Income Statement shows net profit or net loss arising out of activities of a particular accounting period of any business organization. Of all the financial statements income statement is very popular and important.

In brief, The balance which stands after deduction of total expenses from total income of a particular accounting period is called net income. Negative net income may be termed as a net loss.

Incomes mean the profit received from the sale of commodities, rendering services, interest received from the third party for using the assets of a business concern, rent, royalty etc. and selling or exchanging any asset other than commodities.

Expenses mean the expenses directly related to incomes of a particular accounting period, and other expenses of that accounting period, such as payable interest, loss sale of assets and loss of properties due to an accident etc.

The income statement is of two types:

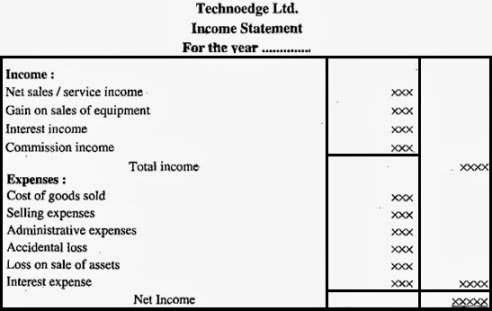

(a) Single-step income statement,

(b) Multiple step income statement.

Single Step Income Statement

In single-step income statement sales or service income and other incomes are to be added in the first stage.

Thereafter,

all operating expenses including cost of goods sold and other expenses are deducted from total income to ascertain net profit or loss.

In the single-step income statement, all data are divided into two groups: Such incomes and expenses. Income includes operating income plus other incomes. Expenses include the cost of goods sold, operating expenses and other expenses.

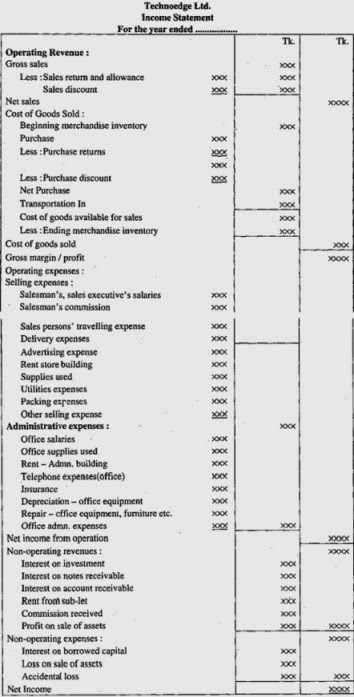

Multiple-Step Income Statements

In this statement profit or income is ascertained showing various incomes and expenditures separately in different stages.

Generally, multiple steps income statement contains the following steps of incomes and expenses;

Operating revenue

Operating revenue means the revenue arising out of the main activities of the business. For example, revenue out of sales and services rendered are both operating revenue.

Cost of goods sold

Cost of goods sold is an important aspect of a business concern. In the income statement, gross income is determined to deduct the cost of goods sold from income out of net sales. The surplus of net sale over the cost of goods sold is called gross profit.

Cost of goods sold = Beginning inventory + Net purchase + Carriage In Ward – Ending Inventory. Gross profit = Net sales – Cost of goods sold.

Operating expenses

Expenses relating to administrative and selling activities other than the cost of goods sold are operating expenses. Operating expenses are of two types, such as selling expenses and administrative expenses.

The expenses incurred in connection with the sale of goods and marketing are called selling expenses.

Such as; Salesman salaries and commission Salesman travel expense Delivery expense, Advertising, utilities, rent- store building, store supplies used etc.

Expenses relating to the overall management of the business are called administrative expenses.

For example, Office salaries, rent-administrative building, insurance, office supplies expense, postage, telegram, conveyance, general expense, depreciation expense, office equipment, furniture etc.

Non-Operating Income and Expenses

The incomes which are not related to sales income or service income are called non-operating income. For example, Interest on investment, interest on notes receivable, accrued house rent from subletting, profit arising out of the sale of assets etc.

The expenses which are not related to purchase – sale and administrative expenses are called non-operating expenses. Such as interest on the loan, interest on capital, accidental loss, loss on sale of assets etc.

Important Relationships in the Income Statement

In brief, the important relationships in the income statement are shown below :

- Net sales = Gross sales – (sales discount + sales returns and allowances).

- Net purchase = Purchase – (Purchase discount + purchase returns and allowance).

- The net cost of purchase = Net purchase + transportation In.

- Cost of goods sold = Beginning inventory + net cost of purchase – ending inventory.

- Gross margin = Net sales – the cost of goods sold.

- Gross Margin rate= (Gross margin X 100)/Net Sales

- Net income from operation = Gross margin – operating expenses.

- Net income = Net income from operation + non-operating revenue – non-operating expenses.

Budgeted Income Statement

A budgeted income statement can be prepared from the data developed in the below schedules. The budgeted income statement is one of the key schedules in the budget process.

It shows the company’s planned profit and serves as a benchmark against which subsequent company performance can be measured. The following schedule contains the budgeted income statement for Hampton Freeze.

The budgeted balance sheet is developed using data from the balance sheet from the beginning of the budget period and data contained in the various schedules.

Hampton Freeze’s budgeted balance sheet is presented in Schedule 10. Some of the data on the budgeted balance sheet has been taken from the company’s previous end-of-year balance sheet for 2007 which appears below:

Segmented Income Statement

For purposes of evaluating performance, business units are classified as cost centers, profit centers, and investment centers. Cost centers are commonly evaluated using standard cost and flexible budget variances. Profit centers and investment centers are evaluated using the techniques discussed in this chapter.

Segmented income statements provide information for evaluating the profitability and performance of a company’s divisions, product lines, sales territories, and other segments.

Variable costs and fixed costs are clearly distinguished from each other, and only those costs that are traceable to a segment are assigned to the segment.

A cost is considered traceable to a segment only if the segment causes the cost and could be avoided by eliminating the segment.

Fixed common costs are not allocated to segments. The segment margin consists of revenues, less variable expenses, and less traceable fixed expenses of the segment.

Return on investment (ROI) and residual income and its cousin EVA is widely used to evaluate the performance of investment centers.

ROI suffers from underinvestment problems managers are reluctant to invest in projects that would decrease their ROI but whose returns exceed the company’s required rate of return.

The residual income and EVA approaches solve this problem by giving managers full credit for any returns in excess of the company’s required rate of return.

Several important principles are involved in constructing a useful segmented income statement. These principles are illustrated in the following example.

SoftSolutions, Inc., is a rapidly growing computer software company founded by Lori Saffer, who had previously worked in a large software company, and Marjorie Matsuo, who had previously worked in the hotel industry as a general manager.

They formed the company to develop and market user-friendly accounting and operations software designed specifically for hotels. They quit their jobs, pooled their savings, hired several programmers, and got down to work.

The first sale was by far the most difficult. No hotel wanted to be the first to use an untested product from an unknown company.

After overcoming this obstacle with persistence, good luck, dedication to customer service, and a very low introductory price, the company’s sales grew.

The company quickly developed similar business software for other specialized markets and then branched out into clip art and computer games.

Within four years of its founding, the organization had grown to the point where Saffer and Matsuo were no longer able to personally direct all of the company’s activities. Decentralization had become a necessity.

Accordingly, the company was split into two divisions Business Products and Consumer Products.

By mutual consent, Matsuo took the title of president, and Saffer took the title of vice president of the Business Products Division.

Chris Worden, a programmer who had spearheaded the drive into the clip art and computer games markets, was designated vice president of the Consumer Products Division.

Traceable and Common Fixed Costs

Sales and Contribution Margin

To prepare a segmented income statement, variable expenses are deducted from sales to yield the contribution margin for the segment.

The contribution margin tells us what happens to profits as volume changes—holding a segment’s capacity and fixed costs constant.

The contribution margin is especially useful in decisions involving temporary uses of capacity, such as special orders. These types of decisions often involve only variable costs and revenues—the two components of contribution margin.

Traceable and Common Fixed Costs

The most puzzling aspect is probably the treatment of fixed costs. The report has two kinds of fixed costs—traceable and common.

Only traceable fixed costs are charged to particular segments. If a cost is not traceable to a segment, then it is not assigned to the segment.

A traceable fixed cost of a segment is a fixed cost that is incurred because of the existence of the segment—if the segment had never existed, the fixed cost would not have been incurred; and if the segment were eliminated, the fixed cost would disappear.

Identifying Traceable Fixed Costs

The distinction between traceable and common fixed costs is crucial in segment reporting since traceable fixed costs are charged to segments and common fixed costs are not.

In an actual situation, it is sometimes hard to determine whether a cost should be classified as traceable or common.

The general guideline is to treat as traceable costs only those costs that would disappear over time if the segment itself disappeared.

For example, if the Consumer Products Division were sold or discontinued, it would no longer be necessary to pay the division manager’s salary.

Therefore the division manager’s salary should be classified as a traceable fixed cost of the division.

On the other hand, the president of the company undoubtedly would continue to be paid even if the Consumer Products Division was dropped. In fact, he or she might even be paid more if dropping the division was a good idea.

Therefore, the president’s salary is common to both divisions and should not be charged to either division.

When assigning costs to segments, the key point is to resist the temptation to allocate costs (such as the depreciation of corporate facilities) that are clearly common and that will continue regardless of whether the segment exists or not.

Any allocation of common costs to segments reduces the value of the segment margin as a measure of long-run segment profitability and segment performance.

Traceable Costs Can Become Common Costs

Fixed costs that are traceable to one segment may be a common cost of another segment.

For example, an airline might want a segmented income statement that shows the segment margin for a particular flight from Los Angeles to Paris further broken down into first-class, business-class, and economy-class segment margins.

The airline must pay a substantial landing fee at Charles De Gaulle airport in Paris.

This fixed landing fee is a traceable cost of the flight, but it is a common cost of the first-class, business-class, and economy-class segments. Even if the first-class cabin is empty, the entire landing fee must be paid.

So the landing fee is not a traceable cost of the first-class cabin.

But on the other hand, paying the fee is necessary in order to have any first-class, business-class, or economy-class passengers. So the landing fee is a common cost of these three classes.

Segment Margin

The segment margin is obtained by deducting the traceable fixed costs of a segment from the segment’s contribution margin. It represents the margin available after a segment has covered all of its own costs.

The segment margin is the best gauge of the long-run profitability of a segment because it includes only those costs that are caused by the segment. If a segment can’t cover its own costs, then that segment probably should be dropped (unless it has important side effects on other segments).

For example, the Retail Stores sales channel has a negative segment margin. This means that the segment is not generating enough revenue to cover its own costs.

Retention or elimination of product lines and other segments is covered in more depth in another chapter. From a decision-making point of view, the segment margin is most useful in major decisions that affect capacity such as dropping a segment.

By contrast, as we noted earlier, the contribution margin is most useful in decisions involving short-run changes in volume, such as pricing special orders that involve temporary use of existing capacity.

Segmented Financial Information in External Reports

The Financial Accounting Standards Board (FASB) now requires that companies in the United States include segmented financial and other data in their annual reports and that the segmented reports prepared for external users must use the same methods and definitions that the companies use in internal segmented reports that are prepared to aid in making operating decisions.

This is a very unusual requirement. Companies are not ordinarily required to report the same data to external users that are reported internally for decision-making purposes. This may seem like a reasonable requirement for the FASB to make, but it has some serious drawbacks.

First, segmented data are often highly sensitive, and companies are reluctant to release such data to the public because their competitors will have access to the data.

Second, segmented statements prepared in accordance with GAAP do not distinguish between fixed and variable costs and between traceable and common costs.

Indeed, the segmented income statements illustrated earlier in this chapter do not conform to GAAP for that reason.

To avoid the complications of reconciling non-GAAP segment earnings with GAAP consolidated earnings, it is likely that at least some managers will choose to construct their segmented financial statements in a manner that conforms with GAAP.

This will result in more occurrences of the problems discussed in the following section.