A subsidiary ledger is an addition of a general ledger used to record each account’s receivables and accounts payable separately.

In a business concern where thousands of customers and credit sales transactions are recorded under the heading “Accounts Receivable” in the general ledger, it becomes almost impossible to know how much is receivable from an individual buyer.

It becomes complex to quickly ascertain the amount owed to a customer if accounts payable is kept in general ledger.

In lieu of this system subsidiary ledgers are maintained to know amount receivable from an individual debtor and the amount payable to an individual creditor.

A group of accounts of same nature is called a subsidiary ledger.

For example, individual accounts receivable fall under the accounts receivable subsidiary ledger.

Where subsidiary ledgers are maintained, the individual accounts relating to accounts receivable and accounts payable are not kept in detail in general ledger.

A subsidiary ledger is an addition to an expansion of the general ledger.

Two common subsidiary ledgers:

- Accounts receivable subsidiary ledger where data relating to individual buyers are kept.

- Accounts payable subsidiary ledger is due where data relating to individual creditors are kept.

In subsidiary ledgers, individual ledger accounts are maintained in alphabetical order. Detail data of subsidiary ledger are accounted for in the general ledger in brief.

As for example, detailed data of accounts receivable subsidiary ledger are transferred to accounts receivable briefly in general ledger.

The general ledger accounts where detailed data of subsidiary ledgers are recorded briefly are called control accounts.

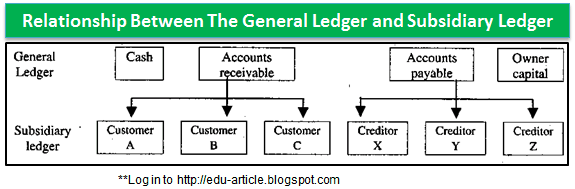

The relationship between the general ledger and subsidiary ledger is shown below through a chart.

At the end of an accounting period, the balance of every control accounts of general ledger becomes equal to the total of balances of individual accounts of the related subsidiary ledger.

For example, as shown above, the balance of accounts payable or general ledger will be equal to the total of balances of individual accounts – X, Y and Z of the accounts payable subsidiary ledger.

Example: The relationship existing between the general ledger and subsidiary ledger is shown below with hypothetical information.

A

| Date | Account Title | Ref. | Debit | Credit | Balance |

| 2002 | $ | $ | $ | ||

| Jan. 2 | Sales | 6,000 | 6,000 | ||

| Jan. 19 | Cash | 4,000 | 2,000 |

B

| Date | Account Title | Ref. | Debit | Credit | Balance |

| 2002 | $ | $ | $ | ||

| Jan. 12 | Sales | 3,000 | 3,000 | ||

| Jan. 21 | Cash | 3,000 | Nil |

C

| Date | Account Title | Ref. | Debit | Credit | Balance |

| 2002 | $ | $ | $ | ||

| Jan. 20 | Sales | 3,000 | 3,000 | ||

| Jan. 31 | Cash | 1,000 | 2,000 |

General Ledger

Accounts receivable

| Date | Account Title | Ref. | Debit | Credit | Balance |

| 2002 | $ | $ | $ | ||

| Jan. 31 | Sales | 12,000 | 12,000 | ||

| 31 | Cash | 8,000 | 4,000 |

The balance of accounts receivable $4,000 of the general ledger is equal to the total balance $4,000 of individual ledger accounts of the subsidiary ledger.

Balances of control accounts of a general ledger are equal to the total of balances of individual ledger accounts concerned.

For example, account receivable $4,000 and balances of individual accounts (A – $2,000 + C – $2,000) $4,000 as shown in the above example are equal.

If financial statements are prepared monthly, the balances of control accounts of the general ledger are ascertained at the end of the month. In the subsidiary ledger, postings are given daily in the individual subsidiary ledger accounts, and balances are ascertained daily.

Balances of subsidiary account remain up-to-date as the postings are given daily. It helps in knowing receivable – payable, bill payment and realization and satisfying quarries of customers.

The advantage of Subsidiary Ledger

Advantages of the subsidiary ledger are discussed below:

- Since transactions relating to a creditor or a customer are shown in a particular account the balances remain up-to-date.

- General ledger remains free from much too expansion and as a result, the number of personal accounts remains limited to the trial balance prepared from the general ledger.

- Use of control accounts and a limited number of accounts in the ledger help in detecting errors and frauds easily.

- One person is entrusted with the responsibility of maintaining one ledger. Thereby he remains always aware of his assigned duties and responsibilities, and this minimizes errors and increases efficiency.

- Since the ledger is divided into many parts, their sizes remain small, which helps the easy movement of the ledger books.