Whatever strategies a diversified company chooses for strengthening its position and performance, they should be properly analyzed and evaluated.

Some systematic procedures need to be followed so that corporate managers can assess the potential and present caliber of the various business units under the corporate umbrella.

Such analysis and evaluation would help them decide what strategic actions they should take to improve the strengths of their business units.

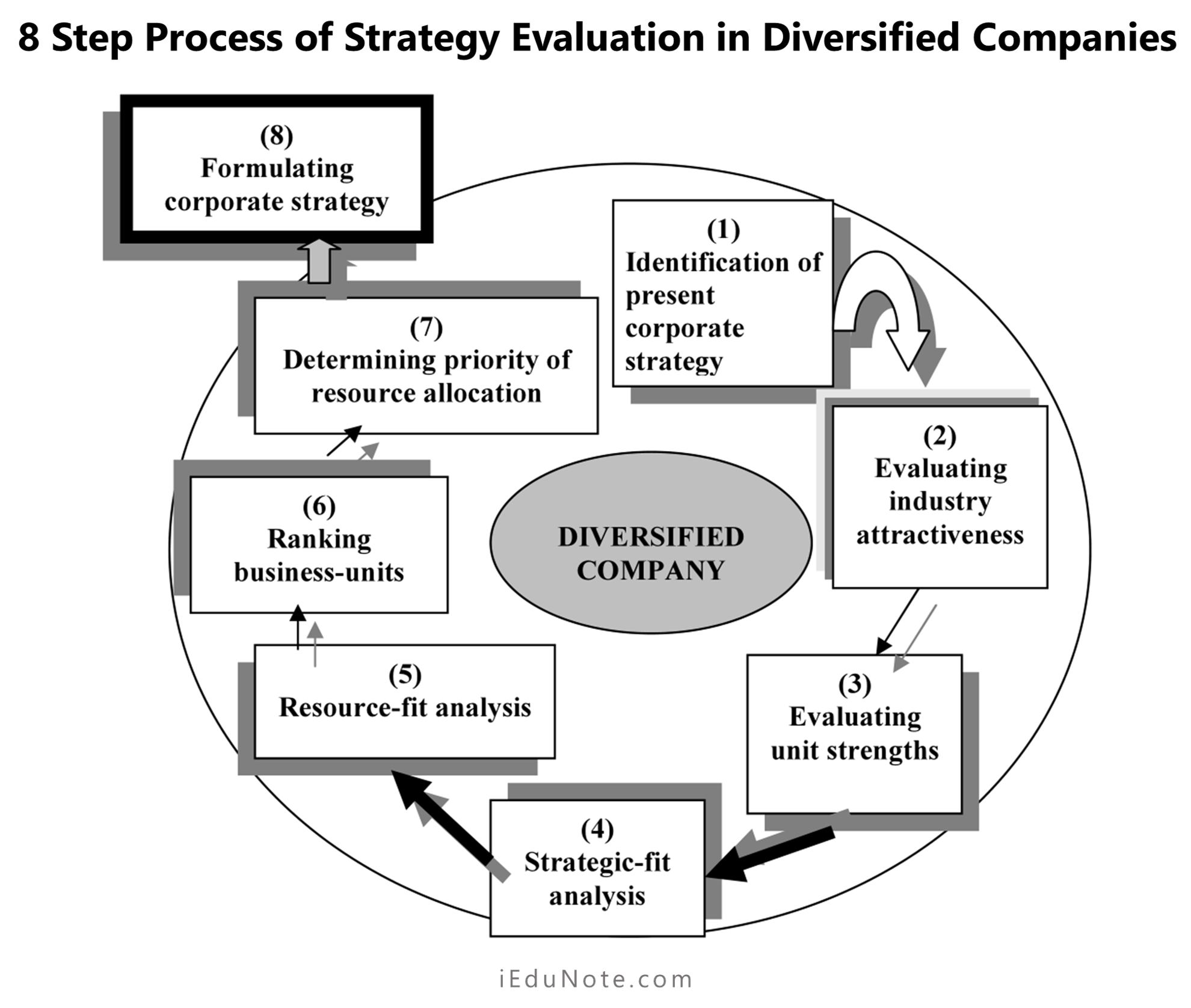

Strategic analysis of diversified companies involves 8 steps. Managers need to follow these steps while evaluating the strategies of their companies.

We provide here a description of these steps.

Step-1: Identifying the present corporate strategy

The strategy makers’ first task in strategy evaluation of a diversified company is to clearly understand the present strategy and business makeup of the company.

For this purpose, they examine the extent of related or unrelated diversification, the scope of operations (domestic to multinational to global), moves to add new businesses, moves to divest weak/unattractive business-units, moves to boost the performance of key business-units, moves to strengthen existing business positions, the extent of cross-business strategic fit benefits, resource allocation priorities among different business-units, etc.

Step-2: Evaluating the industry attractiveness

The strategies must evaluate the attractiveness of each industry in which a company’s businesses are being carried on. Such evaluation should focus on the following:

- The attractiveness of all industries relevant to the company’s businesses to determine each industry’s prospects for growth and profitability, competitive conditions and market opportunities, and the extent of matching company’s capabilities with industry’s technology/resource requirements;

- Each industry’s attractiveness relative to the others to estimate the ranking of the industries from most attractive to least attractive; and

- The attractiveness of all industries as a group to determine how appealing the mix of industries is.

Step-3: Evaluating the competitive strengths of each of the business units

The strategy makers need to evaluate the strength and competitive position of each business-unit under a diversified company to determine the strongest and weakest units.

Strategists usually consider such factors as relative market share, ability to compete on cost ability to negotiate with the key suppliers and customers strongly, technology and innovation capabilities, matching of unit’s competencies with industry key success factors, and profitability relative to competitors.

Step-4: Strategic-fit analysis

The strategy makers in a diversified company determine the potential for the competitive advantage of value chain relationships. They also examine the strategic-fit among the existing business-units.

From this analysis, they can understand whether a unit has a valuable strategic-fit with other businesses. If it is found that good strategic fits exist among the business units, the strategy makers can conclude that the company has a competitive advantage potential.

Step-5: Resource-fit analysis

This analysis is done to determine the extent of matching of a unit’s resource strengths with the resource requirements of its present business lineup.

Resource-fit exists when business-units add to a company’s resource strengths financially or strategically, and when a company has adequate resources to support the resource-requirements of all business units as a group.

Step-6: Ranking business-units

At this step, strategy makers evaluate the units based on performance prospects. They look into sales growth, profit growth, contribution to company earnings, return on investment, cash flow generation, etc.

Usually, strong business-units in attractive industries have better prospects than weak businesses in unattractive industries. Business-units (subsidiaries) with bright performance prospects are good candidates for corporate resource-support.

Step-7: Determining priority for resource allocation

This step involves ranking the business subsidiaries in terms of priority for resource allocation.

Strategy makers need to determine which business-units should have top priority for corporate resource-support, and which ones should get low priority.

Then they should determine the basic strategic approaches that need to be undertaken for each unit.

The alternative approaches, as suggested by Thompson and Strickland, may be invest-and-grow (aggressive expansion), fortify-and-defend (protect current position by strengthening and adding resource capabilities in new areas), overhaul and reposition (make major competitive strategy changes to move the business into a different and ultimately stronger industry position), or harvest-and-divest.

Step-8: Formulating a corporate strategy

Using the information gathered at the previous steps, strategy makers can now proceed toward formulating (or crafting) corporate strategies.

Their strategic moves would aim at improving the overall performance of the diversified company.

Based on relevant information and personal judgments, the strategists may consider divestment for certain units, making new acquisitions, restructuring the portfolio, stay with existing units, or alter the pattern of corporate resource allocation.