An independent auditor plans, conducts, and reports an audit’s results under Generally Accepted Auditing Standards(GAAS), providing a measure of audit quality and the objectives to be achieved in an audit.

Auditing procedures differ from auditing standards. Auditing procedures are acts the auditor performs during an audit to comply with auditing standards.

GAAS, the Generally Accepted Auditing Standard, is the most widely recognized auditing standard in the public accounting and auditing profession.

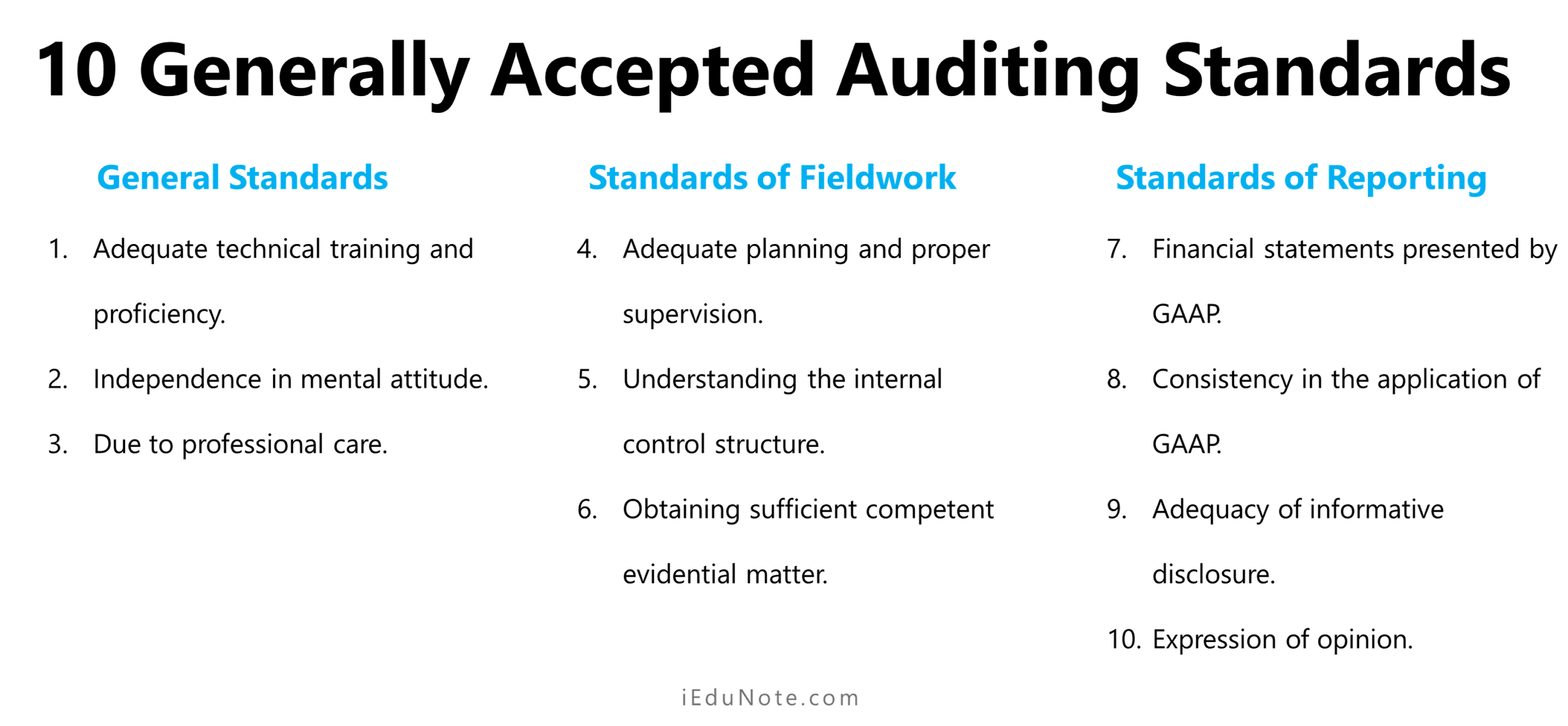

10 GASS standards are approved and adopted by the membership of the AICPA, as amended by the AICPA Auditing Standards Board (ASB). These are;

The three categories of the ten generally accepted auditing standards approved by the members of AICPA are explained below;

10 Generally Accepted Auditing Standards

A. General Standards

The general standards relate to the qualifications of the auditor and the quality of the auditor’s work.

1. Adequate technical training and proficiency

In every profession, there is a premium on technical competence. Three factors determine the competency of the auditor:

- Formal university education for entry into the profession,

- Practical training and experience in auditing, and

- Continuous professional education during the auditor’s professional career.

2. Independence in mental attitude

The auditor must be free of client influence in performing the audit and reporting the findings. The auditor must also meet the independence requirements of the AICPA’s professional conduct.

3. Due to professional care

The auditor must be diligent and careful in performing an audit and issuing a report on the findings. The standard of due care requires the auditor to act in good faith and not to be negligent in an audit.

B. Standards of Fieldwork

The fieldwork standards are so named because they pertain primarily to the conduct of the audit at the client’s place of business in the field.

4. Adequate planning and proper supervision

The work is to be adequately planned, and assistants, if any, are to be properly supervised.

5. Understanding the internal control structure

A sufficient understanding of internal control is to be obtained to plan an effective and efficient audit.

6. Obtaining sufficient competent evidential matter

The sufficient competent evidential matter is to be obtained through inspection, observation, inquiries, and confirmations to afford a reasonable basis for an opinion regarding the financial statements under audit.

Standards of Reporting

In reporting the audit results, the auditor must meet four reporting standards.

7. Financial statements presented in accordance with GAAP

The first reporting standard requires the auditor to identify GAAP as established criteria for evaluating management’s financial statement assertions.

8. Consistency in the application of GAAP

The report shall identify those circumstances in which such principles have not been consistently observed in the current period in relation to the preceding period.

9. Adequacy of informative disclosure

Informative disclosures in the financial statements are regarded as reasonably adequate unless otherwise stated in the report.

10. Expression of opinion

The final reporting standard requires the auditor to either express an opinion on the financial statements taken as a whole or state that an opinion cannot be expressed.