What is the Principle of Indemnity in Insurance?

The principle of indemnity asserts that in the happening of a loss, the insured shall be put back into the same financial position he used to occupy immediately before the loss. In other words, the insured shall get neither more nor less than the actual amount of loss sustained.

This, of course, is always subject to the limit of the sum insured and also subject to certain terms and conditions of the policy.

Therefore, to put it in a much better way, on the happening of a loss, the insurers will try to put the insured back into the same financial position as the insured used to occupy immediately before the happening of the loss, only if the insurance is properly arranged on full value insurance.

Under-insurance and restrictive terms of the policy may preclude the insured from getting the actual loss.

On the other hand, even if the sum insured is more than the actual value of the property or subject matter, this would not entitle the insured to get more than the actual loss.

This principle is indeed very important to keep the business of insurance on track and to keep it free from wagering. This also checks the moral hazard of a man and, at the same time, allows him to get the actual amount of loss and certainly not more than that.

Consider a proposition wherein through over-insurance, somebody is allowed to take more than the actual amount of loss.

Well, in that case, it can be said with definite certainty that there will always be a temptation to create an insured event deliberately for the sole purpose of making a profit out of a loss.

Definition of Indemnity in Insurance

The principle of indemnity was well cared for in the leading case of Castellain V. Preston (1883) in the following way “A contract of insurance is necessarily a contract of indemnity (except life and personal accident insurance) and of indemnity only, and this means that in case of a loss the insured shall be fully indemnified, but shall never be more than fully indemnified.

That is the fundamental principle of insurance, and if ever a proposition is brought forward, which is at variance with it, that is to say, which either will prevent the insured from obtaining a full indemnity or which will give the insured more than a full indemnity, that proposition must certainly be wrong”.

Selection of Sum-Insured

In a contract of indemnity, the selection of the proper sum insured is important as this is always the limit within which indemnity will be considered.

Therefore, if the sum insured is restricted to a lesser amount than the actual value, then in the case of a total loss, the insured gets the sum insured, which does not indemnify him.

Even if it is not a total loss, nevertheless, using a policy condition known as ‘average,’ the insurers will not pay more than the proportionate loss, i.e., corresponding to the ratio between sum-insured and actual value. (Average discussed later on).

Similarly, there is also no point in arranging an excessive sum insured as that will never entitle him to get more than the actual amount of loss as already explained.

This will simply mean the payment of excessive premium without any corresponding benefit. Sum-insured should, therefore, always be base on the actual market value of the subject matter of insurance at the time of effecting the policy of insurance.

The essential requirement of insurance is that it should be full-value insurance.

Application of Principle of Indemnity to Various Branches of Insurance Life

Except for life and personal accident insurance, all insurance contracts are contracts of indemnity. Life and personal accident insurance are not contracts of indemnities simply because life or limb cannot be valued in terms of money.

Legally, therefore, these two types of insurance have been kept outside the scope of the principle of indemnity. In theory, any person can affect any number of policies for any amount, and at the time of claim, all such policies must pay all the sum insured under all such policies.

Even though this is the position of law, nevertheless, insurers would always try to put a check on the possible moral hazard by restricting the sum insured on the financial capability and standing of a man, that is to say, his continued premium payment capacity.

It has to be clearly conceived here that such a check is purely an underwriting check so that the principle of indemnity is not completely shattered, but such a check is not a legal check, that is to say, from the legal point of view, such policies are indeed not contracts of indemnities, and there is no reason why a man cannot legally get any number of policies for any amount.

Non-Life

Apart from life and personal accident insurance, all other types of insurance are contracts of indemnities.

Therefore, Marine, Fire, Motor, EAR, CAR, Burglary, Fidelity Guarantee, Employers Liability, Public Liability, Aviation, Engineering, Products Liability, Crop insurance, and Livestock insurance, etc. are all contracts of indemnity.

Excess, Franchise, and Average – their impact on the Principle of Indemnity

It has already been explained that indemnity is provided subject to certain terms and conditions of the policy. In this context, the above three terminologies are important because they do create an impact on the principle of indemnity.

Excess

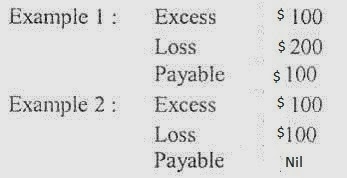

This means that about any loss, a certain predetermined amount shall be deducted, and the balance, if any, shall be paid.

Here it will be observed that due to a policy condition, the insured is not put back into the same financial position after a loss.

From the underwriting point of view, such treatment is sometimes required, particularly to keep a check on moral hazard about an insured that is in the habit of making constant trivial claims.

Another justification of excess is to eliminate trivial claims keeping in view the administrative expenses, which are quite often more than the claim amount itself.

Franchise

If a policy is made subject to a franchise, then to get a claim, the extent of the claim must reach the amount of the franchise when the insured gets the full claim. If the amount of loss does not reach the franchise, then the insured does not get anything. It is a prerequisite to getting a claim.

About the franchise also, it will be seen that if the extent of loss does not reach the amount of the franchise, then nothing is payable, and the insured does not get an indemnity even though he has suffered a loss.

Nevertheless, from the underwriting point of view, like excess, such a check is given to treat moral hazards and trivial claims.

Average

The average is a method by which under-insurance is defeated. The norms of insurance demand that there should always be full-value insurance.

Under-insurance deprives the insurers of getting the actual premium even though they are liable to pay the loss to the fullest extent, and the only limit is the sum insured.

The result is that the experience gets unfavorable, leading to the enhancement of the premium to the detriment of even those who always believe in full-value insurance.

To take care of such a situation, the average has been introduced to make the insured his part-insurer to the extent of under insurance.

There are three types of averages in practice. These are;

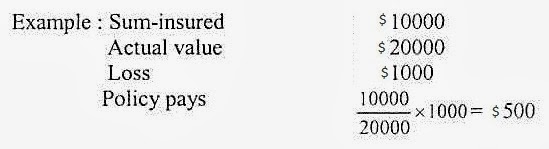

1. Pro-rata Condition of Average

As per this type of average, if at the time of loss, it is found that the actual value of the property is more than the sum insured, then the insurers will pay that proportion of the actual loss that the sum insured bears to the actual value.

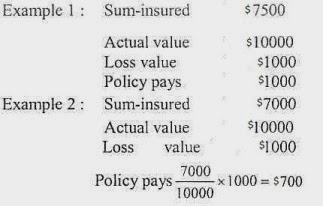

2. Special Condition of Average

This is also known as the 75% condition of average. Under this type of average, if, at the time of loss, it is found that the sum insured is less than 75% value of the property, then the insurers will pay that proportion of the loss that the sum insured bears to the actual value.

If the sum insured is at least to the extent of 75% (or more) of the actual value, then no average applies.

This condition is usually applied to those types of properties (e.g., stock) where there is a possibility of violent fluctuation in price rapidly.

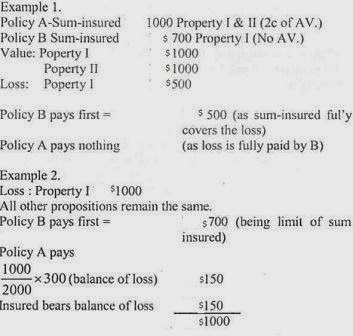

3. Two-condition of Average

This is virtually nothing but a pro-rata condition of average when it becomes applicable. It has two parts. The first part is exactly the pro-rata condition of the average.

The second part says that if, at the time of loss, it is found that there is a more specific policy covering the same loss, then that specific policy shall pay the loss first, and if there is still a balance of claim left, then only this policy shall come forward to pay the balance loss and in case of under-insurance average shall apply in the usual manner on balance.

From all these types of averages, it will be seen that if insurance is not properly arranged on full value insurance, i.e., if there is under-insurance, then the insured will not get a full indemnity.

But it has to be appreciated that this is due to the defective arrangement of insurance for which the principle of indemnity cannot be blamed.

One point is to be remembered here: if the average benefit is obtained by insurers, then they must put this average condition in the policy.

Otherwise, even though there is an under-insurance average cannot be applied.

Effects of Certain Types of Policies on the Principle of Indemnity

There are certain types of policies that do create an impact on the principle of indemnity. These are Valued Policies and First Loss Insurance.

Valued Policies

Valued policies are those policies where the value of the property is agreed upon beforehand and which is made the sum insured under the policy.

The condition of such a policy is that if there is a total loss, then the full sum insured is to be paid even though the actual value is less than the sum insured.

Here the insured makes a profit or gain. If, however, the actual value is more than the sum insured, then the insured loses.

Therefore, the principle of indemnity is not followed strictly, as the usual appreciation and depreciation are not taken into account.

But if there is a partial loss under a valued policy, it is settled on an indemnity basis as is usually done under a normal policy on the ordinary market value basis.

The value agreed upon previously may, however, play an important role in matters of determining liability easily and quickly.

It is quite often argued. Therefore, those valued policies are departures from the principle of indemnity.

The following points should be noted in this regard;

- Only in the case of a total loss there is the possibility of making either an overpayment or underpayment. From experience, it can be said that the possibility of total loss is very rare, as most of us experience partial losses.

- In the case of a partial loss, which is more common, the loss is treated under a normal indemnity basis.

- In undervalued policies, the value that is agreed upon at inception is not just an arbitrary value but a value having a very realistic bearing on the actual market value.

- Valued policies are not usually given to those persons whose bona-fides are not in the knowledge of insurers. In other words, the issuance of valued policies is very restricted.

- Valued policies are usually issued on articles of fairly stable value.

- It may be said that under undervalued policy, the measure of indemnity, is decided at the inception as opposed to ordinary policies, where the measure of indemnity is decided at the time of claim.

Valued policies are considered to be contracts of indemnity in law, and considering the above points, it can very well be said that valued policies are in fact modifications of the principle of indemnity and certainly not departures from the principle of indemnity.

First Loss Insurance

This is a type of policy where the sum insured is deliberately restricted to a sum lesser than the actual value. The concept is that total loss is impossible because of the nature of the subject matter.

For example, in burglary insurance, burglars may not be able to take away all the goods, particularly if they are heavy.

However, in theory, it can never be guaranteed that there won’t be total loss ever.

In the case of a total loss, if at all, the insured is not fully indemnified as the sum- insured is lesser than the actual value at risk.

Such types of policies are not much in use and considering that the probability of total loss is very remote, such policies do not create any significant impact on the principle of indemnity since partial losses are always paid in full subject to the limit of the sum insured.

Methods of Providing Indemnity

There are various ways through which indemnity may be provided. These are;

- Cash Payment: This is the usual way of making payment of a claim. This method is simpler, easier and less cumbersome.

- Repair: This is also another way of providing compensation. Rather than making the cash payment, the insurers will get the loss repaired to pre-loss condition as far as practicable.

- Replacement: Usually, in the case of a total loss, the insurers may replace the subject-matter with another one of the same standard, age, and quality.

- Reinstatement: The insurers may also reinstate the property by option. This is usually considered concerning buildings damaged or destroyed by fire. Usually, it is the option of the insurers to decide on any one of the above four methods.

Impact on Sum-Insured by Successive Claims Payment

The question usually crops up in our mind as to what happens to the sum insured by successive claims payments. The position varies on the type of insurance, and this is considered below;

Marine

About the marine hull, the sum insured remains as it is, even though a number of partial claims have been paid during the same period of insurance. In addition to the payment of partial loss(es), there may be a liability for total loss also.

Unrepaired damage cannot, however, be claimed in addition to total loss as no money was spent on repair. Reinstatement of the sum- insured is, therefore, not required.

About Cargo, the proposition of the claim question as to the reinstatement of the sum insured is irrelevant. The claim is made once at the final destination, and the policy comes to an end.

Fire

Under a fire policy, payment of a loss diminishes the sum- insured by the amount of claim payment and, therefore, if the property is restored, the sum insured shall be required to be reinstated for the remainder of the policy period by paying a pro-rata premium.

Otherwise, the policy remains for a reduced sum- insured due to successive claim payments.

Life

As the claim occurs once only and the policy is given up, the question of reinstatement of the sum insured does not arise.

Accident

- Property insurance: Except for motor, the position is the same as with fire, i.e., reinstatement of the sum insured is required. Concerning the motor, the position is like a marine hull, i.e., reinstatement is not required.

- Liability insurance: Reinstatement of the sum insured is not usually required, i.e., the sum insured is not reduced by successive claim payments unless of course there is a limit on the total amount payable during the period of insurance.

- Personal accident insurance: Like life insurance, reinstatement of the sum insured is not a consideration.

The Doctrine of Indemnity in Marine Insurance

A contract of marine insurance is an agreement whereby the insurer undertakes to indemnify the assured in the manner and the extent agreed upon. The contract of marine insurance is of indemnity.

Under no circumstances an insured is allowed to make a profit out of a claim. In the absence of the principle of indemnity, it was possible to make a profit. The insurer agrees to indemnify the assured only in the manner and only to the extent agreed upon.

The basis of indemnity is always a cash basis as the underwriter cannot replace the lost ship and cargo, and the basis of indemnification is the value of the subject matter.

This value may be either the insured or insurable value. If the value of the subject matter is determined at the time of taking the policy, it is called ‘Insured Value.’

When loss arises, the indemnity will be measured in the proportion that the assured sum bears to the insured value.

In fixing the insured value, the cost of transportation and anticipated profits are added to original value so that in case of loss. The insured can recover not only the cost of goods or properties but a certain percentage of profit also.

The insured value is called the agreed value because it has been agreed between the insurer and the insured at the time of the contract and is regarded as sacrosanct and binding on both parties to the contract.

In marine insurance, it has been customary for the insurer and the assured to agree on the value of the insured subject matter at the time of the proposal.

Having agreed on the value or basis of valuation, neither party to the contract can object to a loss.

On the ground that the value is too high or too low unless it appears that a fraudulent evaluation has been imposed on either party.

Insured value is not justified in fire insurance due to moral hazard as the property remains within the approach of the assured, while the subject- matter is movable from one place to another in the case of marine insurance, and the assured value is fully justified there.

Moreover, in marine insurance, the assured value removes all complications of valuation at the time of loss.

Technically speaking, the doctrine of indemnity applies where the value of the subject matter is determined at the time of loss.

In other words, where the market price of the loss is paid, this doctrine has been precisely applied.

Where the value of the goods has not been fixed in the beginning but is left to be determined at the time of loss, the measurement is based on the insurable value of the goods.

However, in marine insurance, insurable value is not common because no profit is allowed in estimating the insurable value.

Again if the insurable value happens to be more than the assured sum, the assured would be proportionately uninsured.

On the other hand, if it is lower than the assured sum, the underwriter would be liable for a return of premium of the difference. There are two exceptions to the doctrine of indemnity in marine insurance.

Profits Allowed

The doctrine says that the market price of the loss should be indemnified and no profit should be permitted, but in marine insurance, a certain profit margin is also permitted.

Insured Value

The doctrine of indemnity is based on the insurable value, whereas marine insurance is mostly based on the insured value. The purpose of the valuation is to predetermine the worth of the insured.