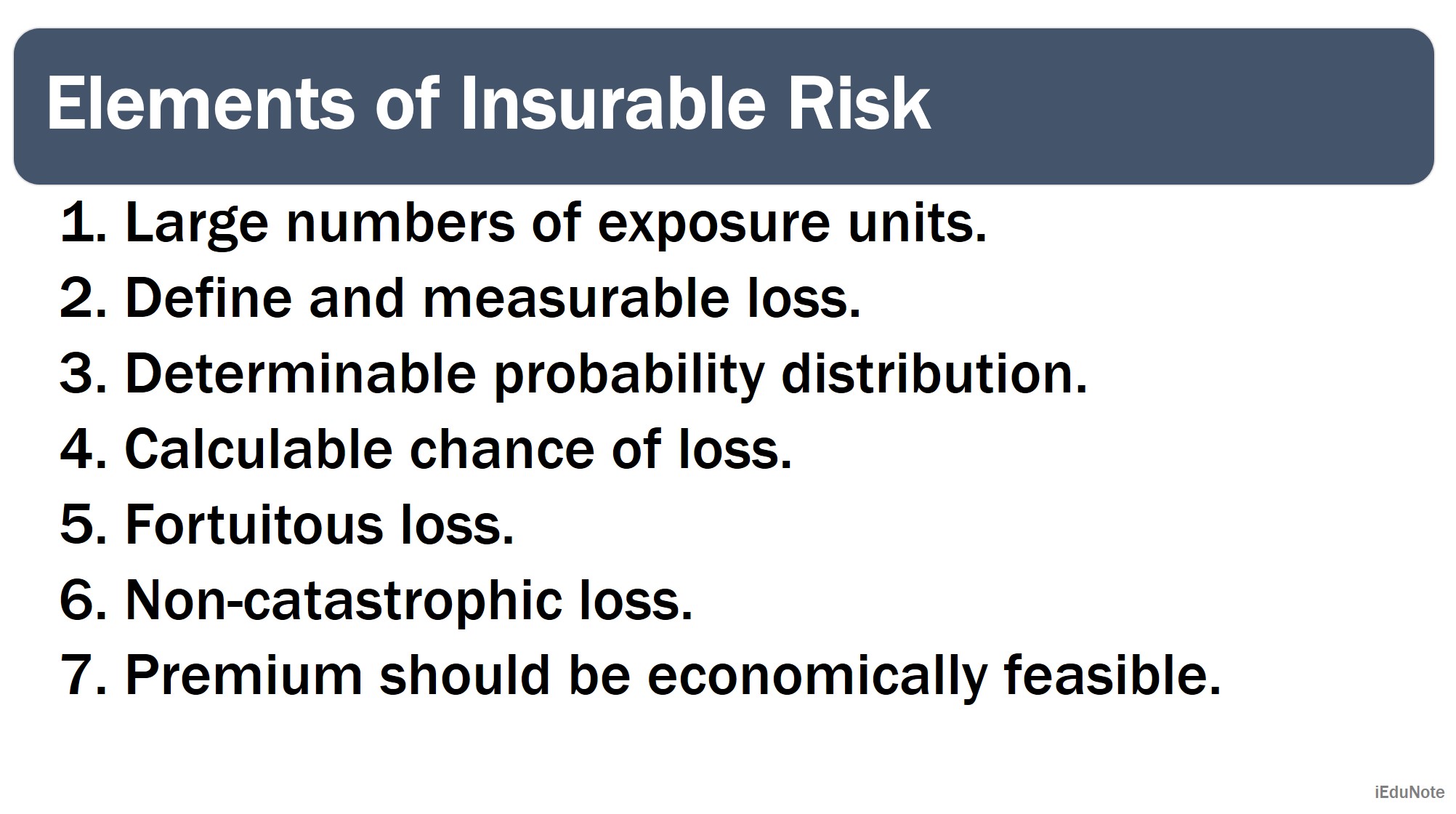

Insurance is a device that gives protection against risk. But not all individual and commercial risks can be insured and given protection. A risk must have certain elements in it that make it insurable. For pure risks to be insurable, they should possess the following characteristics.

Insurable risk has 7 elements. Insurance providers look for these to measure levels of risk and premium levels for insurance protection for anything.

7 Elements of Insurable Risk

These are explained below;

Large Numbers of Exposure Units

The theory of insurance is based on the law of large numbers.

Therefore the prime necessity for a risk to be insurable is that there must be a sufficiently large number of homogeneous exposures to combine reasonably predictable losses.

Lost data can be compiled over time, and losses for the group can be predicted with some accuracy. The loss costs can then be spread over all insured’s in the underwriting class.

Also, the probabilistic estimates used by the insurance company, by logic, assume a large number of units in a distribution, and insurance products are priced accordingly.

Define And Measurable Loss

A second requirement is that the loss should be both determinable and measurable. This means the loss should be definite as to cause, time, place, and amount. Life insurance, in most cases, meets this requirement easily.

The cause and time of death can be readily determined in most cases, and if the person is insured, the face amount of the life insurance policy is the amount paid.

The losses are fairly predictable and can be measured in money terms—loss of peace of mind, tension, etc. Or loss of life cannot be indemnified.

Determinable Probability Distribution

The probability distribution of happening of an adverse event is determinable. This condition is necessary to establish a free premium according to the theory of equivalence.

If there is not determinable distribution, there is no question of issuing a cover by an insurance company.

Calculable Chance of Loss

A fourth requirement is that the chance of loss should be calculable. The insurer must calculate both the average frequency and the average severity of future losses with some accuracy.

This requirement is necessary so that a proper premium can be charged that is sufficient to pay all claims and expenses and yield a profit during the policy period.

Certain losses, however, are difficult to insure because the chance of loss cannot be accurately estimated, and the potential for a catastrophic loss is present.

For example, floods, wars, and cyclical unemployment occur on an irregular basis, and the average frequency and the severity of losses are difficult.

Thus, without government assistance, these losses are difficult for private companies to insure.

Fortuitous Loss

The adverse event may or may not occur in the future and once the insurance company has no control. So naturally, if the event is non-random or the loss has occurred in the past, there is no insurance question.

Also, it is important to note that randomness is ensured by underwriters who guard against adverse selection, the tendency of the poorer than average insured to seek or continue insurance coverage.

Non-catastrophic Loss

The losses should be non-catastrophic. Not all the units in a homogeneous group will be subject to an adverse event. This means that a large proportion of exposure units should not incur losses at the same time.

As we stated earlier, pooling is the essence of insurance. However, if most or all of the exposure units in a certain class simultaneously incur a loss, then the pooling technique breaks down and becomes unworkable.

Premiums must be increased to prohibitive levels, and the insurance technique is so long a viable arrangement by which losses of the few are spread over the entire group.

For example, insurers ideally wish to avoid all catastrophic losses.

In reality, however, this is impossible because catastrophic losses periodically result from floods, hurricanes, tornadoes, earthquakes, forest fires, and other natural disasters. In addition, catastrophic losses can also result from acts of terrorism.

Premium Should be Economically Feasible

It is the final requirement that the premium should be economically feasible. The insured must be able to pay the premium.

Also, for the insurance to be an attractive purchase, the premiums paid must be substantially less than the policy’s face value or amount.

Since the insurance pool is structured to be sufficiently large, the price charged by the insurer for buying the risk is generally low. Thus, it should be sufficient to cause the rich for the insurer and viable for the insured.

![Types of Insurance Organizations [A Comprehensive Guide] 2 Types of Insurance Organizations [A Comprehensive Guide]](https://www.iedunote.com/img/259/types-insurance-organization-e1529504882393.png)