Trial balance errors are errors in the accounting process that cannot be detected by the trial balance sheet. 2 types of limitations of trial balance are clerical errors, and errors of principles. Clerical errors are made by a human. Errors of principle happen when an accounting principle is not applied.

Limitations of trial balance are the errors in the accounting process that cannot be detected by the trial balance sheet.

These types of errors are divided into 2 groups; clerical errors, and errors of principles.

There are 4 types of clerical errors: errors that are made by a human. And errors of principle indicates error because a principle of accounting is not applied properly.

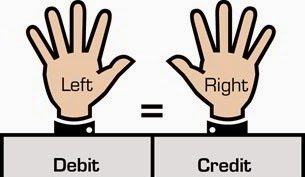

If the totals of debit and credit money columns of trial balance are the same it is presumed that the accounting process is accurate.

But the agreement of both debit and credit money columns of the trial balance does not necessarily prove that there is no error in the accounting process.

Because there might have some undetected errors despite the agreement of trial balances. These are called the limitations of trial balance.

The undetected errors of this type are generally divided into two groups:

- Clerical errors, and

- Errors of principles.

Clerical Errors in Trial Balance

The errors occurred due to the negligence of the employees of the accounts department are clerical errors. These errors are of four types.

- Errors or omissions,

- Errors of commission,

- Errors of misposting, and

- Compensating errors.

They are described below;

1. Errors of omissions

If any transaction is omitted from being recorded in a journal and ledger, it is called the error or omission.

For example, goods purchased from Karin $5,000. If this transaction is not accounted for, still then the trial balance may agree. Because an equal sum of money has been omitted from records of debit and credit accounts.

2. Errors of commissions

Recording incorrect figures in a journal and posting the same amount in the correct sides of ledger accounts is called errors of commission and this does not hamper the agreement of trial balance.

For example,

merchandise purchase $ 1,100 but recorded $ 1,000 both in journal and ledger.

3. Errors of misposting

Posting of an entry from journal to ledger inadvertently in the correct side of the wrong account is called misposting. This type of misposting creates no hindrance in equalizing totals of debit and credit column of trial balance.

4. Compensating errors

If a short or excess amount is posted on one side of an account and if the equal sum of short or excess amount is posted on another side of another account, it is called compensating errors.

This is called so because the wrong posting of one account is compensated by the wrong posting of the same amount in another account and this does not hamper equalizing totals of trial balance.

For example,

Abu account is debited to $400 wrongly instead of $500. On the other hand, Subo account is credited by $800 instead of $900.

As a result $100 short has been written on both sides of accounts and thereby agreement of trial balance is not hampered.

But actually, there lie mistakes in the accounts.

Errors of Principle in Trial Balance

If a revenue expense is recorded as a capital expenditure or vice-versa it is called the error of principle.

For example, the installation cost of a new machine is accounted for by debiting the wage expense account instead of debiting the machinery account.

Causes of Disagreement of Trial Balance

The causes for which totals of both sides of the trial balance disagree are as follows:

- The omission of account from posting in the ledger inadvertently.

- Posting from journal to ledger in the wrong account.

- One account out of two accounts of the transaction is accounted for.

- Recording twice in a particular account of a transaction inadvertently.

- Recording wrong amount i.e. short or excess amount in the ledger accounts at the time of posting from journal to ledger.

- Committing mistakes in balancing a ledger account.

- Committing mistakes in recording the amount of ledger balance in the trial balance.

- Committing mistake in writing ledger balances in the trial balance i.e. debit balance in the credit money column or credit balance in the debit money column.

- Committing mistake in casting totals of debit and credit money columns of trial balance.

The procedure of rectifying an incorrect trial balance

If the totals of both side money columns are not equal, it is to be presumed that there are some mistakes in the accounting process.

The reasons for disagreement are to defect.

For this purpose, the following measures are to be adapted to detect errors and frauds.

- At the outside casting of the trial, balance is to be checked carefully.

- Thereafter, it is to be ensured that all ledger accounts have been posted in the trial balance properly.

- It is to be ensured that all the transactions have properly been posted from journal to ledger.

- Calculation of totals of ledger accounts and balancing of ledger accounts are to be checked properly.

- Verification of correct posting of debit and credit ledger balances is needed.

- It is to be checked that totals of cash and bank account and balancing and inclusion of these balances in trial balance have been made properly.

- It is to be checked that casting of purchase journal, sales journal and other subsidiary journals are correct and these are posted in the ledger accounts properly.

- The current trial balance is to be compared with the past one.

- It is to be observed that the totals of accounts receivable and accounts payable and recorded amount of the same accounts in trial balance are the same.

Rectification of Trial Balance Errors

Correction of errors in accounting by erasing contradicts the accounting principles.

Errors are to be corrected by passing appropriate journal entry or bringing correction in the ledger account concerned complying with the accounting principle.

But rectification of errors depends on the stages errors detected.

There is a proverb in English ‘To err is human’ i.e. it is the man who commits a mistake. A man commits mistake it is natural, mistakes may occur in keeping accounts.

An accountant may amount mistake in keeping accounts of transactions inadvertently or due to a lack of proper knowledge.

The trial balance is the only way to detect errors of accounts if any. But errors may remain in accounts even after the agreement of the trial balance. Rectification of errors of accounts if any is indispensable.

Errors not affecting the agreement of a trial balance

The errors mentioned below do not hamper the agreement of a trial balance. Despite the following errors in accounts, the totals of the debit money column and credit money column agree.

1. Errors of omission

The omission of recording a particular transaction does not hamper the agreement of the trial balance.

For Example:

Goods purchased on account of $1000. If this transaction is not recorded in the books of account the agreement of a trial balance remains unaffected.

2. Error of Commission

The amount written in the journal for a particular transaction may be greater or smaller in the ledger accounts and the debtor is treated as creditor and creditor as a debtor, such types of mistakes are called errors of commission.

For Example:

Goods sold on account $531 to Karim.

For this transaction, if an account receivable is debited $513 and sales account is credited for $513. Although both the accounts are undercast by $18, the agreement of trial balance will not be hampered for this mistake.

3. Compensating Errors

This error is called the self-rectifying error. An error rectified by one or more errors is called compensating error.

For Example:

Salary expense is under debited by $100 but the general expense is over debited by $100.

4. Errors of Principle

In maintaining accounts of transactions some errors may happen due to lack of sound knowledge of accounting principles.

For Example:

Capital expenditure treated as revenue expenditure if the repairing expense of a machine is treated as the cost of machinery.

Errors affecting the agreement of a trial balance

The errors for which a trial balance disagrees are of the wider range. Generally, these are divided into three groups;

1. Errors in costing and balancing

Two sides of ledger accounts are totaled for finding outbalance; of the accounts. Errors committed to totaling lead to errors in balancing.

2. Errors in posting accounts in the ledger from the original books

These errors may happen in different ways.

For Example; while transferring from the journal if a transaction is recorded in only one account in the ledger or recorded on the wrong side of an account or wrong amount is posted in an account.

3. Errors in transferring ledger balance to a trial balance

The trial balance disagrees if ledger account balances are not correctly transferred. From the viewpoint of effects errors-are grouped into, two:

One-sided errors

The errors, which, affect only one side of accounts, are termed one-sided errors. One-sided errors hamper the agreement of the trial balance.

Therefore, in case such an error suspense account is used to make the totals of the trial balance equal, e.g. if debit money column is short-fall the suspense account be used for that shortage and vice-versa.

Double-sided errors

The errors which affect both debit and credit are termed double-sided errors. If the errors affect the debit and credit for an equal amount of money, the trial balance agrees.

But if the errors affect debit and credit for the dissimilar amount, the trial balance disagrees. In such a case, a suspense account is used for an agreement of the trial balance.