The notice of abandonment is essentially given to the insurer to claim the loss as a constructive total loss. If he fails to do so, the loss can only be treated as a partial loss. The notice can be given orally or in writing, and the notice should be unconditional and absolute.

The insurer may either elect to accept or decline the proposal. But, when the insurer elects to object to the notice, the insured should at once commence legal action against the insurer to claim ‘the loss’ under constructive total loss.

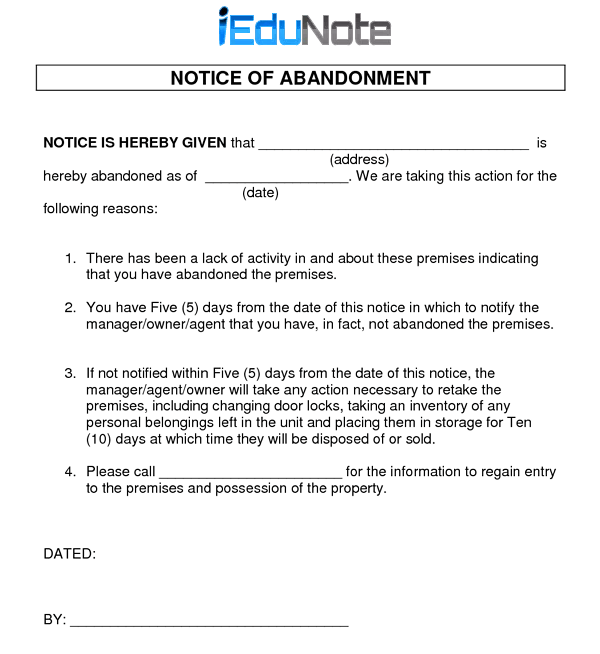

In brief, the notice of abandonment involves the following:

- Subject to the contrary provision, where the insurer elects to abandon the subject-matter insured to the insurer, he must give notice of abandonment if the insured fails to furnish the notice; the loss can be treated as a partial loss.

- The notice can be given in writing or orally. It may be given in any terms that indicate the intention of the assured to abandon his insured interest in the subject matter insured unconditionally to the insurer.

- Notice of abandonment must be given with reasonable diligence after the receipt of reliable information of the loss, but where the information is of doubtful character, the insured is liable to furnish the required information.

- If notice of abandonment is properly given, the assured’s rights are not prejudiced because the insurer refuses to accept the abandonment.

- The acceptance of abandonment may be either expressed or implied from the conduct of the insurer, and the mere silence of the insurer is not an acceptance.

- Where notice of abandonment is accepted, the abandonment is irrevocable.

- Notice of abandonment is unnecessary where there is no possibility of benefit to the insurer if notice was given to him.

- Notice of abandonment may be waived by the insurer.

Effect of Abandonment

- In case of valid abandonment, the insurer is entitled to take over the assured interest in whatever may remain of the subject matter insured.

- At the time of abandonment of the ship, the insurer is entitled to any freight in the course of being earned.

In case of a constructive total loss, the insurer has a right, after the settlement of the claim in full, to take over the property or whatever may remain of it where the insurers elect to take over the remainders of the wreck, the insurers bear the cost of removing the wreck.

But, in case of insurers elect not to take over the destroyed party, it becomes the liability of the ship-owners to remove the wreck and incur necessary expenses for the same.

The constructive total loss in the case of vessels is distinguished from the constructive total loss in cargo or freight.

In the case of cargo, the constructive total loss will be there where the assured is deprived of the goods by insured perils.

In case of damage to the goods, there is a constructive total loss where the cost of reconditioning the goods and forwarding the goods to the destination would exceed their value on arrival.

Hull policy covers total and partial losses, and partial losses are paid in full irrespective of the insured amount; the insured amount merely serves as the maximum limit.