National income can be estimated in terms of clear output or total income. When national income is measured by adding together all income payments made to the factors of production in a year, it is called national income at factor cost.

National income thus is the total of all income payments made to the factors of production.

In the words of J. Sloman: “National income (NI) or national income at factor cost is the aggregate earning of the four factors of production (land, labor, capital, and organization) which arise from the current production of goods and services by the nation’s economy“.

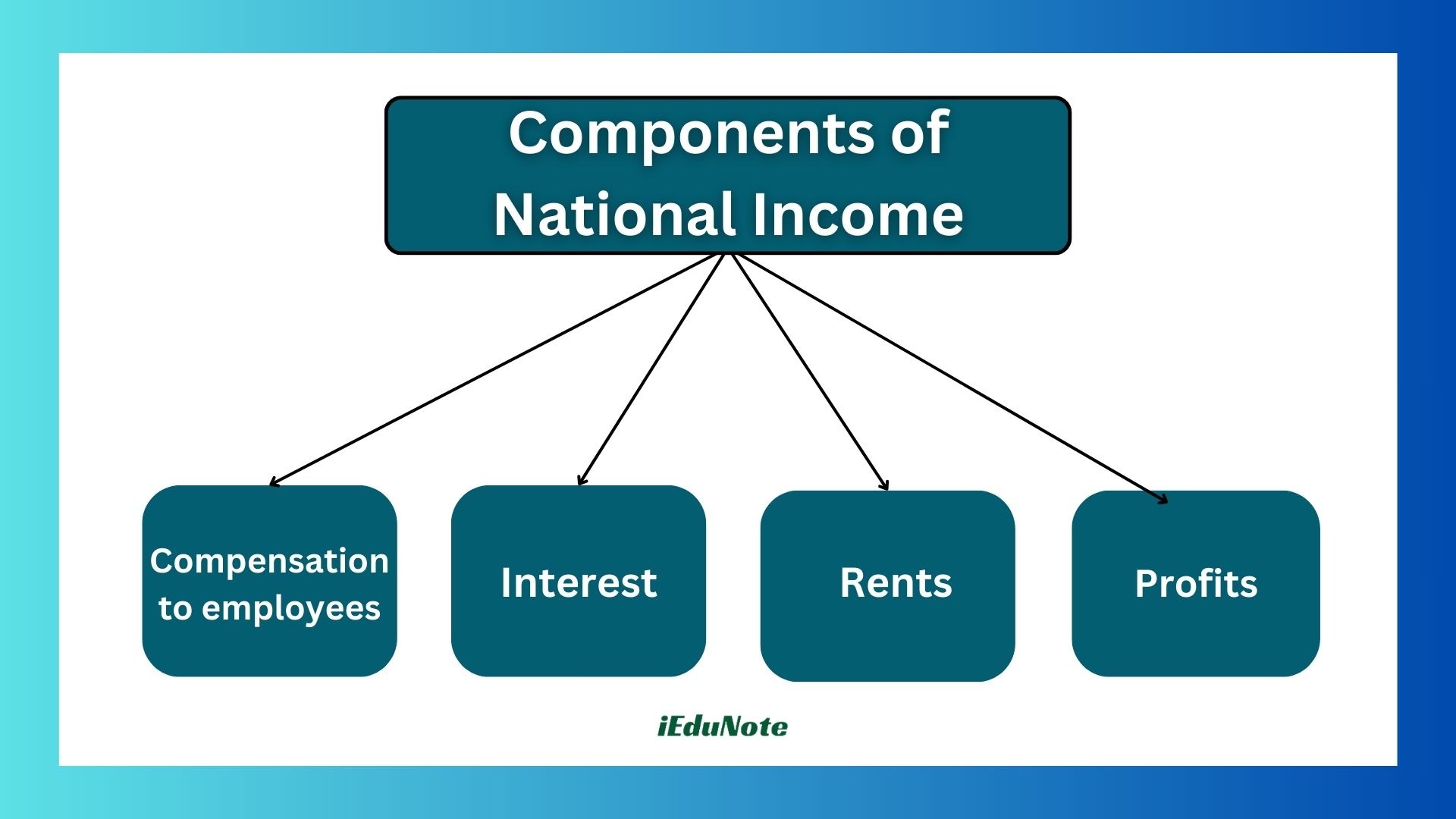

Components of National Income

The main components of national income at factor cost are as follows: The factor incomes are generally divided into four categories:

- Compensation to employees

- Interest

- Rents and

- Profits

Compensation to employees

It is the largest component of national income. It consists of wages and salaries paid by the firms to the workers for their labor services.

Interest

Interest is the payment for the use of funds in a year. The payment is made by private businesses to households who have lent money to them.

Rent

Rent is all income earned by individuals for the use of their real assets such as buildings, farms, etc.

Profit

Profit is the amount which is left after compensation to employees, rent, and interest have been paid out. The sum of compensation to employees, interest, rent, and profit is supposed to equal national income at factor cost.

Methods of Computing/Measuring National Income

There are three methods of measuring the national income of a country. They yield the same result. These methods are:

- The Product Method

- The Expenditure Method

- The Income Method

Product Method or Value Added Method

Definition and Explanation

Goods and services are counted in gross domestic product (GDP) at their market values.

The product approach defines a nation’s gross product as the market value of goods and services currently produced within a nation during one year.

The product approach measuring national income involves adding up the value of all the final goods and services produced in the country during the year.

Here we focus on various sectors of the economy and add up all their production during the year. The main sectors whose production value is added up are:

- Agriculture

- Manufacturing

- Construction

- Transport and communication

- Banking

- Administration defense and

- Distribution of income, etc

Precautions for Product Method or Value Added Method

Certain precautions are to be taken to avoid miscalculation of national income, using this method. These are in brief stated below:

The problem of double-counting

When we add up the value of the output of various sectors, we should be careful to avoid double counting.

This pitfall can be avoided by either counting the final value of the output or by including the extra value that each firm adds to an item.

Value addition in a particular year

While calculating national income, the values of goods added in the particular year are included, and the values that had previously been added to the stocks of raw materials and goods have to be ignored.

GDP thus includes only those goods, and services that are newly produced within the current period.

Stock appreciation

Stock appreciation, if any, must be deducted from value added. This is necessary as there is no real increase in output.

Production for self-consumption

The production of goods for self-consumption should be counted while measuring national income.

In this method, the production of goods for self-consumption should be valued at the prevailing market prices.

Expenditure Method

Definition and Explanation

The expenditure approach measures national income as total spending on final goods and services produced within the nation during a year. The expenditure approach to measuring national income is to add up all expenditures made for final goods and services at current market prices by households, firms, and government during a year. Total aggregate final expenditure on final output is the sum of four broad categories of expenditures:

- Consumption

- Investment

- Government expenditure and

- Net export

Consumption expenditure (C)

Consumption expenditure is the largest component of national income. It includes expenditure on all goods and services produced and sold to the final consumer during the year.

Investment expenditure (I)

Investment is the use of today’s resources to expand tomorrow’s production or consumption. Investment expenditure is expenditure incurred by business firms on (a) new plants, (b) adding to the stock of inventories, and (c) newly constructed houses.

Government expenditure (G)

It is the second largest component of national income. It includes all government expenditure on currently produced goods and services but excludes transfer payments while computing national income.

Net exports (X – M)

Net exports are defined as total exports minus total imports.

National income calculated from the expenditure side is the sum of final consumption expenditure, expenditure by business on plants, government spending, and net exports.

NI = C + I + G + (X – M)

Precautions for Expenditure Method

While estimating national income through the expenditure method, the following precautions should be taken:

- The expenditure on second-hand goods should not be included as they do not contribute to the current year’s production of goods.

- Similarly, expenditure on the purchase of old shares and bonds is not included as these also do not represent expenditure on currently produced goods and services.

- Expenditure on transfer payments by the government such as unemployment benefits, old-age pensions, and interest on public debt should also not be included because no productive service is rendered in exchange by recipients of these payments.

Income Method or Approach

The income approach is another alternative way of computing national income. This method seeks to measure national income at the phase of distribution.

In the production process of an economy, the factors of production are engaged by the enterprises. They are paid money incomes for their participation in the production.

The payments received by the factors and paid by the enterprises are wages, rent, interest, and profit.

National income thus may be defined as the sum of wages, rent, interest, and profit received or occurred to the factors of production instead of their services in the production of goods.

Briefly, national income is the sum of all income, wages, rents, interest, and profits paid to the four factors of production.

The four categories of payments are briefly described below:

- Wages: It is the largest component of national income. It consists of wages and salaries along with extra benefits and unemployment insurance.

- Rents: Rents are the income from property received by households.

- Interest: Interest is the income private businesses pay to households who have lent the business money.

- Profits: Profits are normally divided into two categories (a) profits of incorporated businesses and

- (b) profits of unincorporated businesses (sole proprietorship, partnerships, and producers cooperatives).

Precautions for Income Approach

While estimating national income through the income method, the following precautions should be undertaken.

- Transfer payments such as gifts, donations, scholarships, and indirect taxes should not be included in the estimation of national income.

- illegal money earned through smuggling and gambling should not be included.

- Windfall gains such as prizes won, lotteries, etc. should not be included in the estimation of national income.

- Receipts from the sale of financial assets such as shares and bonds should not be included in measuring national income as they are not related to the generation of income in the current year’s production of goods.

Why Three Methods of Computing/Measuring National Income are Equal?

The three approaches used for measuring national income may show the same result. The reason is that the market value of goods and services produced in a given period by definition is equal to the amount that buyers must spend to purchase them.

So the product approach which measures the market value of goods and services produced and the expenditure approach which measures spending should give the same measure of economic activity.

Now as regards the income approach, the seller’s receipts must equal what the buyers spend. The seller’s receipts in turn equal the total income generated by the economic activity.

Thus, total expenditure must equal total income generated implying that the expenditure and income approach must also produce the same result.

Difficulties/Problems in the Measurement of National Income

According to Kuznets, the measurement of national income is a complicated problem. These problems are discussed below:

Non-availability of statistical information

Some persons like electricians, plumbers, etc., do some jobs in their spare time and earn income. It is very difficult to know the exact amount received from such services. This income which should have been added to the national income is not recorded due to the lack of full statistical information.

The problem of double counting

While computing the national income, there is always the danger of double or multiple counting. If there is a shortage of precautionary income, the cost of the commodity is likely to be counted twice or thrice and national income will be overestimated.

Non-marketed services

In estimating the national income, only those services are included for which payment is made. The unpaid services or non-marketed services are excluded from the national income.

Difficulty in assessing the depreciation allowance

The deduction of depreciation allowances, accidental damages, repair, and replacement charges from the national income is not an easy task. It requires a high degree of judgment to assess the depreciation allowance and other charges.

Housing

A person lives in a rented house. He pays $5000 per month to the landlord. The income of the landlord is recorded in the national income. Let us suppose that the tenant purchases the same house from the landlord. Now the income of the owner-occupant has increased by $5000. Is it not justifiable to include this income in the national income? Should or should not this income be recorded in the national income is still a controversial question.

Transfer earnings

While measuring the national income, it should be seen that transfer payments should not become a part of national income. The payments made as relief allowance, pensions, etc. do not contribute towards current production. So they should be excluded from national income.

The self-consumed portion of production

In developing countries, a significant part of the output is not exchanged for money in the market. It is either consumed directly by producers or bartered for other goods. This unorganized and non-monetized sector makes the calculation of national income difficult.

Price level changes

National income is measured in money terms. The value of money does not remain stable. This means that national income can change without any change in output.

Example: Sectoral share of GDP ( in percentage)

| No. | Sectors | 2013-14 | 2014-15 |

| 1 | Agriculture and forestry | 12.81 | 12.29 |

| 2 | Fishing | 3.30 | 3.30 |

| 3 | Mining and quarrying | 1.65 | 1.62 |

| 4 | Man ufacturing | 17.43 | 17.78 |

| 5 | Electricity, gas and water supply | 1.44 | 1.44 |

| 6 | Construction | 7.09 | 7.14 |

| 7 | Wholesale and retail trade | 13.48 | 13.41 |

| 8 | Hotel and restaurants | 1.02 | 1.03 |

| 9 | Transport, storage and communication | 10.49 | 9.97 |

| 10 | Financial intermediations | 3.79 | 3.97 |

| 11 | Real state, renting and other business activities | 7.12 | 7.38 |

| 12 | Public administration and defense | 3.49 | 3.70 |

| 13 | Education | 2.57>- | 2.63 |

| 14 | Health and social service | 2.10 | 2.11 |

| 15 | Community social and personal service | 12.23 | 12.26 |

| Total= | 100.0 | 100.0 |

Real vs. Nominal GDP

We calculate GDP as the Dollar value. In measuring this value we use market prices for different goods and services.

Distinction between GDP and GNP

But the price changes over time as inflation generally pushes prices upward year after year. The changing price is one of the major problems of economists in estimating GDP/NI.

Here it seems necessary to make a distinction between gross domestic product (GDP) and gross national product (GNP).

Gross domestic product is the total market value of all final goods and services produced by factors of production within a nation’s border during one year.

In other words, GDP is a flow of production produced within the country by domestically located resources in a year.

Gross national product (GNP) on the other hand, is the measure of all final goods and services produced by the citizens within their own country as well as outside the country during one year.

In other words, GNP expresses the monetary value of goods and services produced within the country and the net income received from abroad during one year.

Thus when we move from GDP to GNP, we add a factor of income receipts from foreigners and subtract the factor of income payments to foreigners.