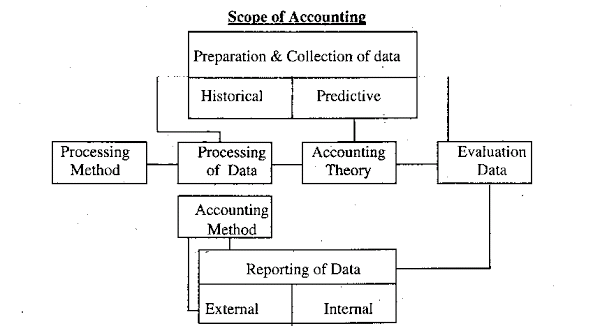

A worksheet is a multiple-column form that is used in preparing and adjusting financial statements. 3 types of the worksheet are; (1) General worksheet, (2) Detailed worksheet, (3) Audit worksheet.

For preparing accounting worksheet you must follow 8 Simple Steps to verify accounting information accuracy before preparation of financial statements. Prepare financial statements from a worksheet is relatively easy because all necessary accounting information is properly presented and structured in the worksheet.

What is Worksheet?

Multiple column sheets wherein all necessary information used for the preparation of the financial statement is recorded in a systematic process is called a worksheet.

The worksheet is not a permanent account.

It is not a part of a journal or ledger. It is a device used for easy preparation of adjusting entries and financial statements.

The worksheet is a multi-column sheet or a computer spreadsheet where the accountant writes, in brief, information necessary for the preparation of adjusting entries and financial statements.

In bigger organizations where the volume of accounts and adjustments are much more, the possibility of error remains at the time of adjustment of adjusting entries with ledger accounts if the worksheet is not prepared.

The preparation of financial statements correctly becomes complicated and sometimes is delayed. In the present day world, it has become the practice of preparing worksheets in big organizations before the preparation of financial statements.

Accountants make adjustments of adjusting entries with other relevant ledger accounts before the preparation of financial statements.

Before the preparation of financial statements, the accountants want to be sure of the arithmetical accuracy of accounts by making adjustments of adjusting entries with ledger accounts through the worksheet and then go for the preparation of financial statements.

The worksheet is prepared at the end of the accounting period before the preparation of financial statements.

3 Types of Worksheet are;

- General worksheet,

- Detailed worksheet,

- Audit worksheet.

They are explained below,

The general worksheet

The general worksheet contains four to six pairs of columns.

Generally, five pair columns or ten columns worksheets can serve the purpose of general business. These five pair columns are;

- Trial balance,

- Adjustment,

- Adjusted trial balance,

- An income statement, and

- Balance sheet.

The detailed worksheet

The detailed worksheet is prepared for containing more detailed information over a general worksheet.

Sometimes extra sheet containing columns are enclosed for explaining particular items. The matters for which item-wise lists are to be prepared are:

- Accounts receivable and accounts payable lists,

- Production expenditure lists,

- Insurance premium lists etc.

Audit worksheet

Audit worksheet is used for preparing financial statements and lists for various uses of business concerns. The audit worksheet is prepared in the light of the auditing of various items included in the worksheet.

It is an aid to audit the work of a business concern. The worksheet is a technique of accounting through which the accounting information is integrated for adjustment and classification.

The main objective of the worksheet is to verify the accuracy of accounting information before the preparation of financial statements.

For preparing an accounting worksheet one must follow 8 Simple Steps to verify accounting information accuracy before preparation of financial statements.

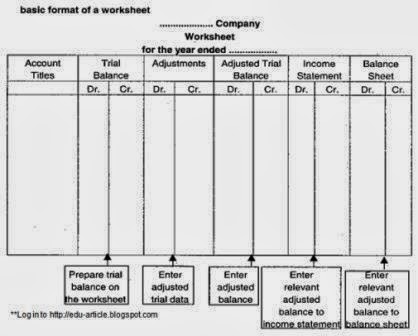

Columns of the worksheet are drawn mainly as per necessity. The number of columns of worksheet depends on the demand of the particular organization.

8 Steps of Preparing Accounting Worksheet

- Name of business organization and preparation date.

- Drawing column and mentioning the head of the column.

- Unadjusted Trial Balance.

- Adjustment column.

- Adjusted trial balance column.

- Income statement column.

- Retained earnings statement.

- Balance sheet.

Steps of preparing accounting worksheet are explained below;

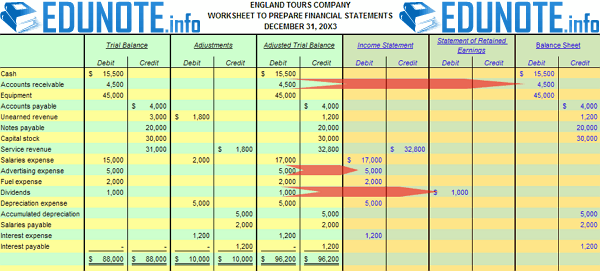

1. Name of business organization and preparation date

At the beginning of the worksheet the name of the organization for which worksheet is prepared is to be written in the bold form and also the date of preparation of the worksheet is to be mentioned.

2. Drawing column and mentioning the head of the column

Drawing column titles are to be mentioned here.

For example, serial number in the first column, the title of accounts in the second column and thereafter pair columns.

3. Unadjusted Trial Balance

After the serial number and accounts title columns, in the unadjusted trial balance, pair column ledger accounts balances are posted straight to check the agreement of trial balance.

This trial balance is called pre-closing trial balance as it is prepared with the ledger balances before keeping accounts of adjustment items.

4. Adjustment column

At the end of the accounting period, the items or transactions which have not been accounted for are written in the debit and credit of adjustment columns.

At the time of making adjustments, if there does not exist any item in the trial balance for debiting and crediting, these adjusting items are to be written below the trial balance under appropriate head(s) in debit and credit columns of adjustment.

To identify the adjusting items separate code numbers for each item be given in debit and credit columns. Thereafter debit and credit columns of adjustments are totaled for assuring their agreement.

5. Adjusted trial balance column

Writing necessary adjustments in the adjustment column, the balance of every account relating to adjustments is ascertained and thereafter all ledger account balances including adjusted ledger balances are recorded in the debit and credit columns of adjusted trial balance.

That is, unadjusted balances of trial balance are adjusted as per rules and these are written down in the column of adjusted trial balance.

Writing all ledger balances – adjusted and unadjusted in adjusted trial balance totals of debit and credit are ascertained to prove the arithmetical accuracy of the ledger accounts.

6. Income statement column

All periodical expenses and incomes of adjusted trial balance are written in debit and credit column of income statement respectively.

The difference between total income and total expenses of the income statement is called profit or loss. The profit/loss of income statement is transferred to the balance sheet if the retained earnings statement is not prepared.

7. Retained earnings statement

In the case of a joint-stock company, the retained earning column is kept in the worksheet before the balance sheet column.

Here previous year’s profit, loss if any and income, loss of income statement of the worksheet are written in the credit money column and distribution of items regarding distribution of profit such as, dividend paid, proposed dividend, income tax paid, creation of fund are shown in the debit money column of retained earnings statement.

The difference between the totals of debit and credit columns is transferred to the balance sheet column of the worksheet.

8. Balance sheet

All assets and liabilities of adjusted trial balance including the balance of income statement, retained earnings statement are written in the debit and credit columns of the balance sheet of worksheet i.e., assets are written in debit money column and liabilities, owners equity are written in the credit money column.

Totals of debit and credit column of the balance sheet are equal.

The number of columns of worksheets and titles of columns depends on the nature and demand of the business concern.

How to Prepare financial statements from a worksheet

Prepare financial statements from a worksheet is relatively easy because all necessary accounting information is properly presented and structured in the worksheet.

The worksheet contains all the information for preparing financial statements. The income statement is prepared with data of debit and credit columns of the income statements of the worksheet.

The balance sheet is prepared from the balance sheet columns of the worksheet.

Financial statements of a business concern mean income statement, retained earnings statement/owners’ equity statement and balance sheet prepared at the end of the accounting period.

The statement which is prepared for ascertaining profit (loss) of business at the end of an accounting period is called an income statement.

The income statement is of two types:

- General or single-step income statement: In this statement, all expenses are deducted straight from income to ascertain net profit (loss). Here the expenses are not shown in the classified forum.

- Multiple-step income statement: In this statement, the cost of goods sold is deducted from sales revenue to ascertain gross profit. From gross profit all operating expenses such as selling expenses, administrative expenses, etc. are deducted to find out net operating income.

After that, other non-operating incomes like rent revenue, interest revenue, etc. are added to net operating income from which other non-operating expenses such as interest expense, loss on the sale of assets, etc. are deducted to ascertain net profit.