A partnership is a relation between two or more persons who join hands to form a business organization to earn a profit.

The persons who join hands are individually known as ‘Partner’ and collectively a ‘Firm.’

The partners provide the necessary capital, run the business jointly, and share the responsibility.

- You must be thinking about how much capital each partner contributes?

- Do all the partners jointly manage the business, or can any of them manage the business on behalf of others?

- Who will take the profits?

- If there is any loss, then who will suffer the loss?

Yes, these are the few questions that might be coming to your mind.

When you invite your friends to start such a business, it should be the duty of all of you to decide;

- The amount of capital to be contributed by each one of you.

- Who will manage?

- How will the profits and losses be shared?

Thus, there must be some agreement between the partners before they start the business.

This agreement is termed as ‘Partnership Deed,’ which lays down certain terms and conditions for starting and running the partnership firm. This agreement may be oral or written.

It is always better to insist on a written agreement among partners to avoid future controversies.

Definition of Partnership Form of Business Organization

Expansion in business requires more capital and managerial skills and also involves more risk. A proprietor finds himself unable to fulfill these requirements. This calls for more persons come together with different ages and start a business.

For example, a person who lacks managerial skills but may have capital, and another person who is a good manager but may at his capital.

When these persons come together, pool their capital and skills, and organize a business, it is called a partnership. Partnership grows essentially because of the limitations or disadvantages of proprietorship.

Let us consider a few definitions on partnership below;

A partnership firm is governed by the provisions of the Partnership Act, 1932. Section 4 of the Partnership Act, 1932, defines partnership as “a relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.”

The Partnership Act-1932 says, “Partnership is the relation between persons who have agreed to share profits of a business carried on by any of them acting for all.”

The Partnership Act of America says, “The partnership is an association of two or more persons to carry on as co-owners a business for profit.”

“The partnership is the relation which subsists between persons carrying on business in common to profit”; British Partnership Act, 1890 (Sec-1).

The Uniform Partnership Act of the USA defined a partnership; “ai an association of two or more persons to carry on as co-owner a business for profit”.

According to J.L. Hanson, “a partnership is a form of business organization in which two or more persons up to a maximum of twenty join together to undertake some form of business activity.

Now, we can define partnership as an association of two or more persons – who have agreed to share the profits of a business that they run together.

This business may be earned on by all or any of them acting for all the persons who own the partnership business are individually called ‘partners,’ and collectively, they are called as firm’ or partnership firm.

The name under which partnership business is carried on is called “Firm Name’.

In a way, the firm is nothing but an abbreviation for partners.

Features of Partnership Form of Business Organization

After having a brief idea about the partnership, let us identify the various features of the partnership form of business organization.

Two or more Members

You know that the members of the partnership firm are called partners.

But do you know how many persons are required to form a partnership firm? At least two members are required to start a partnership business.

But the number of members should not exceed 10 in the case of banking business and 20 in case of other business.

If the number of members exceeds this maximum limit, then that business cannot be termed as a partnership business.

Agreement

Whenever you think of joining hands with others to start a partnership business, first of all, there must be an agreement between all of you.

This agreement contains

- The amount of capital contributed by each partner;

- Profit or loss sharing ratio;

- Salary or commission payable to the partner, if any;

- Duration of business, if any ;

- Name and address of the partners and the firm;

- Duties and powers of each partner;

- Nature and place of business; and

- Any other terms and conditions to run the business.

Lawful Business

The partners should always join hands to carry on any kind of lawful business.

To indulge in smuggling, black marketing, etc., cannot be called partnership business in the eye of the law.

Again, doing social or philanthropic work is not termed as a partnership business.

Competence of Partners

Since individuals join hands to become partners, they must be competent to enter into a partnership contract.

Thus, minors, lunatics, and insolvent persons are not eligible to become partners.

However, a minor can be admitted to the benefits of partnership, i.e., he can have a share in the profits only.

Sharing of Profit

The main objective of every partnership firm is to share of profits of the business amongst the partners in the agreed proportion.

In the absence of any agreement for profit sharing, it should be shared equally among the partners.

Suppose there are two partners in the business, and they earn a profit of $20,000.

They may share the profits equally, i.e., $10,000 each or in any other proportion, say one fourth and three fourth i.e., $5,000/- and $2500/-.

Unlimited Liability

Just like the sole proprietor, the liability of partners is also unlimited.

That means if the assets of the firm are insufficient to meet the liabilities, the personal properties of the partners, if any, can also be utilized to meet the business liabilities.

Suppose the firm has to make payment of $25,000/- to the suppliers of goods. The partners can arrange only $19,000/- from the business.

The balance amount of $6,000/- will have to be arranged from the personal properties of the partners.

Voluntary Registration

You don’t need to register your partnership firm.

However, if you don’t get your firm registered, you will be deprived of certain benefits; therefore, it is desirable. The effects of non-registration are:-

- The firm cannot take any action in a court of law against any other parties for the settlement of claims.

- in case there is any dispute among partners, it is not possible to settle the disputes through a court of law

- The firm cannot claim adjustments for the amount payable to or receivable from any other parties.

No Separate Legal Existence

Just like a sole proprietorship, a partnership firm also has no separate legal existence from that of its owners.

A partnership firm is just a name for the business as a whole. The firm means the partners and the partners collectively mean the firm.

Principal-Agent Relationship

All the partners of the firm are the joint owners of the business. They all have an equal right to participate in their management actively.

Every partner has a right to act on behalf of the firm.

When a partner deals with other parties in business transactions, he/she acts as an agent of the others, and at the same time, the others become the principal.

So there always exists a principal-agent relationship in every partnership firm.

Restriction on Transfer of Interest

No partner can sell Transfer his interest to anyone without the consent of other partners.

Example- A, B, and C are three partners. A wants to sell his share to D as his health does not permit him, also can not do so until B and C both agree.

Continuity of Business

A partnership firm comes to an end in the event of death, lunacy, or bankruptcy of any partner.

Even otherwise, it can discontinue its business at the will of the partners. At any time, they may decide to end their relationship.

Characteristics of Partnership

Based on the above discussion, we can now list the characteristics of a partnership form of business ownership/organization in a more orderly manner as follows:

- Profit and Loss Sharing.

- Contractual Relationship.

- Existence of Lawful Business.

- Utmost Good Faith and Honesty.

- Unlimited Liability.

- Restrictions on Transfer of share.

- Principal-Agent Relationship.

Profit and Loss Sharing

There is an agreement among the partners to share the profits earned and losses incurred in partnership business.

Contractual Relationship

A partnership is formed by an agreement-oral or written among the partners.

Existence of Lawful Business

A partnership is formed to carry on some lawful business and share its profits or losses. If the purpose is to cany some charitable works, for example, it is not regarded as a partnership.

Utmost Good Faith and Honesty

A partnership business solely rests on the utmost good faith and trust among the partners.

Unlimited Liability

Like proprietorship, each partner has unlimited liability in the firm.

This means that if the assets of the partnership firm fall short to meet the firm’s obligations, the partners’ private assets will also be used for the purpose.

Restrictions on Transfer of share

No partner can transfer his share to any outside person without seeking the consent of all other partners.

Principal-Agent Relationship

The partnership firm may be earned on by all partners or any of them acting for all. While dealing with the firm’s transactions, each partner is entitled to represent the firm and’ other partners.

In this way, a partner is an agent of the firm and the other partners.

Advantages of Partnership Form of Business Organization

Partnership form of business organization has certain advantages, which are as follows:

Easy to form

Like sole proprietorship, the partnership business can be formed easily without any legal formalities. It is not necessary to get the firm registered.

A simple agreement, either oral or in writing, is sufficient to create a partnership firm.

A partnership is a contractual agreement between the partners to run an enterprise.

Hence, it is relatively eased to form. Legal formalities associated with formation are minimal. However, the registration of a partnership is desirable but not obligatory.

Availability of large resources – More Capital Available

Since two or more partners join hands to start a partnership business, it may be possible to pool more resources as compared to a sole proprietorship.

The partners can contribute more capital, more effort, and also more time for the business.

We have just seen that sole proprietorship suffers from the limitation of limited funds. Partnership overcomes this problem, to a great extent, because now there is more than one person who provides funds to the enterprise.

It also increases the borrowing capacity of the firm.

Moreover, the lending institutions also perceive less risk in granting credit to a partnership than to a proprietorship because the risk of loss is spread over several partners rather than only one.

Better decisions – Combined Talent, Judgement, and Skill

The partners are the owners of the business. Each of them has an equal right to participate in the management of the business.

In case of any conflict, they can sit together to solve the problems. Since all partners participate in decision-making, there is less scope for reckless and hasty decisions.

As there is more than one owner in partnership, all the partners are involved in decision making. Usually, partners are pooled from different specialized areas to complement each other.

For example, if there are three partners, one partner might be a specialist in production, another in finance, and the third in marketing.

This gives the firm advantage of collective expertise for making better decisions. Thus, the old maxim of “two heads being better than one” aptly applies to the partnership.

Flexibility in operations

The partnership firm is a flexible organization. At any time, the partners can decide to change the size or nature of the business or area of its operation.

There is no need to follow any legal procedure. Only the consent of all the partners is required.

Like proprietorship, the partnership business is also flexible. The partners can easily appreciate and quickly react to the changing conditions.

No giant business organization can stifle such quick and creative responses to new opportunities.

Sharing risks

The losses of the firm are shared by all the partners as per their agreed profit-sharing ratios. Thus, the share of loss in the case of each partner will be less than that in the case of proprietorship.

In a partnership firm, all the partners share the business risks.

For example, if there are three partners, and the firm suffers a loss of $12,000 in a particular period, then all partners may share it, and the individual burden will be $4,000 only.

Taxation rates applicable to partnership are lower than proprietorship and company forms of business ownership.

Protection of interest of each partner

In a partnership firm, every partner has an equal say in decision making. If any decision goes against the interest of any partner, he can prevent the decision from being taken.

In extreme cases, a dissenting partner may withdraw himself from the business and can dissolve it.

The survival capacity of the partnership firm is higher than that of a sole proprietorship. The partnership firm can continue after the death or insolvency of a partner if the remaining partners so desire.

Benefits of specialization

Since all the partners are owners of the business, they can actively participate in every aspect of business as per their specialization and knowledge.

If you want to start a firm to provide legal consultancy to people, then one partner may deal with civil cases, one in criminal cases, another in labor cases, and so on as per their specialization.

Similarly, two or more doctors of different specializations may start a clinic in partnership.

Due to several representatives or partners of the firm, it is possible to develop a personal touch with employees, customers, the government, and the general public.

Healthy relations with the public help to enhance the goodwill of the firm and pave the way for the steady progress of the business.

There is nor divorce between ownership and management. Partners share in the ‘profits and losses of the firm, and there is motivation to improve the efficiency of the business.

Personal control by the partners increases the possibility of success. Unlimited liability encourages caution and care, oh the part of the partner.

Fear of unlimited liability discourages reckless and hasty action and motivates the partners to put in their best efforts.

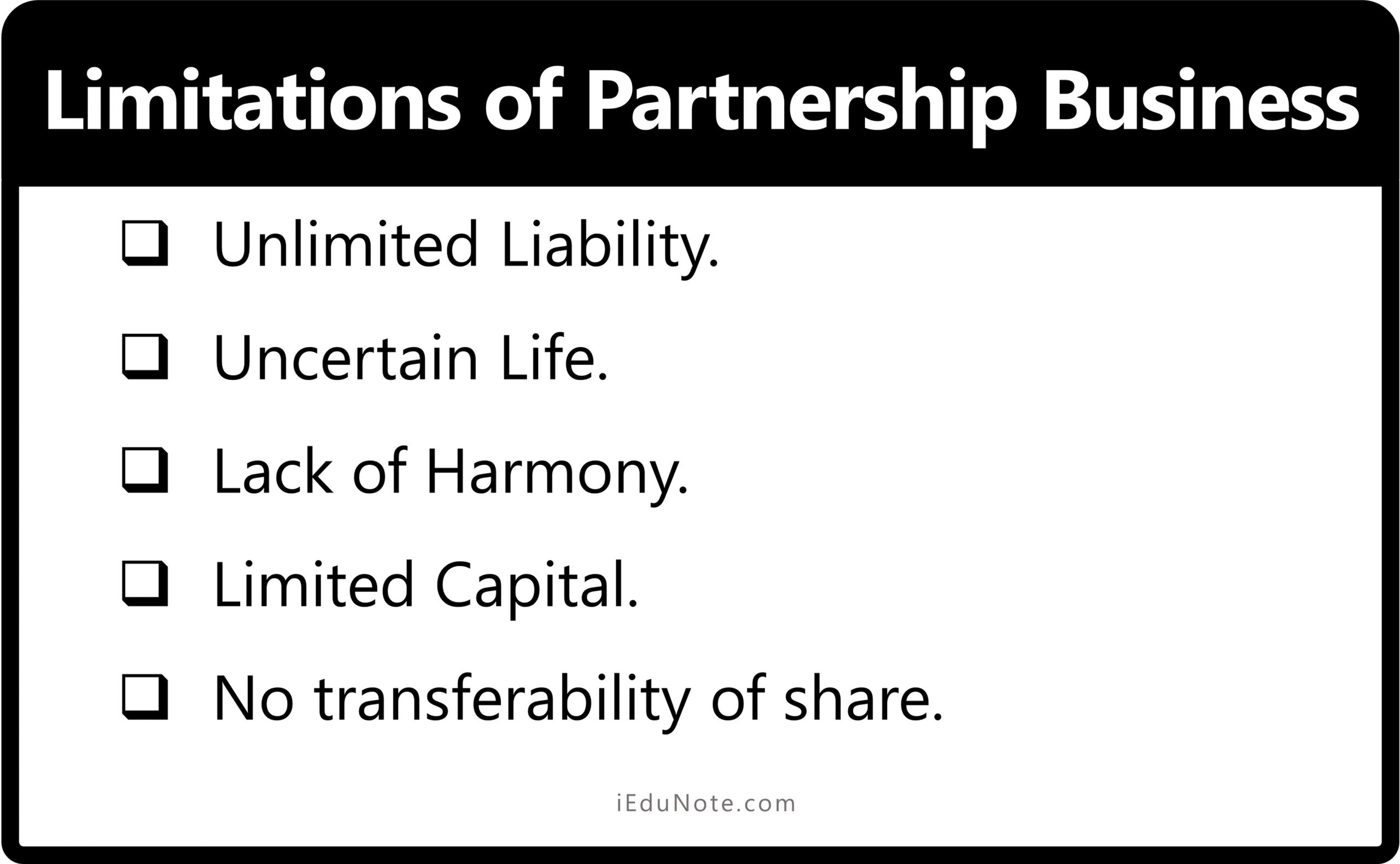

Limitations of Partnership Form of Business Organization

Despite the above advantages, there are certain drawbacks associated with the partnership form of business organization.

Let us discuss all these limitations:

Unlimited Liability

The partners are jointly as well as separately liable for the debt of the firm to an unlimited extent.

Thus, they can share the liability among themselves, or anyone can be asked to pay all the debts even from his personal properties.

In a partnership firm, the liability of parties is unlimited. Just as in proprietorship, the partners’ assets may be at risk if the business cannot pay its debts.

Uncertain Life

The partnership firm has no legal entity separate from its partners. It comes to an end with the death, insolvency, incapacity, or the retirement of any partner.

Further, any dissenting member can also give notice at any time for the dissolution of a partnership.

Lack of Harmony

You know that in a partnership firm, every partner has an equal right to participate in the management.

Also, every partner can place his or her opinion or viewpoint before the management regarding any matter at any time.

Because of this, sometimes there is a possibility of friction, and quarrel among the difference of opinion may lead to the closure of the business on many occasions.

Limited Capital

Since the total number of partners cannot exceed 20, the capital to be raised is always limited. It may not be possible to start a very large business in partnership form.

No Transferability of Share

If you are a partner in any firm, you cannot transfer your share of interest to outsiders without the consent of other partners.

This creates inconvenience for the partner who wants to leave the firm or sell part of his share to others.

Divided Authority

Each partner can discharge his responsibilities in his concerned individual area. But, in case of areas like policy formulation for the whole enterprise, there are chances for conflicts between the partners

Disagreements between the partners over enterprise matters have destroyed many a partnership.

Risk of Implied Authority

Each partner is an agent for the partnership business. Hence the decisions made by him hind all the partners.

At times, an incompetent partner may lend the firm into difficulties by making wrong decisions.

The risk involved in decisions taken by one partner is to be borne by another partner also. Choosing a business partner is, therefore, much like choosing a married male life partner.

Lack of Continuity

Death or withdrawal of one partner causes the partnership to end. So, there remains uncertainty in the continuity of partnership.

Non-transferability of Interest

No partner can transfer his/her share in the firm io an outsider without the unanimous consent of all the partners.

This makes an investment in a partnership firm non-liquid and fixed. An individual capital is blocked.

Public distrust

A partnership firm lacks the confidence of the public because it is not subject to detailed rules and regulations. Lack of publicity of its affairs undermines public confidence in the firm.

Dissolution of A Partnership

The dissolution of a partnership firm merely involves a change in the relationship of partners, whereas the dissolution of the firm results in the complete closure of the business.

If any partner dies, retires, or becomes insolvent, but the remaining partners agree to continue the business of the partnership firm, it is considered a dissolution of the partnership and not the dissolution of the firm.

Dissolution of the partnership alters the mutual relations of the partners, whereas the dissolution of the firm terminates all relations and the firm’s business.

Upon the dissolution of the firm, the business ceases to exist as its affairs are wound up by selling assets, settling liabilities, and fulfilling partners’ claims. The dissolution of the firm refers to the dissolution of the partnership among all partners of a firm.

Conclusion

A partnership is a gathering of people who have agreed, via a deed, to do business and share the profit and responsibilities.

Sole proprietorship form of business organization has certain limitations. Its financial and managerial resources are limited.

It is also not possible to expand business activities beyond a certain limit. To overcome these drawbacks, another form, i.e., a partnership form of business, has come into existence.

A partnership is a relationship between two or more persons who have agreed to share the profits of a business carried on by all or any of them acting for all another way. A partnership is an association of persons carrying on business to make a profit.

Source

Provided by iedunote: https://www.iedunote.com/