The overall objectives of a financial statement audit are expressing an opinion on whether the client’s financial statements are presented fairly, in all material respects, and conform with GAAP.

To meet this objective, it is customary in the audit to identify numerous specific audit objectives for each amount repeated in the financial statements.

These specific objectives are derived from the assertions made by management that are contained in the financial statements.

What is Financial Statement Assertion?

Financial statement assertions are the information that the preparer(business/ company/ accountant) of financial statements provides to another party(auditor/ CPA firm). Financial statements represent a very complex and interrelated set of assertions.

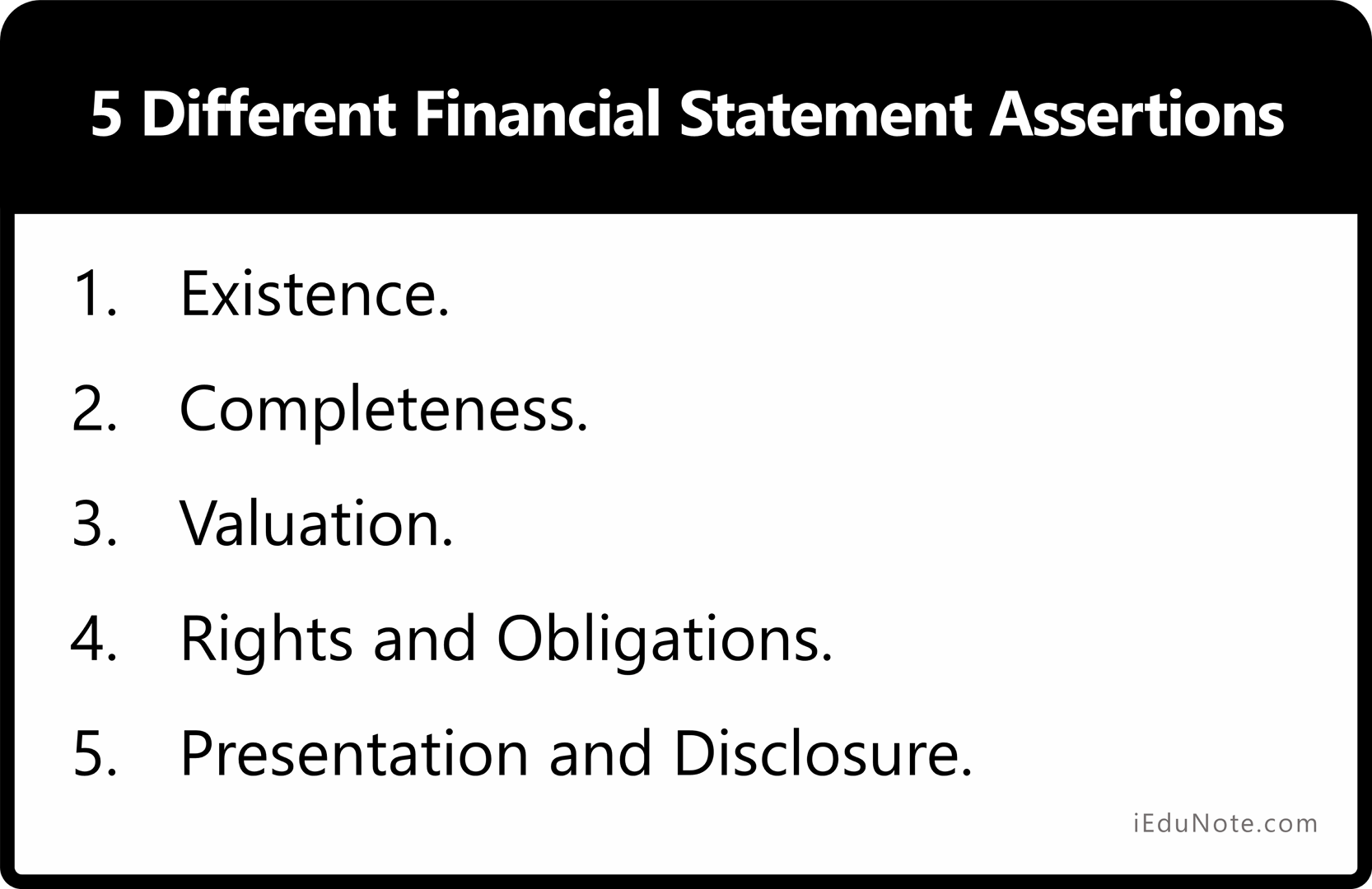

5 Different Financial Statement Assertions in Auditing

The auditors collect five different financial statement assertions to justify every item in the financial statement. There are five financial statement assertions in auditing.

Existence

Assertions about existence or occurrence deal with whether assets or liabilities of the entity exist at a given date and whether recorded transactions have occurred during a given period.

The assertion of existence checks whether the specified assets and liabilities are present on the given date. It is also required to check that the recorded transactions occurred on the specified date.

To test these items of the financial statement, it is hot sufficient that only books have been consulted that record the assets or the liabilities.

There should be proof of the existence of physical assets or liability. For checking existence, help is also sought from outside.

Completeness

Assertions about completeness deal with whether all transactions and accounts that should be presented in the financial statements are so included.

Checking the completeness of a financial statement is to analyze whether all the transactions already given in the financial statement are correctly included.

To abide by the completeness assertion, the auditors prove with the help of sufficient evidence that all the recorded transactions deserve to be included.

An external document further supports this to provide evidence regarding the occurrence of the transaction.

Valuation

Assertions about valuation or allocation deal with whether an asset, liability, revenue, and expense components have been included in the financial statements at appropriate amounts.

Valuation checks whether the different components of the financial statement have been included in the right proportion.

The components are assets, liabilities, expenses, and revenue. The auditor does this with the help of GAAP.

Rights and Obligations

Assertions about rights and obligations deal with whether assets are the rights of the entity and liabilities are the entity’s obligations at a given date.

This is to check whether the assets included in the financial statement are the rights and the liabilities are the company’s obligations.

To ensure this, sometimes special purpose entities are created.

Presentation and Disclosure

Assertions about presentation and disclosure deal with whether particular components of the financial statements are properly classified, described, and disclosed.

This assertion is to ensure whether the items in the financial statements are classified in the right way. It is important to check that the account balance is calculated and disclosed properly.

The following tabulation illustrates the derivation of specific audit objectives for cash based on the discussions of the categories of assertions above;

| Assertion Category | Specific Audit Objectives |

|---|---|

| Existence or occurrence | – The petty cash fund, undeposited receipt, checking accounts, and other items reported as cash exists at the balance sheet date. |

| Completeness | – Reported cash includes all petty cash binds, undeposited receipts, and other cash. – Reported cash includes all unrestricted bank balances. |

| Rights and obligation | The entity owes all items in cash at the balance sheet date. |

| Valuation or allocation | – The items comprising cash have been correctly totaled. – Cash receipts and disbursements journals are mathematically correct mid have been properly posted to the general ledger. – Cash on hand has been correctly counted. – Checking account balances have been properly reconciled. |

| Presentation and disclosure | – All items included in cash are unrestricted, and the cash is available for operations. – Required disclosures such as compensating balance agreements have been made. |

Conclusion

In a financial audit, management assertions or financial statement assertions in auditing are the information that the preparer of financial statements (management) provides to another party.