Cost is the monetary value that a company has spent to produce something. The cost denotes the amount of money that a company spends on the creation or production of goods or services. It does not include the markup for profit. Cost is a measurement in monetary terms of the number of resources used for the production of goods or rendering services.

In accounting, the term cost refers to the monetary value of expenditures for raw materials, equipment, supplies, services, labor, products, etc.

It is an amount that is recorded as an expense in bookkeeping records.

Cost and Expenses are the same

A cost might be an expense or it might be an asset. An expense is a cost that has expired or was necessary to earn revenues. The following examples will illustrate the difference between a cost and an expense.

A company has a cost of #6,000 for property insurance covering the next six months.

Initially, the cost of $6,000 is reported as the current asset Prepaid Insurance.

However, in each of the following six months, the company will report the Insurance Expense of $1,000 the amount that is expiring each month.

The unexpired portion of the cost will continue to be reported as the asset Prepaid Insurance. The cost of equipment used in manufacturing is initially reported as the long-lived asset Equipment.

However, in each accounting period, the company will report part of the. asset’s cost as Depreciation Expense. A retailer’s purchase of merchandise is initially reported as the current asset Inventory.

When the merchandise is sold, the cost of the merchandise sold is removed from Inventory and is reported on the income statement as the expense entitled Cost of Goods Sold.

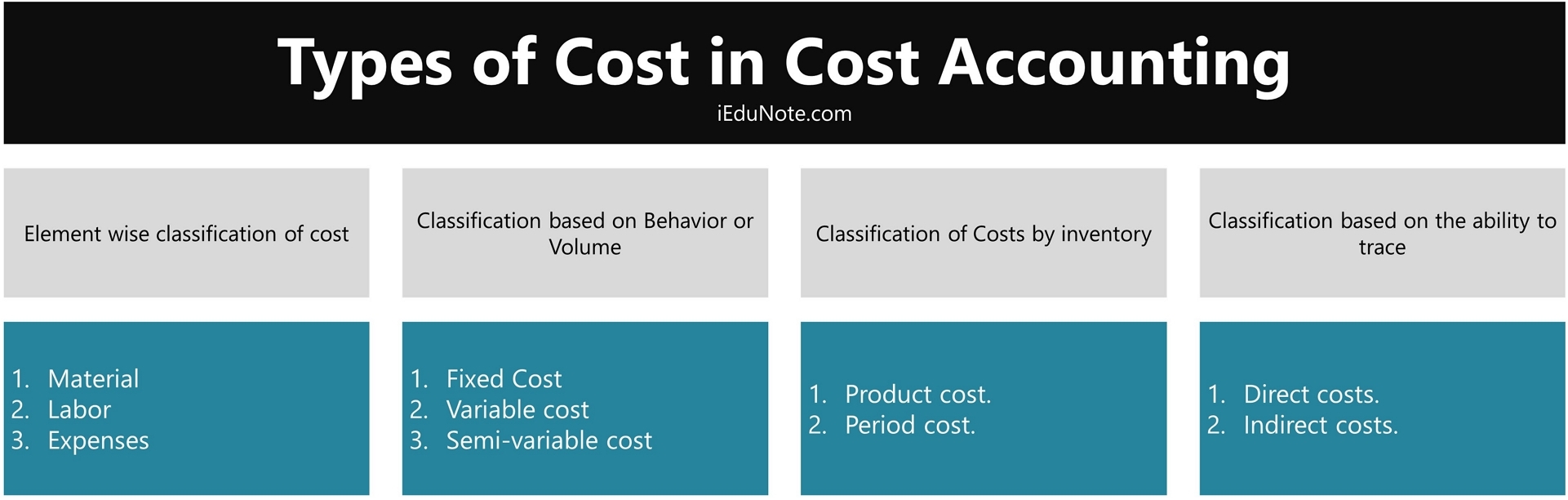

Classification / Types of Cost in Cost Accounting

Classification of cost is very important to understand the nature of cost for controlling the product cost.

In Cost Accounting; costs are classified into the following categories:

- Element wise classification of cost.

- Classification based on Behavior or Volume.

- Classification of Costs by inventory.

- Classification based on the ability to trace.

Element wise classification of cost

The cost of production/manufacturing consists of various expenses incurred on the production of goods or services. These are the elements of cost which can be divided into three groups:

- Material,

- Labor

- Expenses

Material Cost

To produce or manufacture material is required.

For example, to manufacture shirts cloth is required and to produce flour wheat is required.

All material that becomes an integral part of the finished product and which can be conveniently assigned to the specific physical unit is termed as “Direct Material”. Material is classified into two categories:

- Direct Material

- Indirect Material

Labor Cost

Labor is the main factor of production.

For the conversion of raw material into finished goods, human resource is needed, and such human resource is termed as labor.

Labor cost is the main element of cost in a product or service. Labor can be classified into two categories:

- Direct Labor

- Indirect labor

Expenses

All costs incurred in the production of finished goods other than material cost and labor cost are termed as expenses. Expenses are classified into two categories:

- Direct expenses

- Indirect expenses (An item of overheads).

Indirect Expenses = Indirect cost – Indirect material – Indirect labor

Classification based on Behavior or Volume: Term Cost Behavior

Answer: Costs are classified as 3 categories based on behavior or volume which are:

- Fixed Cost

- Variable cost

- Semi-variable cost

Fixed Cost

A cost that remains constant within a given period and range of activity despite changes in production. Per unit fixed cost varies with the change in the volume of production.

If the production increases fixed cost per unit decreases and as there is a decrease in production, the fixed cost per unit increases. Rent and insurance of building, depreciation on plant and machinery, the salary of employees, etc., are some examples of fixed costs.

Variable cost

Variable costs are those cost which varies directly in proportion to change in the volume of production/output.

The cost increases or decreases in the same proportion in which the units produced are termed as a variable cost. Direct material, direct labor, direct expenses, variable overheads are some examples of variable cost.

Difference between fixed cost and variable cost

| Fixed Cost | Variable Cost |

|---|---|

| 1. Fixed cost is those cost which remains constant over a relevant range of output. | 1. Variable cost is those that in total will change proportionately a level of activity are changed. |

| 2. Fixed cost is total fixed but per unit is variable. | 2. Variable cost is the total variable but the unit is fixed. |

| 3. Fixed cost total amount within a relevant output range. | 3. Variable of the total amount in direct proportion to value. |

| 4. The decrease in per-unit cost as volume increases within a relevant range. | 4. Relatively constant cost per unit as volume changes within a relevant range. |

| 5. Assignable to departments based on arbitrary managerial classification or cost allocation method. | 5. Assignable with reasonable case and accuracy to operating departments. |

| 6. Control responsibility resting with executive management rather than operating supervision. | 6. Controllable by a specific department head. |

Semi-variable cost

A cost contains both fixed and variable components and which is thus partly affected by fluctuations in the level of activity.

Semi-variable costs is that cost of which some part remains fixed at the given level of production and other part varies with the change in the volume of production but not in the same proportion of change in production

For example, expenses may not change if the output is up to 50% capacity but may increase by 5% for every 20% increase in output over 50% but up to 70%.

For example, Telephone expenses of which rent portion is fixed and call charges are variable. Figure 28.3 gives an idea of semi-variable cost.

Difference between Committed Fixed Cost and Discretionary Fixed Cost

| Committed Fixed Cost | Discretionary Fixed Cost |

|---|---|

| 1. Committed fixed cost arises on the future decision by the higher management authority. | 1. Discretionary fixed cost arises from yearly appropriation decisions by the higher management authority. |

| 2. It is a long-run phenomenon. | 2. It is a short-run phenomenon. |

| 3. It cannot be adjusted downward without adversely affecting the ability of the organization to operate. | 3. It can be adjusted downward, thereby permitting the organization to operate. |

| 4. It has a minimum level of productive capacity. | 4. Any desired level of productive capacity provided by committed fixed costs. |

| 5. Example: Insurance, Income tax, depreciation, etc. | 5. Example: Repairs and maintained cost, advertising cost, executive training, etc. |

Classification of Costs by Inventory

Classification of Costs by inventory is;

- Product cost.

- Period cost.

What is Product costs?

Product costs are those cost which is charged and identified with the product and included in stock value.

In other words, the costs that are the cost of manufacturing a product are called product cost. Product cost includes direct material, direct labor, direct expenses, and manufacturing overheads.

Product costs include all the costs that are involved in making a product. In the case of manufactured goods, product costs consist of direct materials, direct labor, and factory overhead.

So, we can say, costs that can be easily attributed to products can be termed as product costs. Product cost is also known as inventoriable cost.

That part of the product cost which is sold is called the cost of goods sold and the cost of goods sold is charged against revenue as an expense.

On the other hand that part of the product cost which is not sold is called inventory and inventory is shown as an asset in the balance sheet.

What are Period costs?

Period costs are those costs that are not charged to products but are written off as expenses against revenue of the period during which these are incurred.

They are not transferred as a part of the value of the stock to the next accounting year. They are charged against the revenue of the relevant period.

Period costs include all fixed, costs and total administration, selling and distribution costs.

According to Ray H. Garrison, period costs are all the costs that are not included in product costs.

Basically, period costs are not directly associated with the production, These are not likely to change with the change in production, rather they change with the passage of time.

So, costs that can be attributed to time intervals are termed as period costs. These costs are shown as expenses in the income statement in the period in which they are incurred.

All selling and administrative expenses are considered to be period costs. And. in variable costing, fixed factory overhead is also treated as a period cost.

What are the Differences between product costs and periods of costs?

The differences between product costs and period costs are quite clear in the above discussion. The distinctions between product costs and period costs are given below:

| Point of difference | Product costs | Period costs |

|---|---|---|

| 1. Definition | Costs that can be easily attributed to products are termed | Costs that can be attributed to time intervals are termed as period costs. |

| 2. Calculation of cost of the product | Product costs are included in the cost of products. | Period costs are not included in the cost of the products. |

| 3. Valuation of inventory | These costs are considered in inventory valuation. | These costs are not considered in inventory valuation. |

| 4. Scope |

|

|

| 5. Over or under allocation | There may be over or under allocation of factory overhead which is included in the product | Period cost is not a part of the cost of production. So, there is’ no under or over allocation for these costs. |

| 6. Assets | Product costs are inventoriable and are shown as assets if not sold. | Period costs cannot be shown as assets. These are included .as expense in the income statement. |

| 7. Product pricing | These costs are useful in product pricing | These costs are not useful in product pricing. |

Classification Based on the Ability to Trace

Cost classification based on ability to trace are;

- Direct costs.

- Indirect costs.

Direct costs

Direct costs are those in which cost directly related to production or maintenance. Direct costs include all traceable costs.

In the process of manufacturing a product, materials are purchased, wages are paid to labor, and certain other expenses are also .incurred directly. All these expenses are called as direct costs.

Indirect costs

Indirect costs are those in which costs are not directly related to production or manufacture.

The example of indirect costs is Oil and scrap materials, [indirect materials], the salary of factory supervisors [indirect labor], rent rates and depreciation [indirect expenses].

Indirect costs, often referred to as overheads have to be apportioned to different products on suitable criterion/criteria.