Investment is mainly made to generate income. Meet up the liquidity requirement is another purpose of investment. Commercial banks must maintain adequate capital according to the guidelines of the bank regulatory authority.

Commercial banks invest in different types of securities according to the guidelines of the bank regulatory authorities to reduce the weighted average risk of the loans given for collecting adequate capital.

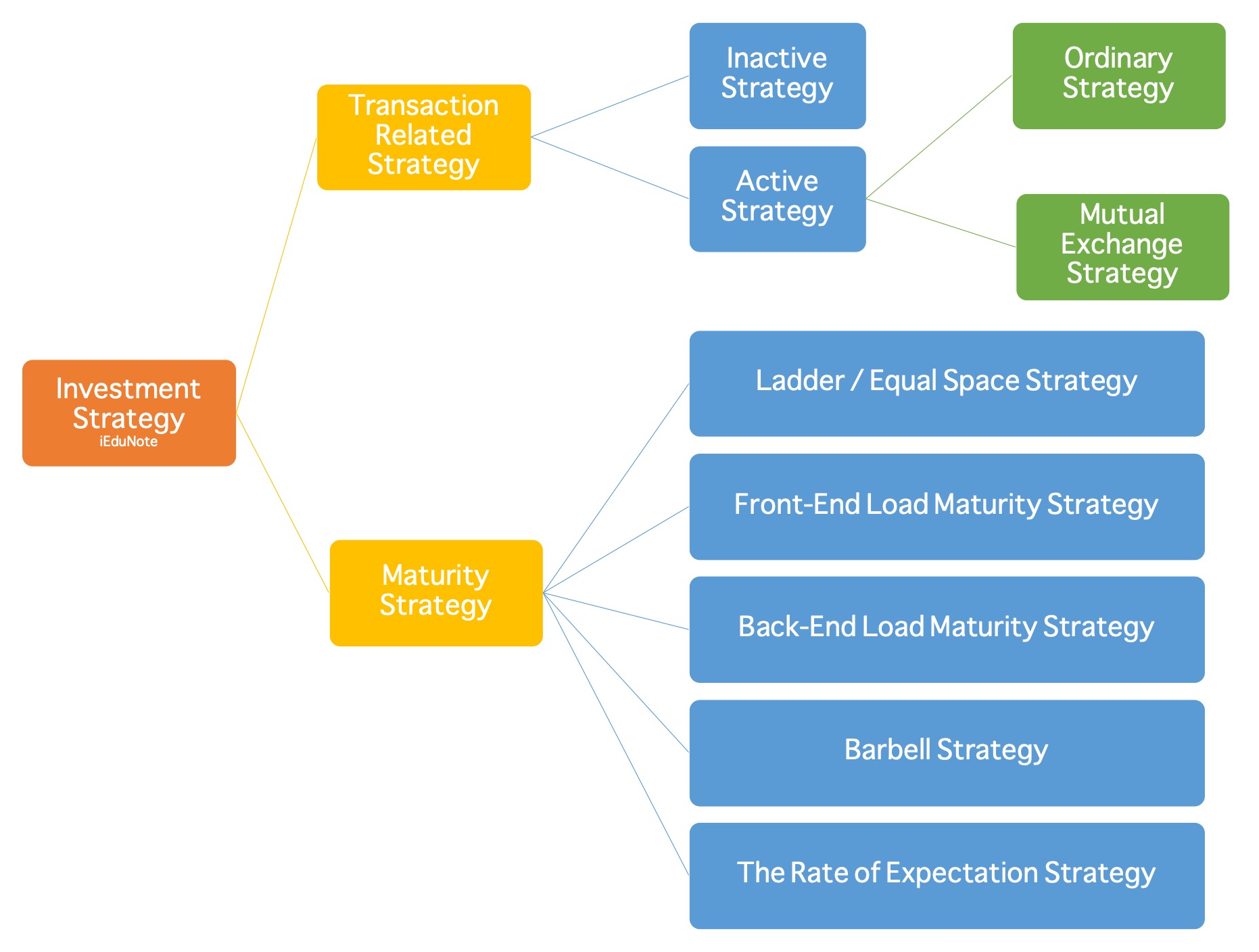

Investment officers follow different strategies from time to time for commercial banks. Different strategies become helpful in different ways to achieve the target. Every strategy has its own merits and demerits.

The Bank investment officer needs to apply these strategies by remembering the bank’s main objective: “Maximize the wealth of the shareholders by maximizing the profit.

Types of Investment Strategies of Commercial Banks

Transaction Related Strategy

Inactive Strategy

According to inactive strategy, banks make investments after considering the factors of selecting an investment portfolio and investable funds through purchasing debenture, bonds, treasury bills, or shares and holding them up to maturity.

At maturity, banks get the principal amount back along with profit. However, such investments can be liquidated before maturity to face the liquidity crisis.

Active Strategy

According to this strategy, the bank’s investment officer docs do not hold debenture, bond, treasury bill, or share inactively up to maturity. Rather observation of the market rate each day is the main issue of this strategy.

Besides, the bank’s investment officer is responsive to the change in interest rates. According to this strategy, new, more profitable securities are purchased by selling the old/existing securities before maturity.

Suppose there remains a high possibility of capital appreciation or a favorable change in interest rate—the profit potential xktII increase, which eventually calls for applying this active strategy. In the case of active strategy, there remains a chance of loss arising from the transaction.

But suppose this strategy is aggressively applied by a skilled investment officer regularly. In that case, the amount of profit at the end of the year will be much higher than that of an inactive strategy.

Maturity Strategy

By investing in the debenture or bond, the investor will receive profit or interest at the end of the maturity. The decisions regarding the amount and maturity are significant for a bank because investments act as the third line of defense besides generating income.

More profits will be earned from long-term investments. But such investments offer less liquidity. On the other hand, short-term investments offer higher liquidity, but the profit is lower in this case.

Now let’s discuss the investment strategies based on maturity.

Ladder / Equal Space Strategy

According to this strategy, the bank’s investment officer determines the investible funds and maximum probable time for investment.

Then he should divide the investible fund by the maximum time period and make an equal investment each year. Therefore, invested funds come back with profit at the end of each year.

And the investment officer can reinvest the fund by following the same procedure. This strategy does not require the special technical knowledge of an investment officer.

Front-End Load Maturity Strategy

According to this strategy, investment is made for a short period. The main purpose of this investment strategy is to meet the liquidity need arid then earn profit. By adopting this strategy, risk related to inflation can be minimized.

Back-End Load Maturity Strategy

This strategy is applicable when short-term investment is not required. This strategy is adopted by an investment officer who makes relatively medium and long-term investments. This strategy tries to reduce risk by making investments for different maturities. The bank can cam maximum profit by applying this strategy.

Barbell Strategy

According to this strategy, the bank’s investment officer determines the investible funds based on liquidity and profitability.

Half of the investible funds are used to make investments in short-term securities to meet liquidity needs. The other half is used to make medium- and long-term investments to earn maximum profit.

The Rate of Expectation Strategy

This strategy is adopted by the investment officer who believes in active transactions. Therefore, an investment officer makes short/medium/long-term investments considering the ups and downs of interest rates and earning high profits by changing maturity.