Records of various business activities are maintained to ascertain the financial position and profit-earning capacity of a business concern. Statements prepared from the accounting records of an organization are called financial statements.

That is, the statements that are prepared at the end of a particular accounting period to measure the overall result of business activities and exhibit the financial position of a business concern are generally called financial statements. In the modem business world, two statements are generally termed financial statements.

These 2 statements are –

Besides, some other statements are also included in financial statements. These statements are also very much important for many reasons, particularly in making financial decisions. Of these statements, statement of retained earnings, cash flow statements, and fund flow statement is mentionable.

The net income or net loss of business concerns for a particular accounting period can be known from the income statement.

The summary of the financial position of a business concern reflected by the records relating to accounts at the end day of the accounting period can be known through the balance sheet. This statement also shows how net income is distributed into different heads.

Changes in the working capital of a particular period can be known from the fund flow statement. This statement provides necessary information regarding sources of working capital and their uses. The cash flow statement provides the sources of cash receipts and payments under different heads for a particular period.

Financial statements represent a brief picture of the financial activities of a company.

Regarding financial statements Donald E. Kieso, Jerry J. Weygandt, and Terry D. Warfield have stated in their Intermediate Accounting (10th edition): “Financial statements are the principal means through which financial information is communicated to those outside an enterprise. These statements provide the firm’s history quantified in money terms.

The financial statements most frequently provided are;

- the balance sheet,

- the income statement,

- the statement of cash flow, and

- the statement of owner’s or stockholder’s equity. Also, note disclosures are an integral part of each financial statement.”

The American Institute of Certified Public Accounts states that financial statements are integrated information of recorded events, accounting conventions, and individual judgment capacity. Judgment capacity is used to influence the statement materially.

Presentation of financial data including Balance Sheet, Income Statement, and statement of cash flow or any supporting statement that is intended to communicate an entity’s financial position at a point in time and its results of operations for a period then ended.

Objectives of Financial Statements

The major objective of financial statements, as specified by the FASB, include the following-

- Financial statements should provide information that is useful to present and potential investors and creditors, and other users in making rational investment, credit, and similar decisions.

- Financial statements should provide information that identifies entity resources and the creditor and owner claims against those resources.

- Financial statements should also disclose significant changes in resources and claims against resources arising from transactions, events, and circumstances.

- Financial statements should provide information that allows managers and directors to make decisions that are in the best interest of the owners.

- Financial statements should provide information that allows the owners to assess how well management has discharged its stewardship responsibility.

Importance of Financial Statements

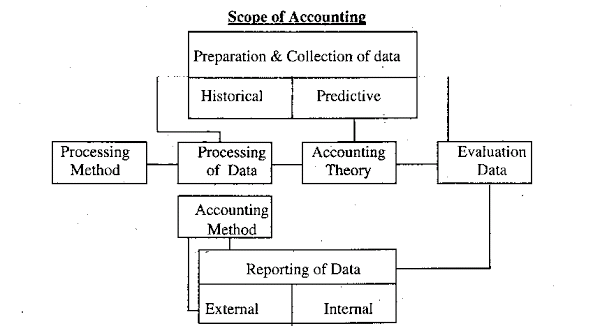

Accounting is an information communication system. Through financial statements, necessary information is communicated to various interested parties. Financial statements play a role in providing information.

Financial statements are considered the mirror of a business concern because they reflect the working capacity or weakness of a business concern. Financial statements come to be used by various parties.

For example, management, investors, banks, creditors, officials, government, business organizations, consumers, and general masses are benefited from financial statements.

George May has classified the financial statements from which parties are benefited into ten;

- Reports of financial supervisor,

- The basis of revenue principles,

- Dividend-determining principles,

- Dividend payment basis,

- The basis for granting a loan,

- Information to potential investors,

- Investment value determining,

- Government supervisory control,

- The basis of cost control,

- The basis of tax principles.

7 Components of Financial Statements

Financial statements are mainly four statements and are generally prepared by most of the business concerns. These are;

- Income statement

- Owner’s equity statement

- Balance sheet.

- Statement of cash flow. These are the most important other statements are;

- Retained earnings statement.

- Statement of fund flow

- Notes to accounts and disclosure.

Income statement

The statement which is prepared at the end of a particular accounting period with the help of periodic income and expenditure to know the operating result, i.e., profit or loss of a company, is called an income statement.

The main source of income of a business concern is sales, and for the profiteering service-oriented organization is the income received from service rendered.

Besides these, other incomes are interest received on investment, profit or sale of assets, etc.

Expenditures mean merchandise purchase of a particular period and operating expenses of a particular period such as administrative expenses, selling and distribution expenses, and other expenses.

Owner’s equity statement

The owner’s equity statement is prepared to show changes in the owner’s equity for a particular period.

In this statement, the profit of a particular period is added to the beginning capital of that period. Losses, if any, drawings are deducted to ascertain the ending capital of that particular period.

Balance sheet

A balance sheet is prepared at a particular date to determine a company’s financial position at that particular date. The ledger account balances that remain after the preparation of income statements are assets, liabilities, and capital.

A balance sheet is a statement of financial position prepared at the end of an accounting period with assets, liabilities, and owner’s equity.

Cash flow statement

In the present day, the cash flow statement is considered an important part of financial statements. Incorporate business organizations, preparation of cash flow statement is mandatory.

The statement, which is prepared to show cash inflow and cash outflow for a particular period, is called the cash flow statement.

Elements of Financial Statements

Asset

Assets are the resource owned by a business; for example, cash, land, furniture, and equipment.

Drawing

Drawing is the withdrawal of cash or other assets from a business for the personal use of the owner. For example- Cash drawing. Goods drawing.

Liability

Liability is the creditorship claim on total assets. For Example- Accounts payable, Salary payable, and Rent payable.

Owner’s equity

Owner’s equity is the ownership claim on total assets. For example- Capital and additional Investment.

Owner’s Equity Statement

The owner’s Equity Statement summarizes the changes in the owner’s equity for a specific period.

Shareholder’s Equity

The owner’s interest in a corporation is called shareholder’s equity.

Accounts Receivable

Account Receivables are amounts due from customers for goods or services solidly based on credit services already provided. They are also oral promises of purchases to pay for goods and services sold.

Accounts Payable

Amounts owed to customers for goods or services purchased on credit.

Cash Flows Statement

A Cash flow statement provides information about the cash inflows and outflows for a specific period.

Income (Earning) statement

A financial statement that shows the revenues and expenses and reports the profitability of a business organization for a stated time.

Revenues

Revenues are the inflows of assets resulting from the sale of products or the rendering of services to customers.

Retained Earnings

Retained earnings equal to the accumulated net income fewer dividend distributions to shareholders.

Expenses

Expenses are the costs incurred to produce revenues measured by the assets surrendered or consumed when serving customers.

Discussion of the importance of financial statements to various parties

Management

The owner or management can know a business’s results and true financial position from financial statements. With the help of the statements, it becomes easier to decide on the expansion or contraction of business as per necessity.

For example, if the return on investment ratio is comparatively high, management is inspired to invest more. On the other hand, if the business incurs a loss, management may decide to contract the business or close it down.

That is, management can make proper and timely decisions, determining a business’s success or failure, with the help of financial statements. Financial statements show the business’s total assets, total outstanding credits, and debts.

Investors

Investment is both long-term and short-term.

A conscious investor invests in a business after proper consideration of its debts, assets, profit-earning capacity, etc. The investor also considers the paying capacity of interest and the security of his investment.

An investor can analyze long the long-term financial capacity of concern from financial statements.

Besides current analysis and interpretation, the investor analyses the future financial position with the help of financial statements.

Creditors

A business’s goal is to repay its creditors within the short term. This debt is paid out of current assets, so creditors are interested in the position of current assets.

The current ratio and acid test ratio, prepared using current assets and current liabilities mentioned in the balance sheet, can help ascertain a business concern’s financial solvency.

Bankers

The bank always considers the security of the loan given to the business concern. It also studies the business concern’s financial capacity to pay the interest on the loan regularly.

The bank interprets a business’s balance sheet to determine its financial solvency and debt-paying capacity. It also studies the business’s revenue-earning capacity.

Government

Financial statements are important to the government for various purposes. From financial statements, the government can be aware of income tax, VAT, sale tax, duties, etc., payable to the government by business concerns.

Besides, financial statements of business concerns play an important role in formulating a country’s trade policy, taxation rules, industrial policy, etc.

The government analyses the country’s financial position from financial statements of business concerns. These financial statements are proof of compliance with the government rules in running the business.

Trade Association

Trade associations render necessary services to their members to protect their interests. They can determine the benefits to be provided to their members by interpreting and analyzing the financial statements of the business concern.

Employees

Employees’ interests are directly related to financial progress and regress of the business concern. Employees always remain eager to know the true financial position of a business concern, and this can be known from financial statements.

Stock Exchange

Shares and debentures of various companies are traded through a stock exchange.

Financial statements help share brokers know the financial position of a business concern. The values of securities of a business concern are fixed upon the basis of its financial statements.

Consumers

The consumers remain interested in a controlled accounting system, which minimizes the cost of production and results in the availability of goods at a lower price.

Research Scholars

Financial statements are important to research scholars engaged in the financial research work of a country because they can obtain necessary data from financial statements regarding business concerns.

People

The financial statements of business concerns also benefit the masses. Business flourishing leads a country to the path of development by increasing investment.

As a result, employment opportunities increase, and a regular supply of goods at reasonable rates is ensured. This helps social development increase the standard of living of the masses people.

From the above discussion, it can be said that the financial statements of concern mean a consolidated position of some matters.

For example, a statement of assets and liabilities prepared at the end day of the year, an income statement determining results of business activities of a particular period, cash flow and fund flow statements showing the reasons for changes in cash and funds, a statement of owner’s or stockholder’s equity and notes to accounts and disclosure.

Effects of Price Changes on Financial Statements

The effect of price level changes on an entity’s financial statements depends on both the rate of price level changes and the composition of assets, liabilities, and equities. The composition of assets, liabilities, and equities is an important determinant of the effect of price-level changes on an entity and its financial statements.

The following are some useful generalizations regarding such effects in times of significant inflation.

- The larger the proportion of depreciable assets and the higher their age, the more understated income tends to be. Thus, the income of capital-intensive companies tends to affect more than that of others by price-level restatements. Accelerated depreciation reduces this effect.

- The rate of inventory turnover has a bearing on price-level effects. The slower the inventory turnover, the more operating income tends to be overstated unless the LIFO method is used.

- The mix of assets and liabilities between monetary and nonmonetary is important. Net investment in monetary assets will, in times of rising price levels, lead to purchasing power losses, and, conversely, purchasing power gains will result from a net monetary liability position.

- The methods of financing also have an important bearing on results. The larger the amount of debt, at fixed and favorable rates relative to the inflation rate, and the longer its maturities, the better is the protection against purchasing power losses, or the better is the exposure to purchasing power gains.

Statements of Financial Accounting Concepts Issued by FASB

FASB has issued six statements of financial accounting concepts that relate to financial reporting for business enterprises

SFAC no#1

Objectives of Financial Reporting by Business Enterprises: presents the goals and purposes of accounting.

SFAC no#2

Qualitative Characteristics of Accounting Information; examines the characteristics that make accounting formation useful.

SFAC no#3

Elements of Financial Statements of Business Enterprises provide a definition of items in financial statements, such as assets, liabilities, revenues, and expenses.

SFAC no#5

Recognition Measurement Financial Statements of Business Enterprises set forth fundamental recognition measurement criteria and guidance on what information should be normally incorporated into Financial statements and when.

SFAC no#6

Elements of Financial Statements of a not-for-profit organization.

SFAC no#7

Using cash How information and present value in accounting Measurements provides a framework for using expected future cash Hows and present values as a basis for measurement.