To increase the volume of deposits, banks undertake different types of strategies. The deposit management process is becoming very much competitive. Banks are now engaged in inventing newer types of deposit schemes to attract more deposits than their competitors.

There are variations in the needs and demands of the people. It is almost impossible for banks to satisfy all these diverse demands with a single type of account. That’s why banks generally offer the following types of accounts to satisfy customers’ demands. Commercial banks have introduced newer types of products over the years to collect more deposits.

3 Main Types of Bank Deposit Accounts

- Current Account.

- Savings Account

- Term or Fixed Deposit Account

13 Types of Bank Deposit Accounts

Besides these three types of accounts, banks may also offer the following types of accounts:

- Current Account.

- Savings Account

- Term or Fixed Deposit Account

- Home Savings Account

- School Savings Account

- Women’s Savings Account

- Laborers’ Savings Account

- Insurance Savings Account

- Foreign Exchange Savings Account

- Post Office Savings Account

- Deposit Pension Scheme Account

- Loan Deposit Account

- Recurring/ Repeated Deposit Account on maturity

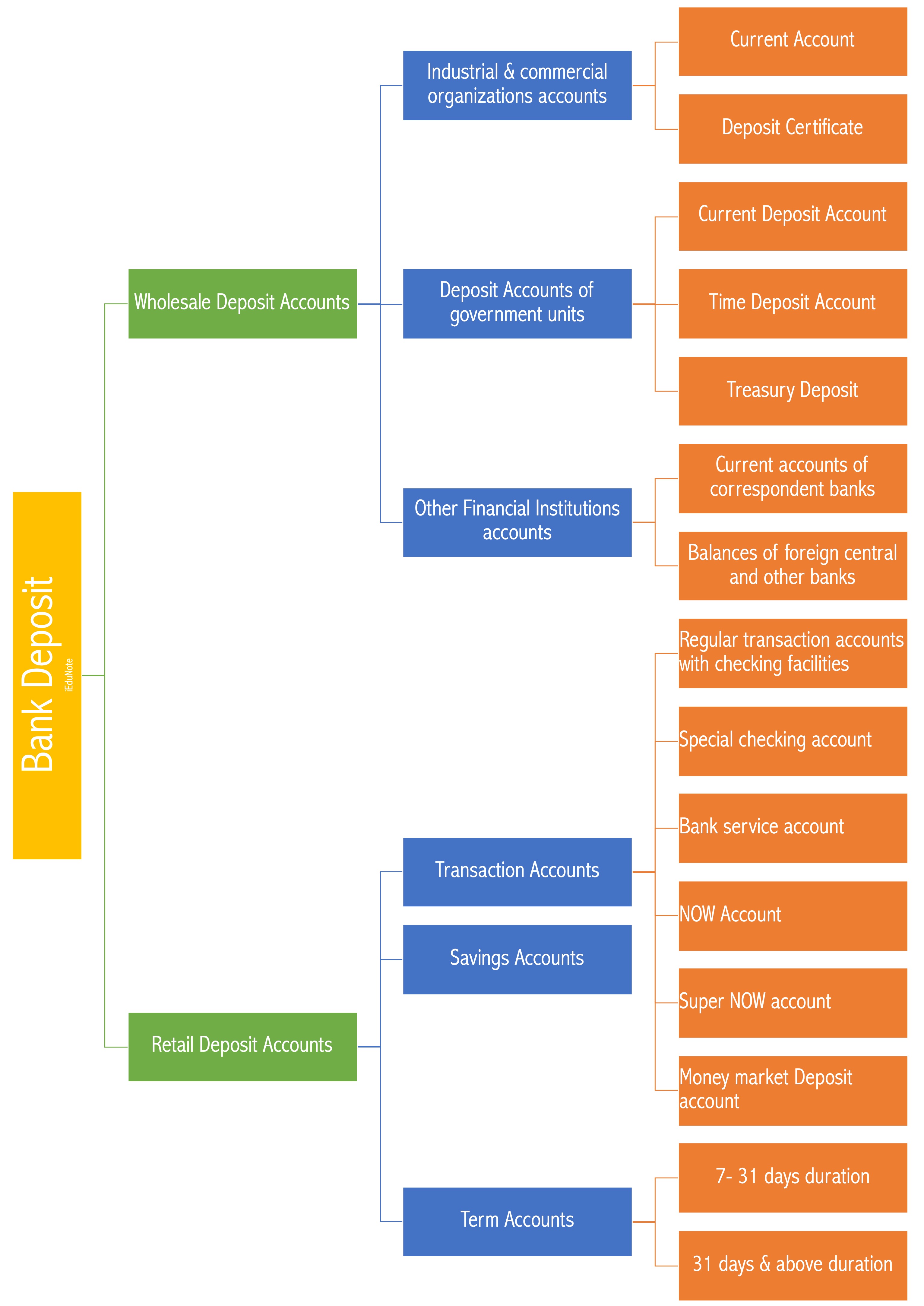

Types of Deposit Accounts in the Western Countries

USA, Canada. Australia and other western countries have different types of deposit accounts according to the various needs of depositors. These deposit accounts can be divided into two types according to the types and characteristics of the depositors:

- Wholesale Deposit Accounts

- Retail Deposit Accounts

These two types of deposit accounts can be hinted at below:

1. Wholesale Deposit Accounts

Institutional deposit clients mainly open this type of deposit account. For example, deposits are kept in commercial organizations, government organizations, financial institutions, etc.

2. Retail Deposit Accounts

This type of deposit account includes deposits from members of the general public society. From the following chart, we can understand the types of wholesale and retail accounts.

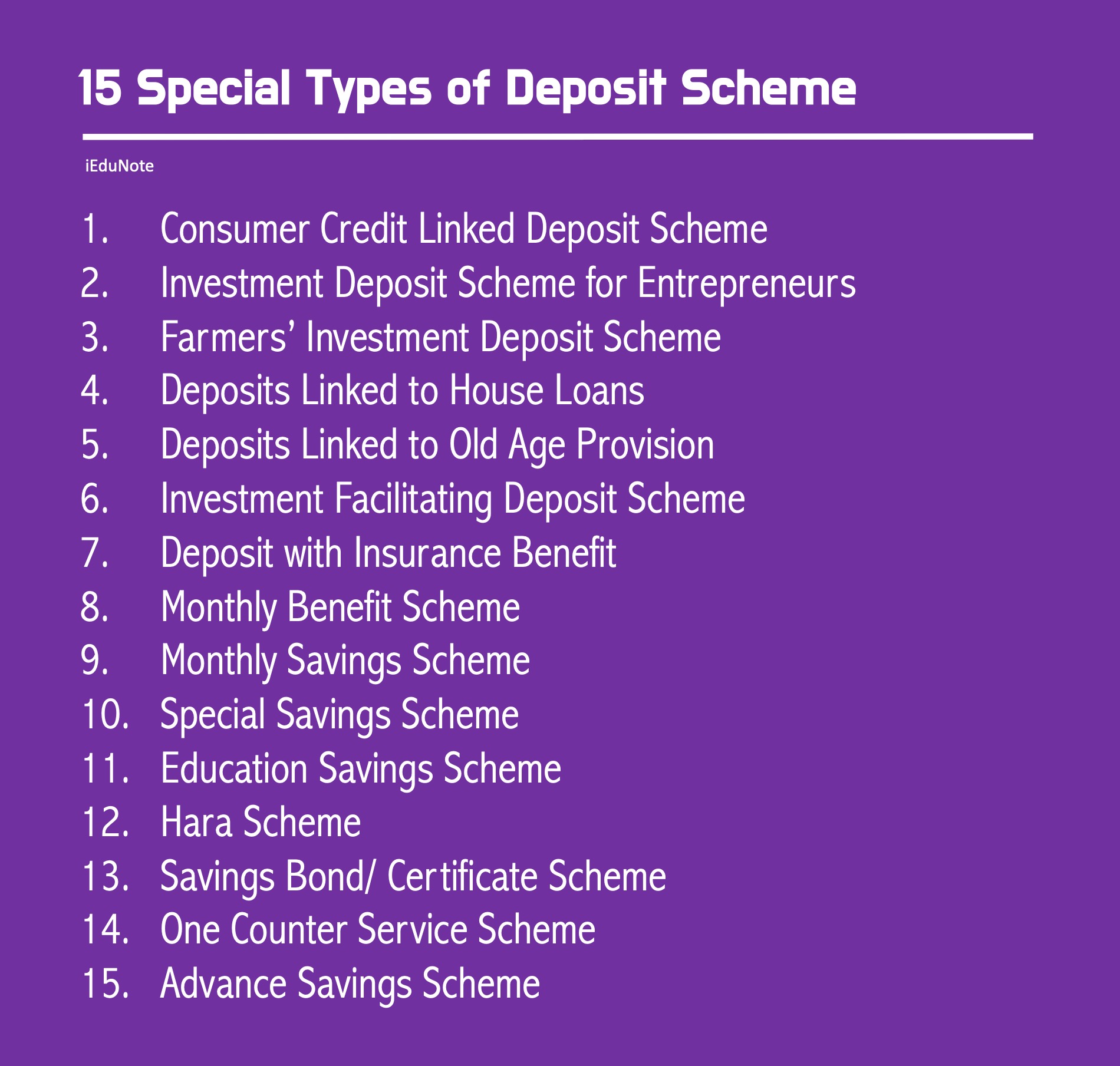

15 Special Unknown Types of Bank Deposit Schemes

A special deposit scheme is one of them. This scheme collects deposits from depositors for a fixed term, promising them to pay an attractive fixed interest rate.

The chance of withdrawing these deposits before a specific lime is very lower. Banks can invest those deposit amounts safely in a more profitable sector for a specific period and thus can earn better income.

Consumer Credit Linked Deposit Scheme

This scheme is designed for small & fixed-income consumers to get a loan to purchase durable goods. Examples of this scheme are the loans provided for purchasing freeze, TV, furniture, computer, etc.

To be eligible to get a loan under this scheme, the client needs to deposit at least 25% of the total price of the commodities. This amount can also be deposited in installments.

Investment Deposit Scheme for Entrepreneurs

Banks often provide loan facilities for the businessman to purchase necessary equipment for business if a certain amount of deposit is accumulated in the account of the loan applicant.

For example, under this scheme. 25 % of the expected loan money be there in deposit in the account as the balance of the loan applicant. This scheme can also be available in installments.

Farmers’ Investment Deposit Scheme

Banks also provide loan facilities to farmers for purchasing useful farming equipment. To get such a loan opening a deposit account is a condition.

Deposits Linked to House Loans

Banks also provide loan facilities to small & medium-income people for building homes. To avail of this type of loan facility, the client must deposit a certain amount monthly for some years, and then the bank will extend a house loan.

Deposits Linked to Old Age Provision

The persons who don’t work in the government or semi-government institutions and who have no opportunity to get a pension in the future sometimes have to pass a miserable life in their old age.

To overcome this problem, banks provide pension or old-age deposit schemes. Under this scheme, the depositors must deposit a specific amount and receive a certain amount monthly after the maturity of the same.

The maturity and rate of interest vary from bank to bank. The duration of this type of scheme is generally 5 to 10 years, depending on the deposit size.

Investment Facilitating Deposit Scheme

Generally, the selection of portfolios & investment decisions are complex issues. Investors keep deposits in the bank as investments.

From time to time, bank purchases or sells shares/ securities according to their best judgment Banks collect a small amount as a brokerage fee from these depositors. Not all deposits are always invested. More or less, some amount is always kept idle in the bank account.

Deposit with Insurance Benefit

Under this scheme, the bank promises depositors provide insurance benefits. The depositor must pay the monthly installments ($100, $500, $1000, etc.) for at least 10 years or so.

After this period, the depositor will get their money back along with interest. But if depositors deposit the installments for at least 5 years and then, for the specific accident, fail to make a deposit any longer, the depositor will get their money back along with interest and the stipulated amount for insurance.

Monthly Benefit Scheme

Under such a scheme, depositors need to keep a large amount at a time for a fixed period (5 to 10 years). After depositing the money, the depositor will continue to receive the specific profit each month until maturity. At the end of maturity, the depositor will receive the principal amount. This will increase the time deposit of the bank.

Monthly Savings Scheme

Depositors keep a specific amount ($100, $200, or $500) each month for specific maturity (5. 10, or 15 years). At the end of the maturity, the deposited amount and the profit are returned to the depositor. If the depositor cannot continue up to the full maturity, the amount deposited over the period will be returned with less than the stated rate of profit.

Special Savings Scheme

Under such a scheme, depositors keep large savings for a fixed period (5, 10, 15, or 20 years). Bank will provide the depositors with double, triple, or quadruple of the deposited amount. The bank may fix the minimum amount.

Education Savings Scheme

This scheme is innovated to support the education expense of children. This scheme can be monthly, or the whole amount can be deposited at a time. At the end of the period, the depositor or their nominee can withdraw a certain amount monthly for a certain number of years.

Hara Scheme

This scheme helps the religious Muslims interested in attending the Bank collect monthly installments for 1 to 20 years & returns the deposit with profit at the end of the term. Some hanks having such schemes also collect the tickets & perform other formalities on behalf of the clients.

If the expense of bank oil Harz purpose is lower than the deposit amount, the talk will return the balance. Again, if the expense becomes greater, the bank will ask (the depositor to make an additional deposit to cover the shortage.

Savings Bond/Certificate Scheme

According to this scheme, the bank sells different types of savings certificates to the depositors. In this way, banks can increase their deposit level.

One Counter Service Scheme

Bank provides utility services to its customers & pays the electric bill, telephone bill, water bill, pension, tax, insurance premium, house rent, etc., as an agent of the client. Only depositors are allowed such services.

Advance Savings Scheme

Under an advance savings scheme, the depositors put a certain amount of money in the bank for a certain period of time. Bank credits the deposit account of the dial depositor by four times the deposit as a loan.

Bank will purchase a government savings certificate or some other less risky fixed-income security with the total fund comprised of both deposit and loan amount. The bank charges a certain rate of interest for the loan amount against the profit from the investment.

At the end of the term, the bank may return the depositor 2 to 3 times greater dividend, and capital gains are encouraging. This scheme is radical and complex.