Negotiable instruments are freely transferable commercial documents, and each type of negotiable instrument has unique functions and features.

Negotiable instruments are a commercial document that satisfies certain conditions and is transferable either by applying the law or the custom of the bleed concerned. This instrument can be transferred freely from hand to hand and has a legal life transferred by more delivery or endorsement.

Negotiable Instruments: Types, Features, Function, Practice

Most Common Types of Negotiable Instruments are;

- Promissory notes.

- Bill of exchange.

- Check.

- Government promissory notes.

- Delivery orders.

- Customs Receipts.

Most negotiable instruments fall under the following two categories; the Negotiated instrument by statute and Negotiated instruments by custom or usages.

A negotiable instrument act states three instruments; check bill of exchange and promissory notes.

They are therefore called negotiable instruments by statute.

Negotiable instruments by statute are;

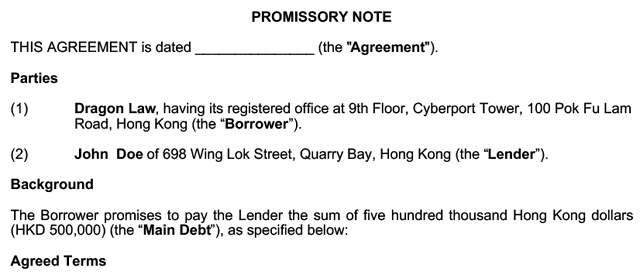

Promissory Notes as Negotiable Instrument

The promissory note is a signed document of a written promise to pay a stated sum to a specified person or the bearer at a specified date or on demand.

The promissory note is an instrument in writing containing an unconditional rule signed by one party to pay a certain sum of money only to or to the order of a certain person or the bearer of the instrument.

Thus a promissory note contains a promise by the debtor to the creditor to pay a certain sum of money after a certain date. The debtor is the maker of the instrument.

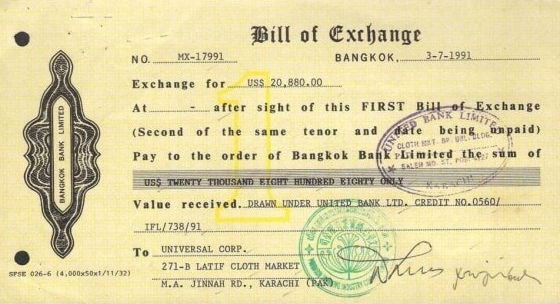

Bill of Exchange as Negotiable Instrument

The Bill of Exchange contains an order from the creditor to the debtor to pay a certain person after a certain period.

The person who draws it is called a drawer (the creditor), and the person on whom it is drawn is called a drawee (the debtor) or acceptor.

The person to whom the amount is payable is called the payee.

Check as a Negotiable Instrument

A check (cheque) is a bill of exchange drawer of a specified banker not expressed to be payable otherwise than on demand.

It is an instrument in writing containing an unconditional order signed by the maker (depositor), directing a certain banker to pay a certain sum of money to the bearer of that instrument.

Some other instruments have acquired the character of negotiability by customs or the usage of trade.

Negotiable instruments by customs or usages are mainly the government promissory notes, delivery orders, and railway receipts that have been held to be negotiable by usage or custom of the trade.