When a voluntary association of firms is formed to achieve common goals and to enjoy monopoly advantages, that sort of initiative is called a business combination. The combination may be formed by a written or oral agreement among the firms.

Sometimes, firms decide to merge themselves into one unit. The main object of the business combination is to achieve common economic welfare for its members. However, it is considered to be unlawful if any of its objectives is against the public interest. Business combinations may be permanent or temporary.

Types of Business Combinations

Combinations may take several forms, such as horizontal, vertical, lateral, and diagonal, circular, or maybe a mixture of two or more of these types.

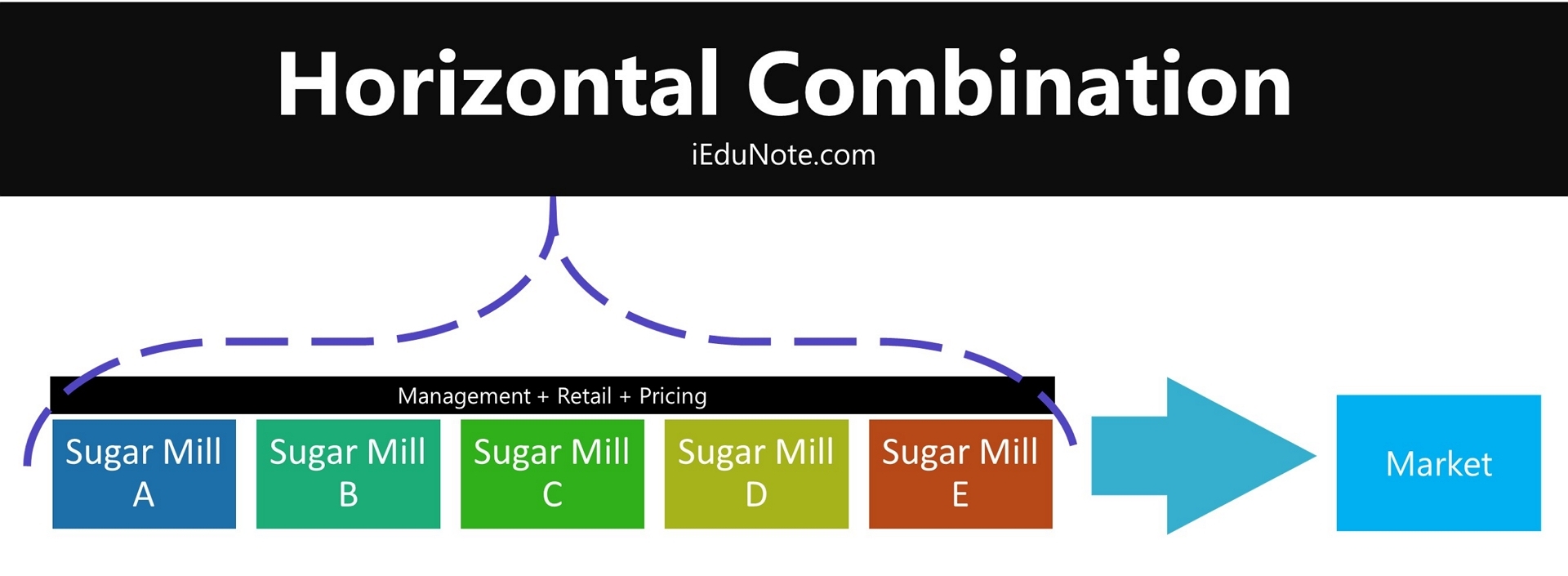

Horizontal Combination

A horizontal combination comes into being when units carrying on the same trade or pursuing the same productive activity join together with a common end in view.

Example of horizontal combinations are;

- Disney’s 2006 acquisition of Pixar.

- Facebook’s 2012 acquisition of Instagram.

The intensity of competition is naturally reduced when several units competing in the same line of business join together. The combining units can well take advantage of the various economics associated with large scale production by making common purchases, pooling resources for research, common advertising, etc.

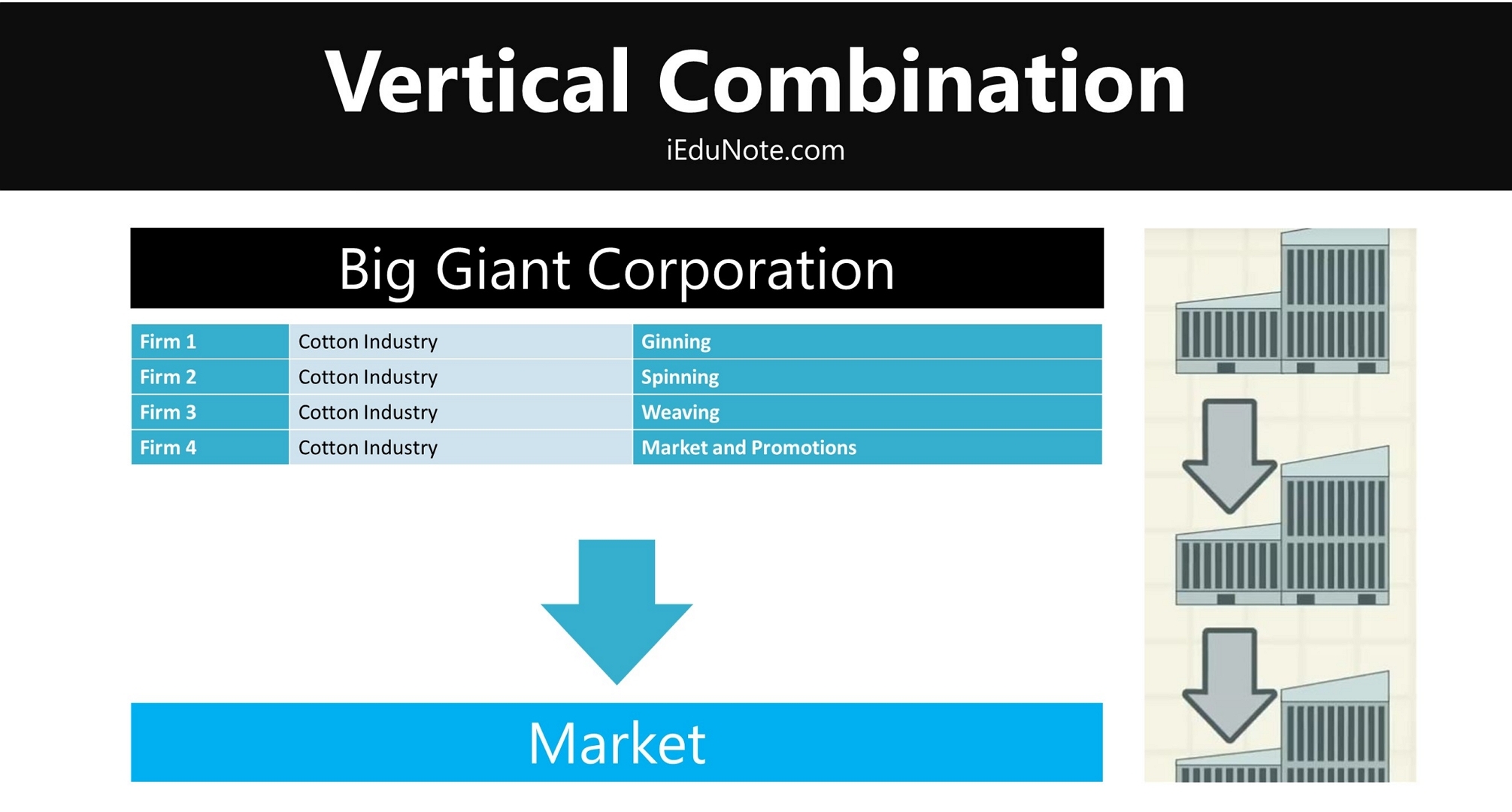

Vertical Combinations

Vertical integration is the combination of firms in successive stages of the same industry. It implies the integration of various processes of an industry.

Vertical combinations are brought into existence with the following objects in view:

- To eliminate the wasteful and unnecessary expenses involved in carrying on the connected processes separately.

- To eliminate middlemen functioning between various units

- To securer economies in marketing, advertising, and transport

- To maintain control over the quality of raw materials and finished products.

| Points of difference | Horizontal Combination | Vertical Combination |

|---|---|---|

| Ownership and control | Single ownership and control | Different ownership and control |

| Stages of Production | Same stages of production | Different stages of production |

| Competition in the raw material market | Horizontal competition cannot eliminate competition among the business units in the raw materials market. | Vertical combination tries to eliminate competition in the raw materials market. |

| Competition in distribution | Horizontal competition can eliminate competition in distribution of ultimate products. | Vertical combination cannot eliminate competition in distribution of ultimate products. |

| Effective control | Horizontal competition can ensure Effective control over the market | Vertical combination cannot ensure Effective control over the market supply. |

| Internal autonomy | In horizontal combination member units are free in their internal affairs. They enjoy complete internal autonomy and independence. | In vertical combination, members have to look to the controlling body even for routine matters. |

| Economies of large scale operation | Horizontal competition can ensure certain economics of production. | Usually vertical combination cannot ensure the economics of large-scale operations. |

| Specialization | In horizontal combination each member produces the end product e.g. cotton .cloth, etc. | Under vertical combination each member looks after a particular sector, and gets sufficient scope to specialize itself in a particular branch of production. |

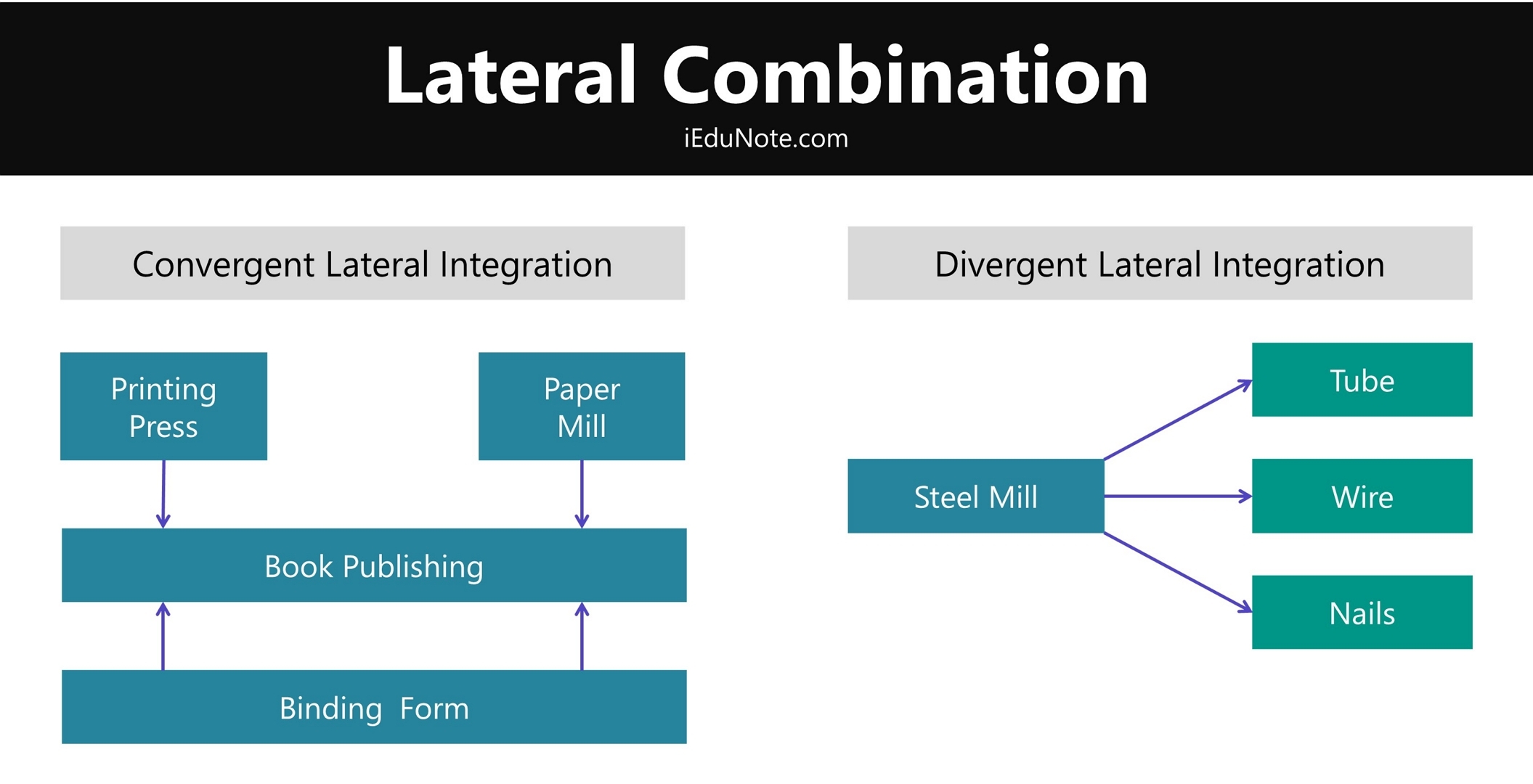

Lateral Combination

Lateral integration refers to the combination of those firms that manufacture different kinds of products though they are ‘allied in some way.’

It can be of two kinds;

- convergent lateral integration, and

- divergent lateral integration.

The convergent lateral combination comes into existence when different forms join together to supply goods and services to help the functioning of major undertakings.

Example: For instance, a book publisher may join with other units to produce paper, do printing work, and provide bookbinding services.

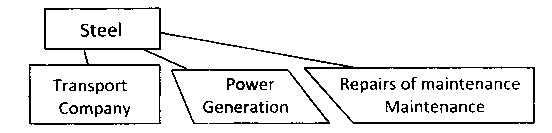

Diagonal Combination

It is also called ‘Service’ integration. Diagonal integration comes into existence when a unit providing auxiliary goods and services to industry is combined with a unit engaged in the mainline of production within the organization.

Example: For example, if an industrial enterprise combines with a transport company, a power station, or a repairs and maintenance workshop and makes these facilities available within the organization, it will be said to have effected diagonal integration.

Circular Combination

When firms belonging to different industries produce altogether different products and combine under the banner of a central agency, it is called a mixed or circular combination.

This is affected to ensure smooth conduct of business operations by making timely availability of auxiliary services within the organization.

Example, For example, Godrej is engaged in the manufacturing of cosmetics, electrical goods, office equipment locks, etc. The object is to secure the benefits of large-scale operations arising out of cooperation.

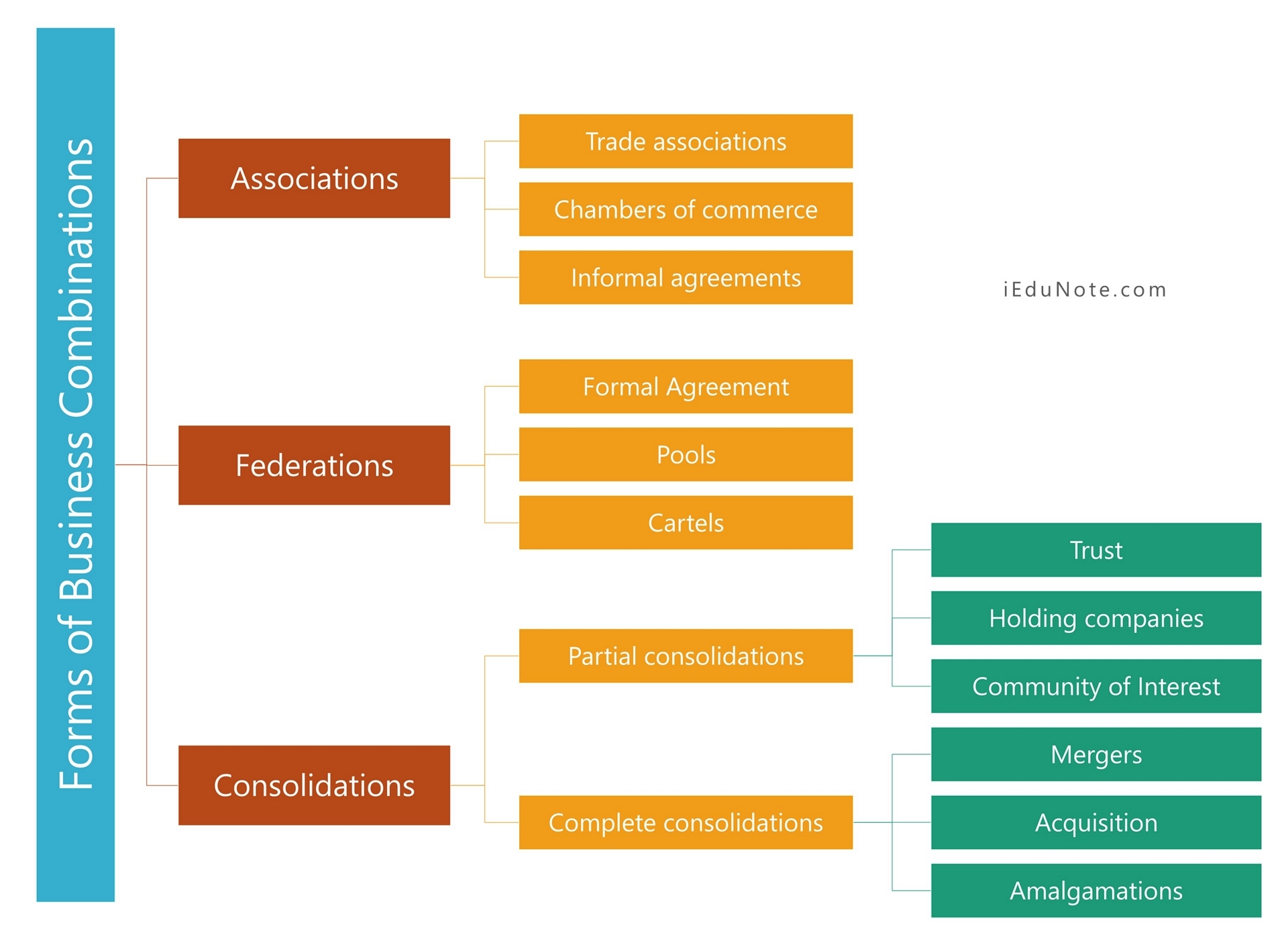

Forms of Business Combinations

Combinations take different forms that have been developed over some time.

- Associations

- Trade associations.

- Chambers of commerce.

- Informal agreements.

- Federations

- Formal Agreement.

- Pools.

- Cartels.

- Consolidations

- Partial consolidations

- Trust.

- Holding companies.

- Community of Interest

- Complete consolidations

- Mergers.

- Acquisition.

- Amalgamations.

- Partial consolidations

Associations

Business units combine to attain some purposes without surrendering their autonomy.

Trade Associations

Under a trade association, business units engaged in a particular trade generally come together and discuss matters for the promotion of their economic and business interest.

They are generally formed on ‘territory bases.

Such an association is organized on a non-profit basis and is essentially educational. Sometimes the association may make representations to the government to safeguard the interests of a trade or an industry.

Chamber of Commerce

The Chamber of Commerce is a voluntary association of persons connected with commerce, trade, and industry.

These are formed to promote and protect the interests of business and business communities in a region, country, or even the world as a whole.

Their functions include promoting, supporting, or opposing legislative or other measures affecting the trade interests of the members and the collection and dissemination of information concerning trade, commerce, etc., to members.

They also refer disputes arising out of trade activities to arbitrations for settlement, performing such other things as may be conducive to the expansion of trade.

Informal Agreement

Informal agreements involve the exchange of promises among members regarding the restriction of output, fixation of prices, etc. They are also referred to as Gentlemen’s agreements.

It is only the moral duty of business units to keep the promise.

Federations

The federation form of combination aims at rendering benefit to member units for certain specific purposes under an agreement. Of such federations, ‘ Pools’ and ‘Cartels’ are most notable.

Pools

It means that the members of the pooling agreement join together to regulate the demand or supply of a product without surrendering their separate entities.

The agreement may relate to the regulation of output, reallocation of output, redistribution of income, etc.

Haney defines an industrial pool as a form of a business organization established through a federation of business units whose members seek a degree of control over prices by combining some factors in the price-making process in a common aggregate and apportioning that aggregate among members.

Cartels

A pool having a common sales agency is known as a Cartel. It is, thus, an output and profit pool.

The object of a cartel is to eliminate competition by forming a federation of producers that pool the output, fix the price, and sell the product. The profits reaped by cartels are distributed amongst the members – units on a pre-determined basis.

Consolidations

The last form of combination is consolidation. This form involves the highest degree of integration. The consolidation may be of two types:

Partial Consolidation

Trusts

Trusts may be defined as a form of a business organization through temporary consolidation in which the shareholders of the constituent organizations under a trust agreement transfer a controlling amount of their stock to a board of trustees in exchange for a trusted certificate.

These trust certificates show their equitable interests in the income of the combinations.

Thus, trustees under the trust manage the affairs of the members’ concerns in the interests of the real owners, who are entitled to dividends based on trust certificates held by them.

Holding Companies

A holding company is a form of business organization that is created to combine industrial units by owning a controlling amount of their share capital.

Controlled companies are referred to as subsidiary companies. The subsidiaries are independent and function in their name. But they are effectively managed by the holding company.

Community of Interests

A Community of interest may be defined as a form of business organization in which, without any formal central administration, the business policy of several companies is controlled by a group of common stockholders or directors.

Thus, the administration of different companies is possible either through managerial integration, administrative integration, or financial integration.

Complete Consolidation

In complete consolidation, the combining units lose their entity.

It is defined as a form of business organization that is established by the outright purchase of the properties of the constituent organizations and the merging of such properties into single business units.

Complete consolidation may be of the following types:

Merger

A merger takes place when; two or more organizations merge, and their operations are absorbed by a news organization.

Acquisition

Acquisition refers to the process of acquiring a company at a price called the acquisition price or acquisition premium. The price is paid in cash, acquiring the company’s shares or both.

To read more about mergers and acquisitions, click here.

Amalgamation

For practical purposes, the amalgamation and merger of the terms are used interchangeably.

| Points of difference | Amalgamation | Merger |

|---|---|---|

| Meaning | A new company is formed to take over the existing business of all the amalgamating companies. After the amalgamation, all combining units are automatically liquidated. | A merger is called the absorption of weaker units by a strong unit. |

| Formation | Under amalgamation, a new organization is formed to effect the fusion of two or more existing companies. | Under merger an existing co, absorbs one or more existing companies. Absorbing company survives. |

| Initiation | Amalgamation takes place on the initiative of an outside promoter, since the business rivalry of several units normally acts as a bar to their coming together on their own initiative. | Under amalgamation, a new organization is formed to effect the fusion of two or more existing companies. |

| Effect on shareholders | Amalgamation affects all shareholders. | In merger, the shareholders of absorbed companies are affected. |

Non-Consolidated Combinations

There are a number of types of combinations that are not classed as consolidations. Each company involved maintains its own identity by one method or the other, joins other companies in a common rather than a competitive effort. The devices used are less formal than are the types just described, but the results obtained are identical. The element of legality is also a factor, as informal methods of combination can result in an undue restraint of trade.

Pools

Originally, pools provided another method, in addition to the trusts, for eliminating competition. In this capacity the U.S. Supreme Court declared them unconstitutional.

In a famous case involving the Addystone Pipe and Steel Company and others, the arrangement by which this manufacturer, together with several more who produced steel pipe, conspired to fix prices was declared illegal.

Pools are usually written agreements among several companies covering one or more phases of operations such as territories, prices or profits, output or patents. The Addystone Pipe and Steel Company case involved a territorial pool.

The companies agreed that each member was to have the exclusive right to sell in certain cities or small areas. In other regions the companies might bid among themselves for the business.

This was known as a restrictive territory as opposed to the cities reserved for one company. Still other areas were free territories in which each company could seek business on a normal competitive basis.

Price and profit pools are based on an agreement to charge certain prices or to share profits on a certain percentage in relation to the entire membership of the pool.

Cartels

Pools of the types just described, if organized in a foreign country, are known as cartels. Most cartels are international in scope, and include such items as zinc, tin, rubber, copper, and diamonds.

In the United States some producers of export goods were placed at a disadvantage in the world markets because they were forbidden under the antitrust laws to combine in any manner that would restrain trade.

In 1918, this condition was remedied by the passage of the Webb-Pomerene Act, which permits manufacturers to join international cartels just so long as such united effort is not extended into local markets.

Exclusive Selling Agencies

If a number of producers form a single agency to market their products, this is known as an exclusive selling agency. The best examples are the cooperative marketing associations.

Patent Licensing

Holders of exclusive patent rights have the opportunity, through patent licensing to a limited number of manufactures or through restrictive use of the patented product, of controlling the output and other uses of such patents.

This differs from a patent pool only to the extent that one company allows others to use its patents or the patented product, whereas in the pool each company in the group contributes its patents for the use of the others.

Interlocking Directorates

If the majority membership of the board of directors of two corporations is composed of the same individuals, these men can direct the operations of the two organizations in such a manner that their activities will be coordinated in just as effective a fashion as though the organizations were consolidated.

If the firms involved are in the same business and are in competition with each other, such a board might be illegal under the Clayton Antitrust Act. If the firms are not competing, interlocking directorates are legal and may promote harmonious working relations between the two corporations.

Gentlemen’s Agreements

If representatives of several competing concerns agree that it would be advantageous to raise prices and if such a price increase does take place, this is called a gentlemen’s agreement.

Community of Interests

If a few individuals are the dominant stockholders in two or more corporations, a community of interests results.

Each company has its own board of directors, but the stockholders who own a controlling interest in the. two or more organizations are responsible for placing and keeping them in their positions. This means that the actions of the board members will favor the other companies.

Collusive Bidding

Government agencies and other business organizations frequently allocate their purchase orders on the basis of bids received.

In some cases, there has been some evidence that one company submitted the lowest bid after agreeing with other so-called competitors that they would submit higher bids. It is difficult to prove collusive bidding, but sometimes the facts point strongly in this direction.

Causes/Reasons for Business Combination

Although the business combination is primarily formed for achieving a common (single) goal, it may also be formed keeping in mind the following reasons:-

Elimination of Competition

Due to hard competition among the firms’ rate of profit decreases. Some firms may suffer a loss also. So the industrialists feel pleasure in setting up a combination to avoid the competition.

To Solve Capital Problem

Small units of production face the problem of capital shortage. They cannot expand their businesses. As a result, small units may form a combination to overcome this problem.

To Achieve Economies

Some small units combine themselves to achieve the economies of large-scale production advantage. It helps to purchase the raw materials at low prices and sell more products which would increase the profit.

Effective Management

Generally, small units are unable to hire the services of experts and experienced managers. So, small industrial units combine themselves to hire the services of effective management.

Tariff Facilities

To compete with external firms, some industrial units combine themselves. The government also imposes heavy duties to protect domestic producers.

Uniform Policy

All the units adopt uniform policy due to business combinations. It regularizes the business activities of all the units.

Use of Technology

The business combination can use the latest technology and new methods of production because its sources are sufficient. In contrast, a single unit cannot do so.

To Face Crises

It is very difficult for the small industrial units to face crises in the days of inflation and deflation. So the small units combine themselves to face these problems easily.

Growth of Joint Stock Companies

The growth of Joint-stock companies has also made it possible for various industrial units to form combinations.

Status in Market

A big firm enjoys a higher status and respect than the smaller one. So, small business units prefer to combine themselves for higher status.

Demand and Supply Balance

A business combination is very useful in controlling the overproduction. It adjusts the supply according to the demand of the market. So overproduction cannot take place, and prices remain stable.

Transport and Communication Development Activities

It has made economic activities fast. Now there is close contact with a businessman with the others. So it has also contributed to the growth of combination.

Research Facilities

Small firms cannot set up the research department, while through business combination, these facilities can be enjoyed.

Economic Instability

In the case of economic and political instability, there is a chance of loss in every moment. To reduce the risk, small industrial units combine themselves.

Advantages of Business Combination

The advantages of a combination are controversial because the creation of monopoly and elimination of competition both are considered the merits and demerits of the combination.

Anyway, the following are the significant merits of combination:

Increase in Capital

The volume of capital may be increased by the formation of a combination. The members combine their resources to conduct large size business.

Elimination of Competition

By the formation of combination, unnecessary competition is eliminated, and member firms earn monopoly profit.

Saving in Expenses

Administrative production and distribution expenses reduce due to combination.

Controls over Production

The combination is very effective in controlling overproduction. It helps to adjust the supply according to the demand.

Large Scale Marketing

In the market, competition position is strong in bargaining. So it sells the product at a higher price.

Experts Services

A combination can acquire the services of experienced specialists. It increases the efficiency of the combination.

Research Work

A combination can spend money on research work, which is very important for the business. This research work reduces its cost and increases its profit.

Use of Modem Technology

A combination is capable of using the latest inventions and new methods of production as a consequence of a transfer of technology. It will increase profit.

Stability

A combination is a more stable form of business as compared to the individuals’ units. The chances of dissolution are also less than others.

Division of Labor

The principle of division of labor is applied in combination, which increases the production efficiency of combination.

Disadvantages of Business Combination

Following are important disadvantages of combination:

Creation of Monopoly

It creates a monopoly that is harmful to the people in the long run.

The concentration of wealth

It concentrates the wealth in a few hands and divides society into few classes, such as rich, middle, and poor.

Reluctant to be Accepted

The combination is disliked by the people, and it is not acceptable.

Changes in Friction

The chances of friction among directors and officers are bright. They quarrel with, each other for their interest

No Personal Contact

It is not possible to maintain direct contact between employees, creditors, and shareholders, due to this business may suffer a loss.

Costly Management

A combination hires costly management, which increases the cost of production.

Over Capitalization

There is always a danger of over-capitalization in the combination. It is harmful to the combination.

Misuse of Funds

The directors of the company enjoy unlimited power and misuse the capital.

National Interest Ignored

Generally, the combinations ignore the national interest, and they involved in such activities that are against the national interest.