Companies use captive insurance companies as risk management tools.

Captive Insurance: Meaning, Types, Benefits, Steps, Examples

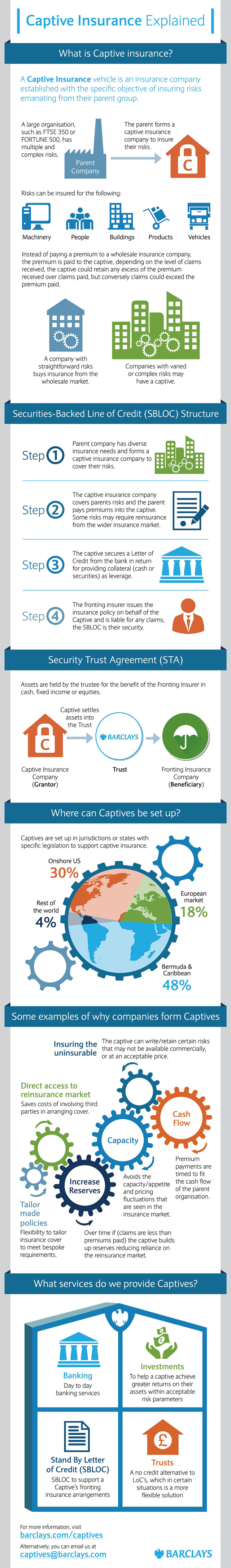

What is Captive Insurance?

A captive insurance company is an entity created and controlled by a parent whose main purpose is to provide insurance to its corporate owner.

The ideology behind this method is that the parent company may save regarding overhead costs and profits which would otherwise be charged by the insurance company. Also, the insured companies claim premiums as expenses, which may lead to advantages regarding potential cash flows.

These captives may either be pure captives or group captives.

2 Types of Captive

2 types of Captive are;

- Pure Captive.

- Group Captive.

Pure Captive

A Pure Captive is an insurance company established by the parent (generally in a non-insurance business) organization to provide insurance coverage to itself or its subsidiary or affiliated organizations.

Group Captives

Group Captives are those formed by a group of companies to provide insurance cover for controlling their respective and collective risk. In U.S. terminology, these are also known as “trade association insurance companies.”

Why Companies form Captives

These are the reasons for using captive insurance;

- Optimized Loss Prevention Benefits.

- Economies of Scale.

- Non-availability of Insurance.

- Stability of Earnings.

- Cost and Tax Advantages.

Optimized Loss Prevention Benefits

The benefits enduring from loss prevention are available directly to the insured.

Economies of Scale

Groups with several subsidiaries can enjoy the benefits of correctly tailored insurance products made available to cover risks.

Non-availability of Insurance

Captives provide to cover risk exposures for which covers are otherwise not available in the market.

Stability of Earnings

The captives reduce the chances of the adverse impact of sudden fluctuations in profits on the firms.

Cost and Tax Advantages

Obviously, as said earlier, captives reduce the cost of risk financing and provide gains in the regime of differential taxes.

This example will make this clear:-

War is an example of most property and risks are net insured against war, so the loss attributed to war is retained by the insured.

Also, any amount of potential loss (risk) over the amount insured is retained risk.

Captive Insurance companies represent a special case of risk retention.

How Captive Insurance Works

Instead of paying a premium to an insurance company, the premium is paid to the captive insurance company.

Depending on the type of the company, level of claims, the captive could retain any excess of the premium received over claims paid.

However, the claims could be more than the premium paid.

Usually, a business with straightforward risks takes insurance from one or more established market leader in the insurance industry.

But; companies that have a complex range of risks, going captive makes better financial sense.

This infographic will explain how captive insurance works

Steps of Securities-Backed Line of Credit (SBLOC) Structure

Step 1: Parent company has diverse insurance needs and forms a captive insurance company to cover their risks.

Step 2: The captive insurance company covers parents risks and the parent pays premiums into the captive. Some risks may require reinsurance from the wider insurance market.

Step 3: The captive secures a Letter of Credit from the bank in return for providing collateral (cash or securities) as leverage.

Step 4: The fronting insurer issues the insurance policy on behalf of the Captive and is liable for any claims, the SBLOC is their security.

Security Trust Agreement (STA) Explained

Assets are held by the trustee for the benefit of the Fronting Insurer in cash, fixed income or equities.

Captive Insurance Company (Grantor) >> Captive settles assets into the Trust >> Trust >> Fronting Insurance Company (Beneficiary)

Where can a company set up Captives?

Captives are set up in jurisdictions or states with specific legislation to support captive insurance.

- Onshore US: 30%

- European market: 18%

- Bermuda & Caribbean: 48%

- Rest of the world: 4%

Services Provided by Captives

- Banking: Day to day banking services.

- Investments: To help a captive achieve greater returns on their assets within acceptable risk parameters.

- Stand By Letter of Credit (SBLOC): SBLOC to support a Captive’s fronting insurance arrangements.

![Types of Insurance Organizations [A Comprehensive Guide] 2 Types of Insurance Organizations [A Comprehensive Guide]](https://www.iedunote.com/img/259/types-insurance-organization-e1529504882393.png)