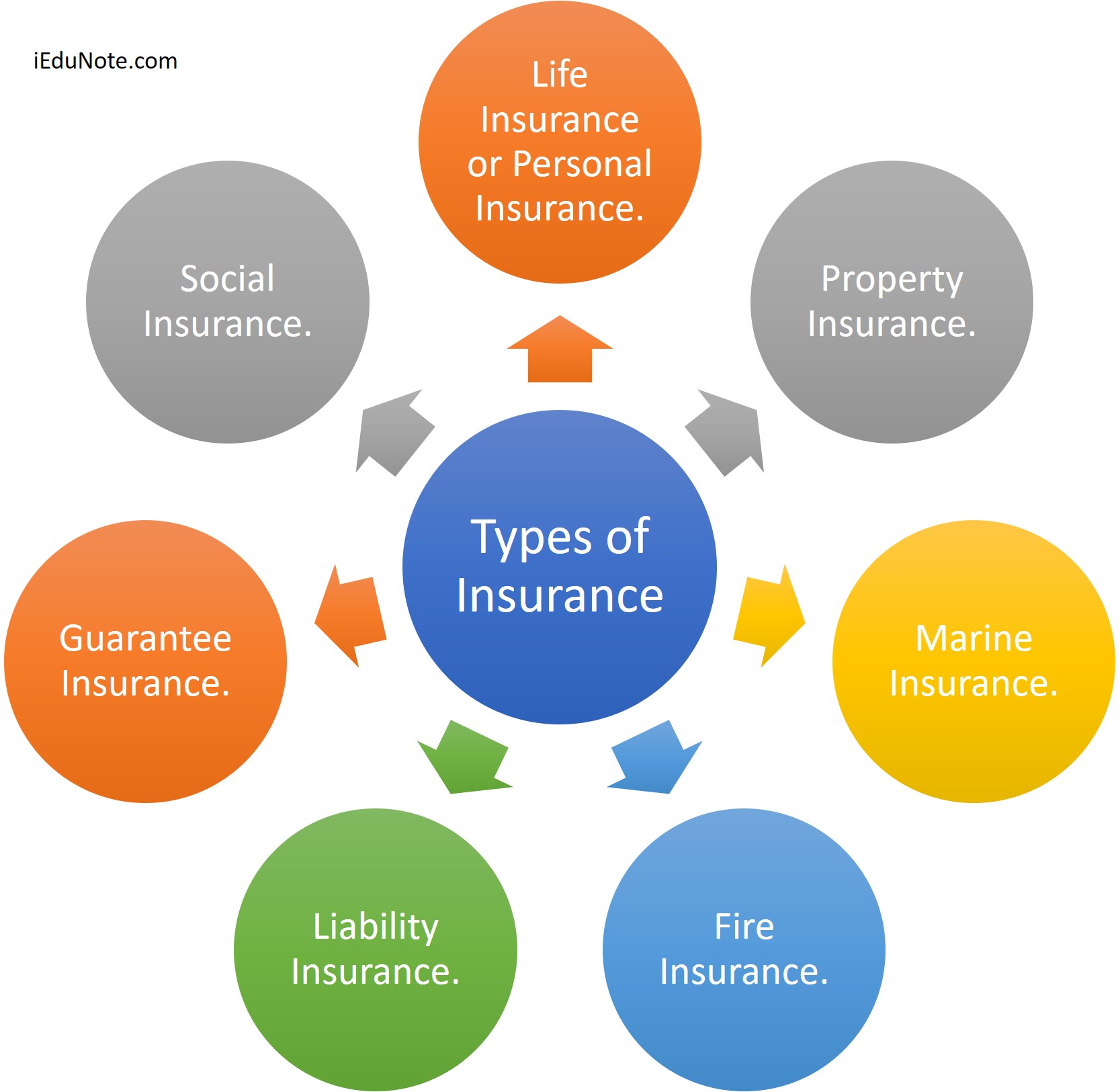

There are many types of Insurance, and the main types are; Life Insurance or Personal Insurance, Property Insurance, Marine Insurance, Fire Insurance, Liability Insurance, and Guarantee Insurance. Insurance is categorized based on risk, type, and hazards.

10+ Types of Insurance

These are explained below.

Life Insurance

Life insurance is different from other types of insurance in the sense that the subject matter of insurance is the life of a human being.

The insurer will pay a fixed amount of insurance at the time of death or at the expiry of a certain period.

At present, life insurance enjoys maximum scope because life is the most important asset of an individual.

Every person requires insurance.

This insurance provides protection to the family in the event of premature death or provides an adequate amount in old age when earning capacity is reduced.

Under personal insurance, a payment is made in the event of an accident.

Insurance is not only a form of protection but also a type of investment because a certain sum is returnable to the insured upon death or at the end of the policy period.

General Insurance

General insurance includes property insurance, liability insurance, and other forms of insurance.

Fire and marine insurance are strictly referred to as property insurance. Motor, theft, fidelity, and machine insurance also include liability coverage to a certain extent.

The strictest form of liability insurance is fidelity insurance, whereby the insurer compensates the insured for losses when they are under the liability of payment to a third party.

Property Insurance

Under property insurance, the property of individuals is insured against specified risks. These risks may include fire, marine perils, theft, damage to property, and accidents.

Marine Insurance

Marine insurance provides protection against losses due to marine perils.

Marine perils include collision with rocks or other ships, attacks by enemies, fire, and capture by pirates. These perils can cause damage, destruction, or disappearance of the ship, cargo, and non-payment of freight.

Marine insurance insures ships (Hull), cargo, and freight.

Previously, only certain nominal risks were insured, but now the scope of marine insurance has been divided into two parts: Ocean Marine Insurance and Inland Marine Insurance.

Ocean Marine Insurance only covers marine perils, while Inland Marine Insurance covers inland perils that may arise during the delivery of cargo from the insured’s warehouse to the buyer’s warehouse.

Fire Insurance

Fire insurance covers the risk of fire.

In the absence of fire insurance, fire losses would increase not only for individuals but also for society as a whole.

With the help of fire insurance, losses arising from fires are compensated, minimizing the impact on society.

Fire insurance protects individuals from such losses, ensuring their property, business, or industry remains in a similar position to before the loss.

Fire insurance not only covers direct losses but also provides coverage for consequential losses such as war risks, turmoil, and riots.

Liability Insurance

General insurance also includes liability insurance, whereby the insured is liable to pay for property damage or to compensate for personal injury or death.

This type of insurance can be seen in forms such as fidelity insurance, automobile insurance, and machine insurance.

Social Insurance

Social insurance provides protection to the weaker sections of society who are unable to pay premiums for adequate insurance.

Pension plans, disability benefits, unemployment benefits, sickness insurance, and industrial insurance are various forms of social insurance.

Insurance can be classified into four categories based on the risk involved.

Personal Insurance

Personal insurance includes the insurance of human life, which may suffer losses due to death, accidents, and diseases.

Personal insurance is further sub-classified into life insurance, personal accident insurance, and health insurance.

Property Insurance

Property insurance covers the property of individuals and society against losses due to fire and marine perils. It also includes coverage for crops against unexpected decline, animals engaged in business, machine breakdown, and theft of property and goods.

Guarantee Insurance

Guarantee insurance covers losses arising from dishonesty, disappearance, and disloyalty of employees or second parties who are party to a contract.

Failure on their part causes losses to the first

party. For example, in export insurance, the insurer compensates for losses when importers fail to pay their debts.

Other Forms of Insurance

Besides property and liability insurance, general insurance includes other types of insurance.

Examples of such insurance are export-credit insurance, state employees’ insurance, etc., where the insurer guarantees payment in specific events.

These forms of insurance are rapidly expanding.

Miscellaneous Insurance

Properties, goods, machines, furniture, automobiles, valuable articles, etc., can be insured against damage or destruction due to accidents or theft.

Different forms of insurance exist for each type of property, covering not only property insurance but also liability insurance and personal injuries.

Differences Among Types of Insurance Contract

Insurance plays a pivotal role in the complex world of financial protection and risk management. This comprehensive guide aims to elucidate the intricate distinctions among various insurance contracts, specifically focusing on life, fire, and marine insurance.

Difference Between a Life Insurance Contract and a Contract of Indemnity

Let’s see the fundamental differences between life insurance contracts and contracts of indemnity.

Life insurance contracts, which are contracts of certainty, are compared with indemnity contracts, typically associated with property insurance.

We explore various aspects such as the occurrence of events, subject matter, premium variance, risk classification, and more.

| Aspect | Life Insurance Contract | Contract of Indemnity |

|---|---|---|

| Occurring of Event | The event, the death, in life insurance is certain, but the only uncertainty is the time when the death will occur. | In indemnity insurance (in fire and marine insurances) the event may not take place at all or may take place in part. |

| Subject-Matter | The subject-matter in life insurance is life. The chances of death would increase along with the advance in age whatever precautionary measures may be taken for improvement of health. | The property in other insurance can be repaired and replaced and may remain usually in good condition. |

| Variance in Premium | In life insurance premium is not much variable. | In other insurance premium is variable in numerous forms. |

| Classification of Risk | The classification of risks is generally simpler in life insurance than in other types of the insurance contract. In life contract, it would be standard, sub-standard and un-insurable. | In other insurance, it may be several. |

| Period of Insurance | Generally, the life insurance is taken for a longer period. | Whereas the other forms of insurance are taken for not more than one two years. |

| Protection and Investment | The life insurance contract provides protection against loss of early death and investment to meet the old age requirement. | Other forms of insurance do not provide investment because the premium paid is not returnable if the contingencies (hazards) do not occur within the period. Other forms of insurance provide only protection against loss of the damage of the property against the insured perils. |

| Premium Payment | The mode of premium payment in life insurance is generally level premium. | Whereas, in other forms of insurances, it is a single premium. |

| Insurable Interest | Insurable interest must be at the time of proposal in insurance. | But in property insurance, it must be present at the time of loss. |

Difference Between Fire Insurance and Life Insurance

Fire insurance, a contract of indemnity, is compared with life insurance, a contract of certainty. We examine the differences in terms of contract type, event occurrence, risk classification, insurance period, protection and investment elements, and insurable interest. This comparison will help clarify the unique characteristics and applications of these two types of insurance.

| Aspect | Fire Insurance | Life Insurance |

|---|---|---|

| Type of Contract | Fire insurance is a contract of indemnity, where payment of loss will be made only when the fire occurred. | Life insurance contract is a contract of certainty, wherein the payment is certainly made. |

| Occurring of Event | The fire may or not occur in fire insurance. | In life insurance, the death will certainly occur. |

| Classification of Risk | There are numerous types of risk in fire insurance. | The risks in life insurance are divided into three classes-the standard risks, sub-standard risk, and uninsurable risk. |

| Period of Insurance | The term of insurance in fire insurance does not exceed generally more than one year. | In life insurance, it lasts for a very long period. |

| Protection and Investment | Fire insurance includes only the element of protection. | The life insurance includes the element of protection and investment because the premium paid sum assured is returnable in the latter case whereas no premium or amount is returnable in fire insurance. |

| Insurable Interest | In Fire insurance, the insurable interest must exist from the date of the proposal to the date of completion of the contract whether by death or by the expiry of the term. | In life insurances, insurable interest must exist at the time of proposal. |

| Assignability | The insured property, insurance policy, or policy amount cannot be assigned to others in fire insurance. | It is freely assignable in life insurance. |

| Moral Hazard | The degree of moral hazard in fire insurance is maximum. | It is very nominal in case of life insurance. |

Difference Between Fire Insurance and Marine Insurance

Let’s compare fire insurance and marine insurance, both of which are contracts of indemnity but serve different purposes. Fire and marine insurance contracts are similar in most the cases because both these contracts are indemnity contracts

We analyze aspects such as moral hazard, insurable interest, profit, and valued policies. This comparison will provide a deeper understanding of these two types of insurance contracts, highlighting their unique features and the specific circumstances under which they are applicable.

| Aspect | Fire Insurance | Marine Insurance |

|---|---|---|

| Moral Hazard | In fire insurance, the chances of moral hazard are high. | In marine insurances, the chances of moral hazard do not exist as much as are in the fire insurance. |

| Insurable Interest | The insurable interest must exist both the time, at the inception and at the completion of the contract. This is the reason fire insurance policies cannot be freely assignable. | The insurable interest in marine insurance must exist at the time of loss. So, the marine policies are freely assignable. |

| Profit | Fire insurance policies do not ordinarily allow a certain margin of profit to be charged at the time of indemnification of loss. | Marine policies generally allow a certain margin of profit to be charged at the time of indemnification of loss. |

| Valued Policies | Fire insurance policies strictly adhere to the doctrine of indemnity and only the market value of the property at the time of loss (valuable amount) is compensated. | Marine insurance policies are generally valued policies and the market fluctuation is avoided. |

Conclusion

The world of insurance is vast and multifaceted, encompassing a wide range of types such as life, property, marine, fire, and more. Each type of insurance serves a unique purpose, offering protection and coverage against specific risks and hazards.

Life insurance, for instance, provides financial security to families in the event of premature death, while property insurance safeguards individuals and society from losses due to fire and marine perils. Understanding these different types of insurance and their respective features is crucial for making informed decisions about risk management and financial protection.

Furthermore, the distinctions among various insurance contracts, such as those between life, fire, and marine insurance, underscore the complexity and diversity of the insurance industry.

As we navigate through life’s uncertainties, insurance serves as a vital tool, providing us with peace of mind and financial stability. Therefore, gaining a comprehensive understanding of the different types of insurance is not just beneficial but essential for everyone.