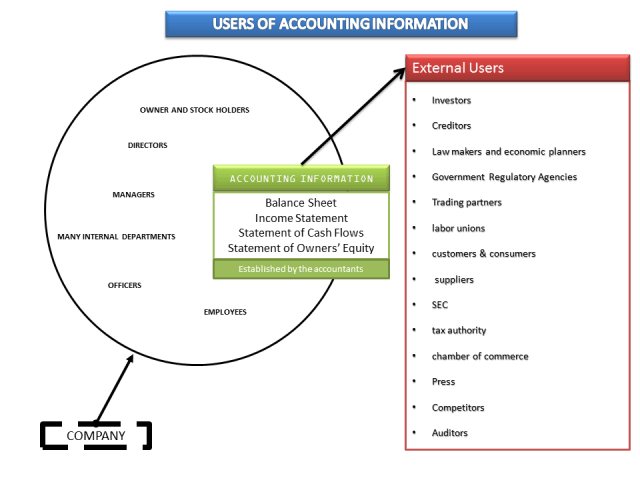

Users of accounting information are internal and external. External users are creditors, investors, government, trading partners, regulatory agencies, international standardization agencies, journalists and internal users are owners, directors, managers, and employees of the company.

Full Comprehensive Guide on Users of Accounting Information

Qualitative Characteristics of Accounting Information

Qualitative characteristics of accounting information are those characteristics that contribute to the quality or value of the information. The overriding qualitative characteristic of accounting information is its usefulness in decision-making.

The Financial Accounting Standards Board (FASB) has identified the following qualitative characteristics of accounting information: understandability, relevance, reliability, and comparability.

Understandability

It is crucial for the information provided in financial statements to be easily understood by the users.

Relevance

The information must be relevant to meet the decision-making needs of users.

Reliability

Reliability does not imply absolute accuracy. There are varying degrees of reliability. Information that is based on judgments, estimates, and approximations may not be completely accurate, but it should still be reliable.

Comparability

Comparability allows users to identify similarities and differences in economic phenomena, as these differences and similarities should not be obscured by non-comparable accounting methods.

Bookkeeping

Bookkeeping is a part of accounting that solely involves recording economic events.

Primary Qualities of Useful Accounting Information

The most distinguished primary qualities that make accounting information useful for decision-making are:

Relevance

The first primary quality of accounting information is relevance. Relevant information provides feedback on past actions that helps confirm or adjust current expectations. Such information can also be used to predict future outcomes. Normally, relevant information provides both feedback and predictive value simultaneously.

Reliability

The second primary quality of accounting information is reliability. Accounting information is reliable if users can depend on it to accurately represent the economic conditions or events it intends to represent. Reliability does not mean absolute accuracy. There are degrees of reliability. Information based on judgments, estimates, and approximations may not be entirely accurate, but it should still be reliable.

Secondary qualities of useful accounting information:

There are two secondary qualities of accounting information:

Comparability

Comparability refers to information that has been measured and reported in a consistent manner across different enterprises.

Comparability enables users to identify the real similarities and differences in economic phenomena because these differences and similarities have not been obscured by the use of non-comparable accounting methods.

Consistency

Consistency is the application of the same accounting treatment to similar events by an entity from period to period. Consistency does not imply that companies cannot switch from one accounting method to another. Companies can change methods, but such changes are restricted to specific situations.

Please let me know if you need any further assistance!

What Are The Types of Users of Accounting Information?

Let’s look at who are the internal and external users of account information and why they use it.

Internal users of Accounting information

Internal users are individual who runs, manages, and operates the daily activities of the inside area of an organization.

So who are the internal users of account information;

- Owners and Stockholders.

- Directors,

- Managers,

- Officers.

- Internal Departments.

- Employees

- Internal Auditor.

Managerial accounting identifies measures, analyzes, and communicates the financial information management needs to plan, control, and evaluate a company’s operations for internal users.

Accounting’s goal is to provide the management with the necessary information or can be defined as Internal users.

External users of Accounting information

External users are those individuals who take an interest in an organization’s account information but are not part of the organization’s administrative process.

External users have a direct or indirect interest in accounting information.

Financial accounting is the process of the preparation of financial reports of the enterprise for use by both internal and external parties.

These reports are important to the external users of accounting information.

Examples of external users of accounting information are;

- Creditors.

- Investors.

- Government.

- Trading partners.

- Regulatory agencies.

- International standardization agencies.

- Journalists.

Creditors and Investors are the most regular example of external users among many other external users.

The external users of accounting are;

Creditors

Creditors or lenders use accounting information to determine the borrower’s ability to repay the loan, the number of assets and liabilities of the borrower, evidence of income, economic position, etc., before he or she lends the money to the economic entity.

Investors

Investors are the capital providers of a business.

Before investing, an investor sees the financial report to figure out the business possibilities in the future. Financial information is important for an investor to ensure the investment is secure.

Trading partners

Business needs business to do business; it is the truth.

Associate trading companies look at the financial information and decide to trade with a particular economic entity.

Government Regulatory Agencies

Financial information is vital for government regulatory agencies as it allows them to monitor the economy and market.

Lawmakers and economic planners

Keeping a nation’s economic structure up-to-date with global changes is important. It is a job for lawmakers and economic planners.

The accounting information provides information necessary for making changes to the existing laws at the right moment for the economy and society’s betterment.

Other examples

There are other external users, for example, labor unions, customers and consumers, suppliers, SEC, tax authorities, chamber of commerce, press, competitors, auditors, etc.

Anybody outside the managing radius of an economic entity is interested in its financial information and is defined as an external user.

For example to that statement; an MBA student looking for financial information on Google, he/she is an external user of the accounting information of Google.

The financial reports or information resulting from the accounting process that is transferred to the users in two forms-internal and external.

These reports are used for the effective operating of the business by internal users. On the other hand, external users use the information to get a real picture of the organization’s financial state.