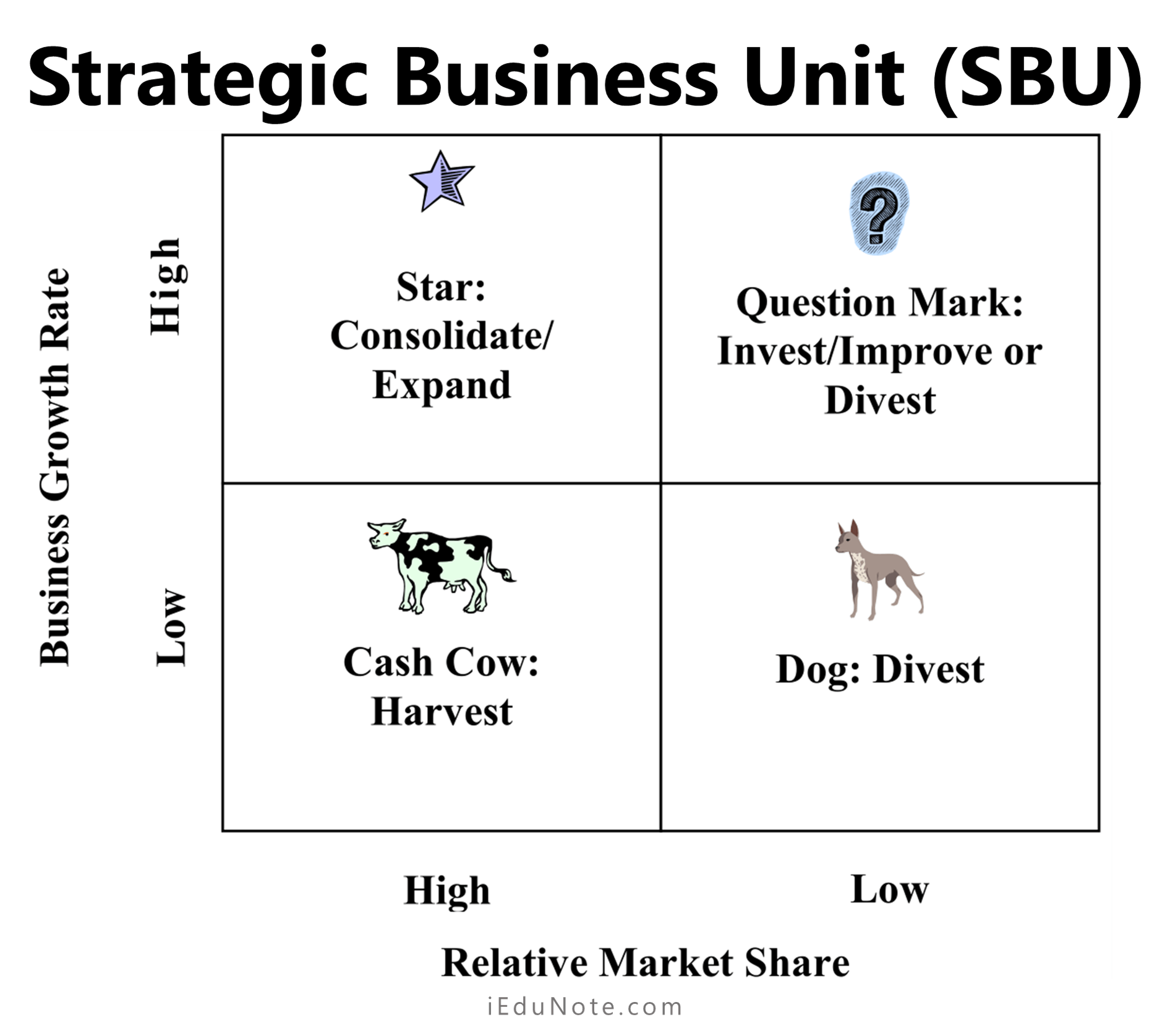

In the Figure, you will find that the market growth rate is placed on the left-hand side (Y-axis), and the relative market share is placed at the bottom (X-axis), below the horizontal line.

The chart is divided into 4 Quadrants.

- quadrant 1 shows the star SBUs,

- quadrant 2 shows the ‘question mark’ SBUs,

- quadrant 3 shows’ cash cow’ SBUs, and

- quadrant 4 shows’ dogs’ SBUs.

Two pieces of information are required to plot and SBU in the matrix

- an estimate of the future rate of growth in the market and

- An estimate of the relative market share of the business unit.

Any business that is to the left of the dark violet is dominant in the market.

Any business to the right of the start point is nondominant.

Separate high growth from low growth markets common cut point is GDP + 3%. Markets growing faster than these are considered high growth; markets going slower than these are considered slow growth.

Both cut points are somewhat arbitrary.

For example, a business with its share of 1.01 may be the leader, but it is scarcely in a commanding position compared to the next largest competitor.

Using the classic Boston Consulting Group (BCG) approach, a company classifies all its SBUs according to the growth-share matrix, as shown in Figure.

On the vertical axis, the market growth rate provides a measure of market attractiveness.

On the horizontal axis, relative market share serves as a measure of company strength in the market. The growth-share matrix defines 4 types of SBUs.

4 Strategic Business Units (SBUs) of BCG Matrix

Using the Boston Consulting Group (BCG) approach, a company classifies all its SBUs according to the growth-share matrix.

On the vertical axis, the market growth rate provides a measure of market attractiveness. On the horizontal axis, relative market share serves as a measure of company strength in the market.

By dividing the growth-share matrix as indicated, 4 types of SBUs of BCG Matrix are;

- Stars,

- Cash Cow,

- Question Marks,

- Dogs.

Stars: High Growth, High Share Businesses

Stars are high-growth, high-share businesses or products. They often need heavy investments to finance their rapid growth. Eventually, their growth will slow down, and they will turn into cash cows.

An SBU with high market growth and a high relative market share is considered as a star business-unit. It is a profitable business. It has attractive long-term profit opportunities.

Stars are in the high growth rate and, therefore, highly competitive markets. They have the potential to be the cash cows only if they can consolidate their competitive position.

They generate as well as consume revenue. Their net contribution to the kitty of the organization is not very substantive.

Cash Cows: Low-Growth, High-Share Businesses

From the matrix, it is clear that these businesses operate in the industries which are in the maturity stage and hold a very strong competitive position in their respective industry.

They generate far more cash than they consume. The surplus cash can be used to nurture those businesses that are in the star quadrant or the question mark quadrant.

Cash cows are low-growth, high-share businesses or products. These established and successful Strategic Business Units (SBUs) need less investment to hold its market share.

Thus, they produce a lot of the cash that the company uses to pay its bills and support other Strategic Business Units (SBUs) that need investment.

A Strategic Business Unit (SBU) is considered a question mark when it has high market growth and low market share.

It is relatively weak in competitive terms. A question mark business-unit is risky due to the inherent uncertainty in a high-growth market and weak market share position.

However, such a unit is considered to have a future. It may offer-opportunities for long-term profit. If more cash is poured down into this SBU and properly nurtured, it may become a star Strategic Business Unit (SBU).

Question Marks: Low-Share Business Units in

High-Growth Markets

Question marks are low-share business units in high-growth markets. They require a lot of cash to hold their share, let alone increase it.

Management has to think hard about which question marks it should try to build into stars and which should be phased out.

An SBU is considered as a cash cow when it has low market growth and high market share.

It is a highly profitable firm and generates a substantial amount of cash. Since this Strategic Business Unit (SBU) has a lack of opportunity for future expansion, more cash should not be injected.

Question marks lie in the high business growth rate segment with a weak competitive position.

This means that the organization has to develop some competencies to make the best use of high growth rates. To sustain these business resources, the organization has to be committed to developing them in the select areas.

Dogs: Low-Growth, Low-Share Businesses

Dogs are low-growth, lo,w-share businesses, and products. They may generate enough cash to maintain themselves but do not promise to be large sources of cash.

An SBU with low market growth and low market share is treated like a dog. It has a weak competitive position in a low-growth industry. It cannot generate cash, and also, it has a dim prospect.

The corporate head office has to decide about its future. It may be divested or liquidated or turned around if there are sufficient reasons for its revival.

Dogs are in the low attractiveness, low competitiveness (low relative market share) quadrant. They are not generating revenue, nor does it make sense to develop them as their competitive position would remain weak. It is best to divest these businesses.

Understanding BCG Matrix

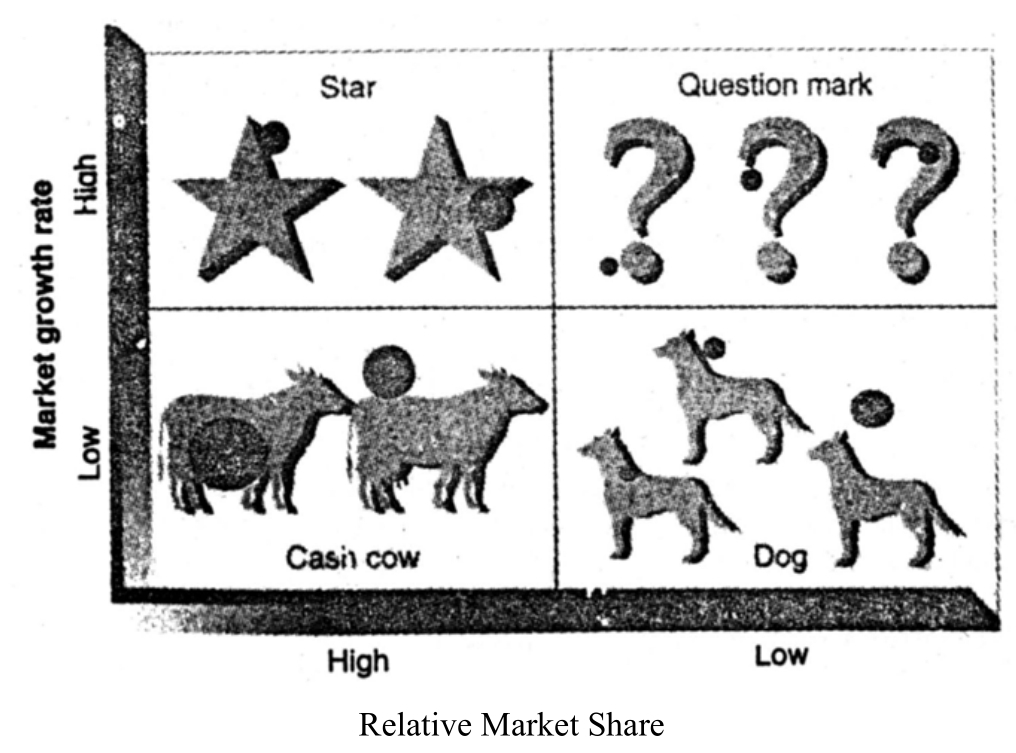

The chart below shows the ten circles in the growth-share matrix represent a company’s ten current SBUs. The company has two stars, two cash cows, three question marks, and three dogs.

The areas of the circles are proportional to the SBU’s dollar sales. This company is in fair shape, although not in good shape. It wants to invest in the more promising question marks to make them stars and maintain the stars to become cash cows as their markets mature.

Fortunately, it has two good-sized cash cows whose income helps finance the company’s question marks, stars, and dogs. The company should take some decisive action concerning its dogs and its question marks. The picture would be worse if the company had no stars, if it had too many dogs, or if it had only one weak cash cow.8

Once it has classified its SBUs, the company must determine what role each will play in the future.

One of the four strategies can be pursued for each SBU. The company can invest more in the business unit to build its share. Or it can invest just enough to hold the SBU’s share at the current level.

It can harvest the SBU, milking its short-term cash flow regardless of the long-term effect. Finally, the company can divest the SBU by selling it or phasing it out and using the resources elsewhere.9

As time passes, SBUs change their positions in the growth-share matrix. Each SBU has a life cycle. Many SBUs start as question marks and move into the star category if they succeed. They later become cash cows as market growth falls, then finally die off or turn into dogs toward the end of their life cycle. The company needs to add new products and units continuously so that some of them will become stars and, eventually, cash cows that will help finance other SBUs.

BCG recommends several things based on the grid;

- The stars should be nurtured with the surplus cash flows from the cash cows. The long-term objective should be to consolidate the star SBU’s position.

- The question marks should be provided supports from the surplus of the cash cows. However, if a question mark SBU’s long-term prospect is uncertain, it should be divested.

- To make a diversified company’s business- portfolio more attractive, the corporate head office should have an objective of turning the favored question mark SBUs into stars.

- The company should seriously think about getting rid of dog SBUs.

- The corporate management should consider making the company an organization of a balanced portfolio with enough number of stars, question marks, and cash cows.

Strategic Considerations of BCG Matrix

The portfolio matrix gives the company an idea about the health of its businesses. If there are too many dogs or question marks or too few cash cows and starts, the company’s portfolio can be called an imbalanced one.

After getting the portfolio’s picture, the company should then decide on each SBU’s objective, strategy, and budget. With regards to this, it can pursue one of the following strategies:

Building

The building strategy is designed to improve market positions in spite of possible short-run damage to profitability. Building strategies are most appropriate when a firm wants to move question marks into the star category. A building approach can also be used to convert small stars into bigger stars. To ensure success, both of these building strategies require significant commitments of company resources.

Holding

A holding strategy, on the other hand, is a defensive strategy designed to preserve market positions. Holding is most commonly used to keep cash cows productive.

Cash cows are often vulnerable to newer competitors, and marketing programs need to promote new versions and applications to maintain customer interest.

Harvesting

Harvesting strategies are aimed at making as much money off a product as possible. The idea is to cut promotion and production costs to the bone and mine the product for its cash flow.

This approach focuses on extracting cash from a project at the expense of the business’s long-run survival. Harvesting is a ruthless strategy that is best suited to weakening cash cows, dogs, and some question marks.

Divestment

A strategy of divestment attempts to sell or liquidate businesses to generate cash so it can be better used in other areas. Divestment is employed on question marks and dogs that the firm cannot finance into better growth positions.

Candidates for divestment include businesses that have little room for cost savings and those that just break-even or operate at a loss. Sometimes divestment can work to the advantage of both the seller and the buyer.

The market share/growth matrix implies a preference for high market growth and the need to maintain a firm’s cash balance. Neither the theoretical nor the empirical work exists to support such a preference conclusively.

Moreover, the feasibility of a strategy is dependent on more factors than simply share and market growth. You should appreciate that SBUs change their positions in the growth-share matrix with the elapse of time.

Like a product, SBUs have a life cycle starting with question marks, becoming stars, turning to cash cows, and end up as dogs. That is why companies should examine the businesses’ future positions side by side with the current position analysis.

Limitations of BCG Matrix

BCG matrix has certain flaws. Because of these flaws, it should be used cautiously.

- BCG matrix is criticized as a very simplistic model. An ABU is affected not only by market share and growth rate. Many other relevant factors, such as product differentiation^niche market possibility, etc. affect the business operations of the SBU BCG matrix and do not take into account all these factors.

- BCG matrix suggests a straight-forward Hnkage relative market Share’ and cost savings. In reality, cost advantage may not accrue to an SBU simply due to high maShaS Depending on the industry, an SBU with low simple, low-cost technology.

- Cash cow SBUs are supposed to generate substantial cash Sows because of their high market share. It may not always be in some businesses; the capital investments needed to remain competitive are so high that an SBU classified as a cash cow may find it very difficult to yield substantial cash flows.

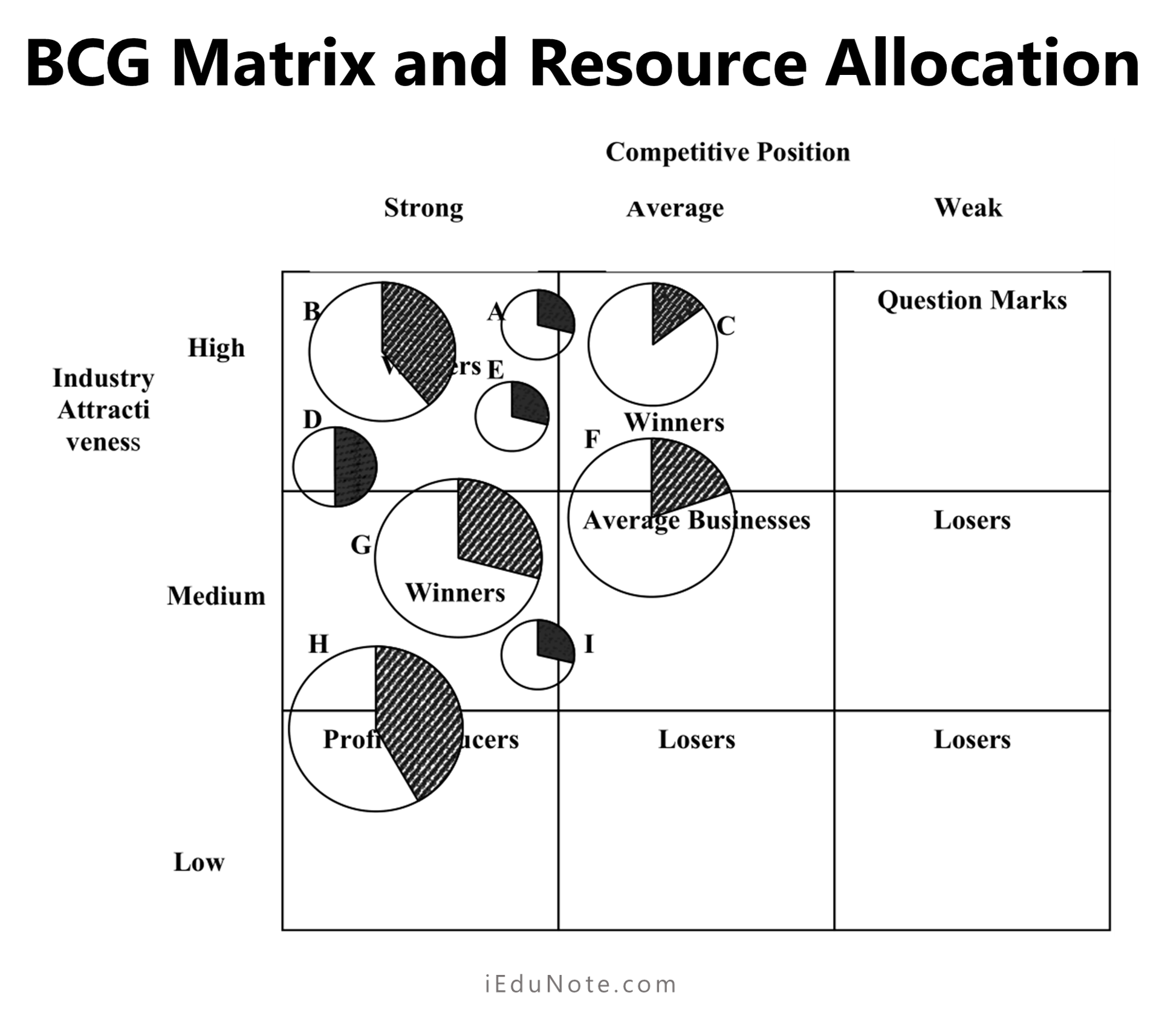

Resource Allocation with BCG Matrix

In a multi-business, different businesses have different resource requirements. Some businesses are net resource generators, and some are resource consumers.

To construct a visual depiction of its various businesses, the organization uses the Portfolio matrices.

The portfolio matrix plots the different businesses on two axes: one that shows the attractiveness of the industry the business is into the strength of the business based on a chosen indicator such as relative market share (in case of the BCG matrix as shown above and Business Strengths in the nine-cell GE Matrix).

The decision-maker must assess the resource requirement of the different businesses plotted on the matrix to allocate resources.

The portfolio has to be balanced in terms of those businesses that generate revenue and are likely to generate revenue versus their resource consumption.

The use of the BCG Matrix lies in estimating which businesses are the net cash generators and which are the net cash consumers. The businesses that are the cash consumers must also exhibit the potential to be the leaders in their business with a highly competitive position so that they can contribute enough cash to nurture future businesses in the future.

Strategic choices are concerned with resource allocation among businesses so that the ones with potential are nurtured and the ones without are divested. The decisions to retain and divest are top management decisions.

What should an ideal portfolio of business be like? An ideal business portfolio developed using the GE nine-cell matrix with industry attractiveness and business strengths as the two measures.

In reality, an organization may have a portfolio where there are too many profit producers, which means no cash users (young businesses that in the future will be profit earners), or too many losers (low possibility of growth/profits), or too many developers (demand too much cash leading to unstable growth).

In such situations, the organization has to balance its portfolio. Those in a strong position and are growing need cash to be harvested from those in a weak industry position.

You will notice that it is recommended to avoid being in those quadrants where the business strength and industry attractiveness are low.

In the Figure below, businesses B, C, F, G, and H. A, D, E, and I could be winners in large markets or have a very dominant position in smaller markets. Notice that businesses are concentrated in the upper left-hand quadrant of the Figure.

An organization may not have an ideal portfolio. The Figure indicates the direction in which the corporate strategies must be fashioned to shift the portfolio towards the left hand upper two quadrants.

According to Hofer and Schendel (1977), the portfolio analysis should yield a statement of the firm’s current portfolio position as well as a forecast of its future position under the existing strategy.

To develop a portfolio analysis, an organization may follow the following steps;

- Choose the matrix to plot its position.

- Assess the relative attractiveness of industries that determines the long-run performance of the business.

- Assess the organization’s competitive position in each industry. Can it derive benefits from the industry?

- Assess the unique opportunity and threats the organization faces in each industry.

- Assess the unique resources of the organization to match the opportunities/threat. This may alter the competitive position assessment.

- Plot the organization’s current portfolio.

- Plot a future performance portfolio.

- Assess what results in the business will attain with the current situation.

- Assess the gaps and make decisions to either change some businesses’ competitive strategies or remove some businesses from the portfolio or add some businesses to the portfolio or reduce the performance targets.

- Prune/strengthen/consolidate businesses as required.

Having allocated the resources, the organization must also ensure that the corporate parent removes any problems that may have been caused or are likely to be caused by inadequacy or shortfall in managerial skills, foresight, and capabilities by sharing of skills, the transference of learning and meditation.

In multi-business companies, corporate parenting enables the headquarters to focus on core competencies and tries to create value among various business units by establishing relationships and a good fit between needs and opportunities of units and resources and capabilities within the firm.

Incorporate parenting, and the corporate headquarters tries to achieve synergy among business units by allocating resources, transferring critical skills and capabilities among various units, and coordinating shared units’ activities to attain economies of scope.

Developing a corporate parenting strategy involves three analytical steps.

- Assess the critical success factors, which are the basis of the unit’s competitive advantage.

- Are there any areas that need improvement? Can the parent contribute?

- What is the fit between the parent’s capability and that of the unit’s? To what extent can they complement?

The parent’s role is not to interfere but to develop. Therefore, corporate parenting requires restraint, the exercise of mature leadership, and discretion retrenchment and combination. Within each of these options are various sub-options.

Further, the organization can develop a functional strategy to support its options and sub-options.

This explains how different organizations can follow widely differing strategies leading to varying profitability in the same industry, other conditions being equal. There is no fixed manner in which an organization decides upon strategies. There are only indicative recommendations.

The process of strategic choice also entails the commitment of financial and other resources through portfolio analysis and access to the corporate parent’s cumulative knowledge and learning through corporate parenting.

Overall, as is the case with other strategic management aspects, a strategic choice is an analytical process backed by managerial foresight, commitment, and vision.

Problems with BCG Matrix Approaches

The BCG and other formal methods revolutionized strategic planning. However, such approaches have limitations. They can be difficult, time-consuming, and costly to implement. Management may find it difficult to define SBUs and measure market share and growth.

In addition, these approaches focus on classifying current businesses but provide little advice for future planning. Management must still rely on its own judgment to set each SBU’s business objectives, determine what resources each will be given, and figure out which new businesses should be added.

Formal planning approaches can also lead the company to place too much emphasis on market-share growth or growth through entry into attractive new markets. Many companies plunged into unrelated and new high-growth businesses using these approaches that they did not know how to manage—with very bad results.

At the same time, these companies were often too quick to abandon, sell, or milk to death their healthy mature businesses.

As a result, many companies that diversified too broadly in the past now are narrowing their focus and getting back to the basics of serving one or a few industries that they know best.

Despite such problems, and although many companies have dropped formal matrix methods in favor of more customized approaches that are better suited to their situations, most companies remain firmly committed to strategic planning.

During the 1970s, many companies embraced high-level corporate strategy planning as a kind of magical path to growth and profits. By the 1980s, however, such strategic planning took a backseat to cost and efficiency concerns, as companies struggled to become more competitive through improved quality, restructuring, downsizing, and reengineering.

Recently, strategic planning has made a strong comeback.

However, unlike former strategic-planning efforts, which rested mostly in senior managers’ hands, today’s strategic planning has been decentralized.

Companies are increasingly moving responsibility for strategic planning out of company headquarters and placing it in the hands of cross-functional teams of line and staff managers who are close to their markets. Some teams even include customers and suppliers in their strategic-planning processes.

Such analysis is no cure-all for finding the best strategy.

But it can help management understand the company’s overall situation, see how each business or product contributes, assign resources to its businesses, and orient the company for future success. When used properly, strategic planning is just one important aspect of overall strategic management, a way of thinking about how to manage a business.