In simple words, the Subrogation Principle in Insurance means; when the insurer (insurance company) pays full compensation for any insured loss (of insured property), the insurer (insurance company) holds the legal right (claim) of the insured property.

This also means the insurer (insurance company) has the legal right to claim any future gains from the said property for any recovery and/or settlement.

Subrogation is a right that a person has of standing in the place of another and availing himself of all the rights and remedies of that another, whether already enforced or not.

In insurance, after payment of a claim, the insurers shall be entitled to take over the legal right of the insured against the liable third party for recovery.

Everybody is entitled to live peacefully and if this peace is disturbed by the wrongdoer of another, then the person who has been subjected to this wrong has a legal right of action against the wrongdoer.

Here comes up the proposition that if the damage sustained by the wronged is also covered by an insurance policy, he gives up his right of recovery against the wrongdoer in favor of his insurers after getting the claim from insurers.

Insurers then directly proceed against the liable third party and recover the loss or damage for their benefit.

An example will make this position clear. Let us assume that A’ had been to New Market driving his car. After parking the car somewhere in front of the market, he went inside, did some shopping, came back, and found that ‘B’ was damaging the car.

In law, ‘A’ has a legal right of action against ‘B’ for damages. Incidentally, A’ may also have comprehensive motor insurance, which protects him against such losses.

Here ‘A’ has open to him two avenues of recovery, and the principle of subrogation asserts that if the insurers pay the full loss, then they (insurers) shall take over the right of ‘A’ (insured) for proceeding against B (third party) for their own (insurers) benefit. In reality, various other propositions may be thought about.

A carrier is primarily liable for the safe delivery of the goods as per the contract of affreightment. A bailee is primarily liable as per the contract of bailment. Such goods may also be covered by insurance policies where the insurer’s liability is secondary.

Here, even though the insurers would make payments in respect of a loss, nevertheless, they would be entitled to, or subrogated to, the right of the insured against the negligent or liable carrier or bailee. “If an insured has a means of diminishing the loss, the result of the use of these means belongs to the insurers.”(CASTELLAIN V. PRESTON, 1883)

A very prominent question that crops up in our mind is why the insured shall not be entitled to recover from both sources. Why shall he have to give up his right in favor of and for the benefit of the insurers?

It has to be borne in mind that the principle of indemnity prevents the insured from getting more than the actual amount of loss. As a result of a loss, a person certainly cannot benefit or make a profit.

Moreover, under the principle of indemnity, it has been well asserted and established that after a loss, the insured should get the actual amount of loss, neither more nor less.

If this principle is to be maintained and preserved from any possible threat or defect, then it has to be ensured that all possible flaws are properly guarded, and loopholes are properly blocked.

The principle of subrogation is a method whereby the possibility of getting more than the actual amount of loss from various sources, thereby infringing the principle of indemnity, is defeated.

Therefore, it is also very correctly said that the principle of subrogation is indeed a corollary to the principle of indemnity, it has its birth from the principle of indemnity, and it has its existence to preserve the principle of indemnity.

It should be borne in mind and appreciated that as the principle of subrogation is a corollary to the principle of indemnity, therefore, it applies only to those insurance contracts which are contracts of indemnity.

As such, it must be understood that subrogation does not apply to life insurance and personal accident insurance contracts, as these are not contracts of indemnity.

How This Right of Subrogation Arises

As already indicated, the right of subrogation arises in the following ways:

Under tort

This is a wrongdoing to another. In other words, it is a breach of duty owed to a third party. A person cannot do wrong to another, causing damage to another’s property or inflicting injury on that person.

If it is so done, then a right of action accrues in favor of the wronged and to the detriment of the wrong-doer.

Under contract

A contract may put some obligation on the person making a breach of the contract to compensate the person who has been aggrieved as a result of the breach.

For example, an obligation under the contract of affreightment and contract of bailment, etc.

Under Statute

Statutes may also create liability for making compensation arising out of a breach thereof. Examples are the Factories Act. Occupiers Liability Act. The Riot Act, Carriage of Goods by Sea Act, etc.

Application of Subrogation in Claims

It has already been explained how subrogation arises and how this goes to the benefit of insurers. In so far as the application of subrogation in claims is concerned, certain considerations must be properly grasped, and these are as follows;

When Subrogation Arises

The position is different about common law and contractual terms and conditions. Under common law, the position is that the insurers must pay the claim first before the right of subrogation can be exercised.

In other words, the insurers cannot go against the third party for recovery unless they (insurers) have made payments to the insured. This position may, however, be varied using policy terms and conditions.

In non-marine policies, there is usually a policy condition known as subrogation condition, whereby the insurers may require the insured to recover (or take all steps of recovery) against the liable third party first at the insurer’s cost and expenses.

This modifies the common law position.

In marine insurance, however, the right of subrogation arises only after making payment by insurers as it is not customary ( and most unusual ) to incorporate any policy condition as such to modify the Common law position.

Extent of Subrogation

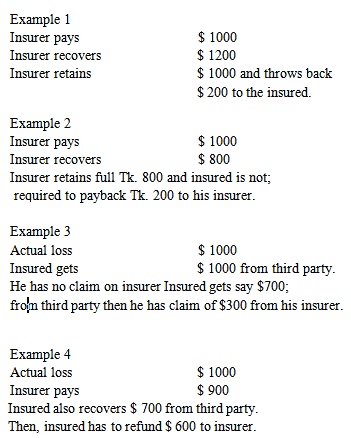

Under the right of subrogation, the insurers are only entitled to benefit to the extent of payment made.

Therefore, if the insurers recover more than the amount paid out, they are entitled to retain from the recovery only to the extent of the payment they made to the insured.

The balance amount must be refunded to the insured. If the recovery is less than the amount of the claim paid out to the insured, there is no question of realizing balance money from the insured.

If the insured already recovers from the third party and if that is a full indemnity, he has no claim against his insurer.

If he has also received payment from the insurer, he must refund the payment received from his insurer.

Suppose the amount received from the third party does not represent full indemnity. In that case, he is entitled to claim only the balance from his insurers so that both payments together would constitute one full indemnity only.

The idea is that as a result of a loss, the insured cannot get more than actual indemnity even though he may have several avenues open to him for recovery.

If the insured realizes from both insurer and a third party, then the (insured) retains only to the extent of full indemnity and returns the balance to the insurer subject to the limit of the insurer’s payment

Exgratia Payments

Although not legally liable, insurers do sometimes make payments under their policies as a matter of grace or favor.

Maybe, there have been minor breaches of policy terms for which the insurers could easily repudiate the claim.

But considering the commercial aspect and minor nature of the breach, the insurers may not be that strict and will be willing to make some payment (whether in full or not) without admitting liability under the policy.

Such payments are known as exgratia payments and never create precedence to give a right of claim to the insured in similar other cases.

It should be remembered that when exgratia payments are made, insurers are not subrogated to the right of the insured. This is because payments are not made by admitting liability.

When, however, one insurer makes a normal payment, and the insured gets an exgratia payment from another insurer also, then the former insurer shall stand subrogated to the exgratia money received from the latter insurer even though this money has not been received as a matter of legal right under that policy.

In connection with the study of subrogation, the students must understand the implication of “Salvage” and “Abandonment” as these do have a bearing on subrogation rights.

Salvage

This usually refers to the remains of the property after a loss. Normally, due to a loss, the whole property is not lost, damaged, or destroyed. Mostly, there remains some value in the damaged property, or maybe it is a case of partial loss when the question of salvage becomes more prominent.

The rule is that when it is a case of a partial loss, the insured can only claim to the extent of the loss or damage sustained.

He cannot normally abandon the property and claim the full. The situation may be different only if the insured surrenders the remains of the property and the insurer also agrees to accept the salvage.

In such a situation, the claim shall be paid in full, and the insurer shall become the owner of the salvage. In cases of clear-cut total losses, the insurers will pay in full and, therefore, shall be entitled to the benefit of the salvage.

Confusion may arise regarding the ownership of salvage in circumstances when under-insurance exists and there is a total loss.

As the insured will not be fully indemnified, he shall be entitled to salvage, but only to such an extent that the loss payment and the value of salvage together do not exceed the full loss or actual indemnity.

It should also be remembered side by side that when full insurance exists (i.e., no under-insurance) and the loss is paid in full, the insurers become the absolute owners of the salvage, if any, and the total sale proceeds belong to them even though the proceeding may turn up to be more than the amount of the claim paid out.

Abandonment

Abandonment usually means surrendering by the insured the remains of the damaged property to the insurer and claiming the total loss.

It is not peculiar to marine, as in marine insurance practice, the assured has the right to abandon the property (subject to the acceptance by the insurer), thereby claiming a constructive total loss.

Therefore, when the insurer pays a total loss, he takes over the salvage as owner. He becomes the absolute owner irrespective of what value is received from the subsequent sale.

The comments made in the English Court judgment of Kaltenbach V. Mackenzie (1878) are important in this regard, which goes on to say “that abandonment is not peculiar to policies of marine insurance; abandonment is part of every contract of indemnity.

Whenever there is a contract of indemnity and a claim under it for an absolute indemnity, there must be abandonment on the part of the person claiming indemnity of all his right in respect of that for which he receives indemnity”.

The situation is different concerning most of the non-marine policies. Usually, there is a policy condition in such policies prohibiting abandonment by the insured and claiming the total loss.

However, the insurers may waive this condition in appropriate circumstances on merit.

The Doctrine of Subrogation in Marine Insurance

The aim of the doctrine of subrogation is that the insured should not get more than the actual loss or damage.

After payment of the loss, the insurer gets the light to receive compensation or any sum from the third party from whom the assured is legally liable to get the amount of compensation.

The main characteristics of subrogation are as follows:

- The insurer subrogates all the remedies, fights, and liabilities of the insured and alters the payment of the compensation.

- The insurer has the right to pay the amount of loss after reducing the sum received by the insured from the third party. But in marine insurance, the right of subrogation arises only after payment has been made, and it is not customary, as in fire and accident insurance, to alter this using a condition to provide for the exercise of subrogation rights before payment of a claim. At the same time, the right of subrogation must be distinguished from abandonment. If the property is abandoned to a marine insurer, he is entitled to whatever remains of the property, irrespective of the value of subrogation.

- After indemnification, the insurer gets all the rights of the insured on the third parties, but the insurer cannot file suit in his name. Therefore, the insured must assist the insurer in receiving money from the third party. If the insured is revoked from filing suit against the third party, the insurer can receive the amount of compensation from the insured. It is a corollary of principle indemnity.