Business organizations need to write and prepare ledger account wherein all the transactions are recorded permanently under different heads of accounts.

As per the accounting principle, the transactions just after their occurrence are recorded in the primary book of account – journal in chronological order of dates with explanations.

But it is not possible to determine the complete results of transactions from the journal.

That is, it is not possible to know the information like how much profit under what heads have been earned, how much expenses under what head has been incurred, how much assets and liabilities are there in a particular business concern from journals.

To know all this information, the transactions of the same nature are to be recorded under different heads or in separate accounts.

That is,

All the transactions relating to an individual, organization assets, income, and expenditure are recorded under the same head of accounts-individual, organization, assets, income and expenditure.

In this way, if various transactions are recorded in different respective heads of accounts, it becomes possible to determine the complete result of any account at the end of the accounting period.

So, it can be said that the book wherein various entries of the journal are posted in brief permanently according to debit and credit under separate heads of accounts is called ledger.

How to Write and Prepare Ledger Account

So, the 5 simple steps for writing and preparing ledger are;

- Drawing the Form – Get pen and paper, start drawing the ledger account.

- Posting transactions from journal to respective ledger account.

- Folioing – Put the page number for a journal entry on the ledger account’s folio column.

- Casting – Separating debit and credit amount.

- Balancing – find the difference between debit and credit to get debit or credit balance of the account.

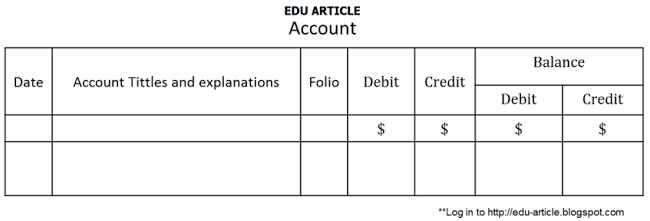

1. Drawing the Form – Get pen and paper, Start Drawing the Ledger Account.

Every leaf of the account is divided into two equal parts by a bold vertical line or two sharp vertical lines. The left side of it is the debit side and the right side is the credit side.

Thereafter, both sides are again divided into four columns i.e., this is divided into eight columns having four on the debit side and four on the credit side.

In the first column of both the sides’ dates, the second particulars, and the third journal folio and the fourth amount are written.

2. Posting Transactions from Journal to Respective Ledger Account.

The act of transferring the transactions from the journal to the respective accounts of the ledger is called posting. The two accounts involved in each transaction are maintained in the ledger.

A debit account of the journal is posted on the debit side of that account and the credit account of the journal is posted on the credit side of that account.

In this regard, it is to be carefully noted that at the time of posting in the debit side of the ledger account, credit account of the journal is to be written in particular column and in the credit side of the ledger account debit account of that journal is to be written in particular column.

3. Folioing – Put the Page Number for a Journal Entry on the Ledger Account’s Folio Column.

The page of the journal from which the journal entries are transferred to the particular ledger account that page number is written in the folio column of a ledger account and the page of the ledger wherein the account is posted the number of that page is written in the journal in the ledger folio column of the journal.

In this way writing of page number of the journal in the ledger and that of the ledger in the journal is called folioing.

4. Casting – Separating Debit and Credit Amount.

The amount of debit and credit of each ledger account is totaled separately on both sides. In this way totaling of debit and credit is called casting.

5. Balancing – Find the Difference between Debit and Credit to get Debit or Credit balance of the Account.

After the totaling of debit and credit of ledger accounts, it shows that the total of both sides is made equal putting the difference on both sides the account is considered balanced.

In this case, nothing is left to be done. But if the total of both sides is unequal, in that case, the difference is to be determined.

Thereafter the amount of difference is added in the deficit side to equalize both sides. This sort of difference between the two sides of accounts is called balance.

The act of equalizing the total of both the sides by adding debit balance in the credit side and the credit balance in the debit side is called balancing.

Debit balance

If the total amount of the debit side is greater than the total amount of credit side of the ledger than the difference between both sides is called debit balance.

For example,

the total of the debit of a particular ledger account is $10,000 and the total of credit of that ledger account is $8,000, -then the difference between these two sides amounting to $2,000 is a debit balance.

As per the rule of debit and credit under the double-entry system, all expenditures and assets accounts show debit balance.

Therefore debit balances of ledger accounts mean expenditure and assets.

Credit balance

On the other hand, if the total of credit money column of a particular ledger account is greater than that of debit money column, the balance is called credit balance.

For example,

the total credit money column of a particular account is $5,000 and that of the debit money column is $4,000, the difference between these two amounts $ 1,000 is a credit balance.

All income and liability accounts always show credit balance i.e. credit balances of ledger account mean incomes and liabilities.