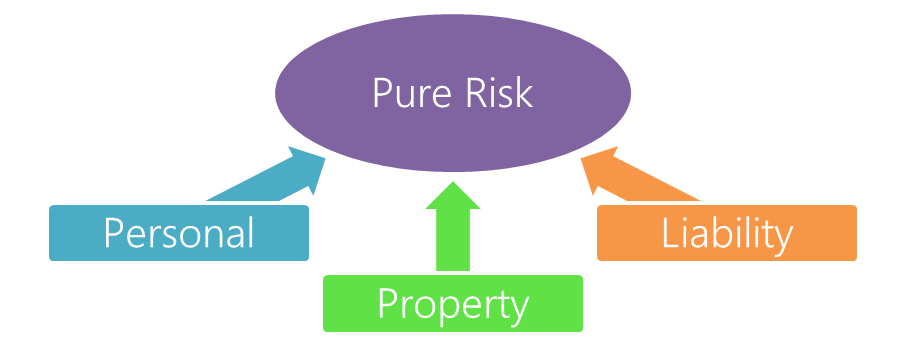

Pure risks are types of risk where no profit is possible, and only full loss, partial loss, or break-even situations are probable outcomes. Types of pure risks are;

- personal risks,

- property risks, and

- liability risks

Pure risks are types of risk where no profit or gain is possible, and only full loss, partial loss, or break-even situations are probable outcomes. There are three types of pure risk.

The result is always unfavorable, or maybe the same situation (as existed before the event) has remained without giving birth to a profit (or loss). Pure risk is a situation that holds out only the possibility of loss or no loss or no loss.

For example, if you buy a new Samsung Note 7, you face the prospect of the book being stolen or not being stolen and no profit from this situation.

There is only the prospect of loss or no loss and no prospect of gain or profit under pure risk.

So, Pure risks are those risks where the outcome shall result in loss only or, at best, a break-even situation. We cannot think about a gain-gain situation.

Types of Pure Risks are;

- Personal risks.

- Property risks.

- Liability risks

Since pure risks are generally insurable, the discussion on risk is skewed towards pure risks only.

Personal Risks

These are the risks that directly affect the individual’s capability to earn income. Personal risks can be classified into the following types:

- Premature Death: Death of the bread earner with unfulfilled or unprovided financial obligations.

- Old Age: It refers to the risk of not having sufficient income at the age of retirement or the age becoming so that mere is a possibility that the individual may not be able to earn a livelihood.

- Sickness or Disability: The risk of poor health or disability of a person to earn the means of survival, the possibility of damage to the limbs of a driver due to an accident.

- Unemployment: The risk of unemployment due to socio-economic factors resulting in financial insecurity.

2. Property Risks

These are the risks to the persons in possession of the property being damaged or lost. The immovable land and building are damaged due to flood, earthquake, or fire, and the movable, like appliances and personal assets, is destroyed due to fire or stolen.

The losses may be direct or indirect/consequential. A direct loss implies the visible financial loss to the property due to mishappenings.

Whereas the indirect ones are the losses arising from the occurrence of an incident resulting in direct/physical damages or loss.

The loss to crops due to flood is a direct loss – the destruction of the growing power is a consequential one.

3. Liability Risks

These are the risks arising out of the intentional or unintentional injury to the persons or damages to their properties through negligence or carelessness.

Liability risks generally arise from the law. e.g. liability of the employer under the workmen’s compensation law or other labor laws in India.

In addition to the above categories, risks may also arise due to the failure of others. For example, the financial loss arising from the non-performance or standard performance in a contract, in engineering or construction contracts.

![Types of Insurance Organizations [A Comprehensive Guide] 2 Types of Insurance Organizations [A Comprehensive Guide]](https://www.iedunote.com/img/259/types-insurance-organization-e1529504882393.png)