Insurable interest is part of an entity’s value for which an insurance policy is purchased to cover the risk of loss.

Full Guide Insurable Interest

What is Insurable Interest?

Insurable interest is a requirement for issuing an insurance policy, making it legal, valid, and protecting against intentionally harmful acts.

Entities not subject to financial loss from an event do not have an insurable interest and cannot purchase an insurance policy to cover that event.

‘Insurable Interest’ Insurance is a collection of risk exposure to protect policyholders from financial losses.

Types of Insurable Interest are;

- Fidelity Guarantee Insurance,

- Credit Insurance,

- Performance Bond.

Fidelity Guarantee Insurance

This type of policy covers the insured in respect of the loss sustained by him arising out of fraud, defalcation, or dishonesty caused by the insured’s employee.

Usually, this type of insurance either handles cash or holds positions of trust to cover those employees.

Four types of guarantees are in use depending on the class of employees, viz., Commercial Guarantees, for persons other than below;

- Court Bonds for administrators, receivers, and other appointments.

- Government Bonds, for trustees, customs, and excite people. Guarantees For Local Govt. Officers.

Credit Insurance

Present-day international trade is mainly transacted on a credit basis, and exporters can sustain heavy losses because of the possible insolvency of the buyers of such goods or because of protracted default in payment on the part of buyers.

The main purpose of credit insurance is to provide financial protection to exporters arising from nonpayment.

Payment of the value of the goods may not be possible for the buyers because of the outbreak of war and because of the restrictions imposed on remittances abroad.

Also, there is always the question of the possible insolvency of the buyer.

Export Credit Guarantee Scheme aims at providing cover to the exporter (insured) arising out of (a) such political risks and (b) insolvency of the buyer.

Performance Bond

These policies aim to protect those responsible under a contract to perform some obligations within a specified time or as per certain pre-determined standards.

If the performance cannot be made as per the contract leading to a loss for the principal, then the principal would have a right to claim damages or compensation for the contractor’s default or the person who is to perform a certain obligation under the contract.

The situation may relate to, for example, the construction of buildings, roads, bridges, mills, factories, etc., or a loan agreement repayable as per certain terms and conditions.

Such persons, sometimes of their own or sometimes in the direction of the principal, are required to take such Performance Bonds or Surety Bonds when insurance companies stand as sureties or guarantors.

In the insurance business, the pertinent question that usually crops up in our mind is, “Can anybody insure anything that he sees around?”

To put it the other way round, who can insure and what?

The answer relating to this pertinent question revolves around the Principle of insurable interest.

This principle asserts that only the person who has an insurable interest -in a subject matter of insurance can insure that particular subject matter.

It is not possible to effect a policy of insurance on a subject matter by somebody who has got no insurable interest in that subject matter. This insurable interest is virtually a legal right to insure.

It is the legal, financial interest of a man on a property, the interest being such that by the safety of the subject matter, he is benefited; by the loss, damage, or destruction thereof, he is prejudiced.

Actually, before the promulgation of certain Acts by the English Parliament, it was not necessary to have an insurable interest in affecting a policy of insurance.

The notable Acts are The Marine Insurance Act, 1745, The Life Assurance Act, 1774 & the Gaming Act, 1845 that necessitated the presence of insurable interest.

Before that, anybody could insure anybody’s life or property and the business of insurance became more of gaming and wagering.

The Marine Insurance Act, 1745 prohibited effecting policies of insurance on British ships or cargo without having an insurable interest.

The Life Assurance Act, 1774 provides that no insurance shall be allowed to be made by a person for his benefit on the life of another unless the person affecting the policy of insurance shall have an insurable interest on the life of that another.

The Gaming Act, 1845 has made all contracts of gaming or wagering null and void.

Present-day position, therefore, is this that insurable interest is necessary for every insurance contract. Insurable interest has best been defined by Macgillivray in the following way.

“Where the assured is so situated that the happening of the event on which the insurance money is to become payable would, as a proximate cause, involve the assured in the loss or diminution of any right recognized by law or in any legal liability, there is an insurable interest in the happening of that event to the extent of the possible loss or liability”. (Macgillivray on Insurance law).

Some provisions of the law are considered below;

- In the leading English case of LUCENA V. CRAUFURD (1806) it was said by the learned judge:

“A man is interested in a thing to whom advantage may arise or prejudice happen from the circumstances which may attend it; interest does not necessarily imply a right to the whole or a part of a thing, not necessarily and exclusively that which may be the subject of privation, but then having some relation to, or concern in the subject of the insurance, which relation or concern by the happening of the perils insured against may be so affected as to produce a damage, detriment, or prejudice to the person insuring ; and where a man is so circumstanced with respect to matters exposed to certain risks or dangers as to have a moral certainty of advantage or benefit, but for those risks or dangers, he may be said to be interested in the safety of the thing. To be interested in the preservation of a thing is to be so circumstanced concerning it as to have benefited from its existence, prejudice from its destruction. The property of a thing and the interest devisable from it may be very different; of the first, the price is generally the measure, but my interest in a thing every benefit or advantage arising out of or depending on such thing may be considered as being comprehended”. The students should try to realize how the concept of insurable interest was well grasped. - Section 5(2) of the Marine Insurance Act, 1906 (of the United Kingdom) lays down a clear concept of the principle of insurable interest when it says: “In particular a person is interested in a marine adventure where he stands in any legal or equitable relation to the adventure or any insurable property at risk therein, in consequence of which he may benefit by the safety or due arrival of insurable property, or maybe prejudiced by its loss, or by damage thereto, or by the detention thereof, or may incur liability in respect thereof.

- The relevant provision of the Life Assurance Act, 1774 is as follows: “No insurance shall be made on the life or lives of any person or persons, or on any other event or events whatsoever, wherein the person or persons for whose use, benefit or on whose account such policy or Policies shall be made, shall have no interest, or by way of gaming or wagering”.

The situation that provoked the promulgation of the Life Assurance Act, 1774 by the British Parliament might be of interest to the students. Before the promulgation of this Act, an insured didn’t need to have an insurable interest in the subject matter of insurance.

Anybody could affect life insurance on any life, the result being that it became a common practice amongst the judges and jurors of the English judicial system to affect life policies on the lives of the suspected criminals brought for trial, where the maximum penalty could be a death sentence.

Being motivated by policy money consideration, the judgment quite often used to be a death sentence irrespective of the merit of the case because only by giving a death sentence could they realize policy money.

The scandal went to such an extent that the Parliament had to enact the Life Assurance Act, 1774, prohibiting life insurance in the absence of insurable interest.

Insurable interest is a fundamental principle of insurance.

It means that the person wishing to take out insurance must be legally entitled to insure the article, the event, or the life. The happening of the event insured against or the death of the life insured must cause the policyholder financial loss.

Essentials of Insurable Interest

The following are the essentials of insurable interest;

- There must be property, rights, interest, life, limb, or potential liability devolving upon the insured capable of being covered by a policy of insurance.

- Such property, right, life, limb, interest, or liability must be the subject matter of insurance.

- The insured must bear such a relationship, recognized by law, to that subject matter of insurance whereby the benefits by the safety of that subject matter and is prejudiced by the loss, damage, or destruction thereof.

When a person fulfills the above criteria or when a person has such a relationship with the subject matter, it is said that he has an insurable interest and it is only then that he can insure.

One point is very clear from the above requirement, and that is that if the presence of such an insurable interest would not have been required and if anybody would have been allowed to affect a policy of insurance on anybody’s life or property in the absence thereof, then there would have been created intentional or deliberate losses solely for making gains without losing anything at all.

It is this principle, which is keeping the business of insurance free from gaming or wagering, or the creation of such a situation.

The subject of insurable interest will be further understood if we can create a distinction between -the “subject matter of insurance” and subject-matter of the insurance contract.” Subject- matter of insurance is nothing but the property that is being insured.

For example, it is life in life insurance, factory, machinery, stock, house, building, etc. fire insurance, ship, cargo, etc marine insurance and so and so forth.

But the subject matter of an insurance contract is indeed not the property as such but the insurable interest of a man in that property.

It was, therefore, rightfully commented by the judge in the leading case of Castellain V. Preston ( 1883 ) that in a fire policy, it is not the bricks or materials or the house itself that a man insures it is the interest of the man in that house that he insures.

Examples of Insurable Interest

Insurable interest exists in the following cases;

- Owners: Owners have got insurable interest to the extent of full value.

- Part owners or joint owners: They have an insurable interest to the extent of their part or financial interest.

- Mortgagor/ Mortgagee: Mortgagor, being the owner of the property, has got insurable interest. Mortgagee, though not the owner, has got insurable interest to the extent of the money advanced, plus interest and an amount to cover up insurance premium.

- Bailees: They have got insurable interest because of a potential liability being created if goods belonging to others get lost or damaged whilst in their custody.

- Carriers: Like bailees, carriers have also got insurable interest given potential liability that might devolve on them for any mishap to the goods belonging to others, but whilst in their custody.

- Administrators, Executors & Trustees: They have an insurable interest because of responsibility put on them by law.

- Life: A person has got insurable interest in his own life. A husband has also got an insurable interest in the life of his wife and vice-versa. No other relationship as such merits the existence of insurable interest. However, insurable interest has been created up to £30 on the lives of parents, stepparents, and grandparents, under the Industrial Assurance & Friendly Societies Act, 1948 & 1958 of U. K., for meeting funeral expenses.

- Debtor and Creditor: A Debtor has an insurable interest in his own life, but he has no insurable interest in the life of his Creditor. A Creditor, on the other hand, has an insurable interest in his own life and he has also insurable interest in the life of his debtor to the extent of the loan, interest, and something to cover up the premium. This is because of the financial interest being created by advancing money.

- Insurers: They have got insurable interest because of potential liability is undertaken from the insured under a policy, and this justifies taking out a reinsurance policy.

- Liability: The creation of a potential liability justifies the existence of insurable interest. The best examples are third-party motor insurance, public liability insurance, employer’s liability insurance, etc.

It should be remembered that a person in the lawful possession of goods of another has got insurable interest so long he is responsible for the goods.

Mere possession without responsibility does not carry any insurable interest.

Similarly, a person having illegal possession of goods has got no insurable interest, e.g., thieves.

One important point concerning insurable interest is that it must be capable of being valued in terms of money. Sentimental value is no criterion.

When Insurable Interest Must Exist

The question as to when insurable interest must exist varies depending on the type of insurance. The position is as follows;

- Marine: Insurable interest must exist at the time of claim, although it need not exist at the time of effecting the policy. However, at the time of effecting the policy, the insured must prove that he is going to acquire insurable interest soon. (Marine Insurance Act, 1906).

- Fire: Insurable interest must exist both at the time of effecting the policy and at the time of claim.

- Life: Insurable interest must exist at the time of effecting the policy, and it may not exist at the time of claim. For example, if a creditor takes out a policy on the life of a debtor and subsequently the debtor pays back the loan, nevertheless, the creditor can continue the policy as per original terms and shall be entitled to sum assured either on death of the debtor or on maturity, even though at the time of claim there existed no insurable interest. (The rule was laid down in the English Case Dalby V. The India and London Life Assurance Co., 1854).

- Accident: Like fire, insurable interest must exist both at the time of effecting the policy and at the time of claim.

It should be remembered that in the absence of insurable interest, the contract should be void ab-initio.

Therefore, the underwriters have to see the position of insurable interest at the time of issuance of the policy and similarly, the Claims Manager has to see the position of insurable interest at the time of settling a claim.

Insurable Interest in Life Insurance

Insurable interest is the pecuniary interest; the insured must have an insurable interest in the life to be insured for a valid contract. Insurable interest arises out of the pecuniary relationship that exists between the policy-holder and the life assured so that the former stands to lose by the death of the latter and/or continues to gain by his survival.

If such a relationship exists, then the former has an insurable interest in the life of the latter. The loss should be monetary.

Mere emotion and expectation do not institute insurable interest in the life of his friend or father merely because he gets valuable advice from them.

The general rule of insurable interest in life insurance

Time of insurable interest

The insurable interest must exist at the time of the proposal. Policy, without the insurable interest, will be the wager. It is not essential that the insurable interest must be present at the time of the claim.

Services

Except for the services of the wife, the services of other relatives will not essentially form an insurable interest.

There must be a financial relationship between the proposer and the life assured. In other words, the services performed by the son without dependence on his father will not constitute the insurable interest of the father in the life of his soul. Vice-versa is not essential for forming insurable interests.

Insurable interest must be valuable

In the business relationship, the value or extent of the insurable must be determined to avoid a wagering contract for the additional insurance. Insurance is limited only to the amount of insurable interest.

Insurable interest should be valid

Insurable interest should not be against public policy, and the law should recognize it. Therefore, the consent of life assured is essential before the policy can be issued.

The legal responsibility may be the basis of insurable interest

Since the person will suffer financially up to the extent of responsibility, the proposal has an insurable interest to that extent; for instance, a person will be under a legal responsibility to expense at the funeral of his wife and children, and he can purchase insurance in their lives up to that extent.

Insurable interest must be definite

The insurable interest must be present definitely at the time of the proposal. The mere expectation of gain or support will not constitute an insurable interest.

Legal consequence

The insurable interest must be there to form legal and valid insurance contracts. Without insurable interest would be invalid.

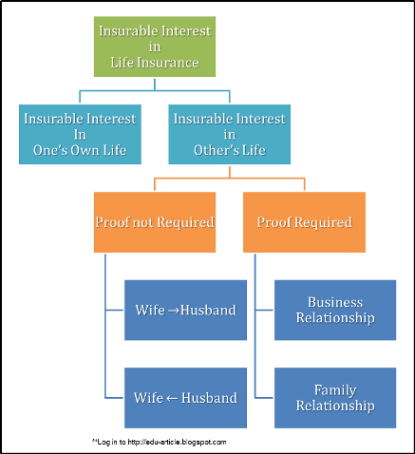

After taking these rules into account, the insurable interest principle in life insurance can be divided into two categories: insurable interest in own life, and an insurable interest in other’s life.

The latter is subdivided into two classes: where the proof is not required and where the proof is required.

Again, this insurable interest is divided into two classes: insurable interest arising due to the business relationship and insurable interest in family relationships.

Insurable interest in one’s own life

An individual always has an insurable interest in his own life. It does not need any verification of proof. Every man is presumed to possess an insurable interest in his estate for the loss of his future gains or savings, which might be the result of his premature death.

According to the definition of insurable interest, it is also evident that the person will continue to gain financially while lying is surviving and will suffer a loss if he is dead because he will be unable to earn or protect the property.

The insurable interest in own life is boundless because the loss to the insured or his dependents cannot be measured regarding money and, therefore, no limit can be placed on the amount of insurance that one may take on one’s own life.

Thus, ideally, a person can take a policy for an unlimited amount of his own life; but in practice, no insurer will issue a policy for an amount larger than amount seems suitable to the circumstances and means of the applicant generally, it is mentioned that one cannot purchase policy usually more than ten times of his one year’s income.

The third party could pay the premium if there were no intention of speculation. If there is a possibility of a wager, the contract will become void.

Insurable interest in other’s life

Life insurance can be affected by the lives of third parties, provided the proposer has an insurable interest in the third party. There are two types of insurable interest in other’s life. First, where the proof is not required, and second, where the proof is required,

Proof not required

There are only two such cases where the presence of insurable interest is legally presumed and, therefore, need not be proved.

The wife has an insurable interest in the life of her husband

It is presumed and decided by reed vs. Royal exchanged 795) that the wife is presumed to have an insurable interest in the life of her husband because the husband is legally bound to support his wife.

The wife will suffer financially if her husband dead and will continue to gain if the husband survives.

Since the extent of loss or gain cannot be measured in this case, the wife has an insurable interest in the husband’s life up to an unlimited extent.

Husband has an insurable interest in the life of his wife

The insurable interest is presumed to exist here, and no proof is required. It was decided in Griffith vs. Fleming (1909) that the husband has an insurable interest in his wife’s life because of domestic services performed by the wife.

If the wife is dead, a husband has to employ another person to render the domestic services, and certain other financial expenditures will involve her death which is not calculable.

The husband is benefited from the survival of his wife, so it is self-proved that the husband has an insurable interest in his wife’s life.

Since the monetary loss at her death or monetary gain at his survival cannot be measured, there is an unlimited insurable interest in the life of the wife.

Proof is required

Insurable interest has to be proved in the following cases;

Business relationship. The policyholder may have an insurable interest in the life of assured due to the business or contractual relationship. In this case, the amount of insurable corresponds to the amount of risk involved. Some such examples are narrated below:

A creditor has in the life of his debtor. The creditor may lose money if (the debtor dies before the loan is repaid.

The continuance of the debtor’s life is financially meaningful to the creditor because (the latter will get all his money repaid at the former’s survival.

The maximum amount of loss to a creditor may be the amount of outstanding loan plus interest thereon and the amount of premium paid; so, the maximum amount of insurable interest is limited to the outstanding loan, plus interest and amount of premium expected to be paid.

The interest is calculated on the estimation of the duration of debt to be paid.

The maximum amount of interest does not say about the payment of the policy amount. It merely determines the chances of speculation. The full amount of the policy is payable irrespective of the payment of the loan and interest. Since it is life insurance, the full policy amount is paid.

A trustee has an insurable interest in respect of the interest of which he is the trustee because of the survival of the other person, the trustee benefits, and at his death, he will suffer.

A surety has an insurable interest in the life of his principal. If the principal (the debtor) is dead, the surety is responsible for the payment of the outstanding loan or obligated amount.

The survival of the principal, he will not suffer this loss. The insurable interest is limited up to the number of outstanding loans, interest, and premium paid.

A partner has an insurable interest in the life of each partner. At the death of a partner, the partnership will be dissolved, and the surviving partner will lose financially.

Even if the firm continues at the death of the partner, the firm has to pay the deceased partner’s share to his dependents; this will involve a huge financial loss to the partnership.

Therefore, the firm collectively can purchase insurance policies in the life of each partner of the firm: since the firm part of the money up to the extent of the deceased partner’s goodwill, capital, the share of profit, and reserve, the firm has insurable interest up to the extent in each partner.

Similarly, all the partners have an insurable interest in the life of each partner because they will financially suffer death.

An employer has the life of a key man. A key man is a person whose presence, capital, and capacity cause profit to the business. If the key man is dead, the business will reduce profit up to a certain extent.

The business suffers reduced profit, expenses involved in appointing and training new persons and the amount to be given to the dependents of a key man at his death. So the business has insurance interest up to such an extent in the keyman’s life.

An insurer has life assured. The insurer suffers from the death of the life assured and, therefore, he can get reinsurance of the assured persons by him. The insurable interest is limited up to the policy amount.

Family relationship

The insurable interest may arise due to family relationships if pecuniary interest exists between the policy-holders and life assured because mere relationship or tics of blood and affection does not constitute insurable interest; the proposer must have a reasonable expectation of financial benefit from the continuance of the life of the person to be insured or of financial loss from his death.

The interest must be based on value and not on mere sentiments.

Similarly, the mere moral obligation is not sufficient to warrant the existence of insurable interest although the legal obligation to get support will form the insurable interest of the person who is supported in the life of the person who is supported.

Thus, a son can insure his father’s life only when he is dependent on him, and the father can take the insurance policy on his son’s life only when he is dependent on his son.

Insurable interest in life insurance indicates that the insured must have a pecuniary interest in the life to be insured for a valid life insurance contract.

Insurable Interest in Marine Insurance

An insured person will have an insurable interest in the subject matter where he stands in any legal or equitable relation to the subject matter in such a way that he may benefit by the safety or due arrival of insurable property or maybe prejudiced by its loss or by damage thereto or by the detention thereof or may incur liability in respect thereof.

Since marine insurance is frequently affected before the commercial transactions to which they apply are formally completed, the assured doesn’t have to have an insurable interest at the time of effecting insurance, though he should expect to acquire such interest.

If he fails to acquire an insurable interest in due course, he does not become entitled to indemnification.

Since the ownership and other interest of the subject matter often change from hands to hands, the requirement of the insurable interest to be present only at the time of loss makes a marine insurance policy freely assignable.

Exceptions

There are two exceptions to the rule in marine insurance; Lost or Not Lost and P.P.I. Policies.

Lost or Not Lost

A person can also purchase a policy in the subject matter in which it was known whether the matters were lost not lost. In such cues, the assured and the underwriter are ignorant about the safety or otherwise of the goods, and complete reliance is placed on the principle of Good Faith.

The policy was terminated if any one of the two parties was aware of the fact of loss. Therefore, the insurable interest may not be present at the time of the contract because the subject matter would have been lost.

P.P.I. Policies

The subject matter can be insured in the usual manner by P.P.I. (Policy Proof of Interest), i.e., interest-proof policies. It means that in the event of a claim, underwriters may dispense with all proof of insurable interest.

In this case, if the underwriter does not pay the claims, it cannot be enforced in any court of law because of P.P.I. policies are equally void and unenforceable.

But the underwriters are generally adhering to the terms and pay the amount of the claim. The insurable interest in marine insurance can be of the following forms:

According to Ownership

The owner has an insurable interest up to the Rill value of the subject matter. The owners are of different types according to the subject matter.

- In Case of Ships: The ship owner or any person who has purchased it on a charter basis can insure the ship up to its full price.

- In the Case of Cargo: The cargo-owner can purchase a policy up to the full price of the cargo. If he has paid the freight in advance, he can lake the policy for the full price of the goods, the freight amount, and the expense of insurance.

- In Case of Freight: The receiver of the freight can insure up to the amount of freight to be received by him.

Insurable Interest in Re-insurance

Under a contract of marine insurance, the underwriter has an insurable interest in his risk and may re-insure in respect of it.

Insurable Interest in Other Cases

In this case, all those underwriters included who have an insurable interest in the salary arid own liabilities.

For example, the master or any crew member of a ship has an insurable interest with respect to his wages. The lender of money on bottomry or respondentia has an insurable interest in respect of the loan.

![Types of Insurance Organizations [A Comprehensive Guide] 2 Types of Insurance Organizations [A Comprehensive Guide]](https://www.iedunote.com/img/259/types-insurance-organization-e1529504882393.png)