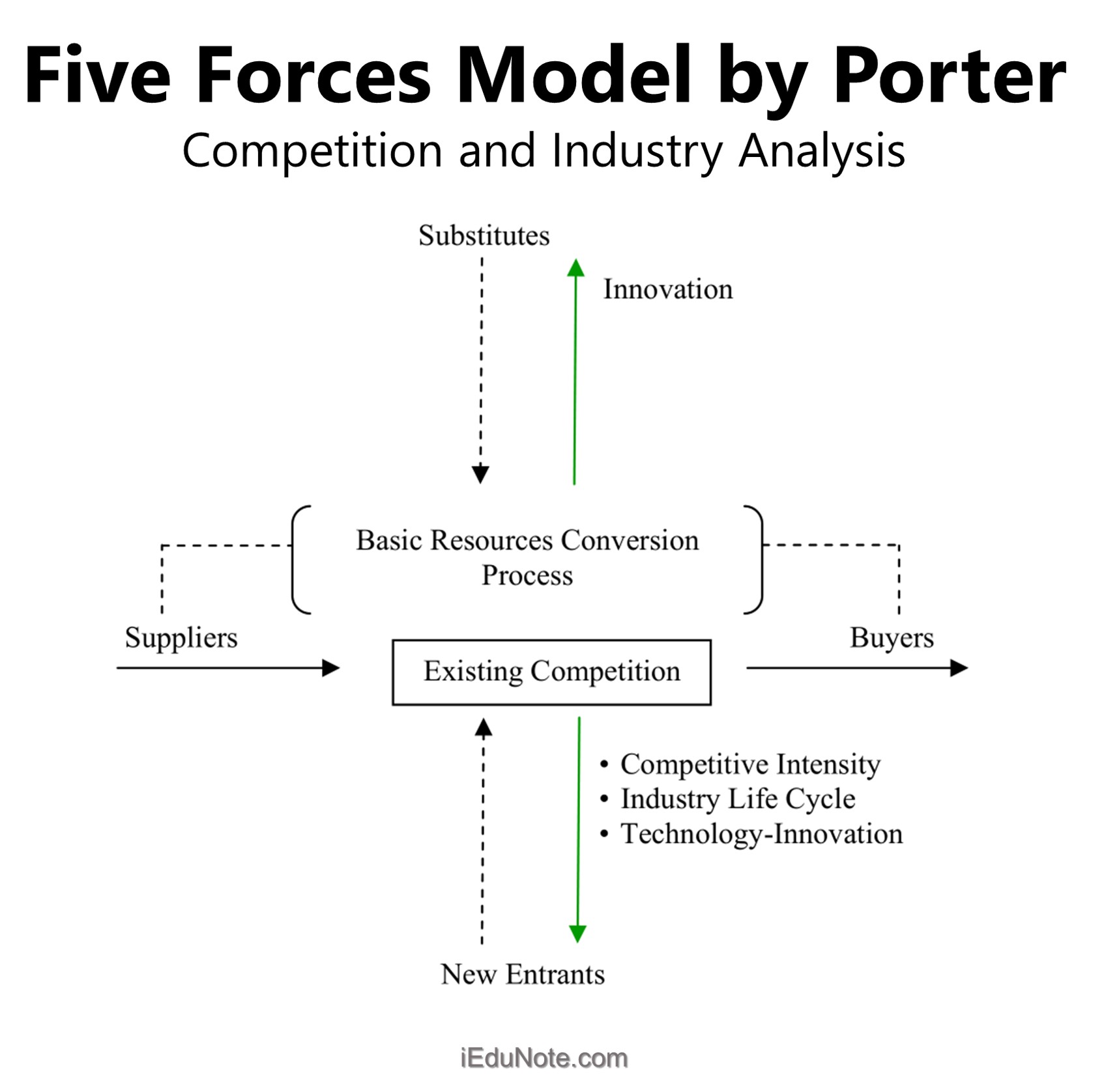

Managers use Porter’s Five Forces Model to analyze competitive forces in the industry’s environment and identify the industry-related opportunities and threats confronting their company.

According to Porter, the five forces explain the industry’s structural determinants and help explain the industry’s profitability in conjunction with immediate competitor behavior.

The five forces model was developed by Professor Michael Porter of the Harvard Business School in his book The Competitive Strategy Techniques for Analysing Industries and Competitors (1980).

Since then, it has been extensively quoted across the academic world as a tool for analyzing the structure of industries. Five of the industry’s constituents mentioned above are from Porter’s list of the industry’s structural forces.

The five forces determine industry profitability because they influence the prices, costs, and required investment in the industry.

We discuss the impact that the individual forces in the industry can have on a firm’s environment within the industry.

Discover Competitive Opportunities and Threats with Porter’s Five Forces Model. Analyze industry forces, profitability, and competition.

Threat of New Entrants

The threat of new entrants refers to the risk of new entry by potential competitors.

A potential entrant eyes the given industry and anticipates higher returns. The entrant may bring new technology or other resources to the industry.

In the marketplace, some competitors are already operating their businesses. They are called existing competitors.

Some other upcoming competitors are not now operating a business in the industry, but they can enter the industry if they have the capability and desire to enter. They are potential competitors.

The success or failure of the entrants would depend upon the reaction of the other players in the industry and the entry barriers in the industry. The existing players in the field would not like a new entrant, as the new entrant can erode the profitability of the existing players.

For example, in car manufacturing, the substantive investment in the plant and the economies of scale enjoyed by the entrenched companies ensured that in the U.S. market, there were no major newcomers till the advent of the Japanese.

Potential competitors create threats to existing companies (incumbent companies) because if they enter-they can make the competition tougher by taking away market share from the existing companies.

Thus, existing companies discourage potential competitors from entering the industry by creating barriers to entry.

‘Barriers to entry’ are created by undertaking some very costly measures for the competitors to adopt.

Barriers to entry imply that the newcomer has to spend large sums of money to counter the entrenched positions of the existing players. The existing players may be enjoying economies of scale.

Such barriers may be strong brand loyalty, absolute cost advantage, sizable economies of scale, high capital requirements, difficulties in building a distribution network of distributors and retailers, restrictive tariffs, international trade restrictions, and government regulations.

On the other hand, if the risk of entry by potential competitors is low, the existing companies can raise prices and earn higher profits.

When entry barriers are low, it is easy for potential competitors to enter the industry.

Despite entry barriers, many entrants enter the industry with appealing products.

The strategy-makers need to identify the entrants, monitor their strategies and tactics, undertake counter-strategy, and deal with the emerging issues by building on the firm’s existing resources and capabilities.

The entrenched players erect barriers through product differentiation and brand loyalty. Cosmetics and jewelry designer wear accessories are industries where brand loyalty is tough to alter.

If the switching costs from the existing players to the newcomers are high, the users are unlikely to switch to the new suppliers.

The insulation from competition makes the entrenched players happy, but are the high entry barriers also, in due course, going to act as exit barriers?

A declining industry with exit barriers will not only threaten profitability but may make divestment of capital difficult.

Potential entrants must also assess the extent to which intellectual property gives an added advantage. In the hospitality industry location is important.

Through discussion and the examples, it is clear that the threat of new entrants can be minimized if the organization invests in economies of scale, brand building, creating an intellectual advantage, and capitalizing on access to strategic resources.

Conversely, a newcomer can try to claim a share of the existing industry. It would depend on the industry’s growth potential if the newcomer or the entrenched player sought synergies with other industries.

From Porter’s model, an organization can gain insight into the likely conduct of competitors given the structure (regulation of supply and demand) of the industry.

It would be worthwhile to refer to “Chapter 3:- Framework for Competitor Analysis” in Porter’s book “Competitive Strategy: Techniques for Analysing Industries and Competitors.”

Bargaining Power of Suppliers

Suppliers play an important role in determining industry profitability. The suppliers have the capacity to control the cost/quality of the inputs.

Labor is also an input, and the supply or short supply of highly skilled labor has the power to bargain, affecting profitability. The more dependent an organization is on its suppliers, the greater the difficulty it faces in shifting/ switching to another supplier.

High switching costs may compel an organization to stick with a supplier to whom better alternatives may be available.

A company has to procure various types of ‘supplies’ from the suppliers such as raw materials, components, parts, and other materials necessary for producing a product.

When the dependency of the customers (buyer firms) is high, the bargaining power of suppliers is enhanced.

Powerful suppliers can raise the prices of materials. As a result, powerful suppliers are a threat to the companies that have to buy at that price.

If suppliers are weak, the company may be in an advantageous position and can demand high quality at a lower price from the suppliers.

However, this threat has been to some extent diluted due to imported paper. Suppliers have very little or no bargaining power if the materials they sell are available from different parties.

Their power increases if the supply of the materials is limited or if the materials are such that they are inevitable for the company (buyer).

According to Michael Porter, suppliers are the most powerful:

- When the product that they sell has few substitutes and is important to the company.

- When the company’s industry is not an important customer of the suppliers, as a result, the suppliers do not need to depend on the companies in the industry. Therefore, they don’t find any good reason to reduce the price or even to improve quality.

- When it is costly for a company to switch from one, supplier to another, in such cases, the company depends on its suppliers and cannot play them off against each other.

- When the suppliers have the environment/opportunity to give threats to the companies in the industry they would directly compete with the companies through developing forward linkage in the industry.

- When buying companies have little opportunity to establish backward linkage to produce their own raw materials as a means to reduce the prices of inputs.

The bargaining power of suppliers is weaker under the following circumstances in the industry;

- When substitute products acceptable to the buyers are easily available.

- When the huge quantity of products is available in the market.

- When buyers can buy from alternative suppliers at a low cost.

- When buyer-firms have the capacity to integrate back into the business of the supplier and thus can satisfy the customer’s own requirements.

- When the customers have ample opportunities to develop strategic alliances with other suppliers, and can thus have win-win gain.

- When continued large purchases on the part of the customers are important for the suppliers.

For example, in the PC market, Intel is the most powerful because of its unique position in producing microprocessors.

Intel is an example of a powerful supplier to computer manufacturers. Intel’s chips power about 80 percent of personal computers. Intel enjoys a size advantage as well as the leadership advantage over other, smaller manufacturers. Intel, by virtue of its size, can determine the price and terms of payment advantageous to it.

Suppliers who enjoy economies of scale are in a better position to offer cost-competitive products, but if there is a shift in technology that enables a different manufacturer to offer a product that is more compatible with the buyer’s cost dynamics or competitive position that the larger manufacturer must either shift to the new technology thereby losing its competitive advantage or be locked in and continue to sell till there are buyers.

Bargaining Power of Buyers

The buyers either enforce a better price or better quality depending on their competitive position.

Buyers of products may be ultimate consumers or even the intermediaries such as dealers, wholesalers, and retailers. The buyer’s bargaining power becomes high when suppliers have to depend on them for some reason.

On the other hand, their bargaining power is weak when suppliers/sellers are capable of raising prices.

Whether; buyer-seller relationships represent a weak or strong competitive force depends on whether buyers have sufficient bargaining power to influence the terms and conditions of sale in their favor and the extent of seller-buyer strategic partnerships in the industry.

According to Porter, the buyer’s bargaining power is highest when:

- The supply industry is composed of many small companies; the buyers are few in number as well as large.

- Buyers purchase in large quantities.

- The supply industry depends on the buyers for a large percentage of its total orders.

- Buyers can switch orders between supply companies at a low cost.

- It is economically feasible for the buyers to purchase the input from several companies at once.

- To force prices down, buyers can use the threat to supply their needs through vertical integration (backward linkage).

Buyer’s bargaining power is generally weaker;

- When a buyer depends on the seller because of the fact that the j brand reputation of the seller is very important to the buyer.

- When there is a high demand for the seller’s products in the market and as a result, a seller’s market prevails in the industry.

- When the cost of procuring products from alternative sources is very high.

- When a buyer purchases a particular product from the seller in a small quantity or does not purchase frequently.

The buyers can be dominant distributors such as Wal-Mart for manufacturers like Proctor and Gamble, or individual buyers such as customers for cars, or a major car manufacturer for a steering component of a car.

In the case of retailers like Wal-Mart, they are a platform from which individual buyers would buy the products of Proctor and Gamble.

Who is more likely to extract a better price from the manufacturer, you as an individual buyer or a large dispersed retailer like Walmart?

In the case of some products, the retailer exerts an influence on the buying decision at the time of purchase (for example, cosmetics, audio, and mobile accessories). In that case, the retailer can exert pressure on the supplier.

The Threat of Substitute Products

Substitute products can play spoilsport for industry profitability. If the substitute product offers a substantive price or performance advantage, the organization has to decide whether to take up the substitute in one go or gradually.

A company needs to consider the competitive pressures from substitute products. The substitute products may come from the same or other industries.

For example;

- Cotton producers are in direct competition with the producers of polyester fabrics.

- Newspapers compete against television to provide the latest news.

- E-mail is a substitute for the overnight delivery of documents by courier service companies.

- Coffee is a substitute for tea.

- Bottled water is a substitute for juice and soft drinks.

- Plastic bottles are substitutes for aluminum cans for beverages.

- Traditional film cameras are fighting hard against their substitute enemy, the digital cameras.

If the buyers view the substitute products as ‘good substitutes’, competitive pressure automatically emerges from the actions of the companies producing substitute products.

In a given industry, there are products that can be substituted for existing ones.

When two products (product A and product B) can be used to replace the other if the price of one increases, consumers can buy B, whose price is lower than the price of A.

There can be perfect or partial interchangeability of the product. Substitutes can be different in technology-price composition but serve the same need.

Coal and natural gas are different but can be used for the same purpose; compact discs and cassettes are different but can be used to store music.

Consider the example of replacing human labor in the hazardous industry with industrial robots. The robots work faster. There are fewer accidents and a reduction in the loss of limb and life.

The industry can increase productivity and profitability.

For example, “Lasik/laser operation of eyes has created a strong competitive pressure on the produces of eyeglasses and contact lenses. Similar is the situation between Television and online streaming services.

The major factors that determine the strength of the competition from substitutes are;

- the attractiveness of the prices of substitutes;

- buyers’ satisfaction with the substitutes in terms of quality and other features; and

- the easiness of switching to substitutes.

When the substitutes are available at lower prices, the producers of the normal product are in high competitive pressure to reduce prices. When substitute products are available, customers begin to compare prices, quality, etc., with the normal products.

Similarly, when switching costs from the normal product to substitute products are low (and also not inconvenient buyers become more prone to the substitutes.

Another extreme example is the likely substitution of going to a movie by Internet browsing, or visiting the opera if you had an hour free and were contemplating any of the three options.

Your need is entertainment and enjoyment. All three can provide that, but they have divergent platforms.

Organizations can look for substitute products or can develop them through research and development or the industry as a unit may look for a substitute product or in some cases the government may compel a shift towards the substitute product.

Thompson et al. have indicated three signs that point to strong competition from substitutes.

These are;

- sales of substitutes are growing faster than sales of the industry;

- producers of substitutes are moving to add new capacity, and

- profits of the producers of substitutes are on the rise.

The existence of substitute products in the industry poses a threat to a company.

Thus, the company’s profit is likely to depress due to cutting down prices. If a company has few substitutes, it has the opportunity to raise prices and thereby increase profits.

Rivalry Among the Existing Firms

In a given industry, competitors try to out-maneuver each other and gain a higher market share. A higher market share is presumed to lead to higher profitability

A very important force in Porter’s Model is the extent of rivalry among the established firms in the industry. In an environment of weak rivalry (competition), a firm can raise prices and make higher profits.

When competition is strong/the industry may face a severe price wars in which firms compete against each other on the basis of price cuts.

If there is severe competition among the firms in the industry, profitability decreases substantially. Thompson and Stricklan regard this force of rivalry as the ‘strongest of the five forces.’

Inter-company rivalry or competition stems from several factors, as identified by Porter in his famous book Competitive Strategy.

These are;

- Competition increases as the number of competitors increases.

- Competition is usually stronger when demand for the product is growing slowly. “

- Competition is more intense when industry conditions encourage competitors to cut prices.

- Competition is stronger when customers’ costs to switch brands are low.

- Competition is stronger when one or more competitors are dissatisfied with their market position and undertake other measures to Win the battle for market share.

- Competition tends to be more intense when it costs more to get out of a business than to stay in the industry.

- Competition becomes more volatile when competitors are diverse in their objectives, strategies, resources, etc.

- Competition increases when powerful companies from outside the industry acquire weak companies in the industry and launch aggressive campaigns to make the acquired companies profitable.

Organizations can lower prices, offer a better quality product, improve after-sales service, add freebies, improve product performance, increase advertising, or intensify the direct selling effort to gain higher market share.

Each functionally driven activity consumes resources and escalates the costs of operations. The action of one organization is likely to be improved upon by the others, and the intensity of rivalry in the industry increases.

Increased rivalry reduces the profitability of the industry.

In intensely competitive industries, price wars are common and may lead to a shakeout in the industry. Price wars are more common in commodity-type industries where product differentiation is low.

Fare wars in the airline industry are fairly common in Asia. The fare wars erode the profitability of the industry.

In most countries, cartelization to protect the fares or watch common interests is controlled through competition or similar laws. (Find the law in your country that restricts monopolies/unfair competition/cartelization).

Conclusion: Why Do Managers Widely Use the Five Forces Model?

Managers can use this model to systematically diagnose the principal competitive pressures in a market.

With this model, they can assess the strength of each of the competitive forces. They can further understand how important each of these forces is.

The major reason behind the wide use of this technique is that it is easy to understand and apply in practice when managers analyze the competition.

Managers find it comfortable to analyze the competitive pressures associated with each force in the model.

They can clearly determine whether the pressures of the five competitive forces exert any strong or weak influence in the marketplace.

Based on their understanding of the interplay of these forces, they can strategically think about the right type of strategy for their company.

Michael Porter’s model has several management implications:

Reveals Strategic Clues

It reveals the most important strategic clues in an industry’s competitive environment. These are the strengths of each of the five forces, the nature of the competitive pressures of each force, and the overall structure of competition in the industry.

Profit margins and Leverage

Profit margins for all competing firms become thin if the suppliers and buyers have considerable bargaining leverage, competition among sellers is strong, low entry barriers allow companies to enter easily into the industry, and competition from substitutes is strong. The opposite happens when competitive forces are not collectively strong.

Strong competitive force can be a threat to the company

Porter argues that the stronger each of these forces is, the more limited the ability of established companies to raise prices and earn greater profits.

A strong competitive force can be regarded as a threat since it depresses profits. A weak competitive force can be viewed as an opportunity, allowing a company to earn greater profits. The strength of the five forces may change over time as industry conditions change.

The manager’s task is to study how changes in the five forces give rise to new opportunities and threats. His/her next task is to formulate appropriate strategic responses. A manager’s strategy-making task becomes easier when he/she can gauge the competitive insights from analyzing the five forces.

The information from the five forces analysis helps managers formulate a winning strategy to ensure the company a sustainable competitive advantage.

Porter’s Model has major drawbacks as a tool for competition analysis. It can be used to analyze only the industry’s degree of competition.

It cannot explore such factors as the influential economic factors in the industry that are relevant to managerial strategy-making. It also fails to identify the driving forces and major causes of changing industry conditions.

This model is unsuitable for assessing the competitive position of rivals, their likely strategic moves, and overall industry attractiveness.

These drawbacks can be overcome using Thompson and Strickland’s Seven Forces Model of Industry Analysis.