In foreign trade, there is no element of the casualness sometimes present in transactions taking place in the local marketplace.

If the documentation for a foreign shipment is wrong, even a small detail – the shipment may be refused by customs at the port of exit or port of entry; it may be delayed; it may be lost.

It is not as easy to correct documentation errors for foreign shipments as it is for shipments within the country.

These are the documents that are used in foreign trade;

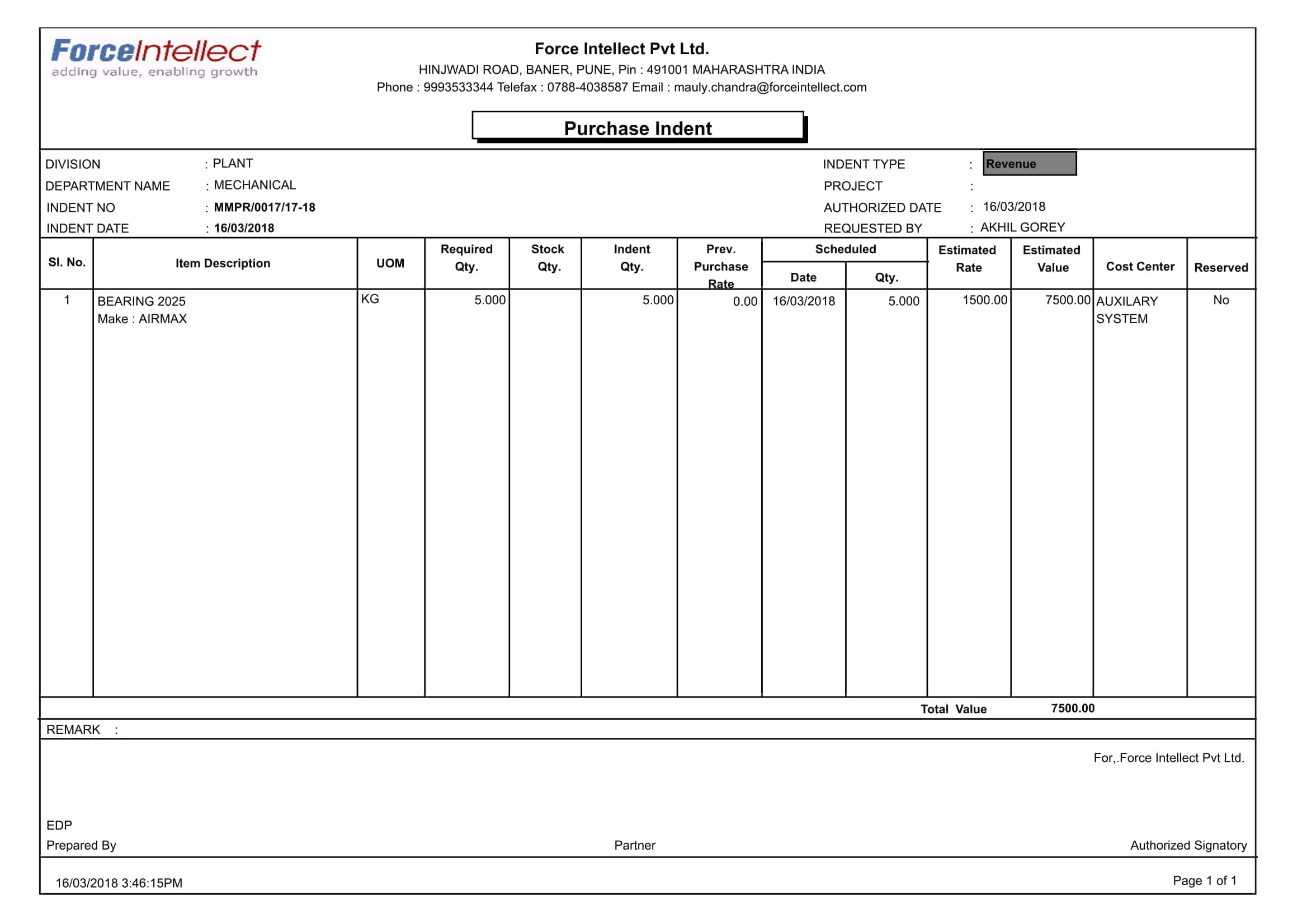

- Indent

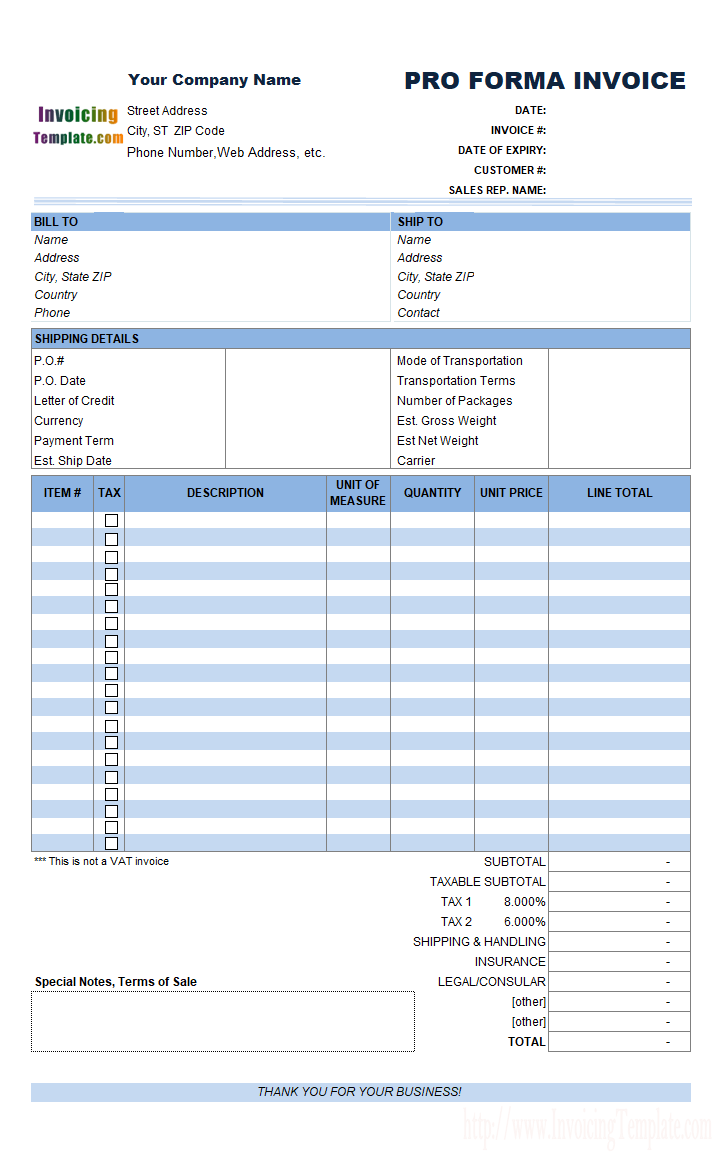

- Pro-forma Invoice

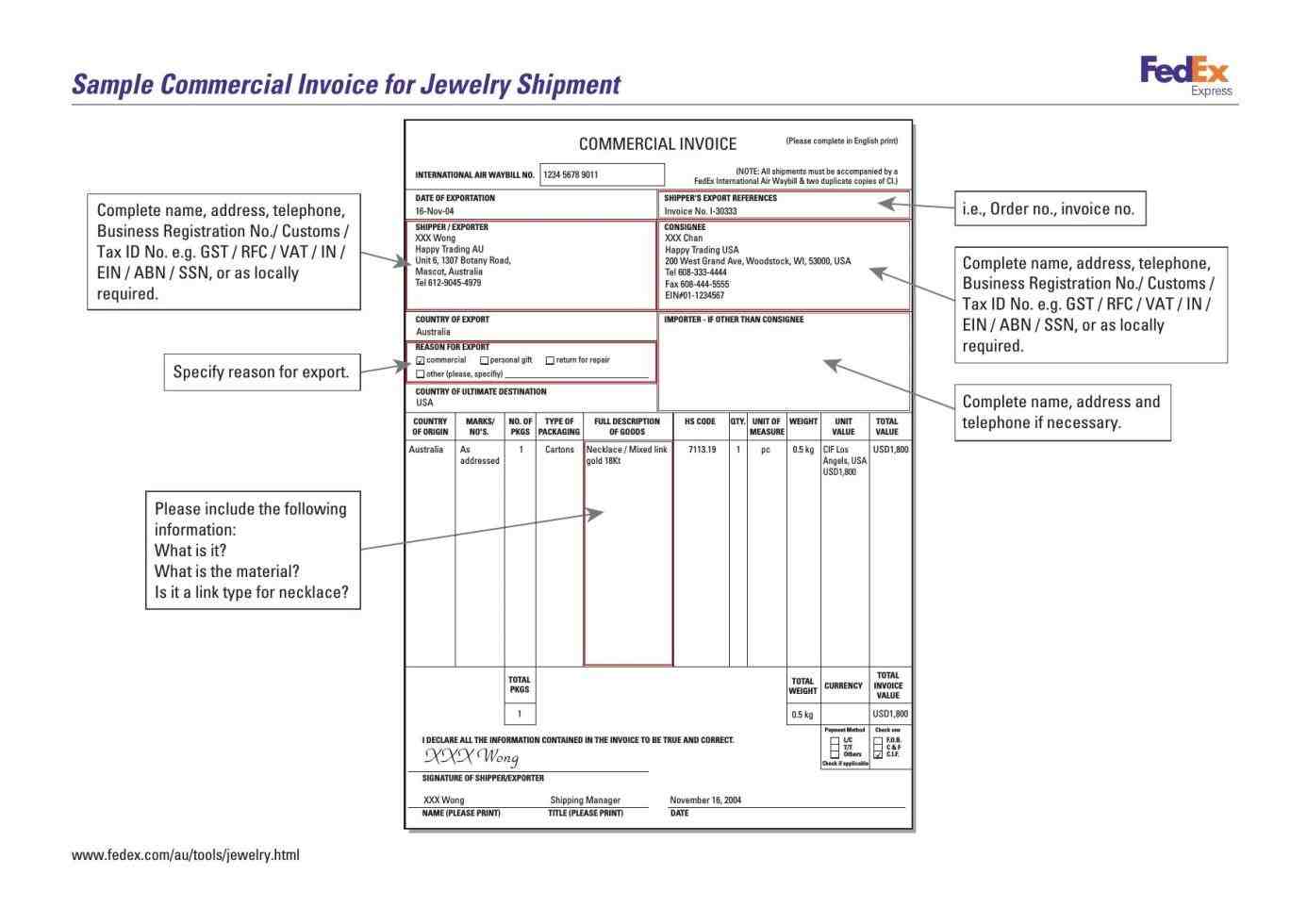

- Commercial Invoice

- Legalized Invoice

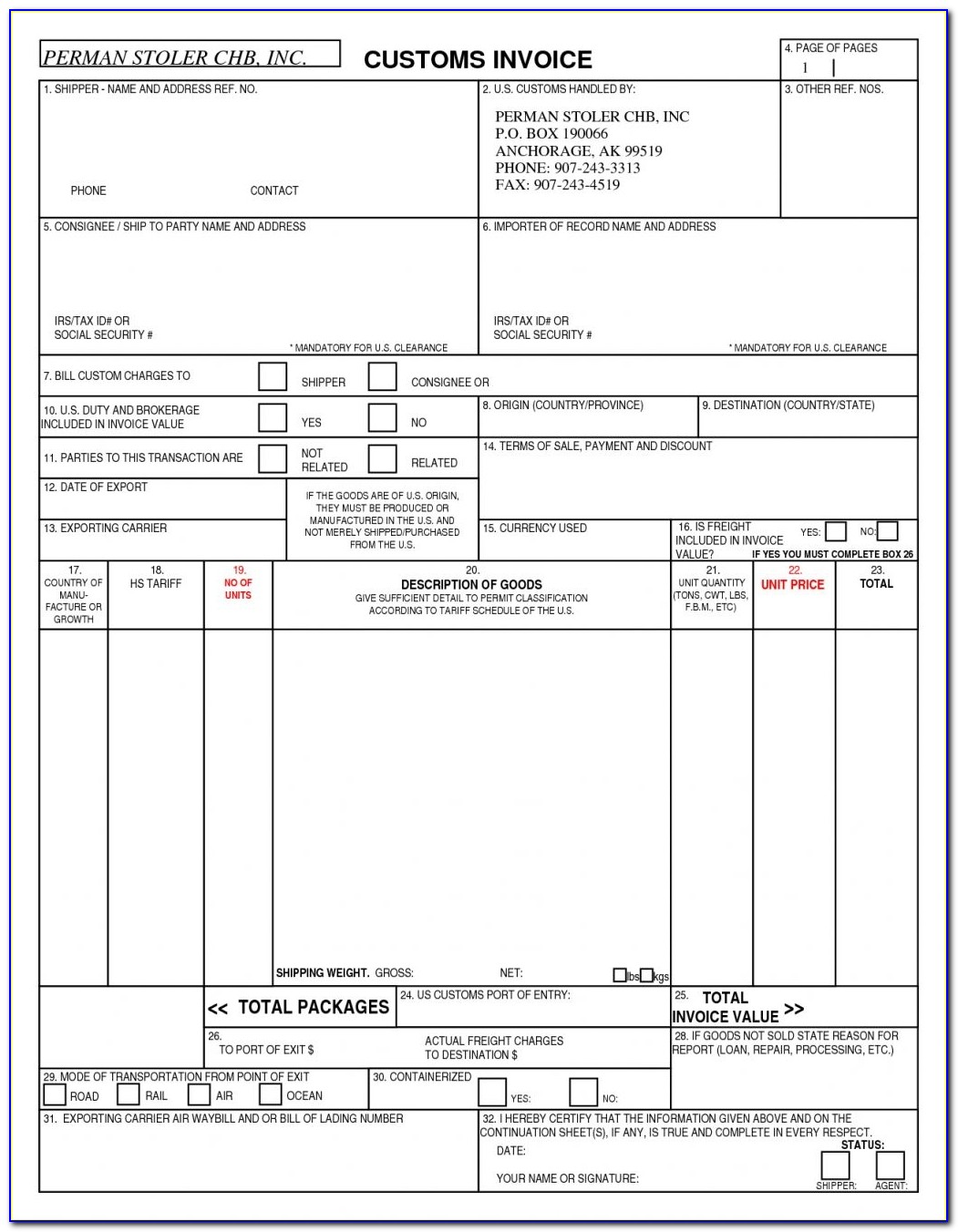

- Customs Invoice

- Packing Note and Packing List

- Certificate of Origin

- Insurance Policy

- Charter Party

- Shipping Bill

- Dock Receipt

- Mate’s Receipt

- Certificate of Measurement

- Bill of Lading

- Airway Bill

- Ship’s Report

- Bill of Entry

- Bill of Sight

- Dock Warrant

- Wharfinger’s Receipt

- Ship’s Delivery Order

- Letter of Indemnity

- Bottomry and Respondentia

- Advice Note

- Delivery Order

- Letter of Credit

- Bill of Exchange

- Letter of Hypothecation

- Trust Letter

- Duty Drawback Document

- Inspection Certificate

Documents Related to Goods

In foreign trade, the following instruments/ documents are worldwide used:

Indent

An indent is an order of goods from an overseas importer to a buying agent located in the exporting country.

The importer usually gives all relevant information regarding the volume, price, and nature of the product. Indent may be of two types- closed and open.

In an open indent, the buying agent, called the export commission agent, can order the goods from any manufacturer.

In a closed indent, the importer mentions the name of manufacturer, price, time of delivery, etc. in the indent.

Pro-forma Invoice

A Pro-forma invoice is the starting point of an export contract.

As and when the exporter receives the trade inquiry from the importer, the exporter submits the Pro-forma invoice to the importer.

The Pro-forma invoice contains details such as;

- name and address of the exporter, name, and address of the intending importer,

- nature of goods,

- mode of transportation,

- unit price in terms of internationally accepted quotation,

- name of the country of origin of goods,

- name of the country of final destination,

- the period required for executing contract after receipt of a confirmed order, and

- signature of the exporter

Commercial Invoice

A commercial invoice is the seller’s bill for merchandise or goods sold by him.

The commercial invoice contains all the particulars and details in respect of;

- name and address of the seller (exporter),

- name and address of the buyer (importer),

- date,

- exporter’s reference number,

- importer’s reference number, description of goods,

- price per unit at a particular location,

- quantity,

- total value,

- packing specifications,

- terms of sale (FOB, CIF, etc.),

- identification marks of the package,

- total number of packages,

- name and number of the vessel or flight,

- bill of lading number,

- place and country of destination,

- country of origin of goods,

- reference to the letter of credit (if opened),

- terms of payment, and

- signature of the exporter.

A commercial invoice is also called ‘document of contents’ as it contains all the important information necessary for the preparation of other export documents invoices.

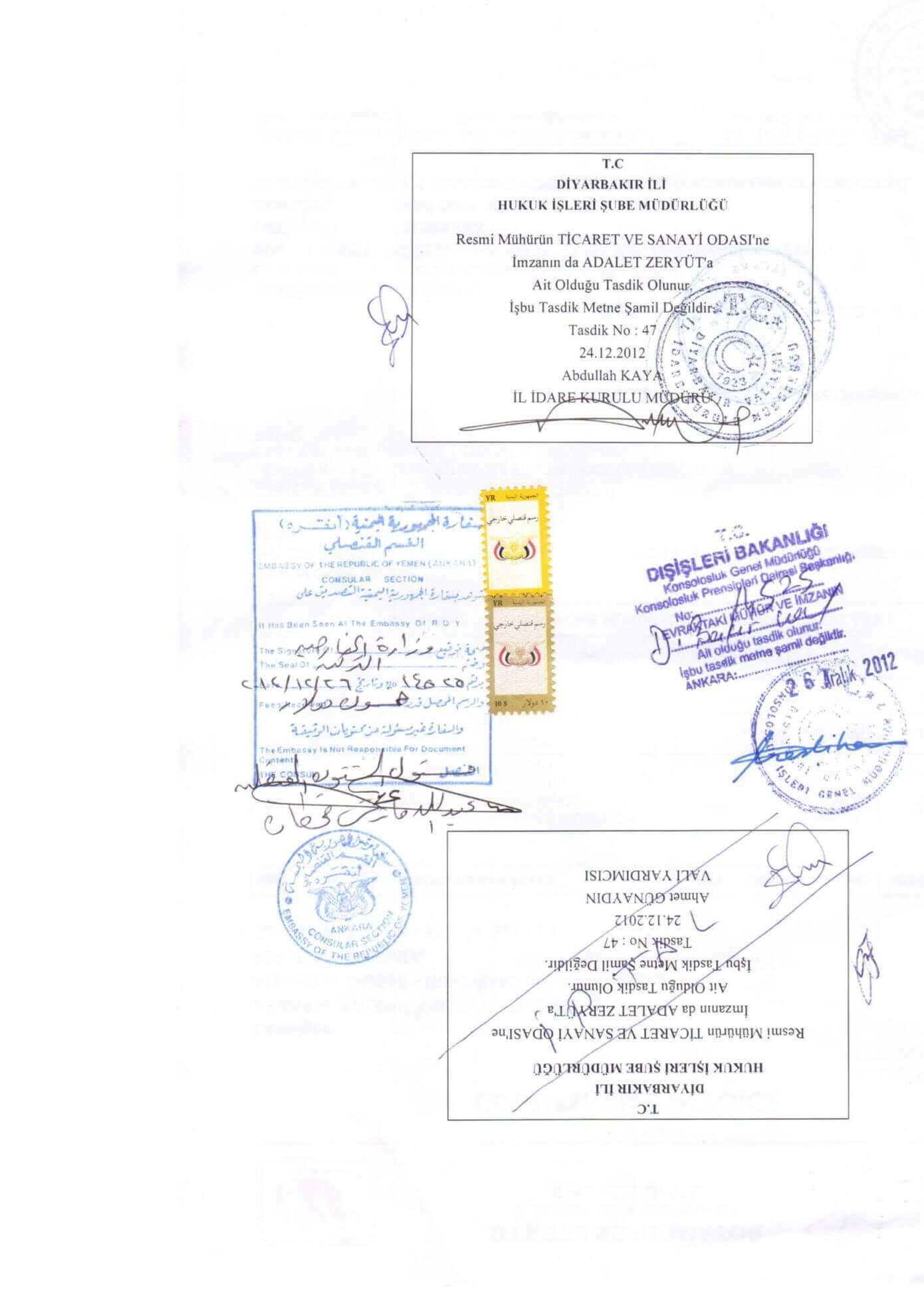

The exporter has to pay a certain fee to obtain the certificate/invoice.

Such fees vary from country to country. The main purpose of obtaining a consular invoice is to secure the authentication of information contained in the invoice.

Once the invoice is signed by the consular of the country, the importer gets comfort and confidence in respect of the accuracy of the information in respect of quality, source of goods, volume, and grade.

Normally, on the arrival of the goods, it is necessary to convince the customs authorities of the importing country that the goods stated in the invoice and the imported goods are the same.

If the customs authorities get suspicious or not convinced, they open the packages of the imported goods. If this happens, considerable delay takes place. The importer is put to hardship by delayed receipt of goods.

To avoid all these problems, the importer insists on the exporter to obtain the consular invoice from the consulate stationed in the exporter’s country.

Legalized Invoice

Certain Latin American countries like Mexico require this.

It is just like a consular invoice, which requires certification from the consulate or authorized mission, stationed in the exporter’s country.

Customs Invoice

When the commercial invoice is prepared on the format prescribed by the customs authorities of the importing country, it is called the customs invoice.

This is the requirement of the USA, Canada, and Australia.

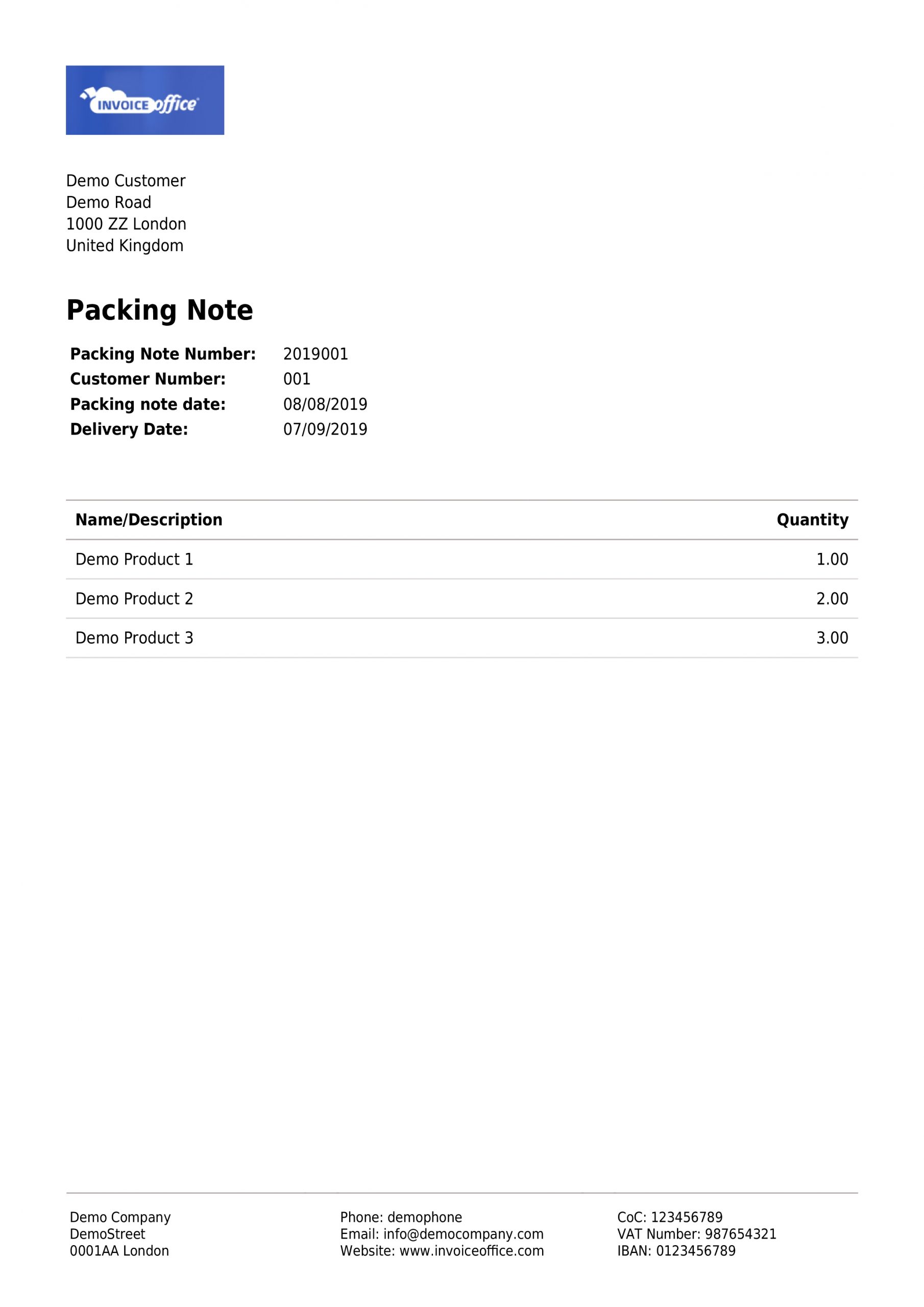

Packing Note and Packing List

Packing note refers to the particulars of contents of an individual pack. In contrast, the packing list is a consolidated statement of the contents of the total number of cases or packs.

A packing note contains the following details:

- Date of packing

- Number of packing note

- Number of the case to which it relates to

- Contents of the case in terms of quantity and weight

- Marking numbers

- Name of exporter

- Name of importer

- Importer’s order number

- Number and date of bill of lading

- Name of vessel/flight

The packing note is kept in each concerned case/pack. Packing notes and packing lists are sent to the importer along with other documents.

If any case contains any shortfall, an importer can communicate to the exporter, in which case there is a shortage of goods for making good.

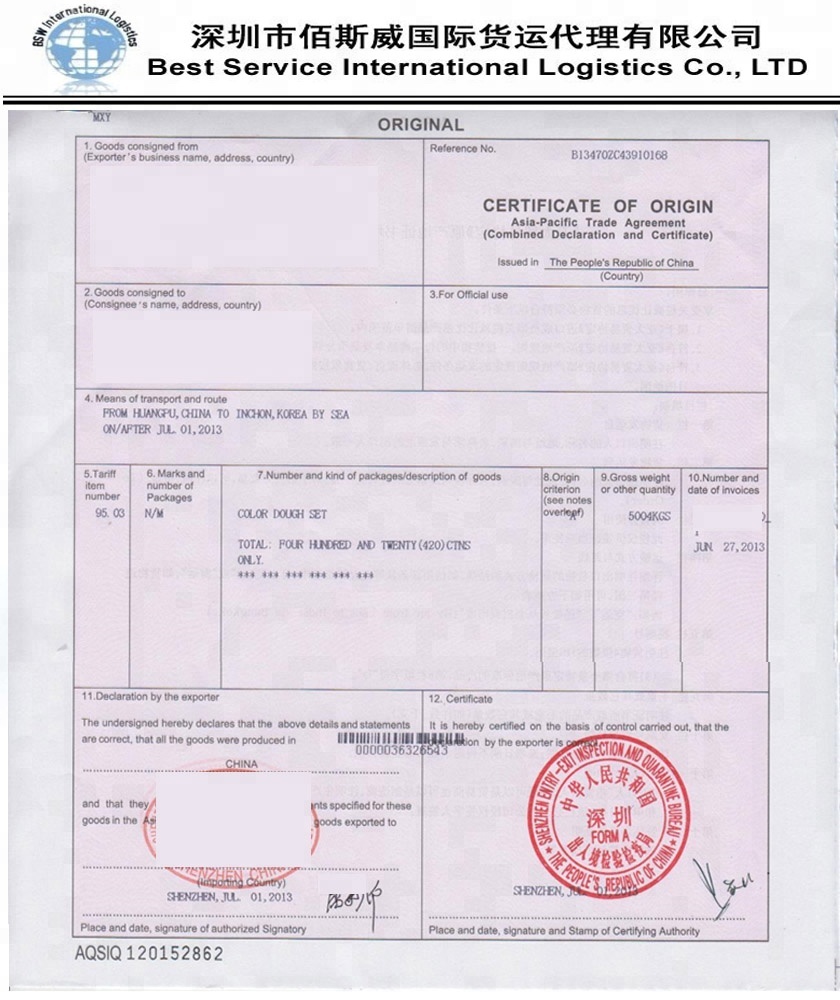

Certificate of Origin

As the very name indicates, certificate of origin is a certificate that specifies the name of the country where goods are produced.

This is necessary where the importing country has banned the entry of goods of certain countries to ensure that the goods from those countries are not allowed to enter.

At the time of arrival of the goods in the importer’s country, this certificate is necessary for the customs to permit preferential tariffs.

Certain countries offer preferential tariffs to goods produced and imported from certain countries.

In such a case, this is a must to the importer to claim preferential tariff, and importer insists on this document from the exporter.

This enables the importer’s country to regulate the concessional tariff only to selected countries and deny the rest.

A certificate of origin can be obtained from the Chamber of Commerce, Export Promotion Council, and various trade associations that have been authorized by the government of the exporter’s country.

Insurance Policy

The policy of marine insurance is very important in the field of foreign trade. It is the legal evidence of the contract for insuring the goods shipped against the risk in transit.

When the goods are sent by sea, there exist many risks such as pilferage, shipwreck, damage by water or fire, etc. To hedge against such risk, the exporter or the importer takes the help of an insurance company.

Generally, the importer instructs the exporter to insure the goods to be sent to him.

The exporter, as per the direction of the importer, insures the goods and forwards the insurance policy to him and charges him for the premium in the invoice.

In the event of loss or damage to the goods on board the ship, the insurance company bears the loss.

Documents Related To Shipment

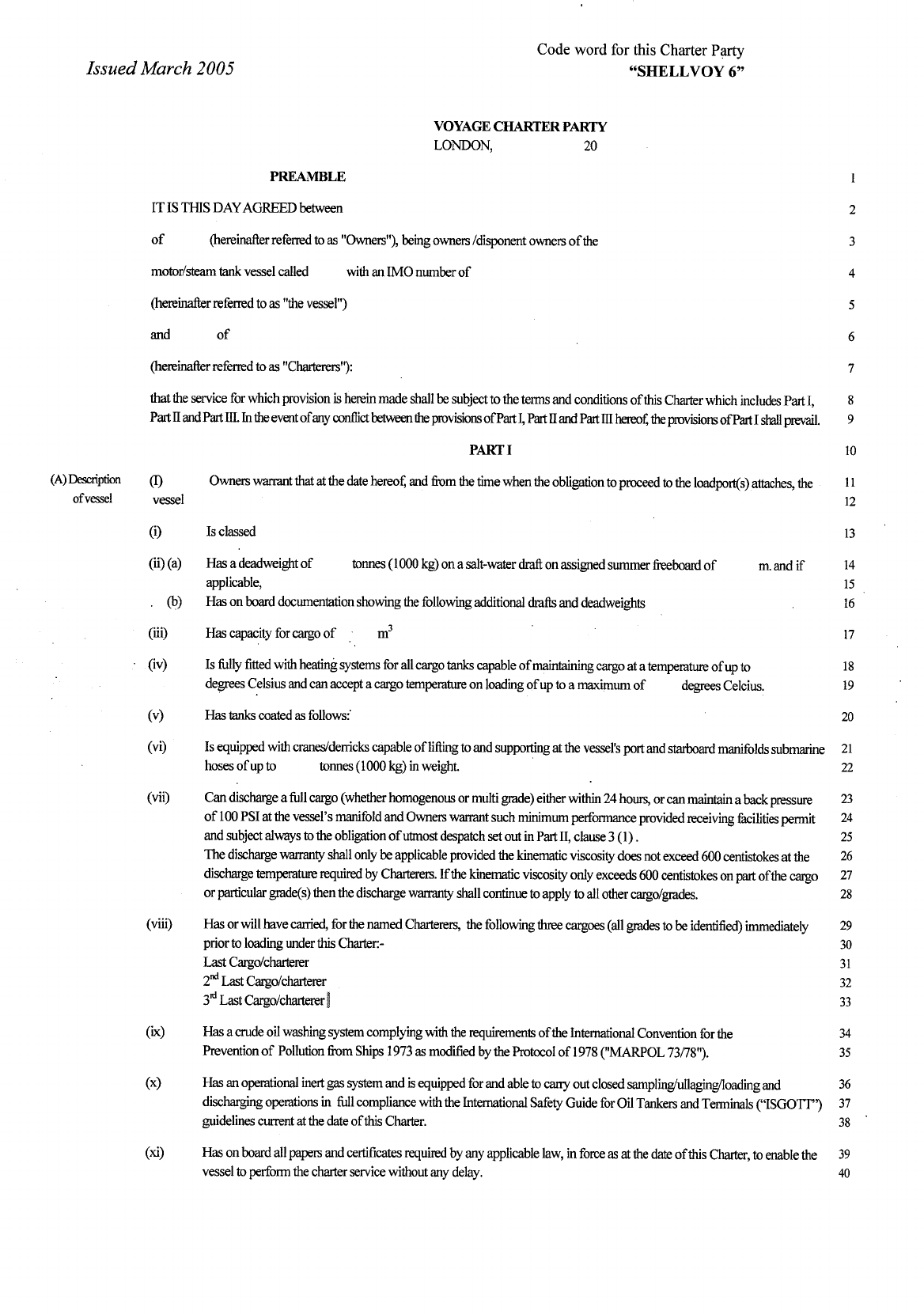

Charter Party

The bulk of the goods in foreign trade are transported by sea. The exporter needs to hire a ship or a part of it to send certain goods to a specified place.

For this purpose, the exporter agrees with the owner of a ship or the charterer.

The document consisting of such agreement, which is duly signed by the owner of a ship and the trader to send a certain amount of goods to a specified person at a particular place, is known as a charter party.

Simply it is a deed of a contract between the owner of the ship and the merchant.

It may be of two types, viz., time charter and voyage charter. The former refers to an agreement whereby a ship or a portion of it is hired for a certain period.

The voyage charter is an agreement by which the entire ship or a portion of it is hired for a specified voyage only.

The charter party usually contains the following clauses:

- Name of the party

- Class of the charter party

- Name of the place where the ship is staying

- Guarantees by the shipowner regarding the seaworthiness of the ship

- Prosecution of a voyage

- Masters’ duty

- Charters’ duty

- Excepted perils

- Lay days

- Provision for loading, discharging, demurrage, cancellation, etc.

Further, there are some clauses such as seaworthiness at the time of sailing and fitness of the ship at the time of loading and unloading, which are implied in the contract.

Shipping Bill

The shipping bill is the main document based on which the permission of the customs is given.

Under manual processing of export documents, the exporter is required to file the appropriate type of shipping bill to seek the order for customs clearance of the export shipment.

Under computerized processing, the exporter does not prepare the shipping bill; instead, it is computer generated.

The goods are allowed to be charted to the docks only after the customs stamp the shipping bill.

The shipping bill contains the following particulars:

- Nature of goods exported.

- Name of vessel, master or agents

- Flag

- Country of destination, the port at which the goods are to be discharged

- Exporter’s address

- Importer’s address

- Details of the packages, such as numbers and marks

- Quantity details of each case, the total number of cases and aggregate weight

- FOB prices and real value

- Whether the merchandise is local or foreign origin which is re-exported

The shipping bill is prepared in 5 copies:

- Customs copy.

- Drawback copy

- Export promotion copy

- Port trust copy

- Exporters copy

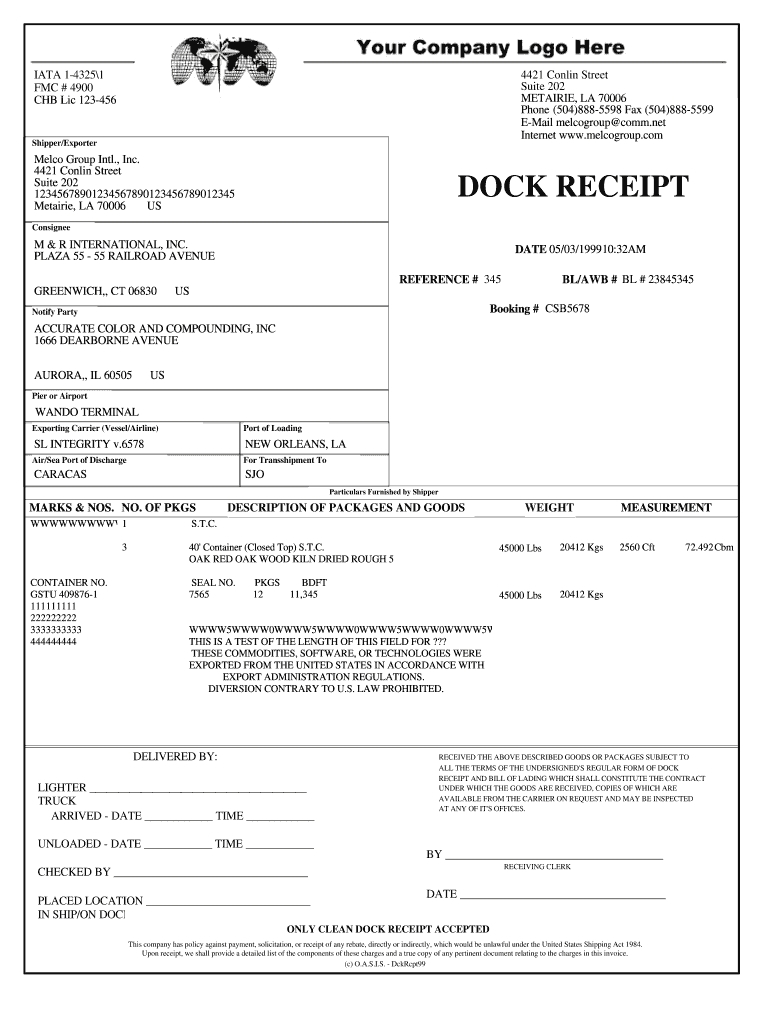

Dock Receipt

Sometimes goods are sent to the importer through the dock company.

In such a case, the exporter collects a receipt from the dock company to the effect that goods have been delivered to the dock company.

This receipt is known as the dock’s receipt.

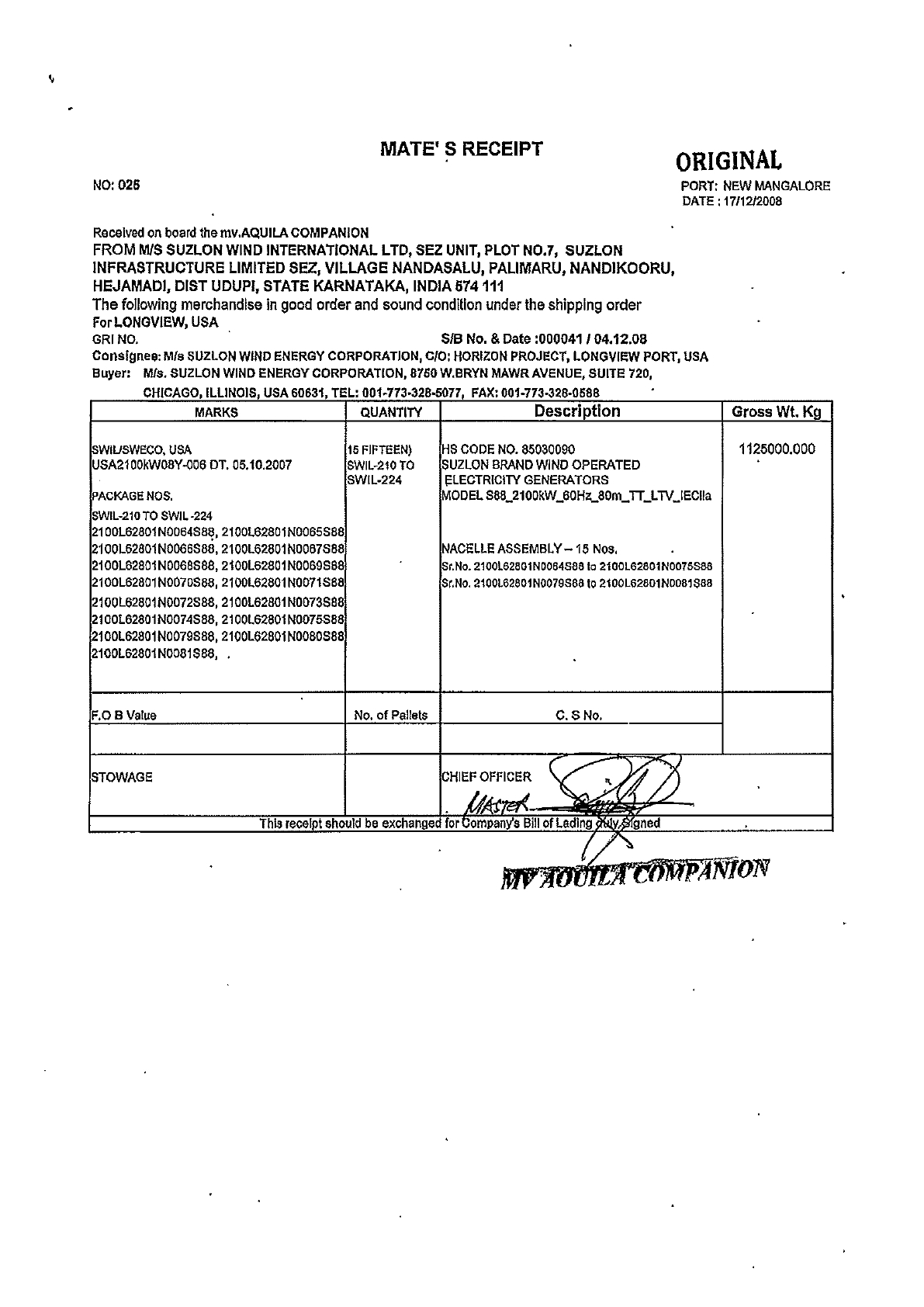

Mate’s Receipt

A mate’s receipt is issued by the mate (assistant to the captain of this ship) after the cargo is loaded into the ship. It is an acknowledgment that the goods have been received onboard the ship.

The person in possession of a mate’s receipt is entitled to the bill of lading that will be issued in due course and exchanged for the mate’s receipt.

Mate’s receipt contains the details about:

- Name of the vessel

- Date of shipment

- Berth

- Marks

- Numbers

- Description and condition of goods at the time they are shipped

- Port of loading

- Name and address of the importer (consignee) and

- Other required details

Certificate of Measurement

Freight is charged either based on weight or measurement.

When weight is the basis of calculation of freight, the shipping company for calculation of freight may accept the weight declared by the exporter.

However, when a measurement is the basis of calculation of freight, the shipping company may insist on a certificate issued by the Chamber of Commerce or other approved organization in respect of goods.

The certificate measurement contains the details in respect of the description of goods, quantity, length, breadth, and depth of the packages, name of the vessel and port of destination of the cargo, etc.

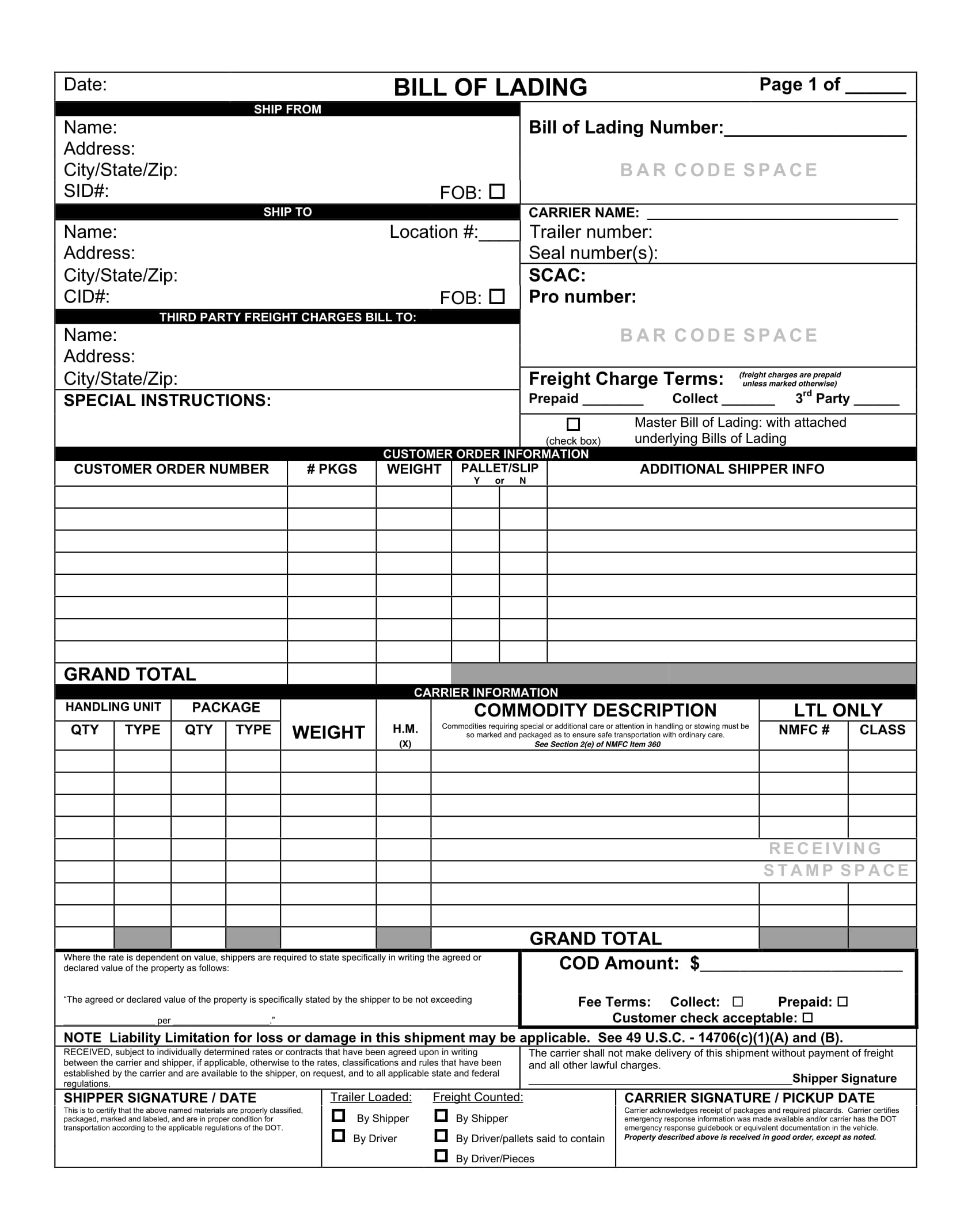

Bill of Lading

Bill of lading is a document issued by the shipping company or his agent acknowledging the receipt of cargo on board.

This is an undertaking to deliver the goods in the same order and condition as received to the consignee or his agent on receipt of freight, and the shipping company is entitled to.

It is a very important document to the exporter as it constitutes a document of title to the goods.

There are two basic types of bills of lading: “straight” (or non-negotiable) and “shipper’s order” (or negotiable).

The latter can be bought, sold, or traded while the goods are in

The shipper prepares the bill of lading, and in it, a full description of the goods is given.

Then, the exporter or the shipper submits the said document to the shipping company, which prepares and forwards a freight note to the exporter.

The note indicates the freight charge for carrying the goods to the importing country.

On payment of the bill or any other arrangement being made between the shipper and the shipping company, the master of the ship signs the bill of lading and returns the same to the exporter.

In case freight is paid by the exporter, the bill of lading is marked ‘freight paid,’ and if the freight is not paid, the bill is marked ‘freight forward’ in which the importer will have to pay the freight of the goods.

According to the rules set forth by the International Chambers of Commerce (ICC), the only bill of lading that is acceptable is one that is marked “CLEAN ON BOARD.”

This statement signifies that the carrier has not taken any exception to the condition of the cargo or packing and that the merchandise has been loaded aboard the carrying vessel.

Purposes of Bill of Lading

Bill of lading serves 3 purposes;

- It is a receipt. As a receipt, the bill of lading indicates that the carrier has received the merchandise described on the face of the document.

- It is contracting. As a contract, the bill of lading specifies that the carrier is obligated to provide transportation service in return for a certain charge.

- It is a document of title. As a document of title, the bill of lading can be used to obtain payment or a written promise of payment before the merchandise is released to the importer.

Contents of Bill of Lading;

- Name and address of the shipper

- Name and address of the vessel

- Name of the shipping company

- Name of the port of loading

- Name of the port of discharge and place of delivery

- Date of loading of goods

- Voyage number and date

- Quantity, quality, marks, and other description

- Number of packages

- Number of originals issued

- Signature of the issuing authority

Importance/Significance of Bill of Lading

Importance of Bill of Lading to the Exporter

It is an acknowledgment from the shipping company that the goods have been received for shipment.

After receipt of the bill of lading, it helps him to send the shipping advice to the importer.

If any damage occurs to the cargo during transit, he can hold the shipping company responsible if he has received a clean bill of lading.

A copy of the bill of lading is required to be attached to the application form to claim the incentives.

It is a contract of carriage between the exporter (the shipper) and the shipping company.

Importance of Bill of Lading to the Importer

It is a document of title to the goods, which enables him to transfer the title by endorsement and delivery. The exporter can send a non-negotiable copy of the bill of lading as advance information of shipment to the importer.

It enables him to pay the freight amount as the bill of lading contains freight details.

Importance of Bill of Lading to the Shipping Company

It helps the shipping company to collect the freight amount from the’ exporter (CIF contract) or importer (FOB contract).

A shipping company can protect itself at the time of receipt from the wrongful claims of exporter/importer by incorporating the condition of goods/packaging.

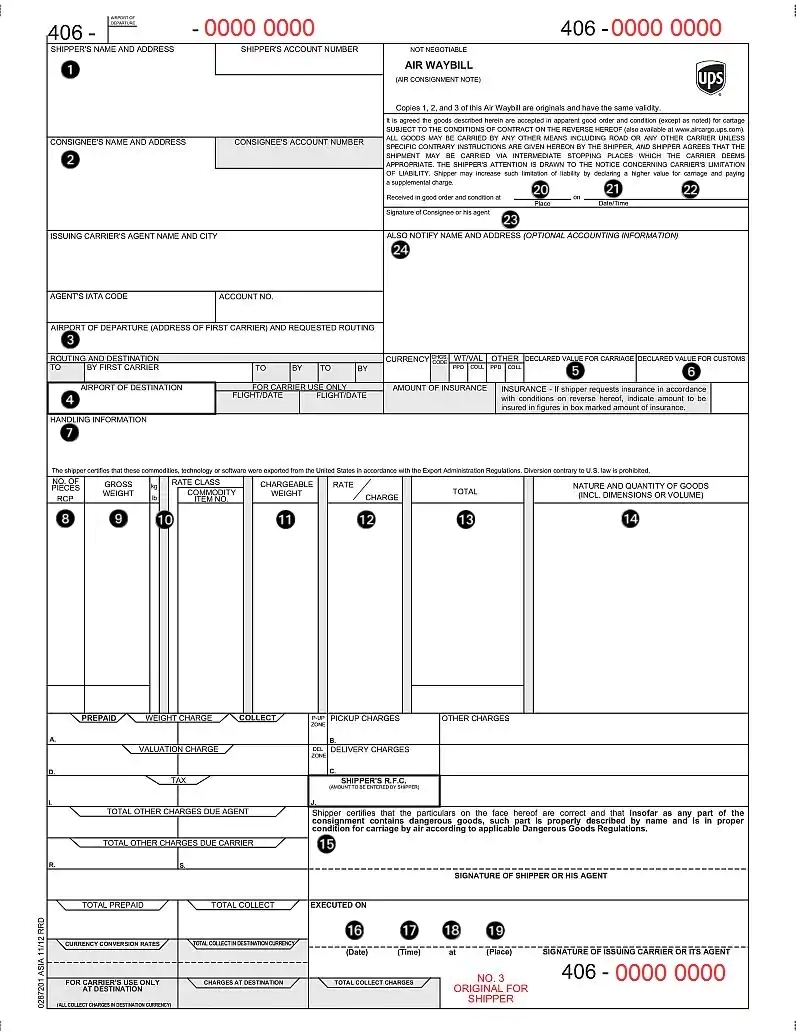

Airway Bill

Airway bill is also called “air consignment note.” It is a receipt issued by an airline for the carriage of goods.

As each shipping company has its bill of lading, so each airline has its airway bill.

Airway bill or air consignment note is not treated as a document of title to goods and is not issued in negotiable form.

Delivery of goods is made to the consignee without the production of the airway bill.

Ship’s Report

The ship’s report is prepared by the master of the ship within 24 hours of the arrival of the ship and is submitted to the custom’s authorities.

This report consists of the name of the ship, the port of registration and nationality, and the port of start, the name of the master, and details of the crew, passengers, and cargo.

In almost all countries, the submission of this report is obligatory.

Goods cannot be unloaded before submitting such reports to the customs authorities. Similarly, another report known as ship’s manifest has to be submitted at the time of departure of the ship.

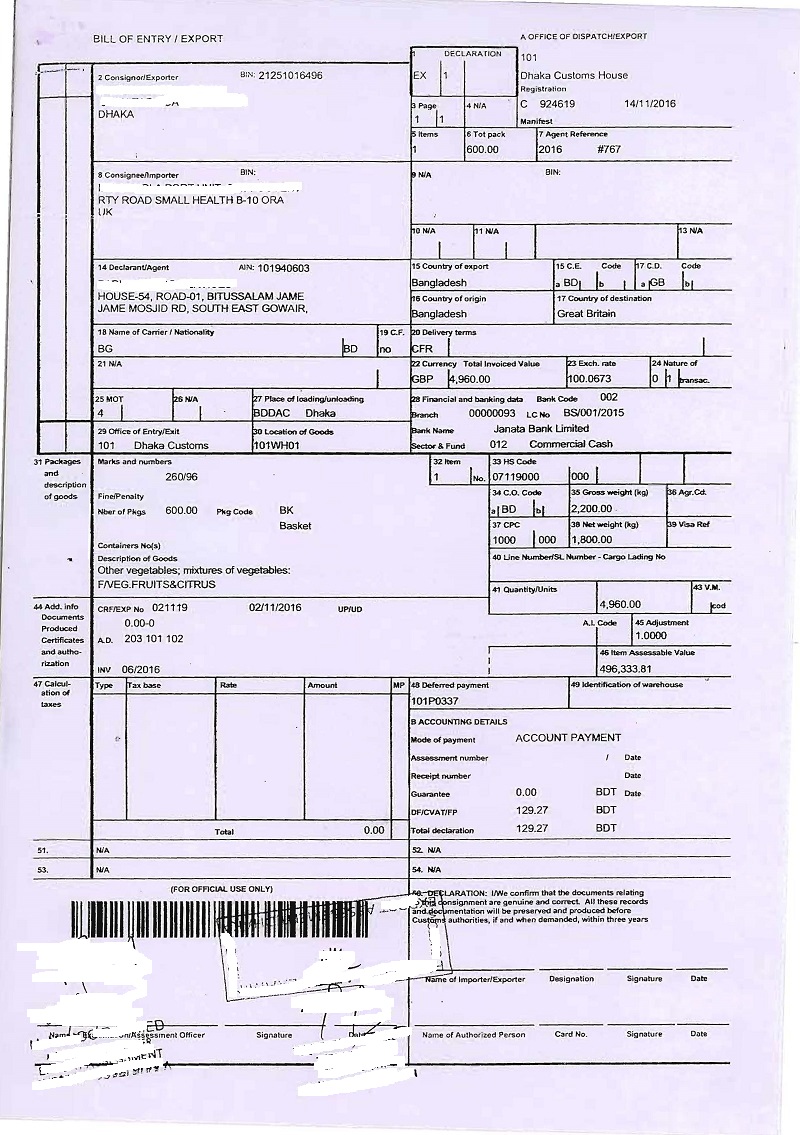

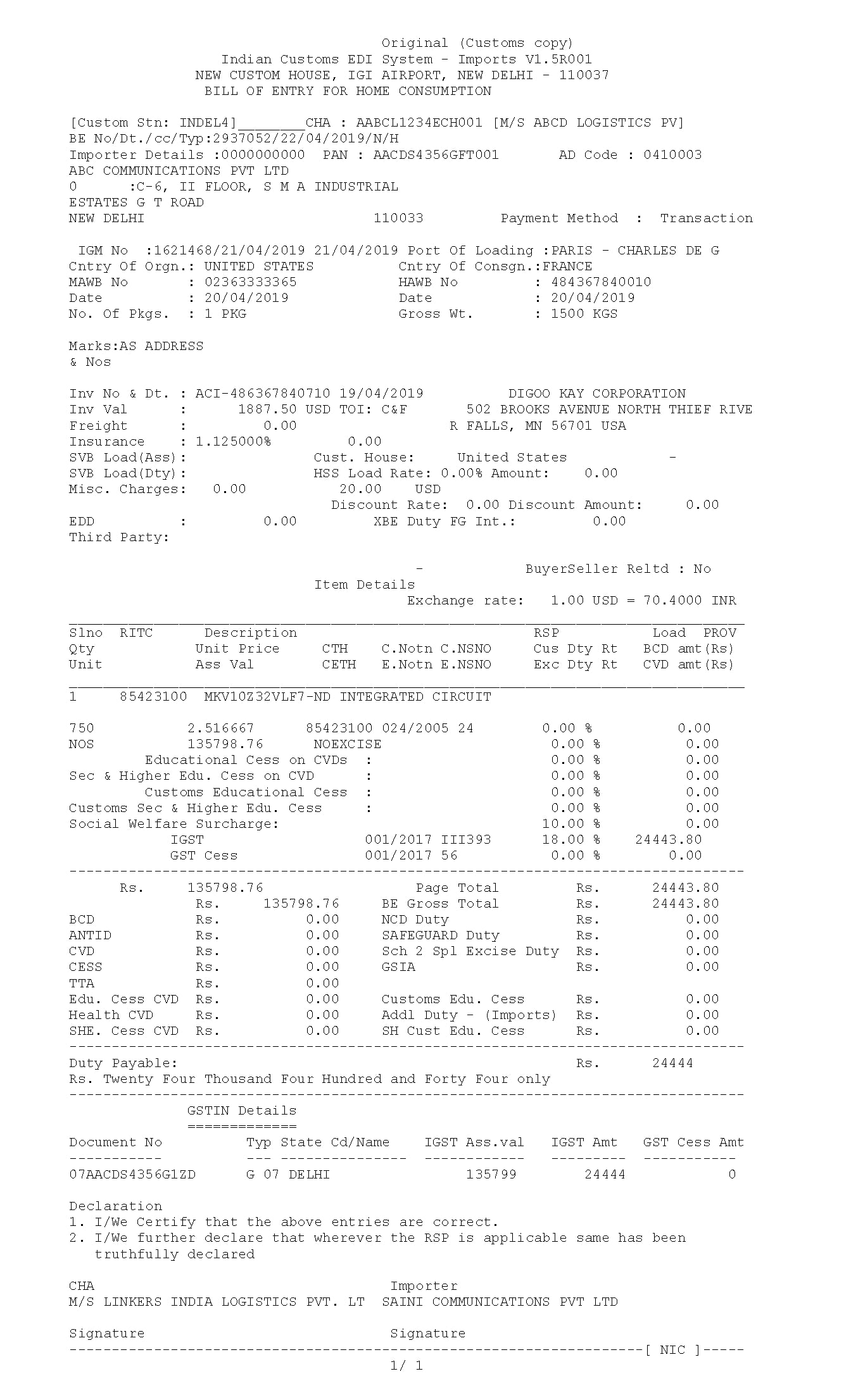

Bill of Entry

Bill of Entry is a declaration made in a particular form by the importer on the arrival of the goods at the port.

The declaration is made in writing to the customs authorities stating the description of the goods, their quantity, and value.

Bill of Entry is prepared from the invoice and other information known to the importer.

The bill of entry helps the custom’s authorities to identify the goods and determine the custom’s duties.

Bill of Sight

Sometimes importer faces some problems to fill up the bill of entry owing to the lack of some information.

In that case, the importer makes a declaration stating his inability to submit the said form in another form known as a bill of sight form.

On submitting such declaration, he is permitted to inspect the goods in the presence of the customs officials and collect necessary data to fill up the bill of the entry form.

Dock Warrant

Dock warrant is issued by the dock company stating therein that certain specified goods of someone have the dock company and that these goods are deliverable to the person named.

Wharfinger’s Receipt

A wharfinger is a keeper of a wharf. The wharfinger takes custody and is responsible for goods delivered to the wharf.

A wharfinger’s receipt is an acknowledgment of the receipt of goods by the wharfinger.

Ship’s Delivery Order

The ship’s delivery order is issued by the shipping company to the dock superintendent to deliver the goods to the person named therein.

The importer needs to produce a bill of lading and other relevant documents to the shipping company and pays the freight, if not paid.

The shipping company then proceeds to issue such an order, and importer may, then, take delivery of goods.

Letter of Indemnity

It is a kind of undertaking by one person to another to indemnify him against any loss that he may suffer in the event of certain happening.

In foreign trade, this letter is given to the shipping company and other authorities by the importer in case the importer is unable to produce all the necessary documents at the time of taking delivery of goods.

In the absence of shipping documents, he may take delivery of goods provided he submits a letter of indemnity.

Bottomry and Respondentia

During a voyage, the captain of the ship may face accidents and may require to get the ship repaired.

For that purpose, he may need money. There are some ways of collecting money.

One may raise money on the security of vessels, freight, and cargo.

If he raises money by the pledge of the ship, freight, or cargo singly and alone, the captain issues bottomry bond.

On the other hand, if he raises finance by mortgaging the ship, freight, and cargo in favor of the lender of money, he issues another bond known as a respondentia.

Advice Note

This refers to a letter written by the exporter to the importer stating therein the date of shipment, route, probable date of arrival of the ship at the port of the importing country.

The exporter usually issues this after the dispatch of the goods.

But this practice is not so common to many. Instead, a copy of the invoice is forwarded to the importer on the dispatch of goods.

Delivery Order

This order is issued by the owner of the goods to the dock company, requesting the superintendent to deliver the goods as per specification.

Like a bill of lading, this is a negotiable document, which can be transferred by mere endorsement and delivery.

Documents Related to Payment

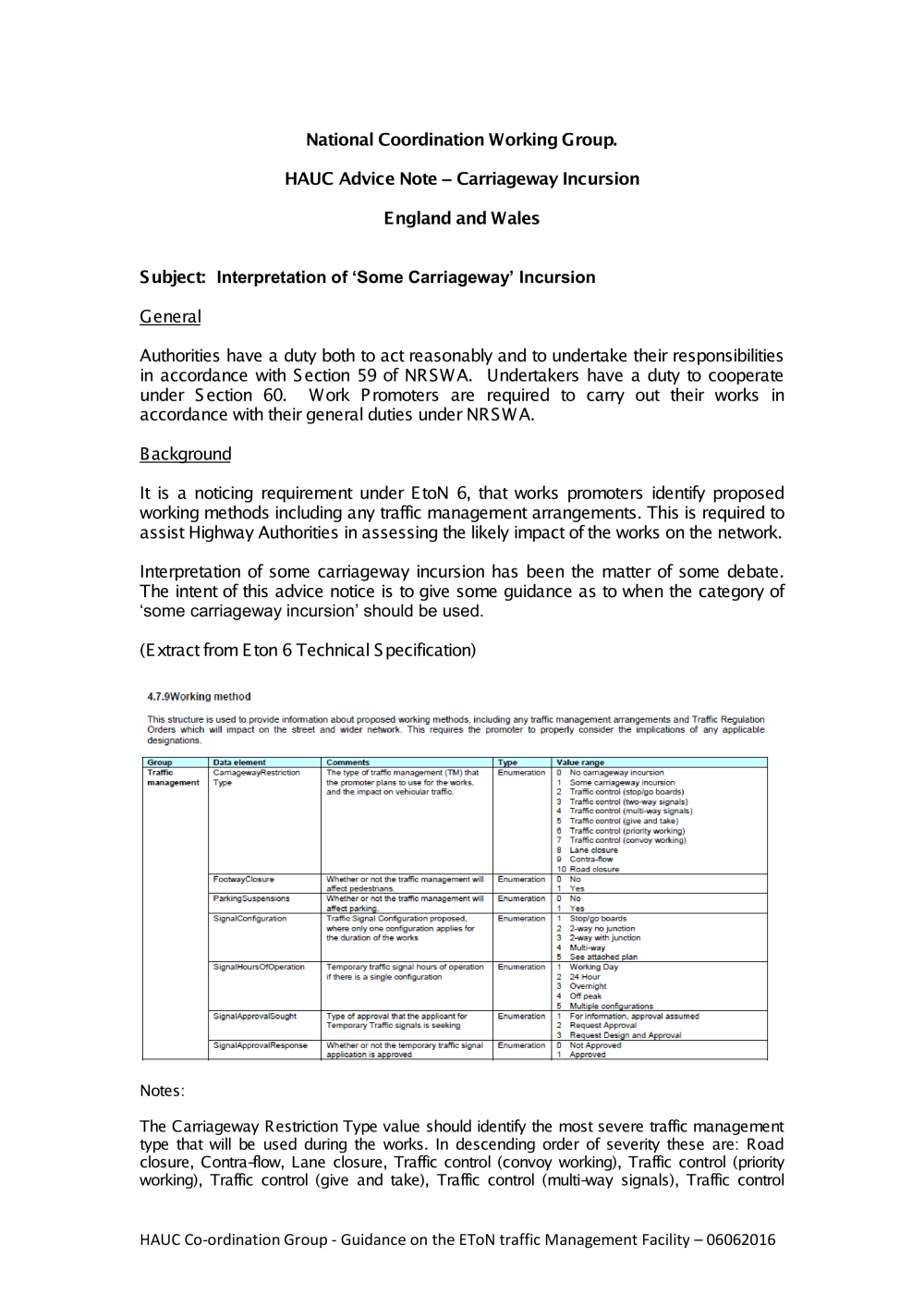

Letter of Credit

A letter of credit (LC) is a document containing the guarantee of a bank to make payment to an exporter, under certain conditions and up to a certain amount, provided the conditions contained therein are complied with.

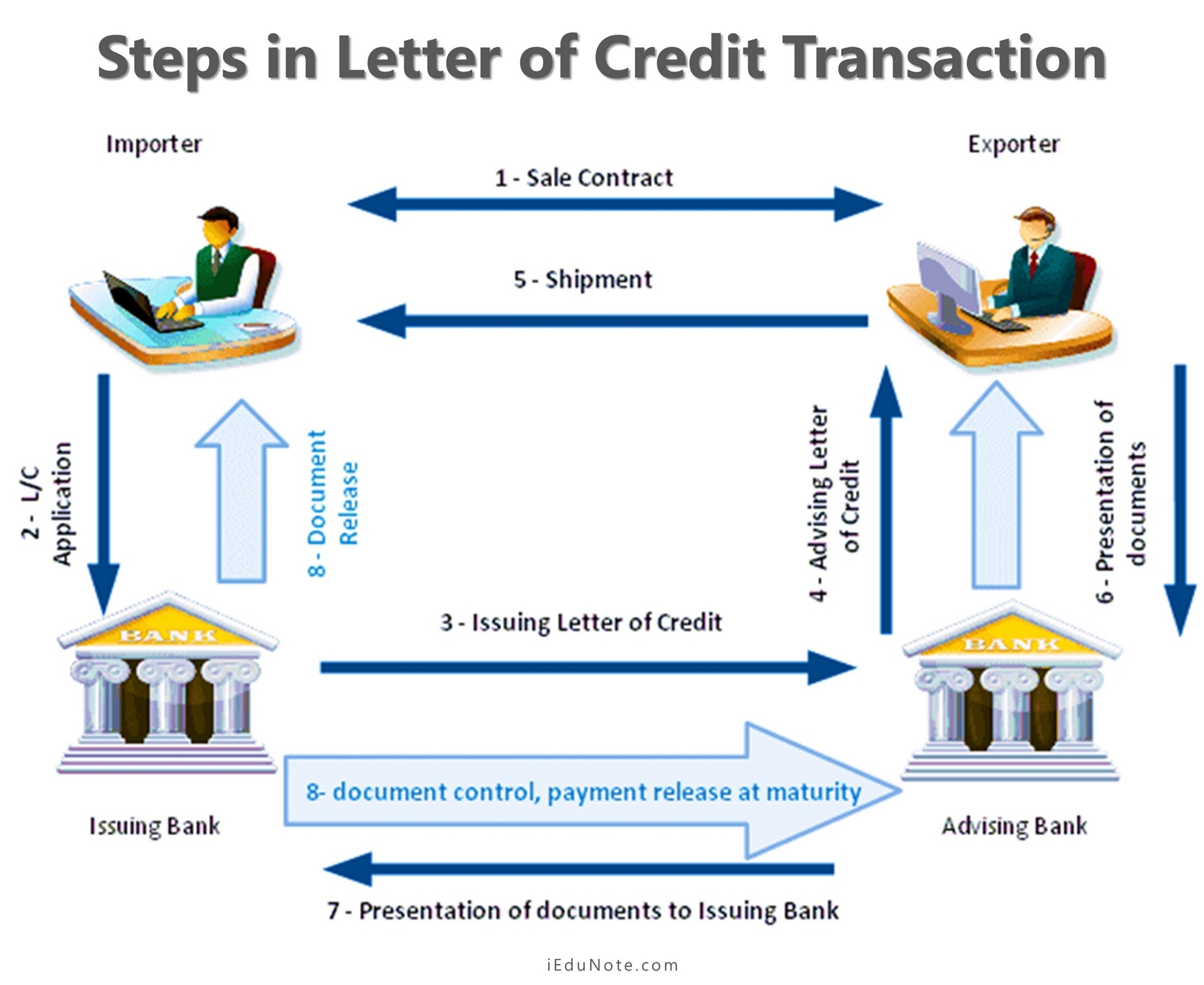

Bill of Exchange

The Negotiable Instruments Act, 1881 defines a bill of exchange as “an instrument writing containing an unconditional undertaking, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of, a certain or to the bearer of the instrument.

Parties to a bill of exchange

Important parties to a bill of exchange;

- The drawer

The drawer is the person who has issued the bill. In an export transaction, the exporter draws the bill as money is owed to him.

- The drawee

The drawee is the person on whom the bill is drawn. Exporter draws the bill on the importer, who is the drawee. Drawee is the debtor who owes money to the exporter (the creditor).

- The payee

The payee is the person to whom the money is payable. The bill can be drawn by the exporter payable to the drawer (himself) or his banker.

- The endorser

The endorser is the person who has placed his signature on the back of the bill signifying that he has obtained the title for the bill on his account or account of the original payee.

- The endorsee.

The endorsee is the person to whom the bill is endorsed. The endorsee can obtain the payment from the drawer.

Types of Bills of Exchange

- Sight bill of exchange

In this bill of exchange, also known as the demand bill of exchange, the drawee has to make the payment on presentation.

- Usance bill of exchange

In case of usance or time bill of exchange, payment is to be made on the maturity date, after a certain period, known as a tenor. When the calculation of the period is made concerning the sight of the bill, the bill is known as ‘after sight usance bill.’ Sometimes, the maturity date is calculated concerning the date of the bill of exchange; it is known as ‘after date usance bill.’

- Clean bill of exchange

A clean bill of exchange is one when the relative shipping documents do not accompany it.

Letter of Hypothecation

Before the banker undertakes to make advances, the party concerned is required to sign a letter of hypothecation, which is addressed by the party to the banker giving the latter right over his goods in consideration of an advance.

This letter indicates the particulars of the bill drawn and of the goods against which it is drawn, and empowers the banker to sell the specified goods if the drawer or the importer refuses to accept the bill when it is presented to him or fails to honor it at maturity.

In the event of difficulty of payment, the banker gets the right to sell the goods.

Trust Letter

Trust letter refers to a document in which the importer admits the sole right of a banker to goods and undertakes to pay the full amount of the sale proceeds.

An importer may take an advance from the banker, against shipping documents, giving title to the goods.

But the importer cannot take delivery of the goods without the shipping documents, and at the same time, the bank cannot and should not release the documents till full payment is made.

Under that situation, a compromise is reached using a trust letter or trust receipt by which the importer admits the sole right to the goods and promises to pay at the time of sale-proceeds of such goods.

Other Documents

Duty Drawback Document

Duty drawback refers to the refund of customs duties previously paid for goods originating from another country that is to be subsequently exported or used in exported goods as raw materials.

The duty drawback document is a kind of document to be filled by the exporter demanding the refund (customs drawback) on duty already paid on raw materials incorporated in goods to be exported.

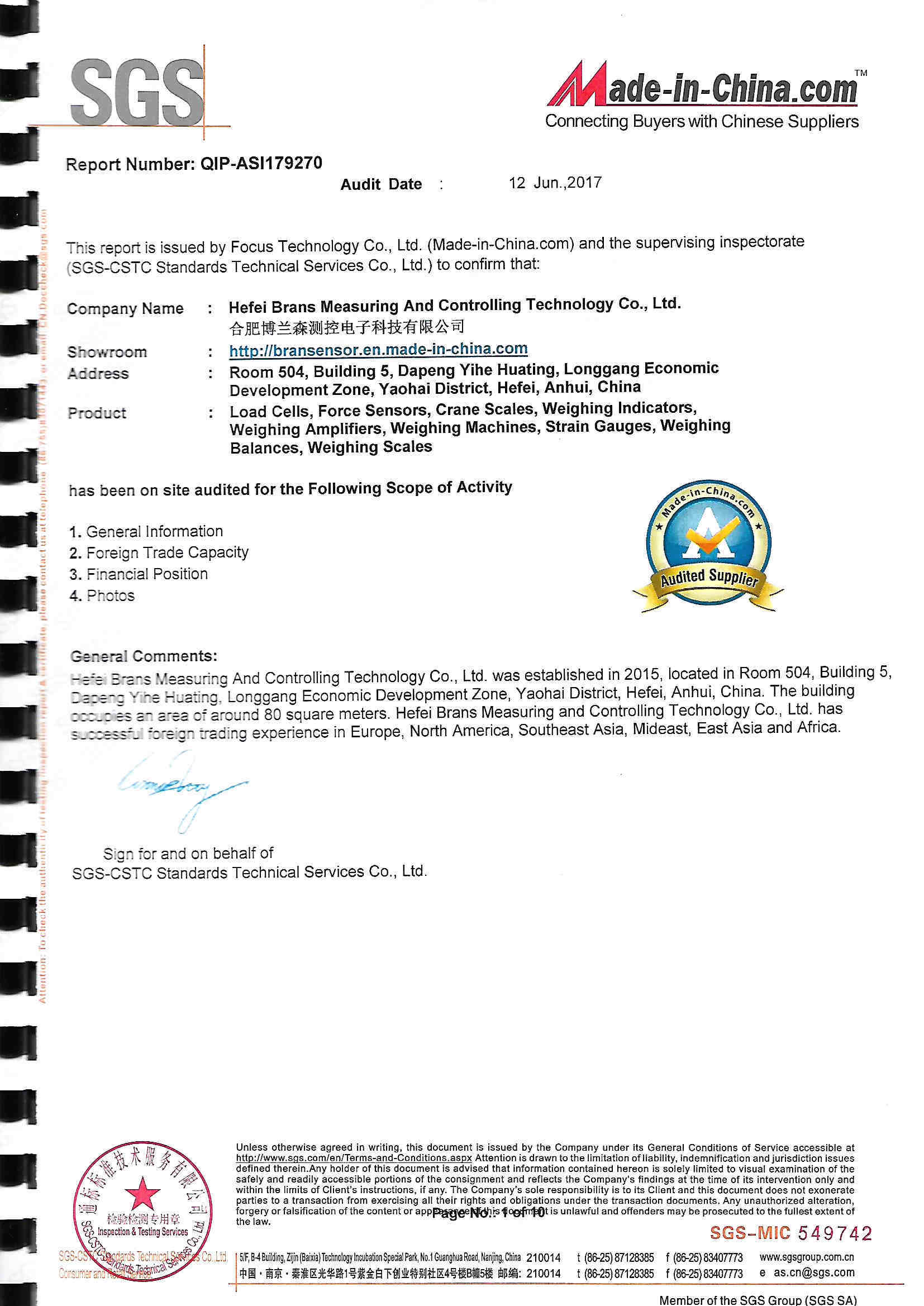

Inspection Certificate

An inspection certificate is required by some importers and countries to attest to the specifications of the goods shipped. This is usually performed by a third party and often obtained from independent testing organizations.