Small or large companies maintain 2 types of Petty Cash Book for all cash transactions of a business. Two types of Petty Cash Book maintained by small or large companies for easy, quick and accurate recording of all cash transactions.

It depends on the nature, volume and necessity of transactions of a business organization. Cash transactions might be of cash or cheque.

What is Petty Cash Book?

The number of daily petty expenses of large business organizations such as paper, ink, conveyance, stamp expense, etc. is so large that if these are recorded in the cash book, it creates wastage of time of the head cashier and makes the cash book unnecessarily voluminous.

To save the valuable time of the head cashier, to enable him to work comfortably and to avoid making the cash book unnecessarily voluminous petty cash system is introduced.

Petty expenses are recorded in petty cash book in chronological order of dates instead of the cash book. The employee, who keeps the petty cash book, is called petty cashier.

A petty cashier receives a fixed amount of money from the head cashier with which he meets petty expenses of a certain period and records in chronological order of dates in the petty cash book.

So, the book, wherein day to day petty expenses for a particular period of a business concern, are recorded in chronological order of dates is called petty cash book.

Types of Petty Cash Book

Petty cash book is of two types:

- Columnar petty cash book, and

- Imprest petty cash book.

Columnar Petty Cash Book and its Preparation Process

Columnar petty cash book contains many money columns to record day to day expenditures. It has two sides – the debit side and the credit side.

Particulars of cash receipts and expenses are written together in a single column known as particulars column and another column is used for writing dates of both debit and credit.

In the debit money column, the amount of cash received from the head cashier is written.

The credit side contains many money columns as per requirement for recording expenses and the expenses are recorded in a classified way in chronological order of dates.

To ascertain the total amount of money spent the total money column is used on the credit side for recording all expenses.

Money spent on purchasing assets or payment of debt is recorded in separate columns known as ledger columns. Thereafter total of money columns and the total of all expense columns of the credit side are drawn.

The difference between the amount of cash receipt and the total amount of cash payments is called balance. This balance is always a debit balance.

Therefore the primary book wherein the money received from the head cashier and the amount of expenditure for a particular period of an organization are recorded in chronological order of dates in separate money columns of both sides, is called columnar petty cash book.

Imprest Petty Cash Book

Like columnar petty cash book, it also contains many money columns in the credit side and one money column in the debit side and a particular column and a date column are also similar to that of the columnar or analytical petty cash book.

Under this imprest system of petty cash book, the head cashier provides a fixed amount of money to the petty cashier in advance for meeting expenditure of a particular period.

At the end of the period, the petty cashier submits to the head cashier a statement of expenditures incurred by him.

It should be noted that the amount of expenditure in the hands of a petty cashier cannot exceed the amount he receives.

The head cashier after proper verification of the expenditures pays an amount equal to the amount spent by the petty cashier again in advance to equalize the prefixed fund of the petty cashier.

Maintaining a cash book under the stated system is called an imprest petty cash book.

For example,

on 1st Jan. 2003 head cashier pays $500 to the petty cashier in advance. In January, the petty cashier spent $400 and submits a statement of expenditure for the spent amount to head cashier.

The head cashier pays him again $400 for meeting expenditure of February.

The petty cashier starts his petty cash book on 1st February with a cash balance of $500.

In this way, at the beginning of every month, the petty cashier will possess $500 as an imprest fund to meet up day to day expenditures.

7 Advantages of Imprest Petty Cash Book

Time wastage minimization under this columnar imprest petty cash book petty expenses are not needed to be posted in the relevant ledger account again and again.

At the end of a period totals of all heads of petty expenses are transferred to a relevant ledger account. This process saves the valuable time of the cashier.

- Labor minimization.

- Control over petty expenses.

- Verification of arithmetical accuracy of petty expenses.

- Opportunity for the petty cashier to work comfortably.

- Determination of expenses.

- Fixed imprest fund.

- Prevention of misappropriation.

1. Labor minimization

Under the imprest petty cash system as the totals of different heads of expenditures are posted in ledger accounts after a certain period, the workload of a cashier is minimized to a great extent.

2. Control over petty expenses

Under imprest, petty cash book system petty cashier submits a statement of expenditure to the head cashier at an interval of a certain period and thereafter receives funds from him for further expenses.

The head cashier before funding again examines the previous expenses. Thereby the possibility of fraud and forgery is removed and there remains control over expenses.

3. Verification of arithmetical accuracy of petty expenses

Under imprest, petty cash book system petty expenses are recorded in chronological order of dates. After a certain period, the amount of total expenses is sorted out and the amount of every head of expenditure is totaled separately.

The total of expenses recorded in various columns is equal to the total of expenses of total columns which proves that recording of expenses is arithmetically correct.

4. Opportunity for the petty cashier to work comfortably

As the petty cashier does not collect cash, he can pay more attention to the expenses incurred and their proper recording.

5. Determination of expenses

Under this system, it is possible to ascertain and know the number of expenses of the same nature of each column separately for a particular period.

6. Fixed imprest fund

The head cashier remains always aware of the cash given to the petty cashier under this system. The head cashier does not have any problem to know the exact cash of the petty cashier as a fixed amount of cash always lies with the petty cashier.

In it, the head cashier can comfortably close accounts.

7. Prevention of misappropriation

Under this system, it is almost impossible on the part of the petty cashier to misappropriate the fund because the head cashier does have full control over the petty cashier.

3 Stages of Operating Petty Cash Fund

As per the principle of cash payment, all payments are to be made by cheque. In the case of payment of petty cash, this basic principle of payment by cheque is not followed.

Every business organization is to pay cash for various day-to-day petty expenses such as a pencil, rubber, paper, ink, pen, conveyance, telephone, postal stamp, revenue stamp, etc.

The payment of these expenses by cheque is not practicable.

Moreover, it creates complexities. If these payments are made by cheques, a huge number of cheques are to be issued every day for petty payment which is time-consuming and expensive.

In some cases, the amount of expenditure is so small that issuing a cheque for it is quite inconvenient and unnecessary.

So for making payment of petty expenses a petty cash fund is created as an alternative to the issue of cheques from where cash payment is made. Operating petty cash funds is very often termed as an imprest system.

Operating petty cash fund contains there stages;

- Fund creation.

- Making payments from funds.

- Replenishing the fund.

1. Establishing Fund

Two necessary steps for establishing petty cash funds are;

- an appointment of a petty cashier who will work as a custodian of this fund, and

- determining the necessary amount of funds. Normally a fund is created to meet daily petty expenses for a maximum of four weeks.

For this purpose, a cheque is given to the petty cashier for a definite sum of money by the company.

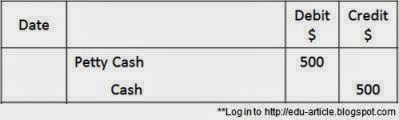

Assuming iEduNote Company decides to establish a petty cash fund for $500 on 1st July. On the same date, a cheque is handed over to the petty cashier.

The General Journal entry for this is;

Petty cashier encashes the cheque and keeps this money in a box under lock and key termed as a petty cash box.

A petty cash fund is created for a definite amount of money. If any alteration of established petty cash fund is not required, the new journal entry is not needed.

For example, the iEduNote company decided to increase the petty cash fund from $500 to 700. For this change, the general new journal entry is the same as above.

2. Making payments from funds

The petty cashier is empowered by the management to spend money from this fund as per the specified rules of the company.

Generally, management fixes up the maximum limit of expenditure by the petty cashier at a time for a particular head of expenditure.

Similarly, payment is restricted out of this fund for some heads of expenditure such as payment of the short-term loan to employees.

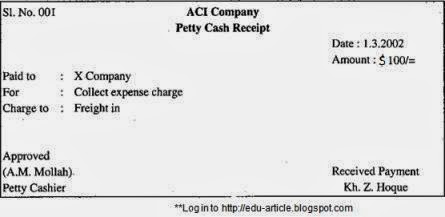

The petty cashier is to use a printed payment receipt containing a serial number for cash head of expenditure.

Every petty cash voucher/receipt is to be signed by the petty cashier and the recipient. Petty cash record is maintained with these receipts/vouchers. These receipts are preserved in the petty cash box.

Specimen form of a petty cash receipt;

Petty Cash fund reduces for every petty cash receipt kept in the petty cash box.

When petty cash fund is almost exhausted due to the increase in many petty cash receipts, the fund is replenished with an equal amount of money spent.

A neutral person is engaged to check whether the petty cashier uses the petty cash properly.

That person must be an internal auditor. Journal entry is not required for a cash payment of transactions from a petty cash fund.

If any entry is passed for this, it would be treated as unnecessary work. Instead, at the time of replenishing the fund, every expenditure is taken into consideration.

3. Replenishing the fund

When a petty cash fund comes down to a minimum limit, it is replenished for the spent money. In such cases, the petty cashier is to furnish a requisition for the new fund.

The petty cashier prepares a statement of petty cash expenditure and sends it along with all petty cash receipts to the cash department.

The general cashier, after proper checking and verifications of the petty expenditures, sends a cheque for the spent amount for meeting petty expenditures for the next period.

The general cashier puts a rubber stamp ‘payment made’ on the deposited petty cash payment receipt to stop their reuse.